Kickstarting an LLC in Wisconsin is a brilliant move for any budding entrepreneur, yet it’s crucial to grasp all associated costs beyond the initial filing fee. Though setting up a Limited Liability Company might appear pricey, it can actually be quite budget-friendly.

In this guide, we’ll dissect the assorted expenses tied to launching an LLC in the Badger State. Our aim is to simplify the process for you while introducing you to ace LLC services like Tailor Brands, which can help pinpoint some smart cost-cutting tactics.

Ready to dive into the entrepreneurial waters of Wisconsin? Let’s unravel the financial nuances of setting up an LLC and learn how to optimize your investment.

What Is the Cost of Forming an LLC in Wisconsin?

The main expense for creating an LLC in Wisconsin centers on a $130 fee. This fee is for submitting your LLC’s Articles of Organization are online for the Wisconsin Department of Financial Institutions.

Wisconsin Foreign LLC Formation Costs

If you’re running an LLC in another state and want to expand into Wisconsin, you’ll need to register it as a foreign LLC there. This involves a registration fee of $100. For this, you must submit the “Foreign Limited Liability Company Application for Certificate of Registration” (Form 521) to the appropriate Wisconsin authorities.

Annual Cost for LLCs in Wisconsin

Maintaining a thriving LLC in Wisconsin means keeping up with necessary ongoing duties and costs to ensure compliance and legal standing. This includes filing an annual report at a cost of $25, which keeps the state updated on critical LLC details like ownership and management.

If you use a trade name, remember to renew it every ten years for a $15 fee. While having a registered agent is compulsory for Wisconsin LLCs, you can either act as your own agent for free or use a commercial registered agent service, which typically runs between $100 and $300 per year.

Staying diligent with these requirements helps secure the ongoing legality and fiscal well-being of your Wisconsin LLC.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Wisconsin With the Best LLC Service?

Tailor Brands LLC Formation Cost

Starting an LLC in Wisconsin starts with a base fee of $130, which may increase if you opt for additional services. Typically, it takes 2 to 3 weeks to process your LLC paperwork. If you’re in a hurry, you can pay an extra $50 to expedite the process to 3 to 5 days or pay $100 to speed it up even more to just 1 to 2 days.

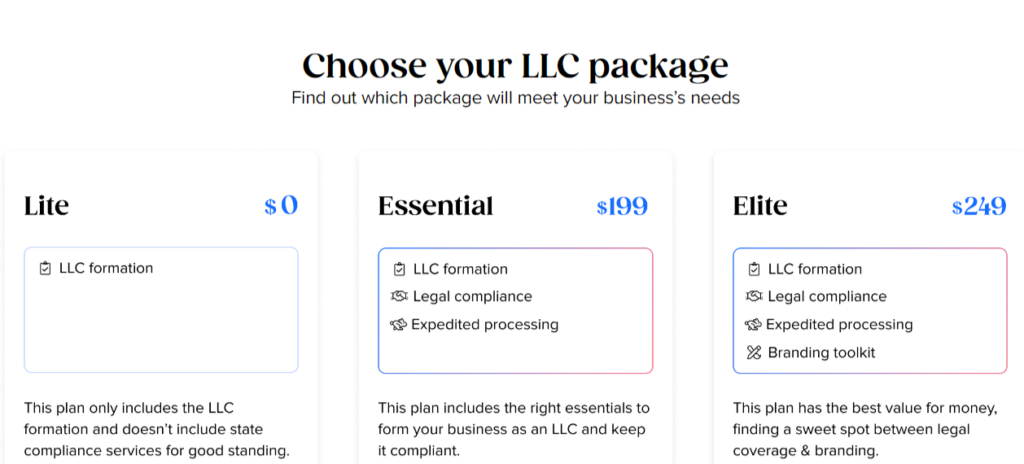

Tailor Brands offers a few LLC formation plans, starting with the Lite LLC plan. This plan covers the essentials of LLC formation and sticks to the standard processing time, costing only the state filing fee. Their Essential LLC plan, priced at $199 plus state fees, includes faster-expedited processing, annual compliance services, and an operating agreement. To keep these services, Tailor Brands charges an annual fee of $199.

The most comprehensive option is the Elite LLC plan, which costs $249 plus state filing fees. It includes all the services of the Essential plan, plus extra business tools like a free business domain for the first year, access to a DIY website builder, an online store, eight free logos, a digital business card, a business cards tool, and a social media post maker. An annual fee of $249 is required to maintain these services with Tailor Brands.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Wisconsin

Wisconsin LLC Name Costs

Choosing a name for your Limited Liability Company in Wisconsin is free since the state’s Department of Financial Institutions (DFI) doesn’t require a Name Reservation to be filed during the LLC formation process. Your chosen Wisconsin LLC name is approved for free when your Articles of Organization are accepted by the state.

However, if you want to reserve your LLC name for up to 120 days before you officially start the LLC formation process, you can do so by submitting Form 1 along with a filing fee of $15.

Wisconsin Registered Agent Costs

In Wisconsin, appointing a Registered Agent is mandatory when forming your LLC. This agent, either a person or a company, receives legal documents and state communications on behalf of your LLC and must have a physical address in Wisconsin, be available during regular business hours.

Choosing to serve as your own Registered Agent or assigning someone you know to the role won’t cost you extra, keeping the fee at $0.

Alternatively, you can opt for a professional Registered Agent Service, which generally charges around $125 annually. While this does involve a cost, these services provide additional business support and help protect your privacy.

Using a Registered Agent Service is especially recommended if you don’t have a Wisconsin address, as state laws require a local physical address. Furthermore, if you prefer to keep your personal address off public records, some Registered Agent Services allow you to use their address instead, enhancing your privacy.

Wisconsin Operating Agreement Costs

The Wisconsin LLC Operating Agreement, a vital document that outlines key details of LLC ownership, management, and profit sharing among members, is available at no extra cost. It’s advisable for both Single-Member and Multi-Member LLCs to draft and keep an Operating Agreement as part of their business records, ensuring each member has a copy for reference.

It’s worth noting that many online platforms often charge between $50 and $200 for comparable LLC Operating Agreements.

Wisconsin EIN Cost

Obtaining an LLC EIN Number, also known as an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN), is free. This unique identifier is crucial for various business activities such as filing income taxes, setting up an LLC bank account, and hiring employees if needed.

Although some websites charge a fee to help you get an EIN, you can acquire your LLC’s EIN directly from the Internal Revenue Service (IRS) at no cost. The online application is simple and can be finished in just a few minutes.

>> Start Your LLC With Tailor Brands >>

Wisconsin LLC Taxes

The yearly LLC costs for owners can vary widely because of the different types of taxes they must pay. These taxes include:

Federal Income Taxes

The Internal Revenue Service (IRS) provides several tax treatment options for Limited Liability Companies (LLCs). For Single-Member LLCs, the default classification is as a Disregarded Entity, meaning the IRS doesn’t require the LLC itself to file a separate federal income tax return.

Instead, the Single-Member LLC owner must file the return and pay federal income taxes. The tax method depends on the LLC’s ownership structure. If an individual owns the LLC, it’s taxed like a Sole Proprietorship. If another company owns it, it’s treated as a branch of that parent company.

For Multi-member LLCs, they are automatically taxed as Partnerships. This requires the LLC to file a 1065 Partnership Return and distribute a Schedule K-1 to each owner, detailing their share of profits. This income then “flows through” to the owners, who must include it on their personal tax returns (Form 1040) and pay the appropriate taxes.

Husband and Wife LLC Taxes

In community property states such as Wisconsin, husband and wife LLCs can opt to file taxes either as a Single-Member LLC (known as a Qualified Joint Venture) or as a Multi-Member LLC. This decision can be made either during the application for an Employer Identification Number (EIN) or by submitting a letter to the IRS.

If no specific choice is made, a husband and wife LLC in Wisconsin will automatically be treated for tax purposes as a Partnership.

Election of Corporate Taxation

LLCs can choose Corporate tax treatment by submitting specific forms to the IRS.

To opt for S-Corporation status, an LLC must file Form 2553. This choice is often advantageous for businesses with steady profits because it can reduce self-employment taxes. However, S-Corporation taxation involves additional costs, so it’s wise for new business owners to discuss this option with their accountant and consider it only once their business has stable revenue.

On the other hand, an LLC can choose to be taxed as a C-Corporation by filing Form 8832. This option is less common and generally benefits larger employers who can save on healthcare fringe benefits. Despite this, most LLCs don’t elect C-Corporation taxation.

Wisconsin State Income Tax for LLCs

In Wisconsin, the tax treatment of LLCs depends on their structure.

Single-member LLCs usually don’t file state-level returns themselves; the owner reports the LLC’s profits or losses on their personal state tax return. Multi-Member LLCs often need to file a Partnership return at the state level, and the individual owners then report their shares of the LLC’s profits or losses on their personal state tax returns.

Moreover, certain industries and types of businesses in Wisconsin may face specific state taxes. Given the complexities of these tax issues, LLC owners are strongly advised to either consult with an accountant for tax preparation and filing or to reach out to the Wisconsin Department of Revenue for comprehensive details on state tax obligations.

Local Income Tax for LLCs in Wisconsin

LLCs in Wisconsin might need to file and pay income taxes at the local level, including town, city, or county taxes. It’s advisable to either seek help from an accountant or contact the relevant local municipality to learn about the specific tax requirements.

Wisconsin Sales Tax

When making sales to consumers in Wisconsin, you may need to collect sales tax and secure a Seller’s Permit from the Wisconsin Department of Revenue (DOR). This permit authorizes the collection of sales tax on retail transactions within the state. It’s also known as a resale license, wholesale license, sales tax permit/license, or reseller permit.

For detailed information on Wisconsin’s sales tax rules and the required permits, it’s a good idea to check out the resources available from the Wisconsin DOR, which include guidelines on permits and use tax regulations.

Wisconsin LLC Payroll Taxes

If your Wisconsin LLC employs staff, you’re responsible for managing several payroll taxes such as federal and state income tax withholding, Social Security tax, Medicare tax, and unemployment taxes. Given the complexity of these calculations and the risk of penalties, it’s wise to either employ a payroll service or consult an accountant to ensure accurate payroll tax management.

>> Get Started With Tailor Brands >>

Wisconsin LLC Cost FAQs

Conclusion

Setting up an LLC in Wisconsin involves more than just the initial filing fee. It requires handling various financial aspects, including securing necessary documents, using registered agent services, and tackling important tasks like drafting operating agreements and obtaining an EIN.

Effective financial management in these areas is key to a successful LLC setup. This is where the expertise of LLC service providers like Tailor Brands proves invaluable. By understanding these comprehensive costs and leveraging the support from Tailor Brands, prospective entrepreneurs can confidently start their LLC journey in Wisconsin.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic