The best mortgage lenders empower you to buy or maintain your own house through home loans. That’s why mortgages are one of the main sources of debt in the U.S., with a national value of $17.6 trillion as of October 2021.

There’s no need to wait until you save enough money to purchase a house if you get a loan from the right bank or financial institution. Get ready to compare the best mortgage lenders of 2023 so you can pick the one which meets your unique needs as a borrower.

Best Mortgage Lenders of 2023

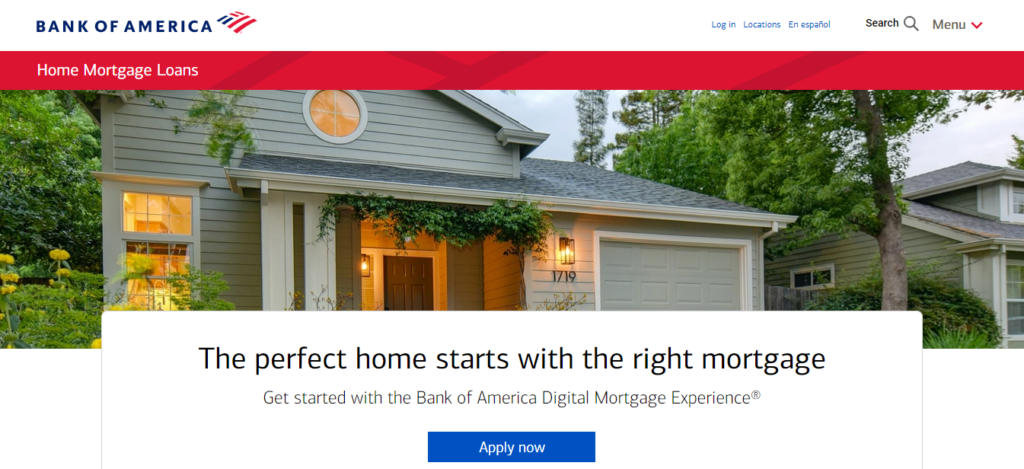

- Bank of America – Best Overall

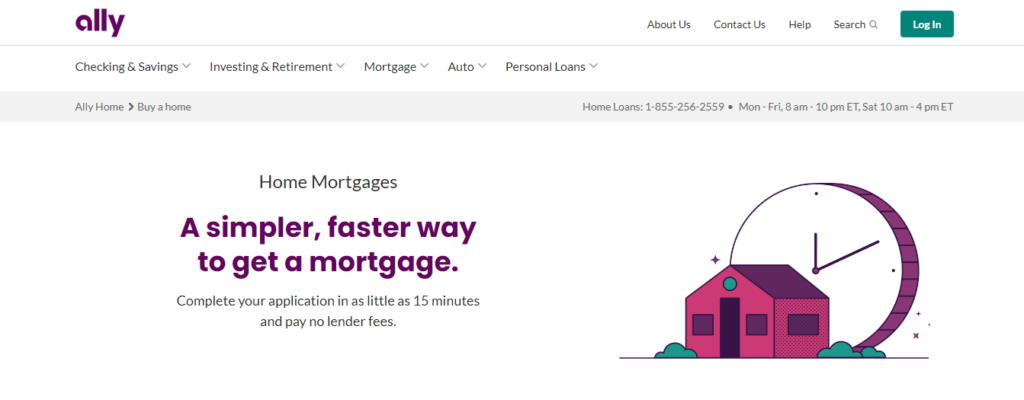

- Ally – Best for Fast Processing

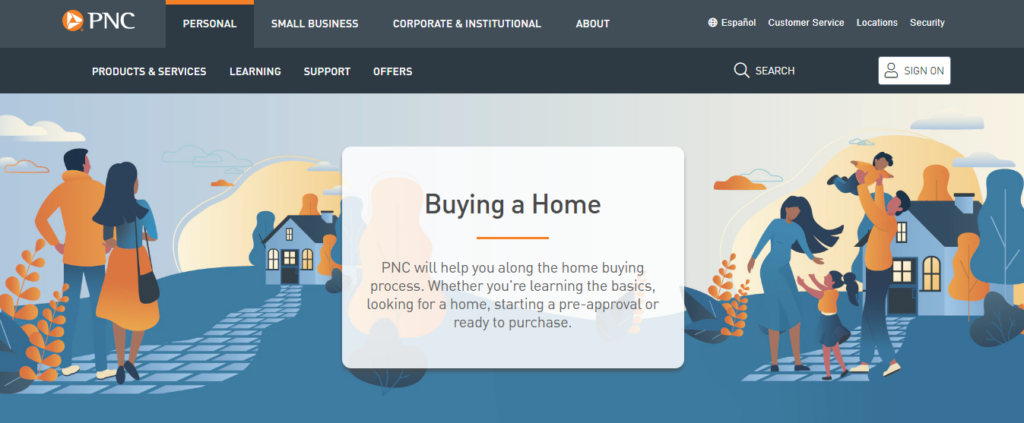

- PNC – Best for Closing Grants

- Chase – Best for Payment Flexibility

- Rocket Mortgage – Best for Low Credit Scores

By far, the most important factors for choosing the best mortgage lender include minimum down payment and interest rate. The lower the minimum percentage, the better, but you also want to consider what your interest rate will be, so you don’t give more money to a bank than to your assets. There are plenty of other things to consider, and you can see how we ranked these lenders in our full explanation of our methodology below.

Bank

Minimum Down Payment

Interest Rate (As of June 2022)

APR (As of June 2022)

Home Buying

Refinancing

Application Process

Payment Methods

Special Feature

Starts at 3%

- 30-Year Fixed: 5%

- 15-Year Fixed: 4.125%

- 5/6 ARM Variable: 4.25%

- 30-Year Fixed: 5.195%

- 15-Year Fixed: 4.472%

- 5/6 ARM Variable: 3.949%

Online or in-person

PayPlan or MortgagePay

Home loan assistance

Starts at 3%

- 30-Year Fixed: 5.125%

- 15-Year Fixed: 4.375%

- 5/6 ARM Variable: 4.875%

- 30-Year Fixed: 5.14%

- 15-Year Fixed: 4.390%

- 5/6 ARM Variable: 4.290%

Online

Automatic, paperless, or one-time monthly payment

3-minute pre-approval

Starts at 3%

Variable

Variable

Online or in-person

Online banking, automated, phone, mail, or in-branch payment

Closing grant

Starts at 3%

Variable

Variable

Online or in-person

Automatic, online, cash, check, money order, phone, or bank transfer payment

Educational incentive

Starts at 3%

- 30-Year Fixed: 5.75%

- 15-Year Fixed: 5.125%

- 30-Year Fixed: 6.021%

- 15-Year Fixed: 5.59%

Online

One-time online, autopay, or mail payment

Supports down payment assistance programs

Bank of America is our number one choice in this roundup of mortgage lenders. It has the highest ranking because it packs together cost-effective rates, transparent data, accessible mortgage plans, and face-to-face services. Of course, we discussed in our Bank of America review that it’s also a solid all-around business bank.

To start with, its mortgage interest rates and APR are the most budget-friendly among all the lenders in the list, based on June 2022 rates. You can take your pick between fixed and variable loans, as well as the length of your repayment schedule. Plus, the current rate list is readily available on the official website so you don’t need to make complex computations anymore.

Also, it presents the Affordable Loan Solution for first-time home buyers of one-unit properties, which allows you to benefit from lower down payments. Finally, Bank of America has physical locations as a traditional bank. You can schedule an appointment if you need personalized assistance related to your mortgage.

While Bank of America is an impressive mortgage lender, it does have certain limitations. For instance, you need to prequalify first before you can apply for a mortgage and estimate your loan amount. The stringent criteria for prequalification include income information, credit check, and bank account data.

In addition to this, the payment options are sparse compared to its competitors. On top of this, you need an existing checking or savings account to take advantage of the PayPlan and MortgagePay methods.

To sum things up, Bank of America is one of the top mortgage lenders because it comes with a lot of perks.

Why we chose it: We salute Bank of America as the best overall mortgage lender in this comparative review. After all, it beats its competitors in terms of cost-effective rates, information disclosure, and in-person service.

- Competitive rates

- Straightforward rate listing

- Affordable Loan Solution mortgage

- Brick-and-mortar branches

- Strict prequalification requirements

- Few payment methods

- Bank of America account required for PayPlan or MortgagePay

Pricing: 3% or higher minimum down payment

Minimum Down Payment

Bank of America only requires first-time home buyers to pay a 3% down payment, which is similar to all the mortgage lenders in the list. Just be aware that the minimum down payment can rise to 5% for mortgages in high-cost areas.

Interest Rate

It offers the lowest interest rates among its competitors in this guide which openly advertise their rates. As of June 2022, the 30-year fixed interest is 5%, the 5-year fixed is 4.125%, and the 5/6 ARM variable is 4.25%.

APR

Again, Bank of America has the overall lowest APR compared to other lenders whose rates are publicly available, as of June 2022. While the 30-year fixed APR is slightly higher than Ally’s at 5.195%, the 15-year fixed and 5/6 ARM variable APR are lower at 4.472% and 3.949% respectively.

Home Buying

Like the rest of its peers, it gives you the chance to purchase a home through the Bank of America Digital Mortgage Experience. However, you need to meet the prequalification requirements first.

Refinancing

It presents you with refinancing opportunities, similar to other mortgage lenders. It grants you as many refinance options as PNC. You can select from fixed-rate, adjustable rate, FHA, VA, and cash-out refinance loans.

Application Process

You can choose from online or in-person application procedures. It’s more versatile than Rocket Mortgage, which only lets you apply over the internet.

Payment Methods

It enables you to make mortgage payments via auto-debit PayPlan or one-time MortgagePay. These two payment options are meager compared to the various payment methods of Chase.

Special Feature

Bank of America’s special feature is the home loan assistance for borrowers who find it hard to make loan payments. There are solutions for those who want to save their home, as well those who are willing to let it go to settle their debts.

Ally has an edge over the other mortgage lenders in the bunch because of its simple application process. After all, you can gain pre-approval in as short as three minutes only. Plus, it helps you close deals up to 10 days quicker compared to the mortgage industry average.

To make things even better, it won’t charge you any lender fees, such as processing, underwriting, processing, or application fees. In addition to this, it’s the runner-up next to Bank of America in terms of affordable APR and interest rates.

Last but not least, it’s more welcoming to borrowers with different financial backgrounds, compared to conventional banks with high standards. It does its best to provide solutions for people who are hesitant to apply for a mortgage because of limited funds or difficult situations.

Nevertheless, Ally has some drawbacks as well. An obvious one is that there aren’t any physical branches you can visit because it’s a digital financial services company, not a traditional bank. Also, it only offers regular loans, but not VA or FHA loans, which might be restricting for some borrowers. Aside from this, there are only a few methods you can utilize to make mortgage payments.

Overall, Ally is a cutting-edge lender whose modern solutions make it convenient for potential home buyers to get a mortgage.

Why we chose it: We award Ally as the best for fast processing among mortgage lenders because it simplifies the way you apply for a home loan.

- Speedy application procedure

- No lender fees

- Reasonable rates

- Less strict requirements for borrowers

- No physical locations

- Basic loans only

- Limited payment methods

Pricing: 3% or higher minimum down payment

Minimum Down Payment

Ally provides down payment options as low as 3%. This rate is the same as the rest of the mortgage lenders in the list.

Interest Rate

Next to Bank of America, Ally has the second lowest interest rates compared to its competitors who publicly display their rates too. As of June 2022, the 30-year fixed rate is 5.125%, the 15-year fixed is 4.375%, while the 5/6 ARM variable is 4.875%.

APR

Once more, it generally has the second lowest APR among the other lenders with openly available rates, as of June 2022. While the 30-year fixed APR is 5.14% slightly lower than Bank of America’s, the 15-year fixed and 5/6 ARM variable APR are a little higher at 4.390% and 4.290%.

Home Buying

Similar to its peers, Ally assists first-time home buyers through the HomeReady mortgage program. In contrast to Bank of America which has strict prequalification requirements, it’s ready to help borrowers with limited down payment resources or challenging circumstances.

Refinancing

It offers refinancing options like the rest of the lenders in this guide. However, you can only apply for basic loans, but not FHA or VA loans, which are available from the rest of its competitors.

Application Process

Ally has the quickest application process out of all the mortgage lenders in the group. The procedure is completely online, in comparison to Chase and Bank of America which both have a face-to-face option.

Payment Methods

There are slightly more ways to pay than Bank of America, but less ways than Chase. You can make automatic, paperless, or one-time monthly payments for your mortgage.

Special Feature

Ally’s special feature is the 3-minute pre-approval process. It streamlines the mortgage application steps so you can save time and effort.

PNC sets itself apart from the other mortgage lenders in the bunch by minimizing your closing costs. Its closing grant can supply you with a hefty amount of $5,000 towards closing fees. Of course, you do need to qualify for the grant first by meeting income requirements or living in certain communities.

Plus, it gives you a wide selection of loan types to choose from, including fixed rate, adjustable rate, VA, FHA, and jumbo loans. On top of this, PNC has physical branches where you can drop by if you need face-to-face services regarding mortgage matters.

However, PNC isn’t exempt from disadvantages. To begin with, you must provide your loan amount and ZIP code first before you can view the APR and interest rates. Finally, you must meet certain standards when you apply for a mortgage by presenting your employment credentials and your income amount.

To make a long story short, PNC can be an attractive option to borrowers who wish to reduce or get rid of closing costs when purchasing a home.

Why we chose it: We recognize PNC as the best for closing grants among mortgage lenders because it makes it more affordable for you to close home deals through financial assistance.

- Closing grants

- Various loan options

- Brick-and-mortar locations

- No direct list of APR & interest rates

- Employment verification required

- Income assessment

Pricing: 3% or higher minimum down payment

Minimum Down Payment

PNC gives you the chance to buy a house with down payments as low as 3%. This minimum percentage is comparable to the other mortgage lenders in this guide.

Interest Rate

The interest rates may change based on your loan amount and ZIP code. There is no readily available list of rates, unlike Bank of America, Ally, and Rocket Mortgage.

APR

Once more, the APR depends on your location and loan value. It doesn’t directly display its APR data, in contrast to Ally, Rocket Mortgage, and Bank of America.

Home Buying

PNC guides you through your home buying journey, similar to all its competitors. You can take advantage of tools and resources when you apply for a PNC Mortgage.

Refinancing

Like the rest of the lenders, it presents you with refinance opportunities. It gives you as many refinance alternatives as Bank of America, thanks to its adjustable rate, fixed rate, jumbo, FHA, and VA loans.

Application Process

You can pick your preferred mortgage application method, whether it be online or in-person. In contrast to Rocket Mortgage and Ally, PNC has physical locations you can visit.

Payment Methods

Next to Chase, it has the second most payment avenues available to borrowers. You can make mortgage payments through online banking, automated, phone, mail, or in-branch methods.

Special Feature

PNC’s special feature is the closing grant. It’s possible for you to receive a $5,000 grant towards closing expenses if you’re a qualified borrower.

Chase trumps the rest of the mortgage lenders in this roundup when it comes to rich payment options. After all, it has a variety of payment methods you can select from. These include automatic, online, bank transfer, phone, cash, check, and money order.

Also, it motivates you to complete the Chase DreaMaker Mortgage educational course by rewarding you with $500. Aside from this, you can drop by brick-and-mortar branches if you prefer to apply for a mortgage in person. That’s because it’s a traditional bank with physical locations, as mentioned in our Chase Bank review.

Still, Chase admittedly has some weaknesses as a mortgage lender. For example, you need to input your ZIP code first before you can browse through the local APR and interest rates. Next, you must be prepared to pay closing costs before you assume ownership of the new house. Lastly, it recommends a good credit score and low debt-to-income ratio for borrowers who want to prequalify for mortgages.

In general, Chase is a conventional bank that gives you freedom to make mortgage payments via your favorite method.

Why we chose it: We commend Chase as the best for payment flexibility because there’s a lot of payment alternatives you can take your pick from.

- Multiple payment methods

- Educational incentives

- Physical branches

- No list of APR & interest rates

- Closing fees

- Strict prequalification requirements

Pricing: 3% or higher minimum down payment

Minimum Down Payment

Chase makes home ownership accessible through down payments as low as 3%. This rate is similar to the rest of the mortgage lenders in the list.

Interest Rate

Its interest rates are variable. You need to enter your ZIP code to see the local rates, in contrast to Bank of America, Ally, and Rocket Mortgage that openly display the data.

APR

Again, the APR is variable. You must provide your ZIP code first to view the APR, unlike Ally, Rocket Mortgage, and Bank of America which publicly lists the information.

Home Buying

Chase enables you to buy your own home, along with the rest of its peers. You can select between Chase DreaMaker Mortgage and Standard Agency Mortgage for low down payments.

Refinancing

It provides you with refinancing plans, just like all its competitors in this review. It features more refinance options than Ally, yet less than Bank of America, with its alternative, FHA, and VA loans.

Application Process

You can apply online or in person for a mortgage. It has brick-and-mortar buildings you can head to, unlike Ally and Rocket Mortgage.

Payment Methods

By far, it has the most payment methods among all the lenders in the list. While most have two or three payment options, Chase beats them all by showcasing seven methods: online, automatic, bank transfer, phone, check, money order, and cash.

Special Feature

Chase’s special feature is its educational incentives. You can potentially earn $500 once you complete a course under the Chase DreaMaker Mortgage program.

Rocket Mortgage is the most viable option for borrowers with a less-than-ideal credit standing among the mortgage lenders in this guide. It gives you the chance to get your home loan approved even if your credit score is as low as 580, at least if you meet certain eligibility criteria. It even encourages you to improve your credit score through the Fresh Start program.

Plus, it’s open to third-party down payment assistance programs. It accepts loans or grants from other organizations to make it easier for you to fund your home down payment. Lastly, you can call Home Loan Experts who can answer your questions about mortgages.

However, Rocket Mortgage has its disadvantages too. To begin with, it has comparatively steep APR and interest rates next to its competitors. Also, while it presents different types of fixed-rate loans, there are no variable loan alternatives.

In addition to this, while it supports down payment assistance from other organizations, it doesn’t have an in-house down payment assistance program of its own. Lastly, there are no physical locations where you can request for in-person services. That’s because it’s not a conventional bank, but an online mortgage lender.

To wrap things up, Rocket Mortgage offers hope to potential home buyers who might not typically qualify for mortgages with traditional banks.

Why we chose it: We acknowledge Rocket Mortgage as the best for low credit scores because you don’t need a spotless record to qualify as a borrower.

- Low credit score requirements

- Third-party down payment assistance support

- Home Loan Experts available

- Relatively high rates

- No variable interest options

- No in-house down payment assistance

- No brick-and-mortar branches

Pricing: 3% or higher minimum down payment

Minimum Down Payment

Rocket Mortgage only requires you to pay a minimum of down payment of 3% or higher. This percentage is comparable to all the other mortgage lenders in this list.

Interest Rate

It has the highest interest rates compared to Bank of America and Ally, which also openly exhibit their rate information. As of June 2022, the 30-year fixed rate is 5.75% and the 15-year fixed is 5.125%.

APR

It also has the highest APR among its peers, particularly Ally and Bank of America which publicly share rate data too. The 30-Year fixed APR is 6.021% and the 15-year fixed APR is 5.59%, as of June 2022.

Home Buying

Rocket Mortgage helps you purchase a new home, just like all its competitors. You can maximize the mortgage tools or request for advice from Home Loan Experts.

Refinancing

It presents you with refinance solutions, similar to all the lenders in this review. With its fixed-rate, VA, FHA loans, it gives you more refinancing options than Ally, but less than Bank of America.

Application Process

The application process is purely online. It’s not like Bank of America, Chase, or PNC which also grant you the alternative of in-person application.

Payment Methods

It offers a little more methods to pay your mortgage than Bank of America, yet less methods than Chase. It allows you to make mortgage payments via one-time online, autopay, or mail.

Special Feature

Rocket Mortgage’s special feature is its acceptance of third-party down payment assistance programs. It supports certain grants and loans from other financial institutions. However, it doesn’t have its own in-house down payment assistance program.

Methodology for the Best Mortgage Lenders of 2023

We took vital factors into account as we compared the best mortgage lenders of 2023. Check out some of the criteria we considered while comparing the lenders to each other:

- Minimum Down Payment: To begin with, we researched what minimum percentage of the purchase price you need to provide as down payment for your new home. Most mortgage lenders offer a down payment as low as 3% for eligible borrowers.

- Interest Rate: We examined how much interest you need to pay every year on your mortgage. Take note that the interest rates in this guide reflect the available information on June 2022.

- APR: We evaluated the annual percentage rate (APR) or total borrowing cost you will incur with your home loan. Again, the APR data comes from June 2022 statistics.

- Home Buying: We confirmed if each lender provides you with home loans so you can buy a new house. All the banks and financial institutions in this list provide mortgage options.

- Refinancing: We checked if every lender presents you with refinancing solutions. Again, all the banks and organizations in this guide grant refinancing loans.

- Application Process: We explained whether you can apply for a mortgage online or in-person. In general, traditional banks provide both application options, while online lenders only let you apply over the internet.

- Payment Methods: We took note of the available ways you can make mortgage payments to each lender. Some examples of common payment methods are automatic, one-time payment, online, mail, and cash.

- Special Feature: We assessed the unique offers which the lenders showcase to attract borrowers. Most special features are related to financial incentives, although some are connected to the application process.

We understand that each borrower has different requirements when it comes to selecting a mortgage lender. That’s why we covered various criteria to help you search for a lender that satisfies your needs.

Frequently Asked Questions (FAQs) for Best Mortgage Lenders

The best mortgage lenders open the door to home buying and refinancing opportunities. Discover the answers to common questions about mortgages and lenders.

Bottom Line on the Best Mortgage Lenders of 2023

Mortgage lenders make it possible for you to own a house whether you’re flush with cash or not. We give a nod of approval to all the best mortgage lenders of 2023 in our comparative review. Nevertheless, we especially recommend Bank of America to future home loan borrowers like you, thanks to its competitive rates, clear information, economical mortgage solutions, and in-person options.

Sections of this topic

Sections of this topic