Whether you’re a small business owner or an entrepreneur looking to optimize your financial management, finding the right bank account is crucial. In this article, we’ve carefully curated a list of the most reliable and feature-rich options available, so you can make informed decisions that align with your business goals.

Managing your company’s finances is no easy task, and having the right bank account can make all the difference. Our selection includes accounts from reputable financial institutions that offer a range of benefits such as competitive interest rates, convenient online banking features, seamless fund transfers, and exceptional customer service. Whether you need a business checking account for day-to-day transactions or a savings account to grow your reserves, we’ve got you covered.

Best Business Checking Accounts On the Market

- BlueVine – Best Business Checking Overall

- Lili – Best for Tax Optimization

- Novo – Best for Small Businesses

- Capital One – Best for Digital Transfers

- Chase Business – Best for Business Services

- Bank of America – Best for Traditional Banking

- Axos – Best for Cash Deposits

- U.S. Bank – Best for Lending

- Oxygen – Best for Freelancers

- American Express – Best for Member Rewards

- NBKC – Best for Add-On Services

- NorthOne – Best for Integrations

When looking into the best business checking accounts, we made sure to consider fees for use and potential upsides in the form of interest rates. Next, we studied lending options, rewards, and how easy it is to transfer funds. Finally, we dig deep to discover any additional features that made a particular checking account stand out.

You can find a more detailed look at our ranking methodology below.

Bank

Fees

Interest Rates

Lending Options

Rewards

Additional Features

$4.95 for cash deposits, $15 for outgoing wires

Up to 2.0% APY

Up to $250,000 line of credit

None

Cash deposits, online payments, multiple subaccounts

$2.50 for out of network domestic ATMs, $5 for international

0% APY

No lending options

Cash back with debit card

Tax optimization software, fast enrollment, smart mobile banking

$0

0% APY

Novo has a line of credit available to existing users

Up to $5,000 in online perks

20 Reserve accounts, invoice tracking, virtual debit card

$15 monthly service fee, $15 per incoming domestic wire, $25 for outgoing domestic wire

0% APY

Loans and lines of credit up to $5 million

None

Unlimited digital transfers, overdraft coverage, $5,000 in free cash deposits

$15 monthly service fee

0% APY

Loans and lines of credit up to $500,000

$300 sign-on bonus, up to $750 in cash back

$5,000 in no-fee cash deposits, waived savings account fee, long list of business services

$16 monthly service fee

0% APY

Loans and lines of credit from $10,000

None

Integrates with Zelle payment app, business services

$35 for outgoing wire transfers

0% APY

Loans and lines of credit starting at $10 million

Up to $200 sign-on bonus

ATM reimbursements, first 50 checks free, Quickbooks integration

$0.50 fee for transactions after the first 125, fees at out of network ATMs

0% APY

Many types of loans and lines of credit up to $12 million

None

$2,500 of free cash deposits, 50% discount on first check order

No monthly maintenance fees, possible out of network and international fees

1.0% APY in attached savings account

No lending options

5% cash back from various merchants

LLC creation assistance

$20 for outgoing domestic wires

1.3% APY

Available through Kabbage funding

30,000 membership reward points

24/7 support, earn points on most purchases

$5 for outgoing domestic wires, $45 for incoming or outgoing domestic wires

0% APY

Available to business owners in the Kansas City metro area

None

Four branch locations in the Kansas City area, $12 in ATM reimbursement, several additional service options

$10 monthly maintenance fee, $15 for domestic wire transfers

0% APY

No lending options

None

Virtual envelopes to budget money, long list of integrations

BlueVine stands out for a high interest rate that few banks can compete with and doesn’t require a minimum deposit or balance to maintain your account. The only fees you’ll need to worry about revolve around cash deposits and outgoing wire transfers. There are no savings accounts to store excess funds in, and you’ll need to watch for monthly transfer limits.

Fees

BlueVine avoids most fees that other best business bank accounts still have. There are no monthly fees, minimum requirements to maintain your account, or costs for an overdraft or incoming wires. You’ll pay $4.95 any time you make a cash deposit, and each outgoing wire is $15.

Interest Rates

It’s possible to receive 2.0% interest on your business checking account if you meet one of two conditions. You must either spend at least $500 per month on your BlueVine Business Debit Mastercard or receive $2,500 per month in customer payments to your account. The interest caps at $100,000, and anything you have beyond that doesn’t earn a thing.

Lending

While BlueVine doesn’t have lending per se, you can get access to a flexible business line of credit to use as you see fit. Lines reach as high as $250,000, with decisions in as little as 5 minutes. There’s no fee for maintaining the account, and you’ll only pay interest on what you use. Current rates are as low as 4.8%.

Rewards

BlueVine’s 2.0% APY is quite the reward in itself. That said, the business checking account doesn’t offer any other rewards for joining at this time.

Additional Features

You can pay bills directly from your BlueVine account or credit card through ACH, check, or wire. The online bank doesn’t place limits on the number of transactions you perform each month. For organization and finance tracking, multiple subaccounts allow you to drop funds into different buckets.

- High interest rate

- Very few fees

- No minimum deposit or balance required

- Checking accounts only

- Monthly transfer limits

- Fee for cash deposits

Why we chose it: BlueVine’s ease of use, few fees, and incredible interest rate make it the best business checking account currently available.

>>> Visit BlueVine and create your business checking account for free.

Lili has all the tools you’ll need to file an accurate report at tax time. The account doesn’t earn any interest, but no minimums or monthly fees help remove the sting. It takes no more than a few minutes to create your Lili business checking account, as the site doesn’t require paperwork or a credit check. You’ll need to track transfers and deposits, as there are some limitations on how much you can move around each month.

Fees

While Lili shines for its free tax software, business owners can also rejoice over a lack of account and overdraft fees. You won’t even incur a charge for foreign transactions or at over 38,000 in-network ATMs in the United States. If you end up using an out-of-network machine, expect a charge between $2.50 and $5.

Interest Rates

There is no interest on Lili’s Business Checking account. Those willing to pay can access a savings account with 1.5% APY, but you’ll need at least $34,000 in your account at all times to offset the monthly cost.

Lending

Lili does not offer any lending options to its clients. If you need a loan or a line of credit, you’ll have to look into other options.

Rewards

Your Lili debit card earns cash back on participating merchants, with the money deposited directly into your business checking account. There are no service or transaction fees to use your debit card anywhere in the world.

Additional Features

Nothing compares to Lili’s tax optimizer, designed to help you reduce tax-based expenses. The software allows you to categorize purchases, find your tax bracket, and file without headaches. The online bank also has a smart mobile app to help keep tabs on personal and business expenses while on the road. Enrollment is simple, requires no paperwork, and can have you banking within minutes.

- Tax optimization software

- No minimum balance or monthly fees

- Quick enrollment

- 0% APY

- No wire transfers

- Low monthly transfer and deposit limits

Why we chose it: Lili’s minimal fees and tax optimization software help businesses hold onto hard-earned income. Plus, if you’re looking for an online business checking account with no credit checks, Lili is a great option.

Novo has one of the best small business checking accounts, as you can perform all its services through a fee-free business bank account if you’re careful. You won’t need to pay a thing to keep your account, and the ATM fees are funded up to $7/mo. There are no returned payments or NSF fees.

Fees

You’ll have to look pretty hard to find fees with Novo, but they do exist. In addition to a maintenance-free checking account, Novo’s ATM fees are funded up to $7/mo.

Interest Rates

Novo’s business checking account does not offer an interest-bearing option for your funds. There’s also no savings account for excess money to grow.

Lending

Novo offers a line of credit product, but it is invite-only and exclusive to existing Novo users.

Rewards

Novo has a relationship with several other business apps and can score some good deals. For instance, HubSpot’s slew of business tools are 30% off with a Novo checking account. Depending on the software you use, it’s possible to save up to $4,000.

Additional Features

Through a carefully crafted dashboard, you can send and track invoices with ease. A virtual debit card lets you spend funds online or in person through your favorite payment app without the hassle of a physical one. Novo Reserves lets you drop money into up to 20 different reserve accounts to plan for incoming expenses or a big project.

- Zero monthly fees to maintain an account

- No minimum balance required

- ATM fees are funded up to $7/mo

- Cannot deposit cash

- Fee for overdrawn accounts

- No savings accounts

Why we chose it: Novo’s nearly nonexistent fee structure speaks well to small businesses. If you’re looking for a bank for your startup, Novo is a great choice.

>>> Sign up with Novo!

Capital One does away with transfer restrictions, allowing you to keep funds flowing from one bank account to the next. There is a small monthly fee to maintain if you don’t need the requirements, but there are no overdraft fees to contend with. You can even deposit up to $5,000 each month via an ATM or one of Capital One’s branch locations.

Fees

Keeping a Capital One Basic Business Checking account requires paying a monthly $15 fee, but the bank will waive the charge if your prior 30 or 90-day balance averages at least $2,000. There are also fees for both incoming and outgoing wires, but it is possible to transfer funds digitally without penalty.

Interest Rates

There is no interest associated with this account, but the money you have in abundance doesn’t have to collect dust. Moving those funds over to one of Capital One’s savings accounts will allow it to generate some annual yield.

Lending

Capital One has a ton of lending options your business can benefit from. You will need an open business checking account and have at least two years in business to apply. Loan and line of credit amounts range greatly, capping at $5 million each.

Rewards

You won’t find any rewards for joining Capital One outright, but the scenario changes once you check out its credit card offerings. With several to choose from, you’ll likely find a card befitting your business needs that will earn rewards for each use.

Additional Features

Unlimited digital transfers allow you to send funds from your bank account to another anywhere on Earth. Capital One Basic Business Checking also protects from overdraft fees and allows free cash deposits of up to $5,000 each month.

- Unlimited free digital transfers

- Does not charge overdraft fees

- Free cash deposits up to $5,000

- Limited physical locations

- Monthly account fee

- No available interest rate

Why we chose it: Capital One eliminates limits on digital transfers, allowing you to keep your finances moving.

Chase introduces a number of business services, such as payment collection and fraud protection alongside a $300 bonus just for signing up. You can even accept credit card payments directly into your account with the Chase app. While there is a monthly service fee, there are several ways to avoid paying it.

Fees

A monthly service fee may be a turn-off with so many fee-free accounts available, but there are several methods of having it waived. All you have to do is keep a $2,000 minimum daily balance, make $2,000 in net purchases on a business card, or receive $2,000 in deposits through the Chase QuickAccept app.

Interest Rates

Chase Business Complete Checking does not offer any interest, but not all hope is lost. It’s possible to open a Chase business savings account to complement what checking can do. Best of all, enrollment in savings is free as long as your checking account is active.

Lending

As a Chase member, you’ll have both loans and lines of credit at your fingertips. You can borrow up to $500,000 at a time, and there’s a lot of flexibility in paying your borrowed money back. Lines of credit similarly go to $500,000 you can pull from as needed.

Rewards

There’s no shortage of rewards at Chase. The bank will deposit $300 into your Business Complete Checking account as long as you meet certain requirements. In addition, Chase has a wide range of credit cards for earning cash back or points toward things like travel.

Additional Features

Signing up for a business checking account with Chase gives access to one of its savings plans at no extra charge. You’ll also have access to an abundance of business solutions for protecting and managing finances to use as you please.

- Several available business services

- Multiple ways to waive the monthly maintenance fee

- $300 sign-on bonus

- Monthly maintenance fees

- Only 20 physical transactions per month

- No APY

Why we chose it: Chase meets your banking needs and beyond with a long list of additional business services.

Business Advantage Fundamentals is a solid business checking option with a low monthly service fee. You can access your account online or from more than 4,000 locations scattered across the country. For such a large bank, it does not have 24/7 customer service or cover out-of-network transaction fees.

Fees

Bank of America is a full-fledged bank with multiple account options and its own list of fees. Business Advantage Fundamentals featured here has a $16 maintenance cost unless you can meet one of the requirements to negate it. To do so, you’ll have to either keep a $5,000 combined average monthly balance or spend at least $250 per month on debit card purchases.

Interest Rates

There’s no APY on Bank of America’s Business Advantage Fundamentals checking account. Although you can open a business savings account for $10 per month, funds within will only earn 0.01%. You can also visit our guide on how to open a business bank account.

Lending

Lending with Bank of America requires you to meet specific revenue and business requirements in order to be considered for a loan or line of credit. Both options start at $10,000, and you can choose to receive funds when needed. Monthly payments vary based on the balance in your account.

Rewards

You won’t find any special rewards for becoming a member of Bank of America. Being able to bank at over 4,300 locations around the country in addition to online adds a lot of flexibility, whatever your current needs may be.

Additional Features

Bank of America is a large bank and has the tools to prove it. You have the benefit of 4,300 branches around the country and the security only something its size can bring. There are a number of business services to make use of, and the bank works with Zelle for quick payments and transfers.

- All-in-one business banking services with a low monthly fee

- Over 17,000 ATMs and 4,300 branches

- Easy to waive the monthly fee

- Lacks 24/7 customer service

- Monthly fees

- Transaction fees when using non-Bank of America ATMs

Why we chose it: Bank of America has all the trappings of a traditional bank, with thousands of locations and several excellent services.

Companies dealing with copious amounts of cash will find Axos’s free deposits a blessing. There are no fees to contend with outside of outgoing wire transfers to eat away at your bottom line. This makes Axos one of the best free business checking accounts out there. The business checking account does not offer interest, but Axos does have a handful of business savings accounts you can take advantage of.

Fees

Axos Bank Basic Business Checking does not charge a monthly maintenance fee or impose requirements on keeping your account open. You’ll receive back any ATM fees you incur each month, making this account effectively free to use. If you plan to send a lot of wire transfers, be aware of Axos’s $35 charge for each one.

Interest Rates

This particular account does not have an annual percentage yield and instead focuses on business perks. Anyone with extra money can open up one of Axos’s interest-bearing business savings accounts and accrue interest that way.

Lending

There are several line of credit and lending options Axos offers its members. Qualifications can be rigid, requiring at least two years in business, among other things. It’s no surprise, considering the minimum loan amounts are $10 million.

Rewards

At present, signing up for an Axos checking account as a new business owner earns a $200 welcome bonus. Even if you’re not a new business, you can still grab $100 for opening your Axos account.

Additional Features

Over 91,000 ATMs across the country are considered in-network with Axos, but there’s fee reimbursement if you happen to come across an out-of-network one. The online bank will pay you back for the first two wire transfers each month as well. On the financial side, Axos integrates seamlessly with Quickbooks to help with your books.

- Cash deposits allowed via MoneyPass and AllPoint ATMs

- No monthly fee and unlimited transactions

- Interest-bearing savings accounts available

- Limited integrations

- No APY available

- Poor customer service

Why we chose it: Free cash deposits and a low fee structure make Axos Basic Business Checking one of the best business bank accounts out there.

U.S. Bank has loans and lines of credit for any need your business may face, from expansion to an unexpected expense. Depending on your business, you can also benefit from specialized merchant services for various business industries. Banking in person is possible in one of 2,400 locations if you’re lucky enough to find yourself in one of the 26 states they exist.

Fees

U.S. Bank Silver Business Checking doesn’t have any overt fees for service, but you can quickly find yourself in trouble with transactions. Your first 125 are free each money, with every subsequent one $0.50 a piece. It’s also wise to watch out for non-U.S. bank ATMs, as these frequently come with a charge as well.

Interest Rates

U.S. Bank’s interest rates with checking accounts are a bust, but the institution does have business savings and money market accounts to consider. If you have the funds to float, storing some in savings will earn you an amount depending on what you choose.

Lending

Lending options are plentiful with U.S. Bank, and one of the biggest reasons it stands out for having the best business bank accounts. Small business or large, you can request amounts from $5,000 to several million, depending on your business type. Lines of credit work much the same way, with varying amounts based on what you’ll use the money for.

Rewards

U.S. Bank doesn’t have any rewards for signing up or maintaining an account. There are multiple credit card options with welcome offers and options for you to peruse.

Additional Features

U.S. Bank lets you deposit up to $2,500 in cash every statement cycle, which can be helpful if your business doesn’t use a ton of cash. If you plan to pay out in checks, it’s possible to get 50% off your first order. Besides lending, U.S. Bank has a slew of other services worth investigating.

- Lending to fit your needs

- Specialized merchant services for restaurants, retailers, and service providers

- 2,400 branch locations

- Charges transaction fees

- Only locations in 26 states

- No interest

Why we chose it: U.S. Bank’s lending options cater to businesses of all sizes, adding value to an already solid business checking account.

Oxygen carved a space for itself in the fintech niche, acting as a great option for freelancers and boutique sole proprietors. There are no discernible fees across the board, and shopping at select merchants earns 5% cash back just for making a purchase. To keep finances secure, you can create an unlimited number of single-use debit cards with set dollar limits.

Fees

Oxygen claims to be fee-free from top to bottom but does specify that out-of-network and international withdrawals may be subject to a charge. You’ll never have to worry about paying for ACH transfers or keeping your account open.

Interest Rates

While you won’t earn interest for funds in your business checking account, Oxygen remedies the problem by adding business savings account to the mix. Any money hanging out in savings accrues 1.0% interest for balances of $20,000 or less. Amounts in excess still earn interest, but at a much lower rate.

Lending

Oxygen is a mobile fintech company and not a bank. Because of this, Oxygen is unable to offer any lending options.

Rewards

Making necessary purchases feels a little sweeter when you get paid to do it. Buying things like gas, rideshares, or shipping services can earn 5% cash back with no questions asked.

Additional Features

Oxygen is a great option for business bank account for LLCs and even offers formation services as part of its package. Freelancers wanting the personal protections that come with a limited liability company can speed up registration right from Oxygen’s mobile app.

- Aimed at trendy business owners

- 5% Cashback rewards

- Create virtual, single-use debit cards

- Virtual bank, no cash deposits

- Fewer integrations than other options

- No lending options

Why we chose it: Oxygen speaks the language of the trendy business owner, offering some cool banking features along the way. It’s also one of the best checking accounts for sole proprietors.

Where most of the best business bank accounts for LLCs forget about interest, American Express shows up with a 1.3% APY. You’ll also have access to a debit card that accrues points you can turn into cold hard cash. Many on-the-go features are only usable on iOS, and there’s no way to deposit cash. Should you ever encounter an issue with your account, customer service is always on hand to help.

Fees

You’ll only find a fee for outgoing domestic wires with American Express, and the price is quite reasonable. There’s no monthly maintenance fee, NSF penalties, or any charge for receiving money from various sources.

Interest Rates

American Express currently flexes an interest rate of 1.3% APY, 43 timeless the national deposit rate. The interest applies to amounts up to $500,000, but anything beyond that point doesn’t earn a penny.

Lending

Through Kabbage Funding, American Express makes available business loans and lines of credit for companies in need. Your venture must be at least a year old, bring in at least $3,000 in revenue each month, and have a FICO score of at least 640. Right now, it’s possible to earn $250 by connecting your American Express account to Kabbage. Check out our Kabbage Funding review for more information.

Rewards

New members can earn 30,000 reward points just for signing up. To be eligible, you’ll need to deposit at least $5,000 into your account and maintain that balance for at least 60 days. In addition, you’ll have to make at least ten qualifying transactions during that same time frame.

Additional Features

Select debit card purchases to earn reward points you can then convert into deposits dropped right into your bank account. It’s also possible to use points for gift cards, travel, and the like. If you have problems with points or any other American Express feature, the company has a customer service team standing by 24/7.

- Earn membership rewards on almost every purchase

- Up to 1.3% APY

- 24/7 customer service

- Mobile check deposits only available on iOS

- Cash deposits not supported

- Only available to American Express customers

Why we chose it: American Express offers a generous interest rate and pays you to shop with point-to-dollar deposits.

NBKC Bank is the perfect blend of large-scale operations and down-to-earth customer service you want in a bank. While it only has four branches in the Kansas City area, NBKC’s online presence will more than suffice. There aren’t many fees to deal with throughout the bank’s many features, but you will want to watch out for international wire costs.

Fees

You can perform just about every one of NBKC Bank’s functions without worrying about a single fee. The one area you’ll want to tread lightly in is international wires, where incoming and outgoing transfers will set you back $45 each time.

Interest Rates

Sadly, there are no interest rate options with NBKC Bank’s business checking account. You can open up a fee-free business money market account and earn 1.25% APY on monies within.

Lending

NBKC Bank works carefully with business owners to determine the best loan option to suit your needs. It also has line of credit options to have on hand in case of emergency. The downside to lending with NBKC Bank is that your business must be located in the Kansas City metro area to be eligible.

Rewards

There aren’t any special perks for joining NKBC Bank. Fortunately, there are several credit cards providing cash back, sign-up bonuses, or point generation to incentivize use.

Additional Features

Anyone in the Kansas City area will have access to the four NBKC Bank branches currently open for business. Whether in-person or online, there are a number of business solutions you can use to better your business. Available services include fraud management, cash management, and professional invoicing.

- Many extra service options

- Few fees to contend with

- Excellent customer service

- No physical bank branches outside of Kansas and Missouri

- High international wire fees

- Zero APR for business checking account

Why we chose it: NBKC Bank acts like a digital provider but has all the add-on services you’d expect from a major financial institution.

NorthOne understands the need to move money around. It works with hundreds of financial apps to allow quick and easy money transfers and doesn’t put a limit on how much you can do. These perks come at the cost of a $10 monthly service fee that can’t be waived. On the plus side, calling support connects you with a real human being without the need to navigate an automated assistant.

Fees

NorthOne is quite transparent about its fees, announcing a $10 service charge each month to keep your account open. There’s no way to waive this cost. The only other fee comes from incoming or outgoing domestic transfers.

Interest Rates

Any money in your NorthOne business checking account won’t accrue any interest. What’s more, the financial services company doesn’t offer a savings account to tuck additional funds into.

Lending

NorthOne focuses solely on business checking accounts. Because of this, you won’t find any available lending options.

Rewards

At this time, there are no rewards for signing up with NorthOne. Perks for using the service all exist within your account.

Additional Features

With NorthOne, you can connect your favorite accounting, point of sale, or eCommerce software direct to your bank account. There’s no need to manually enter transactions or follow funds from one place to the other. It’s also possible to use envelopes to sort money into groups for taxes, rent, and other buckets.

- Integrates with popular business apps

- Unlimited free transfers each month

- Instant support from actual humans

- Monthly fee

- No international wire transfers

- No interest rate

Why we chose it: NorthOne links with the top apps across accounting, eCommerce, and point of sale software for a seamless financial experience.

Our Ranking Methodology for the Best Business Checking Accounts

When it comes to the best for your business, not just any checking account will do. We studied the best business checking accounts across multiple banks to help find the perfect option for you. During our search, we considered the following methodologies when making our top picks:

- Fees: It’s not ideal to go broke from all the fees your financial institution charges. The best business bank accounts keep fees to an absolute minimum. Even if some charge a monthly fee, many provide a way to get costs waived.

- Interest Rates: Gone are the days of every institution giving interest for having money in a business checking account. There are still a few willing to deposit funds into your account each cycle just for doing business. The best ones offer significantly higher rates than the national average.

- Lending: There will likely come a time when you’ll need to borrow money for an expansion or an unexpected expense. Many of the top business checking accounts make it easier to acquire these funds because you already have a business relationship with them. Having to use a third party can increase risk and payback costs.

- Rewards: The financial institution shouldn’t be the only one to benefit from you opening an account. The best business checking accounts show their support through sign-up bonuses, cash back, or online perks.

- Transfers: As a business, your money moves around a lot. The last thing you need is to incur penalties for too many transfers or the inability to get funds where they need to go. The best business accounts remove limitations and make it easy to connect you with vendors and popular financial apps.

- Additional Features: Banks and fintech companies are not created the same. We dug deep to discover any additional features each one offers and how you can make the most of your business dealings.

Beware of “Mattress” Banking!

Did you know many online banks are crediting as low as 0.1%? You may as well stick your money under your mattress! Bluevine business checking accounts pay an APY up to 1.2% on balances up to $100,000.

Unlimited transcations with no monthly fees!

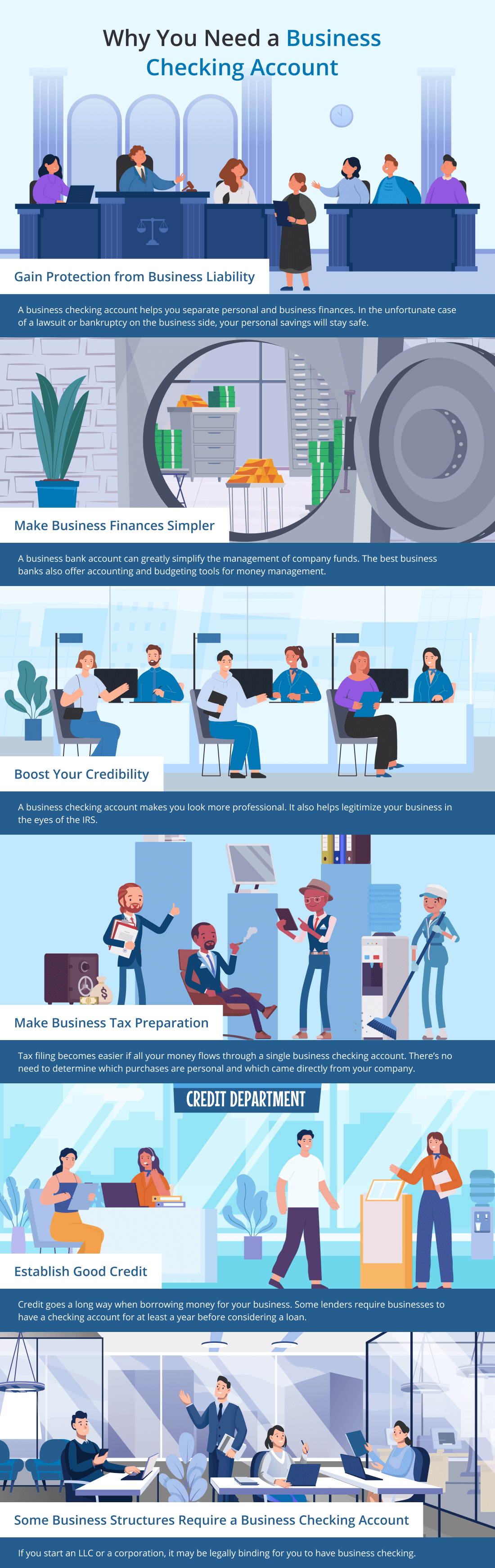

Reasons To Consider a Business Checking Account

There are a multitude of reasons to consider a business checking account over other banking options. Here are some of the top motivations for doing so:

It May Be Required

While not the case for every type of company, some business structures require the use of a business checking account. If you have a limited liability company or corporation, you’ll need to separate personal and professional finances into two piles. Funds specific to your venture need to go into a checking account set aside for business purposes only.

Protection from Business Liability

Going hand in hand with the previous point, LLCs and corporations need to have distinct accounts for business finances far away from personal funds members have. In the event of a debt or lawsuit, no one can reach across this boundary and take money from your personal stash. This holds true even if your business does not have enough funds to cover the penalty.

If you mix your professional and personal finances in any way, all bets are off. You could become personally liable for expenses you otherwise would not need to pay. Even the slightest crossover can be enough for a judge to rule your business is not actually a separate entity.

Simplicity

Opening a business bank account can greatly simplify the management of company funds. Some of the best business checking accounts offer accounting or budgeting tools right within their suite of features, whereas others integrate with top financial apps. Either way, you can automate much of your bookkeeping to save time and monitor where your money goes any time at a glance.

A Boost of Credibility

Establishing a business checking account shows vendors, shoppers, and the government that you’re the real deal. Even if your company started out as a side gig, a business checking account serves to make you look more professional. You can make payments with a company card and have customers pay your business directly, making your operation look that much more credible in the process.

When dealing with the IRS, having a dedicated business bank account helps legitimize your business. You can’t deduct expenses at tax time if the government believes your business is just a hobby, but an account with payment and purchase records can swing things in your favor.

Easier Tax Preparation

Speaking of taxes, the prep process becomes way easier if all your money flows through a single business account. There’s no need to determine which purchases are personal and which came directly from your company.

Many of the best small business checking accounts have tools to help automate tax payments, or at least buckets you can store funds in for tax time. If the IRS detects foul play, you may have to deal with audits or careful scrutiny of your business practices.

Establishing Credit

Credit goes a long way when borrowing money. Lenders often require bank records and credit card statements to see how you handle your funds. While you may still be able to obtain a loan with poor credit, your chances of a better rate are much higher if you’re in good standing. Banks doubling as lenders usually require having a checking account for at least a year before considering a loan.

What You Need To Open a Small Business Checking Account

Starting your very own business checking account isn’t a complicated process if you have all the right paperwork. Be sure to have all the following available when you go to apply.

Personal and Business Identification

You’ll need at least one government-issued photo ID, such as a passport or driver’s license, to open a business bank account. The bank will also ask for your personal address, contact information, date of birth, and social security number. Any business owner with at least a 25% stake will need to do the same.

The application will also ask for your business name, address, and any assumed names you’re using. There will also be line items for your business type and the industry you work in. You will also need your EIN number.

Organizing Documents

No matter your business type, you’ll need to provide a registration certificate and any necessary business licenses. LLCs and corporations also must have organizing documents and operating agreements handy.

EIN Number

Sole proprietorships and single-member LLCs may be able to open an account with a social security number. However, it’s wise to have an employer identification number (EIN) for business purposes. Opening a bank account with an EIN helps create a divide between personal and professional finances, protecting private funds in the event of legal trouble.

Initial Deposit

Some business checking accounts require an initial deposit at the time of opening. It’s worth researching any requirements so you don’t find yourself in a pickle.

Quick View on the Best Business Savings Accounts

- Capital One Business Savings Account – Best Overall

- NBKC Business Money Market – Best for Add-On Services

- Bank of America Business Advantage Savings Account – Best for Rewards

- Lili Automatic Savings – Best for Tax Optimization

- Axos Bank Business Premium Savings – Best for Welcome Bonuses

- U.S. Bank Basic Business Savings Account – Best for Lending Options

When checking out the best business savings accounts, we looked for any pesky fees and interest rates that serve to offset them. We also found it important to understand minimum deposit requirements at the time of opening and limitations on drawing money out. Finally, we looked for additional features that made a particular company stand out and how easy it was to use an account.

You can find a more detailed look at our methodology below.

Bank or Fintech

Fees

Interest Rates

Minimum Deposit

Withdrawals

Additional Features

$3 monthly service fee (waivable), $2 for out of network ATMs

0.20% APY

$250 minimum opening deposit

Up to 6 free each cycle

Overdraft coverage if linked to business checking

None

1.26% APY

$0.01

6 free withdrawals each month

Four physical bank locations, additional banking services available

$10 monthly service fee (waivable), fees for excessive deposits

Up to 0.04%

$100 to open account

Up to 6 transfers or withdrawals each monthly cycle, up to $1,000 in cash from ATM

Can set up automatic transfers, overdraft protection, rewards program

$9 monthly service fee, $2.5 for out of network domestic ATMs, $5 for international

1.50% APY

$0.01

Maximum six withdrawals per month

Tax optimization software, fast enrollment, smart mobile banking, overdraft forgiveness

$25 overdraft fee

Up to 0.20% APY

$25,000 minimum opening deposit

Up to 6 free withdrawals per statement cycle

$200 bonus for new business owners, ATM reimbursements, Quickbooks integration

Monthly maintenance fee (waivable), fees at out of network ATMs

0.01% APY

$500 minimum opening deposi

Limited to 6 withdrawals each month

More than 2,400 bank locations in 28 states

Business Checking Accounts That Earn Interest

Sometimes, you don’t have to look to business savings accounts to earn interest on your money. Some of the best business checking accounts offer APY on their own:

- Bluevine Business Checking – 2.0% APY on balances up to 100k & Best Bank Account for LLCs

- American Express Business Checking – 1.3% APY on balances up to $500k

Capital One has a baseline APY of 0.20%, but many businesses can qualify for higher promotional rates for the first 12 months of use. There are only a handful of branch locations around the country, but the bank’s extensive ATM network more than makes up for it.

If you accidentally pull too much from your account, you’ll never have to worry about overdraft fees. Beware of the monthly account fee should you not be able to keep up with the requirements.

Why we chose it: Capital One’s large ATM network, minimal fees, and high promotional interest rates of up to $5 million make it one of the best online savings accounts for businesses.

- High promotional interest rates

- Does not charge overdraft fees

- Large ATM network

- Limited physical locations

- Monthly account fee

- Out-of-network ATM fees

Fees

You’re looking at a $3 per month service fee with Capital One if you can’t meet monthly criteria. Fortunately, this is no more difficult than having at least $300 in your business savings account at all times. For other fees, expect a $2 charge for out-of-network ATMs both in the United States and abroad.

Interest Rates

Capital One advertises a 0.20% interest rate as a current baseline to go off of when setting up your account. It’s possible to grab a promotional rate for your first year with the bank, although this amount seems to be on a case-by-case basis. Whatever rate you end up with, it’s good on balances up to $5 million. Any funds beyond that will receive a lower APY.

Minimum Deposit

It takes a $250 initial deposit to open a business savings account with Capital One. Once you’ve opened an account, you don’t need to maintain a set amount. If you can maintain a balance above $300, you won’t have to worry about monthly fees.

Withdrawals

Capital One gives six free withdrawals each payment cycle. Going over the limit can result in unsightly fees. For each withdrawal, you can take up to $600 out through an ATM at a time.

Additional Features

Besides a promotional interest rate for the first year, having a linked business checking account saves you from overdraft fees on your savings. Beyond that, Capital One works with business owners to find banking products that best suit their needs.

NBKC Bank loves offering a lot for very little. Its money market account has minimal fees to contend with across the board, so your money stays with you. Memberships unlock several add-on services you can build into your account, from fraud protection to invoicing. There aren’t any physical branches outside the Kansas City area, and the app lacks a few features. However, NBKC’s customer service more than makes up for it.

Why we chose it: NBKC Bank goes beyond traditional banking with professional invoicing, cash management, and several other powerful service options.

- Many extra service options

- Few fees to contend with

- Excellent customer service

- No physical bank branches outside of Kansas and Missouri

- High international wire fees

- Mobile app limitations

Fees

Good luck stumbling across a fee while using NBKC Bank. There’s no charge to open an account, maintain it, or if you have an overdraft. Furthermore, you aren’t penalized for returned checks, using a debit card, or depositing money into your business money market account. The only area you have to worry about is international wire transfers, which can set you back $45 a pop.

Interest Rates

NBKC Bank has a high-yield business savings account at 1.26% APY. Best of all, this rate remains whether you have a penny or millions stashed away.

Minimum Deposit

There are no requirements for opening or maintaining your money market account through NBKC Bank. You won’t ever encounter a fee for falling below a certain threshold, nor will your interest rate suffer.

Withdrawals

You can withdraw funds from your money market account up to six times per statement period. It’s possible to pull out up to $1,010 from an ATM each day as long as you have sufficient funds.

Additional Features

This is where NBKC bank really shines. As a traditional bank, it offers a multitude of banking services you can use with your business. These extend to invoice processing, cash management tools, and one-on-one service from industry experts. Anyone living in the Kansas City area can take advantage of these services from a physical branch location.

The Business Advantage Savings account gives you the opportunity to level up your interest through various reward tiers based on your monthly balance. There are monthly fees, but it is possible to waive these through a handful of requirements. With thousands of branches and ATMs around the country, chances are you’ll never be far from one. This is a good thing, because transaction fees for using non-Bank of America ATMs can be high.

Why we chose it: Bank of America’s Preferred Rewards program offers interest rate boosts and other incentives to serve your business.

- Preferred rewards to boost interest rate

- Over 17,000 ATMs and 4,300 branches

- Can waive the monthly fee

- Lacks 24/7 customer service

- Monthly fees

- Transaction fees when using non-Bank of America ATMs

Fees

Bank of America has a $10 monthly service fee for anyone unable to meet the requirements to have it waived. To qualify for free savings, you’ll need to do at least one of the following:

- Maintain a $2,500 minimum daily balance

- Include one Business Advantage Savings account as part of your Business Advantage Relationship Banking solution

- Become a member of Preferred Rewards for Business

Otherwise, there are incremental fees if you deposit more than 25 items or over $5,000 in cash during a statement cycle.

Interest Rates

You’ll start off at 0.01% APY, no matter what your average daily balance is. Should you enroll in Bank of America’s Preferred Rewards program, you’ll be able to increase this rate as you move up the ladder. To be eligible, you must open a Bank of American business checking account and have an average daily balance exceeding $20,000 across your business deposit accounts.

Interest rates at higher tiers are:

Gold: 0.02%

Platinum: 0.03%

Platinum Honors: 0.04%

Minimum Deposit

To open a Business Advantage Savings account, you’ll need to make an initial deposit of at least $100. There’s no penalty for falling below this number, but there are plenty of perks for moving it higher. You can waive the monthly service fee or tap into high-interest rates if your balance is high enough. In case you missed it, we have also guide on how to open an EIN-only business bank account.

Withdrawals

When working with your savings account, you’ll have to limit withdrawals to six per payment cycle. The maximum amount you can withdraw from an ATM at a time is $1,000.

Additional Features

The Preferred Rewards program offers many benefits beyond an interest rate increase. You can earn discounts on auto loans and merchant services while cutting down on ATM fees just by moving up the ranks. Bank of America also protects your account from overdrafts and allows automatic transfers so you can maximize your interest.

Lili’s all-in-one banking app is super simple to set up, rarely taking more than a few minutes to create your account. Although online-only, Lili has many great features, such as tax optimization software to help keep you in good standing with the IRS. To access business savings, you’ll have to sign up for Lili Pro, a premier service with a monthly service fee. Fortunately, this high-yield business savings account puts many other financial institutions to shame. By the way we also have reviews for other business savings accounts such as; Novo Review and Bluevine Review

Why we chose it: Lili’s checking and savings accounts come with personalized tax optimization tools to ensure you can file easily and without issue.

- Tax optimization software

- High yield business savings account

- Quick enrollment

- Must transfer money to savings every day

- Monthly service fee

- Low monthly transfer and deposit limits

Fees

It will cost you $9 per month to subscribe to Lili Pro, the mobile app’s advanced tier of service. There’s no way to remove this fee, and you’ll need a Lili Pro membership to open a business savings account. There are no additional charges for doing business, but watch out for $2.50 fees for domestic out-of-network ATMs and $5 for international ones.

Interest Rates

Lili is one of the top high-interest business savings accounts out there, offering up to 1.50% APY on funds located within. The rate actually went up from 1% at the beginning of the year.

Minimum Deposit

There’s no minimum deposit required to start a Lili business savings account. However, you will need to deposit at least $1 per day into your business savings account to keep it open. You can set this transfer to happen automatically so you don’t forget.

Withdrawals

Lili limits monthly withdrawals from your business savings account to just six. It can be challenging to move funds back to checking, and the process can take up to a week to complete. Make sure to plan ahead if you’re going to need to tap into what Lili calls an emergency savings account. When taking money out through an ATM, the cap is $500 per day.

Additional Features

Lili has cool tax optimization tools to help you save for the season. With it, you can categorize purchases, find your tax bracket, and file all from the app. Enrollment is lightning fast, and the smart mobile app makes it easy to bank from anywhere. There’s also overdraft forgiveness if you overstep the bounds of your account.

While most financial institutions stifle transfers, Axos offers a lot more leeway with up to 20 per month across your accounts. Anyone setting up an account for the first time can earn a $100 bonus for doing so, and new businesses may see up to $200 in free money. The Premium Savings account does have a hefty $25,000 initial deposit that some small businesses may not be able to afford, however.

Why we chose it: Axos allows more transfers than most other online savings accounts for businesses and has a nice welcome bonus for new owners.

- Up to $200 welcome bonus

- Allows 20 transfers per month

- Integrates with Quickbooks

- No cash deposits

- High initial deposit required

- Poor customer service

Fees

Axos Bank scoffs at fees, charging absolutely nothing for monthly maintenance nor costs should your balance fall below a certain threshold. This makes Axos the best free business bank account for cash deposits.

You’ll want to keep tabs on your finances though, as $25 for over drafting your account can be a punch in the gut.

Interest Rates

You’re looking at a 0.20% interest rate with Axos Bank no matter how high your business savings account goes. The online provider does seem to imply a rate increase if you pass the $5 million mark. If your Premium Savings account falls below $24,000, the rate drops to 0%.

Minimum Deposit

You’ll need at least $25,000 in initial funds to open up an Axos Premium Savings account. Once up and running, there’s no requirement to maintain this balance or fees if you drop below it. If funds dip below $24,000, you won’t earn any interest.

Withdrawals

Like most other business savings accounts, you can perform up to six withdrawals each statement cycle. You can draw up to $1,010 from your account each day.

Additional Features

Axos Bank really stands out for dropping money into your account at startup, making a good bank account for startups. An extra $100 to $200 can mean a lot to an up-and-coming business, and all you have to do is sign up. Additionally, Axos integrates well with Quickbooks software for financial tracking.

U.S. Bank has some great lending options to complement its checking and savings accounts for business owners. It’s possible to set up business loans or business lines of credit for an immediate expense or grow your business. The bank has more than 2,400 branch locations around the country in 28 states, so you may have a drive a little to find one. While you’re there, take advantage of the specialized merchant services U.S. Bank offers for your business type. Don’t also forget our review for the other business savings accounts like; Chase Bank Review and SoFI Review

Why we chose it: You can use U.S. Bank’s business savings account to set money aside for a rainy day or make use of a long list of lending options.

- Lending to fit your needs

- Specialized merchant services for restaurants, retailers, and service providers

- 2,400 branch locations

- Nontransparent fees

- Only locations in 28 states

- Very low APY

Fees

The fee schedule at U.S. Bank is very muddy. You’ll need to visit a branch or call an agent to figure out monthly charges for not meeting your account requirements. It is clear that you can avoid monthly fees if you maintain at least $500 daily. There are also ambiguous fees for transactions and the use of out-of-network ATMs.

Interest Rates

U.S. Bank’s interest rate is 0.01%. It doesn’t matter how much you have in your account; your money will only grow at this rate.

Minimum Deposit

There’s a $500 minimum opening deposit for a U.S. Bank Basic Business Savings account. Should you call below this minimum, you will incur a monthly maintenance fee from the company.

Withdrawals

With U.S. Bank, you’ll have the standard six monthly withdrawals to work with. Within a 24-hour period, it’s only possible to pull out $300 from your business checking account using an ATM.

Additional Features

If you prefer to bank in person, U.S. Bank has more than 2,400 locations scattered throughout the United States. These branches cover 28 states, seemingly without rhyme or reason. The bank does make it easy to view account features through a handy app and detailed monthly statements.

Methodology for the Best Business Savings Accounts

We looked into many different factors when selecting the best business savings accounts to populate this list. Here are the top considerations we used when making our decision.

- Fees: There’s little point in using a bank that’s going to slowly suck your account dry. We make sure to avoid institutions with hidden fees or high costs for doing business that ultimately put you at risk of losing money instead of growing your account. If there are monthly maintenance fees, we prefer providers with the option to waive these amounts if you meet certain criteria.

- Interest Rates: Interest rates are the bread and butter of any savings account. Without a good interest rate, there’s no reason not to leave all your funds in a checking account for quick and easy access. With a national average rate hovering around 0.24%, banks should meet this or have incredible features to make up for it.

- Minimum Deposit: Banks requiring a minimum initial deposit can be a barrier for startups or up-and-coming small businesses. Even worse are penalties for failing to maintain a certain threshold over a period of time. Any institution with a high deposit requirement has to have a good reason for doing so.

- Withdrawals: Your money only works for you when you have the ability to access it. It’s hard to find a bank without withdrawal limits on a savings account, but knowing how much you can take out and when is half the battle. ATMs should allow withdrawals from your business savings account, and the limit should be on the higher side.

- Additional Features: Many banks and fintech companies follow cookie-cutter systems that lead to lackluster service options. The best business savings accounts have features making them stand out from the masses. This can include a large ATM network, access to physical branches, overdraft protection, and financial management tools.

- Ease of Use: We wanted to make sure each option making our list was easy enough for the most novice of business owners to understand and use. Access to funds was an important factor, along with the ability to communicate with support staff should the need arise. We also tried to locate organizations with transparent fee structures and clear guidelines on what you can and can’t do.

Best Business Checking Account and Business Savings Account Frequently Asked Questions (FAQs)

The logic behind a business savings account isn’t always clear. This FAQ answers some of the most popular questions about the benefits of opening one.

Bottom Line

In conclusion, choosing the best business bank accounts for your company is a critical decision that can significantly impact your financial success. By considering factors such as fees, perks, rewards, and money management features, you can find an account that aligns with your business needs. Whether it’s a top-notch checking account that streamlines your daily transactions or a savings account that helps you accumulate funds for future endeavors, the right banking solutions can provide stability, convenience, and growth opportunities for your business.

Remember to assess your specific requirements, compare the available options, and select accounts that offer a balance of benefits, affordability, and reliability. With the 18 best business bank accounts of 2024 highlighted in this guide, you can make informed decisions and take confident steps towards optimizing your company’s financial management. Embrace the power of these top checking and savings solutions to drive your business forward and lay a strong foundation for continued success.

Not sure how to open a business savings account? Read our guide on how to open a business bank account to find out.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.

Sections of this topic

Sections of this topic