In today’s digital age, the role of traditional brick-and-mortar banks is diminishing as payments and banking services move online. However, they still offer unique benefits that mobile banks can’t match. In this Chase Bank review, we’ll explore the offerings of one of America’s largest full-service banks.

>> Open an Account With Chase Bank >>

Our Verdict

Chase Bank offers banking solutions catered for businesses, called Chase for Business. Chase Bank mixes the traditional brick and mortar with online banking by offering a large branch network and user-friendly online tools – what we consider ideal for small businesses that need both worlds combined together.

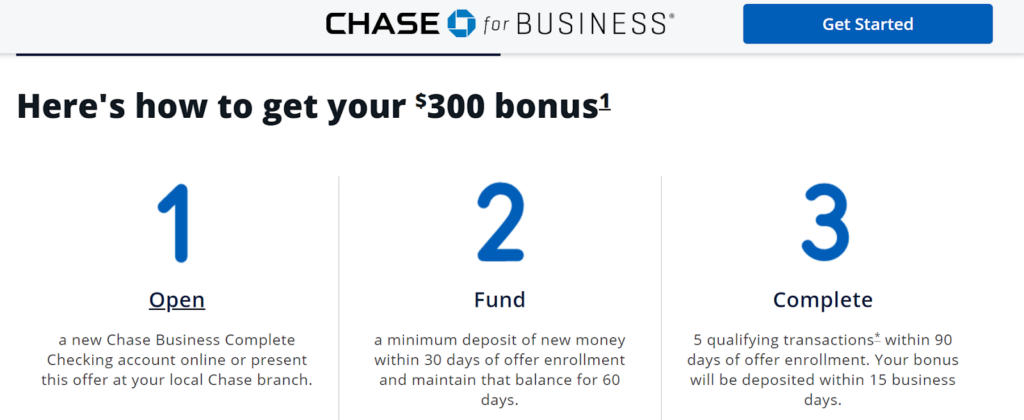

As a traditional bank, Chase Bank doesn’t seem to want to fall behind its digital banks competitors and wants to attract customers – so it’s offering a $300 bonus to new customers when opening a Chase Business Checking account. It ranks fourth when it comes to the best business checking accounts.

- $300 bonus to new customers and cashback with business credit card

- 16,000 ATMs and 4,700 branches available across the U.S.

- No minimum opening deposit

- $15 monthly fee

- Low to zero interest-earning potential

- In-person visit to open an account

Chase Bank Business Account at a Glance

The Chase Business Complete Banking account stands out among the best business bank accounts for LLCs. This business account gives its account holders the best of the offline and online world: It provides access to 16,000 Chase ATMs and 4,700 branches across the U.S. while providing user-friendly online banking tools.

This business checking account offers many benefits for the business owner. The first one is the sign-up bonus. If you sign-up for the Chase Business Complete Banking account, you’ll get a $300 bonus if you deposit $2,000 on your account, maintain it for at least 60 days, and complete one of the five activities required within 90 days of offer enrollment.

However, if you can’t afford to maintain the minimum deposit to get the bonus but still want to open a business account at Chase Bank, the good news is that you can, and there’s no minimum opening deposit. But the rewards and benefits don’t stop there.

Chase Bank also gives a $750 bonus cash back for new business credit card members and unlimited 1.5% cash back rewards on every purchase. You must spend $7,500 on purchases in the first three months after account opening.

The Chase Business Complete Banking account isn’t a good fit for those looking for some earning potential within their bank accounts. Chase Bank doesn’t offer interest in most of its accounts. Also, we wouldn’t recommend this account for people who don’t want to pay an in-person visit to open an account, you must visit a Chase branch in person to open a Chase Business Complete Banking account.

Who Chase Bank Business Account is Best For

This account is for business owners who need in-person support, have access to several ATMs nationwide, and use user-friendly mobile and banking tools.

You should also consider the Chase Business Complete Banking account if your business handles many transactions but doesn’t want to pay per-transaction fees. Online transactions are unlimited.

If you want to open a fee-free business account, here is a detailed Oxygen Review, Kabbage Review, and SoFI Review packed with information about both FinTech companies’ pros, cons, and alternatives.

Pricing

In this review, we’re mostly covering Chase Business Complete Banking, which caters mostly to small business owners. However, Chase Bank offers three business checking accounts: Chase Business Complete Banking, Chase Performance Business Checking, and Chase Platinum Business Checking.

We’ve compared the main features of the three accounts to better understand all price tiers in the business checking account.

>> Experience Better Banking With Chase Bank >>

Chase Business Complete Banking

Chase Performance Business Checking

Chase Platinum Business Checking

Monthly Fee

$15 or $0 monthly fee if you maintain $2,000 minimum daily balance

$30 or $0 monthly fee if you maintain $35,000 combined average beginning day balance

$95 or $0 monthly fee if you maintain $100,000 combined average beginning day balance

Cash Deposit Fee

Fee-free at $5,000 in cash deposits per statement cycle

Fee-free at $20,000 in cash deposits per statement cycle

Fee-free at $25,000 in cash deposits per statement cycle

Mobile and Online Banking

Multiple User Accounts

Accept Card Payment

Fraud Prevention Services

Fee-free Incoming Wires

Cash Management Support

Platinum Business Customer Service

Chase Bank Business Account Features

As a brick and mortar traditional bank with digital banking tools, Chase Bank Business accounts offer many benefits among its features, even in the entry-level option. We’ve listed the main features below.

Mobile and Online Banking

The Chase Mobile® Banking app is easy to use and offers security with encryption technology and offers many interesting features to business owners such as online bill pay (and schedule payments), fraud protection, receiving or sending payments, getting account alerts and setting up multiple account users straight from the app.

Sign-up Bonus

If you’re looking for a business checking account with a sign-up bonus, this is an opportunity to earn some extra money. Chase Bank offers $300 for newcomers who sign up for Chase Business Complete Checking, deposit $2,000, maintain the account for 60 days, and complete five of the qualifying activities, such as debit card purchases and Chase QuickAccept deposits.

Cash Back Bonus

If you’re looking for a business checking account with a sign-up bonus, this is an opportunity to earn some extra money. Chase Bank offers $300 for newcomers who sign up for Chase Business Complete Checking, deposit $2,000, maintain the account for 60 days, and complete five of the qualifying activities, such as debit card purchases and Chase QuickAccept deposits.

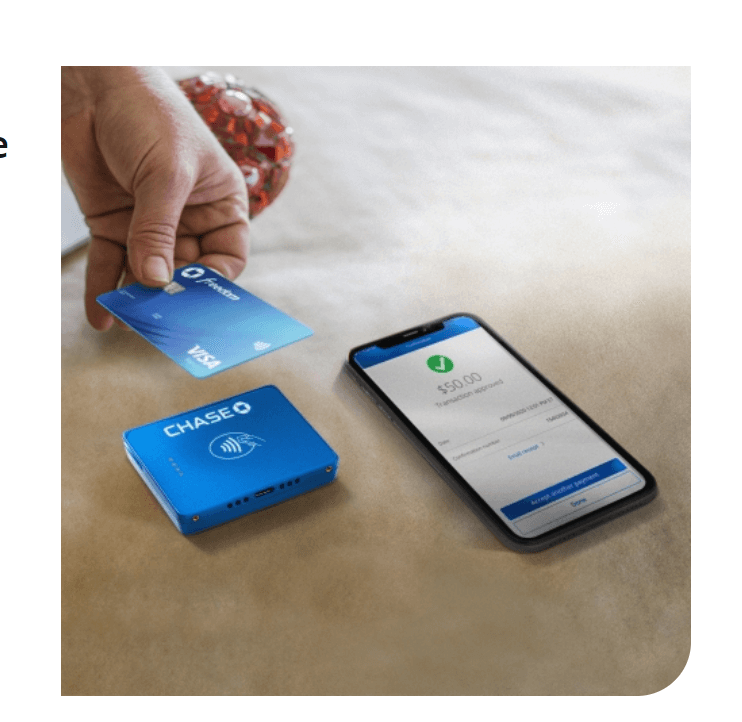

Accept Card Payment

Your business can accept credit and debit card payments with Chase QuickAccept in the Chase Bank app. This payment processing service connects with a mobile card reader to tap, swipe or dip transactions and you can receive the funds into your account on the same day.

No minimum opening deposit

Most brick-and-mortar business checking accounts require a minimum deposit of money to open a bank account. However, the Chase Business Complete Banking℠ account is one of the few that doesn’t do that. Even if you have no extra cash, you can even open a Business Complete Banking℠ account with no money.

>> Open an Account With Chase Bank >>

Alternatives to Chase Bank Business Account

In case you aren’t sure whether the Chase Bank Business account isn’t the best fit for your business, there are some alternative options and we’ve listed the best ones.

Bluevine is an excellent alternative for Chase Bank. You can pay bills, apply for small loans in minutes, and even earn a decent interest rate without paying monthly fees. Instead of Chase, you can open a bank account in a few minutes with no minimum deposit, so it’s a good fit for businesses of any size. Read our complete Bluevine review here.

Bluevine provides an impressive 2.0% APY on checking account balances up to $250,000, available to users who spend $500 monthly on their debit card or receive $2,500 in monthly customer payments. They offer two tiers, Bluevine Plus and Bluevine Premier, where users can earn up to 4.25% APY.

- Earn up to 1.2% APY

- No monthly fees

- No minimum balances

- Only allow cash deposits through Green Dot Services

- No physical branches

Another great option for small businesses is Novo. The mobile-only bank offers an easy-to-use platform, under a 10-minute application, refund ATM fees and no monthly fees, as opposed to Chase Bank.

Novo offers free ACH transfers you can easily sign into your app via your mobile device and pay bills, send money, fund payroll, or transfer money to your personal account within seconds. However, Novo falls short in two aspects: it doesn’t allow users to set up recurring payments and as a digital bank it doesn’t let you deposit cash.

- User-friendly app

- Refund ATM fees

- No monthly fees

- No recurring payment functionality

- Can’t deposit cash

What’s interesting in Mercury is that it advertises itself as a fintech, not a bank. Mainly focused on ecommerce businesses and startups, this company offers both virtual (generated instantly) and physical cards, it integrates with major accounting software, and Mercury’s checking and business savings accounts are completely free with no minimum deposit or balance requirements.

The drawback of opening an account with Mercury is that, like most online-only banks, you can’t deposit cash and in case you’re looking for some earning potential – similar to Chase Bank – Mercury offers no-interest drawback.

- Virtual and physical card available

- No minimum deposit or balance required

- Accounts integrate with major accounting software

- Can’t deposit cash

- No interest-earning potential

Frequently Asked Questions (FAQs) for Chase Bank

We’ve listed the most asked questions about Chase Bank Business Account.

Bottom Line on Chase Bank Review

Chase Bank is a strong choice for small business owners, offering the convenience of fee-free ATMs, in-person support, and cash deposit options, all while providing the ease of online banking at your fingertips.

>> Open an Account With Chase Bank >>

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.

Sections of this topic

Sections of this topic