Novo is a digital banking tech company ideal for entrepreneurs with small businesses or side hustles. The company allows you to separate your personal and business income and provides a reliable banking experience. Through a partnership with Middlesex Federal Savings F.A, the platform offers one of the best business checking accounts online.

About 61% of internet users bank online. If you are earning a passive income from your side hustle or small business and wish to open a small business checking account, Novo might be for you. But before you make the decision, read this detailed Novo review to know whether it’s right for you.

Our Verdict

Novo is a fintech (financial tech) company that provides digital checking accounts for small businesses. The service allows you to open a business account easily, deposit income from your side hustle, and use banking data from your cash flow and expenses for bookkeeping and reporting.

Novo stands out for simplifying opening a small business checking account. You don’t need to stand in line for hours or handle massive paperwork to open your account.

- Unlimited fee-free business checking transactions

- ATM fees are funded up to $7/mo

- Smooth integrations with third-party software like Shopify and QuickBooks

- No option of automating recurrent bill pay

- No option to open a savings or interest-bearing account

Novo at a Glance

Novo is an independent fintech company that offers online financial services through its partnership with Middlesex Federal Savings F.A. Users enjoy safe digital banking packed with the security protections of a traditional bank and FDIC insurance.

Using the Novo platform gives you access to a robust suite of helpful digital tools designed to help entrepreneurs, freelancers, and small business owners manage their routine banking tasks. Opening a Novo account is straightforward, and it will only take you ten minutes to unlock attractive fintech features, including fee-free banking, free ACH transfers, and unlimited invoicing.

Eligibility Criteria

You do not need a perfect credit score to open a Novo business checking account. The company does not check user’s credit histories. However, Novo does offer an invite-only business line of credit product, available to existing users. If you need immediate access to additional capital and don’t qualify for Novo’s credit line, you may also want to consider credit unions for business banking accounts.

You are free to open a small business bank account for your LLC, sole proprietorship, partnership, or corporation. Companies specializing in money services, gambling, cannabis, crowdfunding, or cryptocurrencies are the only exceptions. While opening a Novo account is relatively easy and fast, you must submit essential business documentation. Other eligibility requirements include:

- Account owner must be a U.S. resident with legal status

- You must be at least 18 years old with a Social Security Number, although it is also possible to open a business account with an EIN

- Account owner must have a valid U.S. mailing address

Who is Novo Best For?

Novo offers digital banking services where users enjoy a free checking account, invoicing tools, and smooth integrations with third-party business tools that can streamline financial processes. Because of the lack of essential features like cash deposits, a Novo account is only ideal for entrepreneurs with small businesses or side hustles who primarily operate digitally.

Novo Pricing

Novo offers relatively inexpensive digital business banking. Apart from providing fee-free business banking accounts with no monthly maintenance fees, there are no fees allied with ACH transactions or wire transfers. Novo offers ATM fees are funded up to $7/mo. Other perks include free:

- Transfers, irrespective of their volume

- Debit card replacement

- Check deposits

- Paper statements

- Stop payments

- Mailed payments by physical checks

Features

Cost

Opening Deposit

$50

Min Balance Requirement

$0

Cash Deposit Fees

N/A

Monthly Fee

$0

ACH Fee

$0

ATM Fees

$7/mo

Wire Transfer Fees

0%

Foreign Transaction Fees

0%

The only significant fees users may encounter include the cost of purchasing money orders from approved vendors whenever they want to make a cash deposit through the platform’s mobile check deposit feature. Additionally, Novo offers reimbursement of ATM fees up to $7 per month. There are no returned payments or NSF fees. It’s also crucial to be aware of the following transaction limits and expected processing time.

Transaction Type

Transaction Limit

Processing Time

ATM Withdrawals

$1,000

Same Day

ACH Transfers

$1250 or $5,000/day

2-3 Business Days

POS Transfers

$5,000 or 20 Transactions/Day

Same Day

Mobile Check Deposits

$20,000/Day or $40,000/ Month or a Monthly Maximum of 20 Transactions

5 Business Days

Mailed Checks

$5,000

10 Business Day

Novo Features

Novo offers a decent range of business checking account features and tools that benefit entrepreneurs, freelancers, and small business owners. Apart from an easy and fast application process, here are other features users enjoy from the platform.

Fee-Free Banking

Novo offers fee-free banking, meaning freelancers, solo entrepreneurs, and small businesses don’t have to worry about recurrent account maintenance fees. The only cost you will incur is a $50 initial deposit.

Mobile App

A Novo online business checking account gives users the flexibility of managing their business finances from anywhere. You can download the mobile app to your iOS or Android phone to enjoy a range of online and mobile banking features in the palm of your hand.

Free ACH Transfers

The free ACH transfers from other bank accounts make it easier for users to fund their Novo accounts or spend their money. Novo does not accept cash deposits, although you can conveniently deposit a physical check by simply taking a picture. Also, you can fund your checking account by integrating it with Stripe and receiving credit and debit card payments from your clients.

Another option for funding your account is to purchase a money order and then deposit it into your account through the platform’s mobile check deposit feature. Some of Novo’s approved money order vendors include Grocery Stores, USPS and Walmart.

Novo provides a free debit card, and you can expect a full refund of any fees incurred during ATM withdrawals. Also, you can use the Novo Virtual Card feature to pay vendors through mailed checks, ACH transfers, or wire transfers. The free transfers also make it convenient to pay yourself from the side hustle by occasionally sending funds to your personal account.

Unlimited Invoicing

The Novo platform allows you to create unlimited invoices, send and manage them from your checking account. You can also accept invoices from customers via Stripe or ACH transfers.

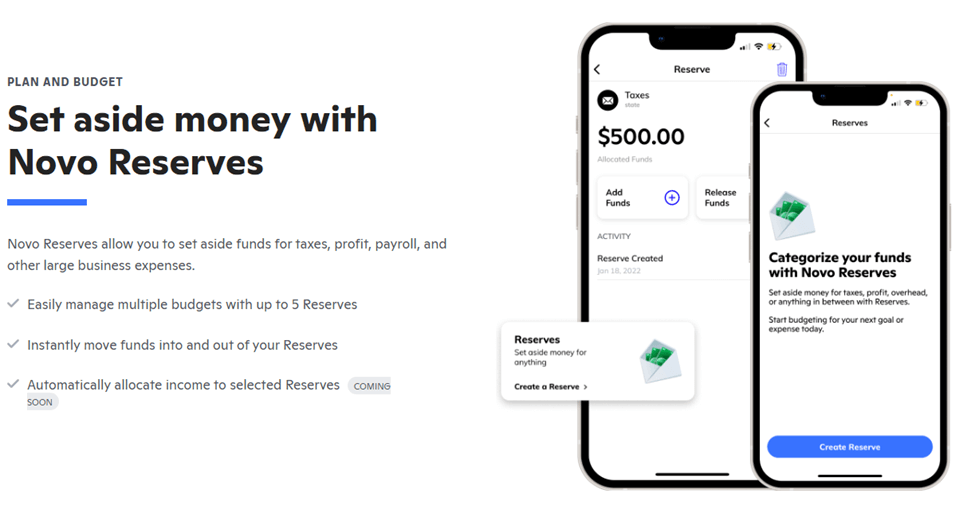

Business Budgeting

You can create up to 20 reserves through the Novo reserves and set aside funds for predetermined expenses like payrolls or taxes. This allows you to plan ahead, create multiple budgets and business objectives and even transfer your statements to bookkeeping software like QuickBooks.

Integrations

Novo offers plenty of flexibility by allowing smooth integrations with third-party software. Once you install your mobile app for Android or iOS, you can connect your account with other digital tools, including Zapier, which allow you to connect to thousands of business apps that automate various processes.

You can connect to about 15 popular apps through your Novo business checking account. If you need eCommerce options, the platform allows integrations with Amazon, Shopify, Etsy, and WooCommerce. It also integrates directly with accounting software like Zero and QuickBooks. Furthermore, you can link to the platform’s POS partners like Square and Stripe.

Also, having a Novo business checking account makes you eligible for discounts on software offered by the platform’s partners. For instance, you enjoy fee-free credit card processing worth $20,000 with Stripe. Other Novo partners that offer equally enticing discounts to users include Snapchat, HubSpot, QuickBooks, and Gusto.

Novo Alternatives

Novo provides a platform where freelancers, solo entrepreneurs, and small businesses can create business checking accounts and make easy and free transactions via ACH transfers or integrations with TransferWise, Slack, and Stripe.

Unfortunately, the platform may still not offer the best digital banking solutions for some ventures, personal consumers, or larger enterprises.

Here are a few good alternatives to consider if the Novo business checking account does not match your business needs or goals.

One of the best alternatives to Novo is Kabbage Business Checking. This is a fintech company that offers checking accounts at equally competitive rates. There are no monthly fees or transaction fees, not to mention that users can also benefit from other Kabbage products, including a business line of credit from $2,000 to $250,000.

Kabbage Pricing

Kabbage offers a fee-free business checking account just like Novo. It also provides the added benefit of making cash deposits at a fee. Here is the pricing to expect:

- Minimum balance requirement—$0

- Monthly fee—$0

- Unlimited electronic transactions—$0

- Teller cash withdrawals —$3

- Foreign transactions—3% of the transaction amount

- Domestic wire transfers—$25 per transaction

- APY on balances up to $100,000—1.10%

Who is Kabbage Best For?

Kabbage is best for entrepreneurs and small businesses who desire the flexibility of having a business checking account and enjoying other financial products like a business line of credit. If you are an established company that has operated for at least a year, you can benefit from attractive loan terms like a repayment term of up to 18 months with an APR of 9% to 36% on average

How Does Kabbage Compare to Novo?

Both Kabbage and Novo offer reliable business checking accounts. However, they target a different audience. Novo is best banks for startups, freelancers, and small businesses who merely want to separate their personal and business accounts without taking out loans.

On the other hand, Kabbage is ideal for more established ventures and business borrowers who have already built a good FICO score and wish to benefit from a business line of credit. Read the Kabbage review to learn more about its features and pricing.

- No minimum opening deposit, minimum balance requirement, or monthly fees

- 1.10% APY interest on account balances up to $100,000

- Integrates directly with Kabbage Loans

- Lacks integrations with third-party software

- Cash deposits are not free (vendors charge $4.95 per deposit)

- Complex fee structure for outstanding balances

BlueVine Business Checking

BlueVine is a fintech company that provides financial solutions through a partnership with Coastal Community Bank. The company offers innovative digital banking solutions ideal for small businesses that want feature-packed checking and savings accounts.

While the checking account is not entirely fee-free, BlueVine eliminates most fees and offers a competitive interest rate on balances up to $3 million.

BlueVine Pricing

BlueVine offers a range of fee-free online banking features, coupled with the ability to make cash deposits through Green Dot at a $4.95 fee. Also, users enjoy an Annual Percentage Yield upto 4.0% for balances up to $3 million.

- Minimum balance requirement—$0

- Monthly fee—$0

- Unlimited in-network ATM transactions—$0

- Out-of-network ATM transactions $2.5

- Bill Pay with Credit Card transaction fee—2.9% of the transaction amount

- ACH and incoming wire transfers—$0

- Outgoing wire transfers— $15 per transaction

Who is BlueVine Business Checking Best For?

BlueVine offers a business checking account ideal for entrepreneurs and small businesses that primarily handle online transactions. If your operations do not need the traditional branch-based banking services, this platform is a solid option. Using a BlueVine checking account, you can dodge the pain points of high transaction and account maintenance fees while earning attractive interest on your unused funds.

How Does BlueVine Compare to Novo?

Both BlueVine and Novo offer comparable financial tools. However, BlueVine has an edge above Novo for providing attractive interest rates on balances up to $3 million, not to mention that there’s no opening deposit requirement. While Novo offers the best integrations with third-party software, a BlueVine checking account is the least expensive to maintain. Read the Bluevine review to learn more about its features and pricing. If you need more banks for a lesser expense to maintain, read this Lili Review and Oxygen Review.

- No minimum opening deposit, minimum balance requirement, or monthly fees

- High-yield APY upto 4.0% (terms and conditions apply)

- Unlimited fee-free transactions

- No free cash deposits (vendor fees apply)

- No customer service on the weekends

- No savings account

Unlike Novo, Kabbage, and BlueVine, which are fintech companies, Capital One is an online bank. It offers full-service digital banking services at a reasonably low cost compared to the rates of traditional land-based banks. Apart from providing business and commercial solutions through360 Checking accounts, the company also offers credit cards and auto loans.

Capital One 360 Banking Pricing

Capital One 360 Banking does not offer the cheapest digital banking solutions. However, users commend the company for being straightforward with all fees and charges.

- Minimum balance requirement—$0

- Monthly fee—$0

- In-network ATM transactions—$0

- Overdraft fees—$0

- Stop payment— $25 per item

- Outgoing domestic wire transfer — $30

- Outgoing foreign wire transfers—$0

Who is Capital One 360 Banking Best For?

Capital One 360 Banking is a solid alternative for entrepreneurs and small businesses that want all the perks of a digital fintech company while still enjoying the option of visiting local bank branches for in-person support. What sets Capital One apart is its hundreds of branches and Cafes across the U.S.

How Does Capital One 360 Compare To Novo?

Capital One is a better alternative to Novo if you need more than just a business checking account. It offers a range of financial and banking resources and a generous APY interest on all checking accounts. However, Novo is the more affordable option, ideal for not just small businesses but also freelancers and startups. Read the Capital One review to learn more about its features and pricing. Here’s also a detailed US Bank Review and Axos Review with a lot of information that you need when looking for a business checking account.

- Plenty of mobile and online banking tools and features

- Automatic savings account transfer option

- 0.10% APY interest on the checking account with balances up to $1

- No ATM fee refunds

- Bank branches are limited to two Southern and seven Eastern states

- CD rates aren’t competitive

Frequently Asked Questions (FAQs) for Novo Review

Here are the answers to some frequently asked questions to further acquaint you with what this fintech company has to offer.

Final Thoughts on Novo Review

With digital banking users expected to exceed 65% of the US population, the markets are quickly getting swamped with platforms offering digital business checking accounts. We hope our comprehensive Novo review makes it easier to decide whether this relatively new fintech company offers the perks necessary to help you manage your business finances.

In a wrap, Novo is a solid option to consider for its affordability, integrations, and small business-friendly offerings. However, alternatives like Capital One and Kabbage are attractive options for larger enterprises that don’t mind added fees as long as they enjoy a business checking account with increased functionality.

If you are interested in opening a business account, here is a detailed Bank of America Review, NBKC Bank Account Review, and Chase Bank Review packed with information about the pros, cons, and alternatives.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.

Sections of this topic

Sections of this topic