Your business bank account acts as a home base for your business’s financial database. Bank of America offers two types of business checking accounts for small to large business owners. In this Bank of America review, you’ll see why using the second-largest US bank (by assets) may be the best choice for you.

Our Verdict

Bank of America provides two appealing business checking accounts that offer the important banking features you would expect from a major banking institution. Whether you’re part of a small business or large enterprise, you can utilize Bank of America’s high cash deposit limits and Business Advantage 360 online banking platform.

The online banking platform offers bill pay, mobile check deposits, an excellent mobile app, and an integrated cash-flow monitoring tool. Bank of America’s business accounts also offer unlimited fee-free electronic transactions. These include ACH transactions, debit card transactions, remote deposits online, and electronic debits.

- All-in-one business banking services with a low monthly fee

- Easily waivable monthly fee

- Over 17,000 ATMs and 4,300 branches

- Lacks 24/7 customer service

- QuickBooks integration only featured on higher-tier plan

- Transaction fees when using non-Bank of America ATMs

Bank of America at a Glance

Bank of America offers business bank accounts that allow you to pay invoices, receive payments from clients, deposit cash and checks, and manage your business transactions. As one of the best small business bank accounts, a Bank of America business account is ideal for cash-heavy businesses.

With the Fundamentals business account, you can deposit up to $7,500 in cash per statement cycle for free. Then, it costs $0.30 per $100. You’re also limited to 200 check deposits or other deposits per cycle. Afterward, it costs $0.45 per item.

With the Relationship business account, you can deposit up to $20,000 per statement cycle for free. You also receive a maximum of 500 check deposits or other debits per statement cycle. Nonetheless, both plans offer unlimited free ACH, debit card, check deposits, and electronic debits through Remote Deposit Online.

Bank of America sets itself apart from other banks because of the great user experience in its online website and mobile app. It’s also easy for business account holders to waive fees, add additional accounts, and receive perks from the Business Advanced Relationship Rewards Program.

Who Bank of America is Best For

Bank of America offers the best bank accounts for entrepreneurs and for businesses looking for a traditional banker with outstanding mobile app capabilities. This is also the best business bank for those who prefer going to brick-and-mortar locations to conduct their banking. Bank of America also has a significant global presence, adding value for small businesses that do business internationally.

Pricing

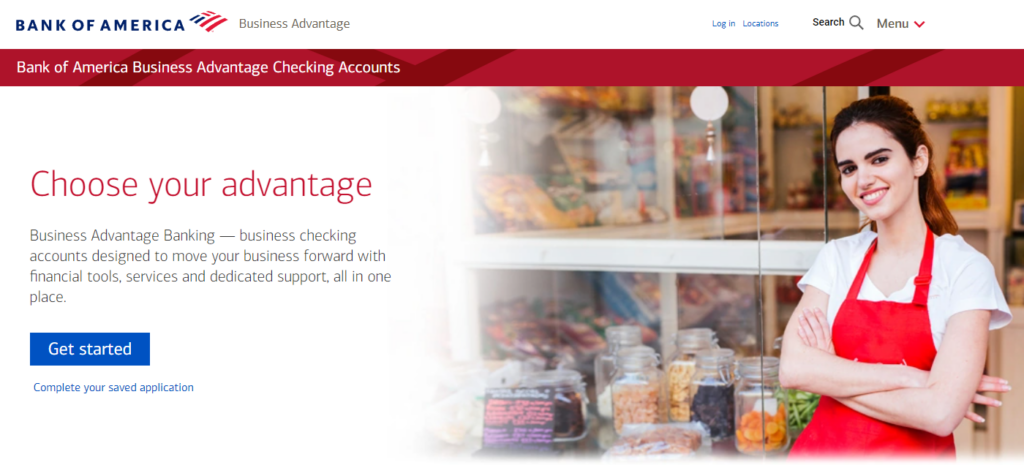

Bank of America offers two different business bank accounts called Business Advantage Fundamentals Banking and Business Advantage Relationship Banking. Each of these checking accounts comes with efficiency tools like Cash Flow Monitor, and Mobile Check Deposit. However, the Business Advantage Relationship Banking account includes additional features.

Business Advantage Fundamentals Banking

Business Advantage Relationship Banking

Monthly Fee

$16 to $0/month (see ways to waive fee below)

$29.95 to $0/month (see ways to waive fee below)

Minimum combined average monthly balance to waive monthly fee

$5,000

$15,000

Spend $250 in new net qualified purchases to waive monthly fee

Yes

No

Become a member of Preferred Rewards for Business to waive monthly fee

Yes

Yes

Minimum opening deposit

$100

$100

Good for

Small to medium-sized businesses

Medium to large-size businesses

Account management services

Not included

Included

Additional perks

None

Free stop payments and wire transfers

Zelle for your business

Yes

Yes

Easy QuickBooks integration

No

Yes

As you can see, Bank of America offers several ways to waive your monthly fee. In addition to fee waiving, both plans offer access to Zelle. Bank of America offers two different checking accounts. Fundamentals is better suited for small businesses, while Relationship is better for large businesses that need integration tools and account management capabilities.

Bank of America Features

Here’s a closer look at all the key features in our Bank of America business account review. These features are what distinguish Bank of America from other financial institutions.

Business Advantage Fundamentals Banking Account

Business Advantage Fundamentals Banking is Bank of America’s basic business bank account. This plan has a monthly fee of $16. However, you can waive the monthly fee by keeping a minimum combined average balance of $5,000 or spending $250 in new net qualified purchases each statement cycle. You can also waive the fee as a member of the rewards program.

Furthermore, it costs an additional $16 per month to open a second Business Advantage Banking account and $10 a month to open a Business Advantage Savings account. These are both free on the Business Advantage Relationship Banking account. The Fundamentals plan offers $200 teller transactions and checks per month for free.

If you are interested in opening a fee-free business account, here is a detailed Chase Bank Review, NBKC Bank Account Review, and US Bank Review packed with information about the pros, cons, and alternatives to both fintech companies.

Bank of America charges fees for incoming wire transactions. It costs $15 for each domestic transfer and $16 for each international transfer.

Business Advantage Relationship Banking Account

If your business is more developed, you should choose the Business Advantage Relationship Banking account. This plan costs $29.50 per month but can be waived if you maintain a minimum combined average balance of $15,000 or more. The fee is also waived if you join the rewards program or become a Preferred Rewards for Business member.

The Relationship plan doesn’t have fees on incoming wires and stop payments. Furthermore, you get access to account management capabilities that would cost $15 per month on the Fundamentals plan. Account management services include managing access for multiple users and integration with QuickBooks.

With the Relationship plan, you get access to a Business Advantage Savings account for free. The Relationship plan also offers access to Cash Flow Monitor to easily track your business’s financial performance.

Electronic Transactions

Both Bank of America business accounts offer unlimited fee-free electronic transactions. This feature allows Bank of America to stand out among its competitors in the brick-and-mortar space. This is because most traditional banks have a set monthly limit that comprises both non-electronic and electronic transactions.

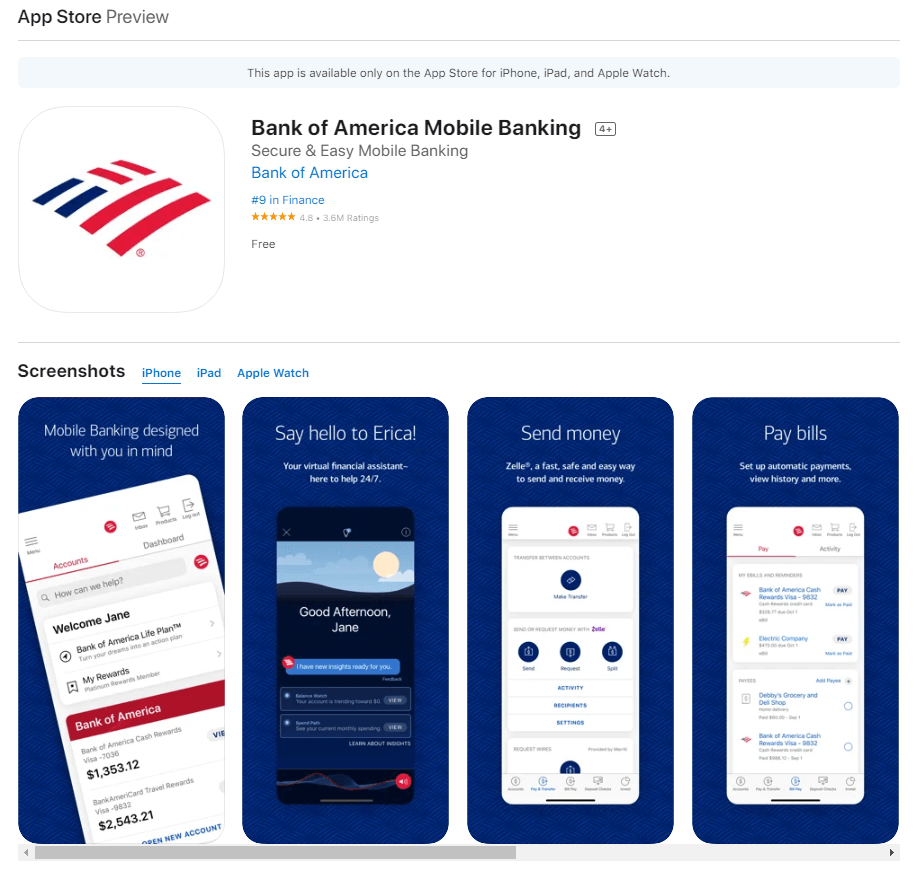

Bank of America Mobile App

Bank of America has one of the highest mobile app ratings with 4.8 stars out of 5 and over 3 million total reviews on the Apple App Store. This is because the app offers an extensive range of tools to manage your business checking account.

Inside the app, you can pay bills, manage your account, view balances, and make transactions. You can also use mobile check deposit or send and receive payments with Zelle. The app also features state-of-the-art security protocols with biometric access through Face ID and Touch ID.

Digital Tools

Bank of America business bank accounts offer several digital tools to make your life easier. These include Zelle, Cash Flow Monitor, Erica, profile linking, digital debit cards, and account management tools.

Zelle is a secure tool that you can use to receive payments from customers or send payments to vendors with no fees. You can use Zelle right from the Bank of America mobile app. Cash Flow Monitor helps you analyze your business financial data and identify key insights on your business’s performance. This way, you can find ways to improve efficiency and profitability.

Erica is Bank of America’s virtual financial assistant. This tool can help you search transactions, transfer or send money, and receive bill reminders. Bank of America’s profile linking tools help you view and manage personal and business accounts with a single login.

Preferred Rewards for Business Program

Bank of America offers a rewards program, Preferred Rewards for Business, that you can join for free. There are three levels to the program: Gold, Platinum, and Platinum Honors. Each level offers various incentives, including discounted interest rates on loans, refunds on payroll services, and increased interest on your savings account.

For example, the Gold plan offers a financing interest rate discount of 0.25%, and savings account interest boost of 5%. It also offers credit card bonus rewards of 25% and merchant services rewards of 0.05%

To join the program, you need to have a balance of $20,000, $50,000, or $100,000 in your Bank of America business checking account.

Alternatives to Bank of America

Selecting the right business bank account can significantly impact how you manage your business finances in the future. Here are a few key alternatives to consider.

Bluevine

BlueVine is an excellent banking solution for small business owners looking to keep business and personal funds apart. With a BlueVine checking account, you can earn 1.5% interest on your balance up to $100,000. To earn the 1.5% interest, you’ll need to spend at least $500 per month with your BlueVine Business Debit Mastercard. Bluevine Premium offers a 4.0% APY on balances of up to $3 million.

If you are a small business owner you can check out these other review and might be a great help for you to choose the right banking account; Axos Review, Lili Review, and Capital One Review.

However, you can also earn the 1.5% interest if you receive at least $2,500 per month in customer payments into your bank account via ACH, wire transfer, mobile check deposit, or directly from your merchant payment processing provider. However, this excludes cash deposits.

BlueVine offers unlimited fee-free transactions, no ACH transfer fees, and no incoming wire fees. You also receive refunds on your withdrawals to over 38,000 ATMs nationwide. It’s quick and easy to create your BlueVine business checking account. Anyone from sole proprietorships to corporations can have their bank account up and running in less than an hour. Interested in opening a sole proprietorship account? Then check out the best business bank accounts for sole proprietors.

Pricing:

It’s free to sign up for a business checking account with BlueVine. Furthermore, there are no monthly fees or minimum balance requirements to keep your account open. The only fees with BlueVine are for cash deposits, outgoing wire transfers, and withdrawing cash from out-of-network ATMs.

- Competitive interest rates

- No monthly fees or minimum balance requirements

- Unlimited transactions

- Only allow cash deposits through Green Dot Services

- No savings account

- No physical branches

Novo

Novo is a digital banking solution that offers no monthly fees and no minimum balance requirement. It’s easy to make an account on Novo, and it typically takes 10 minutes for your account to be approved. Once your account is approved, you need to make your initial deposit of at least $50. Then, you can begin using your business checking account.

Novo is the best business bank account for small-business owners who are on the go. This banking provider offers unlimited refunds for ATM charges, a built-in invoicing tool, and direct integration with top business tools.

Since Novo focuses on its digital presence, it cannot accommodate cash deposits. Therefore, Novo is not the best solution for cash-heavy businesses. Bank of America is a better option for businesses that need to deposit cash.

Pricing

Novo doesn’t have any monthly fees or minimum balance requirements. It’s completely free to open a business checking account with Novo.

- Zero monthly fees

- No minimum balance required

- Refunds on all ATM Fees

- No savings accounts

- Fees on overdrawn accounts

- Cannot deposit cash

Kabbage is a small-business lender who expanded its product suite in 2020 to offer business checking accounts. Kabbage Checking is an online-based free business checking account that includes a simple application process and limited fees.

A Kabbage business bank account is best for those looking for a free business checking account with no monthly fees or balance requirements. Furthermore, this is an excellent platform for businesses that manage most of their finances online

Kabbage offers 1.10% APY on balances up to $100,000. Therefore, Kabbage is a great option for businesses interested in earning interest on their checking account funds.

Pricing

There are no monthly fees or minimum opening deposit requirement to begin using your Kabbage business checking account.

- No minimum balance requirements

- Easy application process

- Easy line of credit without prepayment charges

- Digital bank only

- Fees up to $4.95 per cash deposit

- No integration with other tools

Frequently Asked Questions (FAQs) for Bank of America Review

Below are a few questions that you have thought of during our review of Bank of America. Continue reading to find answers to the most common ones.

Bottom Line on Bank of America Review

If you want to learn how to open a business bank account with Bank of America, there are three options. You can apply online, call Bank of America, or visit a Bank of America branch.

Bank of America’s checking accounts are excellent choices for businesses that are able to maintain the minimum balances to waive the monthly fee. With a Bank of America checking account, you can access a comprehensive set of banking tools, making your life that much easier.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.

Sections of this topic

Sections of this topic