Wave Payroll is an online payroll service that offers basic payroll capabilities, and can help you calculate and file payroll taxes, but only in some states. Although it appears to be a part of the wider Wave Accounting suite, you can also use it as a standalone payroll application. That said, Wave Payroll is best for small businesses with basic payroll needs.

Our Verdict

Although it’s easy to use, Wave Payroll isn’t the most feature-rich payroll service. It has limited payroll automation options, no mobile app, and offers only one payroll report. Automatic tax filing options are also limited as Payroll by Wave offers this service for 14 states only.

Despite its lack of features, Wave Payroll is still a good option if you’ve only got a few employees to pay. It’s easy to set up and you don’t need a lot of technical know-how to run payroll with it. If your business already uses Wave Accounting, then this payroll service can help you keep things simple and integrated.

- Easy to use

- Integrates well with Wave Accounting

- Offers an employee self-service portal

- Files taxes for 14 states only

- Payroll isn’t automated

- No mailing service for checks or tax forms

Wave Payroll at a Glance

Wave Payroll is a great choice for small business owners who don’t have a lot of experience with running payroll. It has an intuitive user interface and is easy to learn and use. But if you’re looking for a wider set of features including tools to manage employee benefits, a mobile app, or multistate tax filing, Wave Payroll is not for you.

Wave can’t fully automate payroll, but you can still set up payment schedules and get pay time reminders. With the employee self-service portal, new employees can set up their profiles and manage their taxes on their own. You don’t get time tracking functionality with this payroll service, but you can still use its online timesheets to add hours manually.

When it comes to direct deposits, you can get your employees paid three business days after you run payroll with Wave. It also offers payment by paycheck but you’d have to print checks on your own since it doesn’t have a mailing service.

Wave Payroll offers a 30-day free trial for you to check whether it suits your business. This gives you plenty of time to test out all the features from the employer and employee sides of the payroll service. If you think it’s a good fit, you can sign up for it by paying a very reasonable monthly fee.

Who Should Use Wave Payroll

Wave Payroll is a good choice to run payroll for small businesses. It can help you keep things simple if you’ve got 5-6 employees. But if your company is larger than that, you’re better off looking for other payroll software.

If you’ve just hired your first employee and are just learning how to do payroll, Wave can help you get well-versed in it. It has a simple and intuitive interface and won’t present a steep learning curve. If you’re already using Wave Accounting, we’d recommend you stick with Wave Payroll because the two integrate very well.

Payroll by Wave is also a great choice if you hire seasonal employees. You can easily change an employee’s status from active to inactive so you don’t have to pay payroll fees for a worker who isn’t temporarily working. This is why Wave is one of the best restaurant payroll software.

We also recommend it if you’re uncertain whether you’d need the payroll service in the upcoming months. Wave Payroll lets you temporarily pause your payroll subscription and you can always resume it when you need it again with ease.

Wave Payroll Pricing

Wave Payroll is on the cheaper part of the online payroll service spectrum. It has one of the lowest base fees plus a reasonable per-employee charge. The total cost of running payroll with Wave depends on your state, whether you choose auto tax filing, and the number of employees you have. The chart below summarizes Payroll by Wave’s pricing structure.

With automatic tax filing

Without automatic tax filing

Base fee

$35/month

$20/month

Per employee charge

$6/person/month

$6/person/month

This payroll service doesn’t have a very complicated pricing structure. It has a simple base fee and an additional charge for every employee or contractor paid. The only difference is that if you get Wave’s automatic tax filing, the base fee is $35 per month. Learn more about how to process payroll for contractors.

Remember that this feature is not available in all states. If you’d be filing your payroll taxes yourself, you need only pay a $20 base fee.

Wave Payroll Features

As mentioned above, Wave Payroll isn’t the most feature-rich payroll processing service. But it still has some tools up its sleeve that are worth mentioning.

Ease of Use

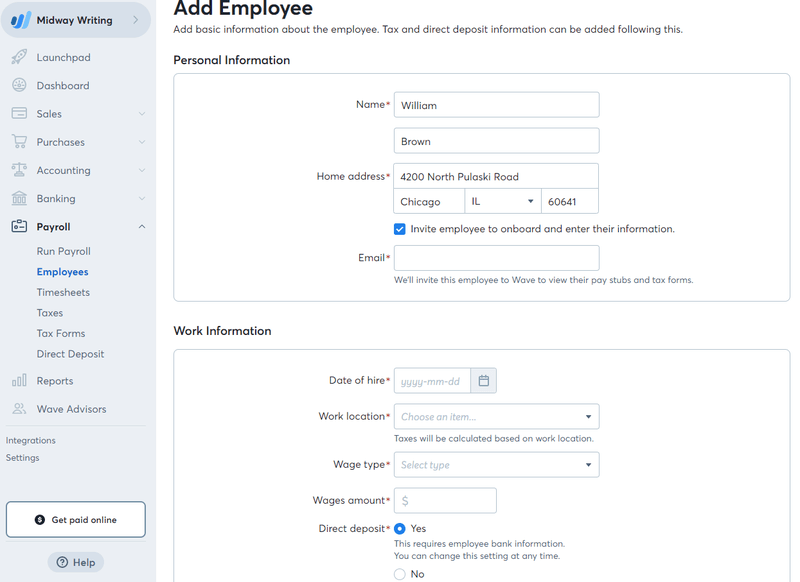

Wave Payroll is easy to use, there’s no doubt about it. It’s specially designed with small businesses in mind and is best for entrepreneurs with little to no experience in running payroll. You can easily set up the payroll service with a step-by-step guide.

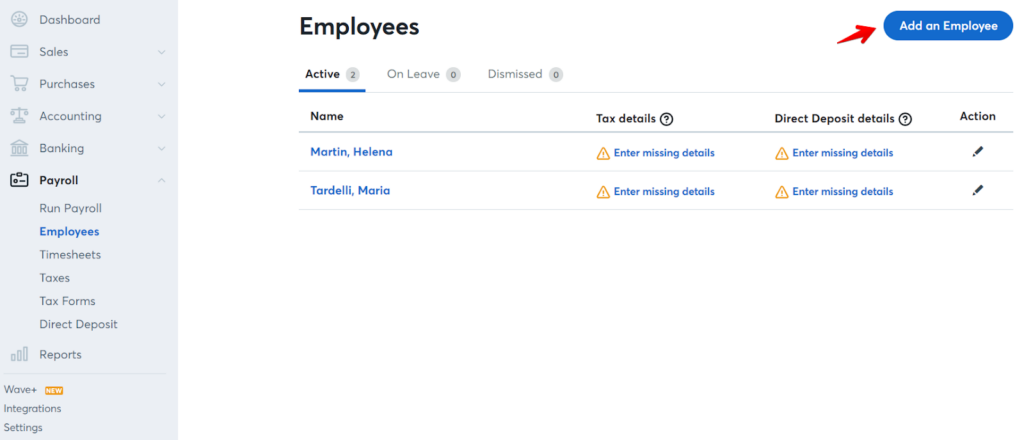

First, you create records for your employees and contractors and then add information about your business. You can monitor your progress through the setup process with a sliding bar at the top of the page.

Adding a new employee can sometimes be time-consuming, but it still is a generally straightforward process. The employee self-service portal allows your employees to add information to their profiles, manage their tax deduction info, and also view pay stubs and tax forms.

Some customers have complained about the Wave’s data entry being too complicated. For instance, adding hours worked and other company information is a bit too complicated and time-consuming according to some customer reviews. But all in all, running payroll with Wave is usually easy.

Automated Tax Filing

Wave Payroll offers automatic tax filing in the following 14 states only:

- Arizona

- Florida

- Washington

- Georgia

- Illinois

- Indiana

- California

- Minnesota

- North Carolina

- Tennessee

- Texas

- New York

- Virginia

- Wisconsin

If you’re in one of these states, Wave can automatically calculate, pay and file payroll taxes for you. It will also automatically generate tax forms including W-2s and 1099s, but you’re still directly responsible for submitting them in due time.

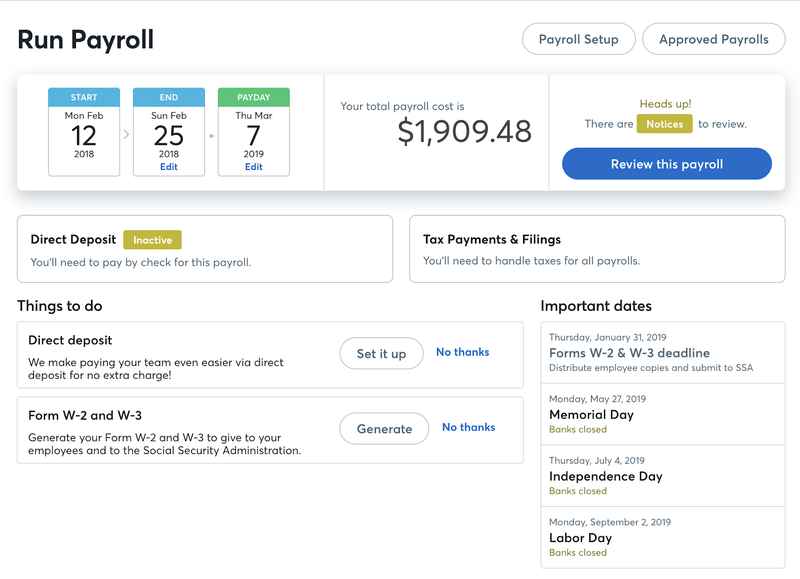

Dashboard

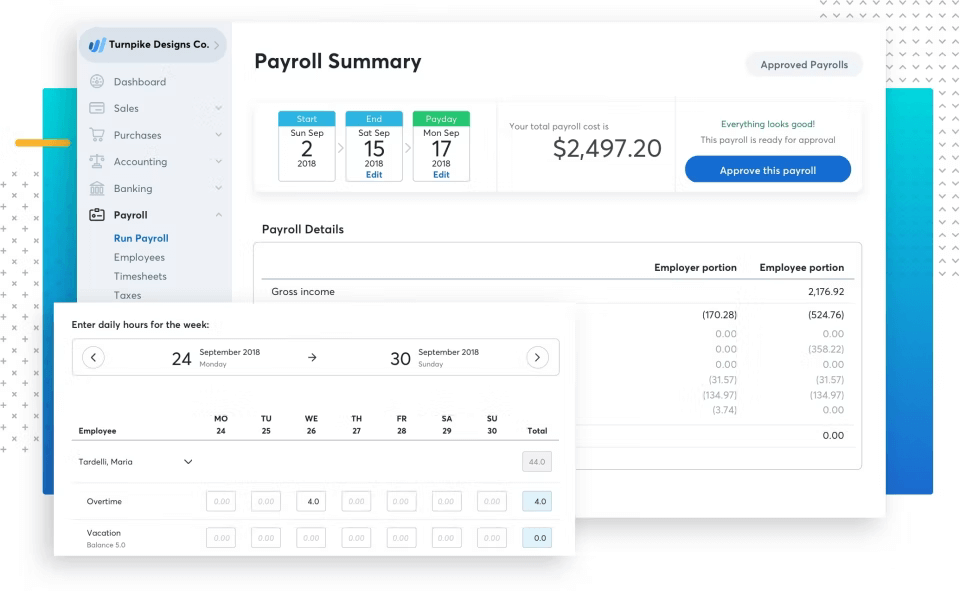

You can get a quick overview of all payroll-related information directly from Wave’s dashboard. This includes all upcoming important dates, total payroll costs, and a to-do list to see what payroll-related tasks are pending. Read the how to conduct payroll audit for small businesses.

The Review this Payroll button takes you to your current payroll details. If you want to make changes to the current payroll, you’d have to delete it to record your changes.

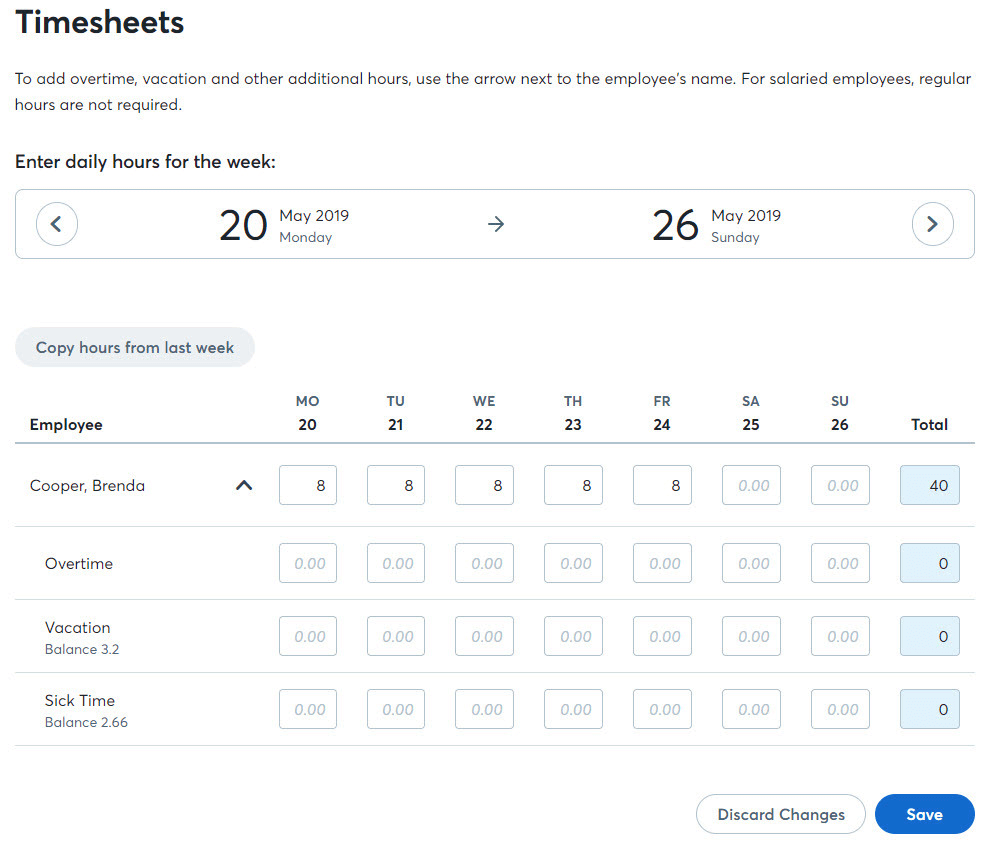

Timesheets

You don’t get in-house time-tracking abilities with Wave Payroll, however, you can still use its timesheets features to record hours worked and overtime for your employees manually. For hourly workers, you can use the timesheets to enter their hours worked, overtime, and PTO information. You don’t have to record hours worked for salaried employees but you can still use timesheets to record their overtime hours and PTO information.

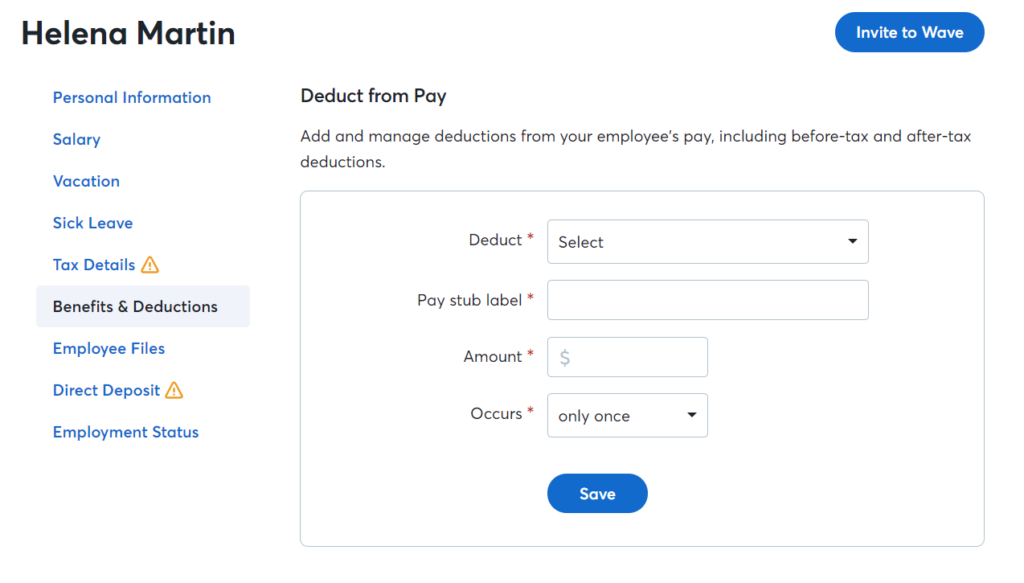

Employee Deductions

Since this payroll processing service doesn’t offer employee benefit management tools, you have to enter the deductions manually. You need to click on the “Deduct from Pay” button to add before-tax deductions.

Wave only gives you two options for payroll deductions: health insurance and 401(k). Almost all other competitors offer more than that. Plus, you can’t enter deductions in the form of a percentage, making things unnecessarily complicated. If you want to withhold a part of the pay, you need to enter the actual amount.

Wave Integrations

Wave Payroll integrates seamlessly with other Wave apps, including its invoicing and accounting services. Every time you approve a payroll run, the relevant bookkeeping data is automatically logged in to Wave Accounting. You can also use the receipt-tracking app to keep up with all your expenditures.

Wave apps can also integrate with BlueCamroo, Google Sheets, and Zapier. This allows you to connect your payroll service with several other business solutions including CRM software, email marketing, and appointment scheduling tools.

Customer Support

Wave Payroll offers 24/7 live chat support and email support for its customers. It also has a blog to help you answer questions and solve your problems with step-by-step guides. That said, customers have complained that their email support is too slow.

As a business owner, you always want your payroll-related questions answered as soon as possible. This is an area where Wave Payroll can improve a lot by using phone support with customer care agents just a phone call away.

Alternatives to Wave Payroll

If you think Wave Payroll isn’t the best choice for you and your business requires a more feature-rich payroll solution, take a look at the alternatives below.

If you hire hourly wage contractors only, Square Payroll is a great choice for you. Square works for both salaried and hourly employees and contractors, however, you don’t have to pay a base fee if you buy the contractor-only plan. It doesn’t cost a lot more than Wave Payroll, but it offers many more features including employee benefits management, and integrations with a range of apps. Read the full Square Payroll review to learn more about it.

- Low pricing

- Easy to use

- Integrates with other tools

- Basic HR functionality only

- Slow customer support

- Basic payroll reports

Pricing

- Pay employees and contractors: $35 monthly subscription + $5/month/per person paid

- Pay contractors only: $5/month/per person paid

Gusto tops our list of best payroll software simply because it offers small businesses a great all-round solution for all payroll related tasks. It has a range of features you can pick from. Apart from integrating with other Gusto apps, this payroll software also works well with third-party tools like Xero and QuickBooks. Read the complete Gusto review to find more and you can also check out the Gusto vs Quickbooks review.

- Unlimited payroll runs

- Overtime alerts

- Files taxes in all 50 states

- More expensive option

- Declining customer service ratings

- No mobile app

Pricing

- $39/month + $6/month/per person paid

SurePayroll is great for small to medium businesses that need a simple but powerful software solution. This payroll software lets you automate payroll processing and also deals with taxes and tax forms.

This payroll service is an excellent option for a single business owner, household, or other small businesses that work inside one state. It’s also a more affordable option, so if you’re operating on a limited budget, you should consider SurePayroll. Read the SurePayroll review if you’re interested in it or the Gusto vs SurePayroll review.

- Unlimited payroll runs

- 2-month free trial

- Can process and submit taxes

- Struggles with employees who switch between hourly and salaried roles

- App can be challenging to navigate

- Long customer service hold times

Pricing

- No Tax Filing: $19.99/month + $4/per person paid

- Full Service: $29.99/month + $5/per person paid

- Household Payroll: $49.99/month (includes one employee) + $10/per additional person paid

Frequently Asked Questions (FAQs) for Wave Payroll review

Here are a few frequently asked questions about Payroll by Wave to help you solve your remaining queries.

Bottom Line on Wave Payroll Review

Wave Payroll is a cost-effective payroll solution, but it’s not a good choice if you’re outside the 14 states it offers tax filing services in. That said, you’ll find it a straightforward payroll solution if you’ve got a few employees to pay. It can become excessively time-consuming for larger teams.

It’s one of the cheapest payroll services out there, although there are a couple of free payroll services as well. If you’re on a tight budget, Wave can help you out with your payroll needs without you having to break the bank. But if you need to manage employee benefits, better integration with third-party software, and a mobile app to run payroll on the go, we recommend you look somewhere else.

Sections of this topic

Sections of this topic