In this Paychex review, you’ll see how it helps you complete your payroll, tax, and HR tasks in a fast, convenient way. It offers powerful payroll features, scalability, and cost-effective pricing, making it good payroll software for many small businesses.

Our Verdict

Paychex is the ideal payroll software for scaling businesses, thanks to its excellent payroll functionality, flexibility, and value for money.

- Wide range of payroll, tax & HR features

- Ability to scale based on business growth

- Fairly affordable price of low-tier plan

- Some tax services require additional fees

- Pricing of mid-tier and high-tier plans is not transparent

- Certain advanced features only available for premium plans

Paychex at a Glance

Paychex is an all-purpose payroll software which provides an impressive number of payroll, tax, and HR services. It assists you in all stages of the payroll process, starting from the computation of salaries up to making timely payments to your staff members. Plus, it automatically calculates, pays, and files your federal, state, and local taxes on your behalf. On top of this, it simplifies HR procedures like employee screening, onboarding of new hires, and administering employee benefits.

This payroll platform is powered by Paychex, Inc., a leading provider of human capital management solutions. Founded in 1971 by B. Thomas Golisano, it now has over 700,000 users in the U.S. and Europe. It is considered as the biggest HR company for small to mid-sized businesses, claiming that it is used to pay one out of 12 employees in the private sector in the U.S.

Paychex stands out among other payroll services because of its scalability, meaning you can adapt it to the growth of your business. It packs a wide variety of features, including convenient payment methods, employee self-service options, reporting tools, advanced payroll services, automated tax filing, regulatory compliance tools, HR assistance, optional services, and mobile app.

Pricing:

Starts at $39 / month + $5 per employee

Who Paychex Is Best For

We recommend Paychex for scaling businesses that need payroll software to simplify the payroll process. It’s only fitting that the plans are named “Flex” because you can adjust this flexible platform as your business expands. While Paychex offers a basic package for small businesses, you can upgrade to premium plans with advanced features as your organization grows into a mid-sized or large business.

Pricing

The payroll requirements of your business will depend on the current size and type of your business. That’s why Paychex offers three kinds of plans which differ in terms of pricing and features.

Key Features

Paychex Flex Essentials

Paychex Flex Select

Paychex Flex Pro

Price

$39 / month + $5 per employee

Custom

Custom

User Interface

Simple, easy-to-use UI

Simple, easy-to-use UI

Simple, easy-to-use UI

Payment Methods

Direct deposit & on-site check printing

Direct deposit & on-site check printing

Direct deposit, on-site check printing, paper checks, check signing & check logo services

Employee Self-service

Employee account registration & self-service options

Employee account registration & self-service options

Employee account registration & self-service options

Reporting

Standard analytics & reporting plus general ledger report

Standard analytics & reporting plus general ledger report

Standard analytics & reporting plus general ledger report

Payroll Advanced Services

Garnishment payment services

Dedicated payroll specialist

Dedicated payroll specialist, garnishment payment services & accounting software integration

Tax Services

Payroll tax administration plus W-2 & 1099 Form assistance

Payroll tax administration plus W-2 & 1099 Form assistance

Payroll tax administration plus W-2 & 1099 Form assistance

Regulatory Compliance

New hire reporting, labor compliance poster kit & workers’ compensation insurance

New hire reporting, labor compliance poster kit & workers’ compensation insurance

New hire reporting, labor compliance poster kit, workers’ compensation insurance & state unemployment insurance services

HR Services

HR library & business forms

HR library & business forms plus learning management system

HR library & business forms, learning management system, onboarding tools, employee screening, plus employee handbook builder

Optional Services

Pay card, financial wellness program, tax credit services, and Employee Assistance Program (EAP)

Pay card, financial wellness program, and tax credit services

Pay card, financial wellness program, and tax credit services

Mobile App

Paychex Flex mobile app

Paychex Flex mobile app

Paychex Flex mobile app

Customer Support

24/7 support

24/7 support

24/7 support

To summarize, these are the three paid plans which are available from Paychex:

- Essentials ($39 / month + $5 per employee): It provides basic payroll and tax filing services to small businesses with one to nine employees.

- Select (Custom): It offers enhanced payroll services and HR support to small, mid-sized, and large businesses.

- Pro (Custom): It provides full-service payroll, HR, hiring, and onboarding services for startup, medium-sized, and huge businesses.

You can select the Paychex plan that meets the needs and budget of your business. While you can start out with the basic plan, you have the option to upgrade to premium plans once your business expands.

Take note that you need to contact Paychex to get a quote for the Select and Pro plans since the price is not available on the official website. The total amount will depend on the exact requirements of your business.

Paychex Features

Paychex showcases a broad range of features that makes it easier for you to handle the payroll, tax, and HR aspects of your business. In this Paychex review, let’s explore how these features work, including payment methods, employee self-service accounts, reporting capabilities, advanced payroll tools, tax filing services, regulatory compliance assistance, HR tools, optional services, mobile app, and customer support.

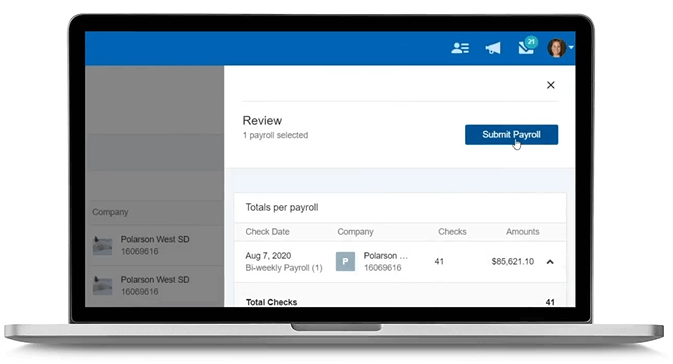

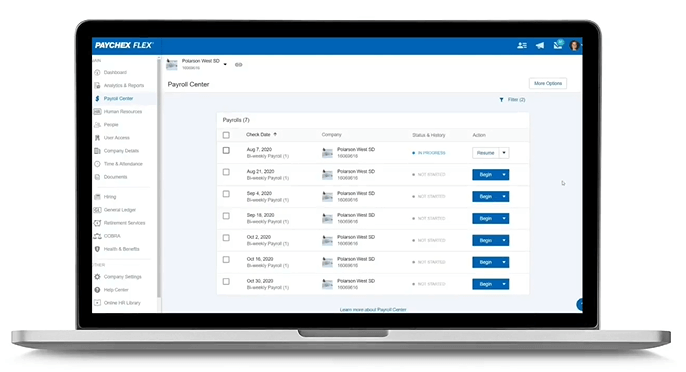

User Interface

Paychex has a simple user interface (UI) that is easy to use and navigate. The main menu in the left-hand column gives you a clear overview of the available options, while the display menu takes up the majority of the screen space to show the details of the section you selected.

The UI enables you to enter payroll information with just a few clicks, whether you are using the desktop version on your computer or the mobile app on your smartphone. It prompts you to gather the required documents, plus it even lets you migrate your data from your former payroll system for a smoother transition.

Payment Methods

All Paychex Flex plans offer two payment methods that make it easier for you to pay your employees on a regular basis. The first option is direct deposit, which enables you to transfer the salary of your staff members directly into their bank accounts. The second alternative is on-site check printing, which lets you print check payments straight from your office. In addition to this, the Select and Pro plans provide more payment options for extra versatility. These additional methods include paper checks, check signing, and check logo services.

Employee Self-service

Aside from speeding up your payroll tasks, Paychex also gives you the chance to divide the labor among your team. It encourages you to add new employees to the system by inviting them to register for their own Paychex Flex accounts. After they finish setting up their accounts, each staff member can perform some payroll activities independently so you and the payroll department can save time.

Reporting

Paychex has reporting capabilities that encourage you to evaluate your existing payroll process and improve it if necessary. On one hand, the standard analytics and reporting feature generates essential reports so you can enhance the way you handle your payroll system. On the other hand, the general ledger report grants you access to all the financial transactions of your team so you can keep track of your expenses.

Payroll Advanced Services

If you need more payroll solutions beyond the basics, Paychex provides advanced types of payroll services. First, the Essential and Pro plans include garnishment payment services which aids you in deducting and remitting garnished wages to agencies.

Next, both the Select and Pro plans let you experience the services of a dedicated payroll specialist who can assist you with your payroll and tax needs. Finally, the Pro plan exclusively offers accounting software integration, which connects your payroll information to accounting software like Xero, QuickBooks Online, and Sage Intacct.

Tax Services

Paychex reduces your hassle during tax season through its tax services. Through the Paychex Taxpay feature, it automatically computes, pays, and files your state, federal, and local taxes on your behalf. It also helps you with completing W-2 and 1099 forms, which you need for your employees and contractors. Just be aware that you need to pay additional fees to take advantage of Paychex Taxpay and tax form services.

Regulatory Compliance

All the Paychex plans assist you in becoming compliant with business regulations via new hire reporting, labor compliance poster kit, and workers’ compensation insurance. First, it helps you fulfill state reporting requirements for your new or rehired employees and contractors. Next, it provides you with current printed or electronic state and federal labor compliance posters which you can exhibit in the office.

Aside from this, it gives you the option to pick a plan with the guidance of licensed agents of the Paychex Insurance Agency. On top of everything, the Pro plan aids you in overseeing your state unemployment insurance procedures for your staff members.

HR Services

Paychex offers HR services which range from basic to advanced, depending on the plan you select. The Essentials package grants you access to HR documents and business forms. Aside from HR library privileges, the Select plan boosts your knowledge through the Paychex learning management system. You and your staff members can join online courses which will teach you how to enhance employee retention and minimize turnover.

On top of these services, the Pro package also includes onboarding features that make it fast for your new hires to digitally complete direct deposit forms, tax forms, and documents. It allows you to conduct background checks on candidates for job positions. Last but not least, it provides an online employee handbook builder tool which lets you create a company guide based on state and federal policies.

Optional Services

Paychex provides optional services at no extra charge. For the convenience of your employees, you can digitally deposit wages in prepaid pay cards. The financial wellness program can also enable your staff members to fulfill their financial objectives through short-term loans and educational tools.

Plus, the Employee Assistance Program (EAP) gives your staff members the chance to address personal issues which could otherwise have adverse effects on their work productivity. Finally, for the sake of your business, you can also apply tax credits to increase your tax savings.

Mobile App

The Paychex Flex mobile app lets you monitor and manage your payroll even when you are on the go. It keeps you updated on Paychex data and it allows you to process payroll even when you are away from the office. Plus, you can download this app to your Android or iOS smartphones.

Customer Support

Paychex provides customer support on a 24/7 basis. You can reach out to U.S. based service specialists any time, especially if you need help addressing your payroll concerns or troubleshooting technical issues.

On one hand, the client admin support handles your problems with payroll management, attendance, time tracking, health insurance, and benefits. On the other hand, the client employee support aids your staff members by finding their W-2 forms, getting support contacts for retirement accounts, and answering their questions.

Alternatives to Paychex

Paychex is definitely an ace when it comes to scalability. However, there are other factors which may be more vital to you when it comes to selecting payroll software. That’s why we have compiled some options to Paychex that you may be interested in.

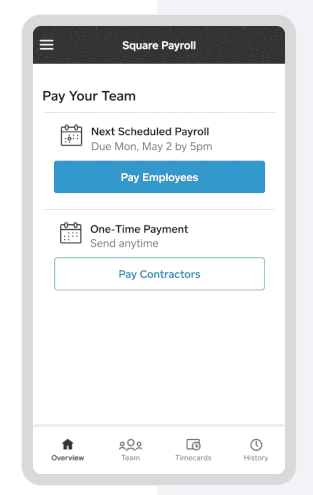

Square Payroll

Square Payroll is a payroll solution for small businesses that offers full-service payroll. It allows you to process payments for your contractors using your Square Checking account and balance. Plus, it keeps track of the time of your freelancers via timecard syncing. Aside from this, it automates the filing of your local, state, and federal payroll taxes.

Square Payroll may be a suitable choice for you if you only or mostly need to pay independent contractors instead of permanent employees. It specializes in the contractor payroll process, in contrast to Paychex which is designed mainly as an employee payroll system.

Pricing:

- Pay Contractors Only: $5 / month per person paid

- Pay Employees & Contractors: $35 / month for subscription fee + $5 / month per person paid

ADP

ADP is a payroll platform that focuses on HR services. Even the basic plan covers HR support, employee onboarding, reviews, and health care compliance paperwork. In addition to this, the advanced packages include background checks, HR specialist help, and ZipRecruiter assistance. Plus, it comes with typical payroll services like recurring payroll runs, automated tax filing, and tax form services.

ADP could be an appropriate alternative for you if you need a payroll software that is rich in HR features. Both ADP and Paychex include HR tools, but ADP places greater emphasis on HR while Paychex concentrates more on payroll.

Pricing:

- Essential Payroll

- Enhanced Payroll

- Complete Payroll & HR Plus

- HR Pro Payroll & HR

*Fill out the form at the ADP website to access plan rates

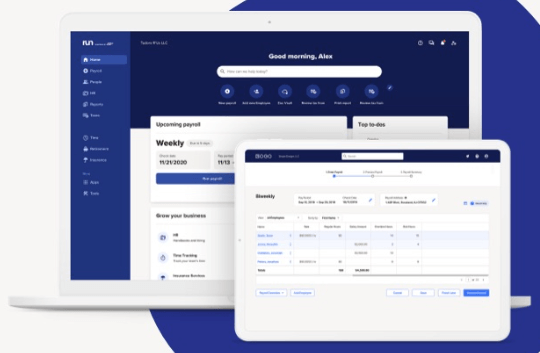

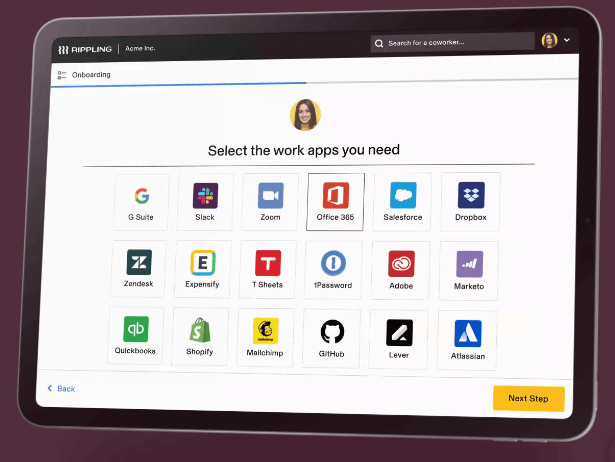

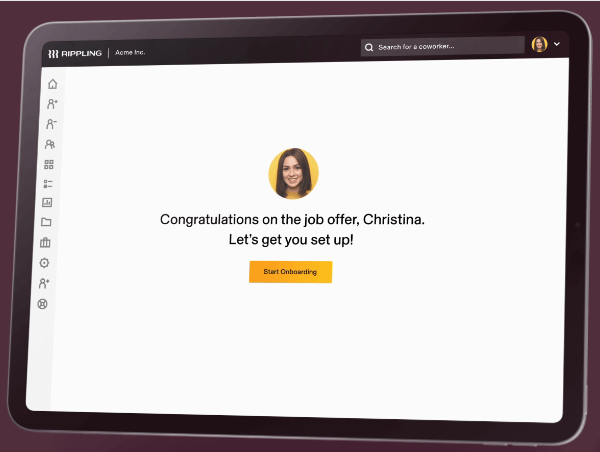

Rippling

Rippling is a payroll solution with a visual-centric user interface (UI). It makes it simple for you to oversee your payroll system, benefits, time and attendance, learning management, talent management, and PEO services in a central location. On top of this, it allows you to automate your payroll workflows and reports through the template library.

Rippling may be a better fit for you if you prefer working with a payroll software that is visually friendly. While both Rippling and Paychex are fairly easy to navigate, the Rippling UI relies more on icons, graphics, and images compared to the Paychex UI which is largely text-based.

Pricing:

- Starts at $8 / month per user. Contact Rippling to get a custom quote.

Frequently Asked Questions (FAQs) for Paychex Review

Paychex is a popular payroll software that is used by many business owners in the U.S. and in other countries. Discover the answers to common questions about Paychex to learn if this platform works for your business.

Bottom Line on Paychex Review

Paychex streamlines your payroll procedures so you can pay your staff members the right amount at the right time. We recommend Paychex for you if you need a scalable, affordable payroll software with robust payroll, HR, and tax features. Hopefully, this Paychex review has guided you to decide if this platform is the perfect fit for your business or not.

Sections of this topic

Sections of this topic