Payroll software like OnPay automates each step of the payroll process, making it easier to manage employee payrolls. The program allows you to set aside taxes and other deductibles, automate direct deposits and even maintain accurate and well-organized payroll records. In this OnPay payroll review, you’ll see how it can simplify an otherwise complex process. …

Human Resources

Most Popular

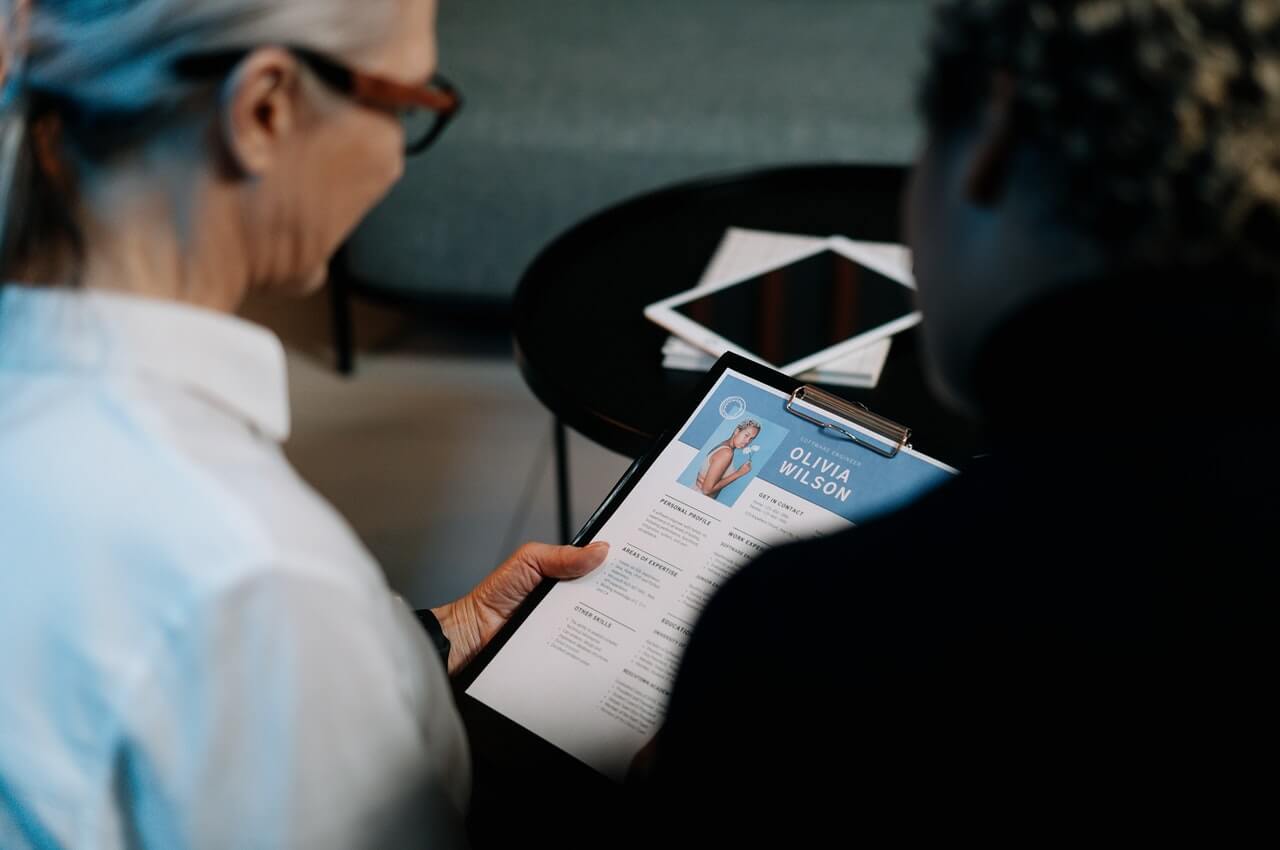

In the recruitment lifecycle knowing how to interview potential candidates is a fundamental skill to learn. The interview process takes place after you have either shortlisted qualifying candidates who have applied to your applicant tracking system for your roles. Or you have sourced candidates that meet the criteria of the job you are looking to …

One of the biggest expenses for any restaurant is payroll. Modern payroll software platforms for restaurants include features that do the math for you, file your taxes, manage benefits, and even help with hiring new workers. Check out our list and see which of the best restaurant payroll software can help you save money in …

Executive resume writing services are dedicated to delivering exceptional customer satisfaction. A professionally crafted resume captures the attention of hiring managers, resulting in more inquiries, an increased number of interviews, and, ultimately, a higher likelihood of securing your desired role. These businesses often offer a range of complementary services. Expert writers can craft compelling cover …

Gusto is a payroll processing software, offering tools to expedite payment processing and tax filing. To rise above the competition, it provides features to make other areas of business management easier as well. This Gusto review uncovers the features that make this platform shine. Our Verdict Gusto at a Glance Gusto packs a lot into …

Contractor payroll is an organized process that enables you to pay independent contractors and freelancers. It is an essential procedure for you if you hire people to perform services for your business. An independent contractor is a temporary employee, while a freelancer is a self-employed, nonpermanent worker. Learn how to manually complete the freelancer payroll …

As promised, here is Part II of Useful Quotes for Training and Education. I have decided, on a whim really, that I will sit down with my new speech students and let them discuss the meaning of the following quotes, and how they might use them in a speech. Of course, there are useful quotes …

Square Payroll is an online payroll service specially designed for small businesses. It offers an easy way to manage employees’ paychecks along with seamless timecard imports, automated tax filings, and a range of other helpful features. We’ve thoroughly researched the payroll processing software market on your part to bring you a comprehensive Square Payroll review. …

SurePayroll is a payment processing app designed to take the stress and guesswork out of paying your employees. This SurePayroll review takes a look at the software’s top features and what makes it worth considering for your small business. Our Verdict SurePayroll at a Glance SurePayroll stands tall as one of the best payroll options …

In the recruitment lifecycle knowing how to interview potential candidates is a fundamental skill to learn. The interview process takes place after you have either shortlisted qualifying candidates who have applied to your applicant tracking system for your roles. Or you have sourced candidates that meet the criteria of the job you are looking to …

Hopefully by now, you have heard or read enough advice to know that giving me your job description doesn't tell me what I want to know. I need to know what did, how your did, what were you able to accomplish. I need verbs, actions, and results. Simple as that. Sure if you want to list on your resume that you were "employee of the month" that is great, but what I really care about is what you did to earn that recognition and why it was important in your role. If you can give me that in a concise way on your resume, even better. If not, I am going to ask you if you make it to the interview, so be prepared to give the details.

In today’s fast-paced recruitment landscape, an Applicant Tracking System (ATS) has become essential for businesses looking to streamline their hiring process. An ATS is a software designed to automate and simplify recruitment, helping HR teams manage job applications, screen resumes, and coordinate interviews. It categorizes applicants, scores resume based on set criteria, and helps recruiters …

To screen a job applicant, an HR manager has to look carefully through a resume to confirm whether the experiences and skills listed meet the job requirements. When businesses receive hundreds of resumes, dozens of hours can be wasted going through them. To fight this problem, many businesses are now using applicant tracking systems to …

Who says your failures can’t lead to success? Employers it seems. We are fond of saying, “Failure is not an option.” And “when it’s rough, the tough get going.” That may be a positive result of the United States’ unemployment situation and a lagging economy. Today’s unemployed may have failed in nailing a specific job …

The changes in the job market over the past few years have certainly impacted job seekers in a way that many of us have not seen before. For the first time in history, there are four generations of workers in the job market with each generation facing a unique challenge. Whether you are a recent college grad looking for your first opportunity or a victim of downsizing looking for your next career, the job search can be a very frustrating experience.

While us Cavs fans are hoping Gilbert's prediction about the curse are right, Lebron should be hoping it works out in Miami.

Let’s say you have the training certificates and education as well as the experience just to get in the door. It’s frustrating seeing others without your work experience, walk in and take the same job you may have the experience and extra specific training for. So, why didn’t you get the job? We can’t really …

This section of the library provides miscellaneous information that may be helpful as an overview of various aspects of business law in the United States of America. Businesses designing personnel policies should obtain advice from an attorney specializing in the area of employee laws. Businesses requiring legal advice regarding potential or current litigation should seek …

U.S. Employee Law: Equal Opportunity Employment (EEO) Assembled by Carter McNamara, MBA, PhD This section of the library provides miscellaneous information about equal opportunity employment laws (EEO) which may be helpful as an overview of various aspects of business law in the United States of America. Businesses designing personnel policies should obtain advice from an …

Topics in U.S. Employee Law: Religious Rights of Employees Assembled by Carter McNamara, MBA, PhD This section of the library provides miscellaneous information which may be helpful as an overview of various aspects of business law in the United States of America. Businesses designing personnel policies should obtain advice from an attorney specializing in the …

The workplace today is filled with its own set of politics and "workplace dynamics" as it sometimes called. There are power structures within the organization both formal and informal. Often times the informal leader has the strongest voice while the formal leader struggles with the very concept of guiding others or having them "follow them."

US Employee: Protecting Against Workplace Discrimination Laws Assembled by Carter McNamara, MBA, PhD This section of the library provides miscellaneous information which may be helpful as an overview of various aspects of business law in the United States of America. Businesses designing personnel policies should obtain advice from an attorney specializing in the area of …

Assembled by Carter McNamara, MBA, PhD This section of the library provides miscellaneous information which may be helpful as an overview of various aspects of business law in the United States of America. Businesses designing personnel policies should obtain advice from an attorney specializing in the area of employee laws. Businesses requiring legal advice regarding …

Assembled by Carter McNamara, MBA, PhD This section of the library provides miscellaneous information that may be helpful as an overview of various aspects of business law in the United States of America. Businesses designing personnel policies should obtain advice from an attorney specializing in the area of employee laws. Businesses requiring legal advice regarding …

Assembled by Carter McNamara, MBA, PhD This section of the library provides miscellaneous information which may be helpful as an overview of various aspects of business law in the United States of America. Businesses designing personnel policies should obtain advice from an attorney specializing in the area of employee laws. Businesses requiring legal advice regarding …

One of the biggest expenses for any restaurant is payroll. Modern payroll software platforms for restaurants include features that do the math for you, file your taxes, manage benefits, and even help with hiring new workers. Check out our list and see which of the best restaurant payroll software can help you save money in …

Gusto is a payroll processing software, offering tools to expedite payment processing and tax filing. To rise above the competition, it provides features to make other areas of business management easier as well. This Gusto review uncovers the features that make this platform shine. Our Verdict Gusto at a Glance Gusto packs a lot into …

Contractor payroll is an organized process that enables you to pay independent contractors and freelancers. It is an essential procedure for you if you hire people to perform services for your business. An independent contractor is a temporary employee, while a freelancer is a self-employed, nonpermanent worker. Learn how to manually complete the freelancer payroll …

Square Payroll is an online payroll service specially designed for small businesses. It offers an easy way to manage employees’ paychecks along with seamless timecard imports, automated tax filings, and a range of other helpful features. We’ve thoroughly researched the payroll processing software market on your part to bring you a comprehensive Square Payroll review. …

SurePayroll is a payment processing app designed to take the stress and guesswork out of paying your employees. This SurePayroll review takes a look at the software’s top features and what makes it worth considering for your small business. Our Verdict SurePayroll at a Glance SurePayroll stands tall as one of the best payroll options …

Managing the administrative side of your business is never easy. Today, there are lots of powerful tools that help keep admin tasks more feasible. An essential part of a company’s operations is how it facilitates its payroll services. Instead of outsourcing your payroll, you can save on costs and time by using an online payroll …

Running payroll might look simple, but it’s considered one of an organization’s most complex administrative functions. Using the right payroll software can streamline the whole accounting process. ADP is a popular payroll solution, but there may be an ADP payroll alternative that better suits your company. ADP has a strong history of providing solutions for …

If you own a small business with multiple hourly workers, it’s essential to convert minutes for payroll when your employees work partial hours. Converting their time worked to exact minutes prevents a lot of payroll problems in the future. It also provides accurate wage distribution to ensure your employees aren’t overpaid or underpaid. How to …

© Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC. Adapted from Field Guide to Consulting and Organizational Development Suggested Pre-Reading Overview of Performance Management Process for any Application Sections of This Topic Include Traditional Performance Management Process Problems With Traditional Approach Progressive Approaches to Performance Management Traditional Performance Management Process Whether for organizations, teams or …

The emergence of the team idea can be traced back to the late 1920s and early 1930s with the now classic Hawthorne Studies. These involved a series of research activities designed to examine in-depth what happened to a group of workers under various conditions. After much analysis, the researchers agreed that the most significant factor …

This quick team building exercise gets small teams to communicate when they can’t see one another or their progress. Communication is the key to success with this team building exercise Overview The challenge is to take a length of rope and lay it out on the ground to make a perfect square. Throughout the task …

Performance Management: Understanding the Process Much of the information on this topic is adapted from the books Field Guide to Leadership and Supervision in Business and Field Guide to Leadership and Supervision for Nonprofit Staff. Information on this topic describes the foundational performance management a process that underlies Employee Performance Management, Team Performance Management and …

Optimizing Application Performance: Planning for Success © Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC. Adapted from Field Guide to Consulting and Organizational Development Strongly Suggested Pre-Reading Performance Management: Traditional and Progressive Approaches Overview of Performance Management Process for any Application Approaches to Developing a Performance Plan NOTE: The term “domain” in the following refers …

Many leaders and organizations bring in a team building expert when things are going horribly wrong, feel better for a day or two and predictably go back to the same old type of interactions. This approach gives team building a bad name or makes it appear ineffective when it can actually be a powerful tool …

© Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC. Adapted from Field Guide to Consulting and Organizational Development Suggested Pre-Reading Overview of Performance Management Process for any Application Sections of This Topic Include 4 Key Benefits of Performance Management 15 Other Benefits Concerns 4 Key Benefits of Performance Management 1. PM focuses on results, rather …

Selecting Performance Measurements: Guidelines for Any Application Assembled by Carter McNamara, MBA, PhD Suggested Pre-Reading Overview of Performance Management Process for any Application Sections of This Topic Include Guidelines for Selecting Measurements Myths About Measurements Examples of Measurements General Resources Also, consider Related Library Topics Learn More in the Library’s Blogs Related to Performance Management: …

In businesses large or small, it can be difficult to stay on top of everything that’s going on. Having a firm understanding of productivity and budgeting can spell the difference between success and failure. The best project management software with time tracking offers more than just time tracking in real time. Automating time tracking can …

As promised, here is Part II of Useful Quotes for Training and Education. I have decided, on a whim really, that I will sit down with my new speech students and let them discuss the meaning of the following quotes, and how they might use them in a speech. Of course, there are useful quotes …

Ideas for Improving Any Training and Development Plans © Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC. Adapted from the Field Guide to Leadership and Supervision in Business and Field Guide to Leadership and Supervision for Nonprofit Staff. Sections of This Topic Include Introduction Planning — Some Considerations for Developing the Training and Development Plan …

Best Practices for Effective Training with Learners Sections of This Topic Include Preparation for Implementing Your Training Plan Key Considerations During Implementation Wise Advice for Any Trainer Additional Resources to Guide Implementation of Your Training Plan Also, consider Related Library Topics Learn More in the Library’s Blogs Related to Implementing Training Plans In addition to …

Guidelines for Successful Peer Learning © Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC. Sections of This Topic Include What is Peer Learning? What Are the Benefits of Peer Learning? What Are Some Forms of Peer Learning? How Do I Develop a Peer Learning Program? Various Additional Perspectives On Peer Learning Also consider Related Library …

Directions for Learners to Complete This Training Plan Complete this training plan by following the guidelines in the document Complete Guidelines to Design Your Training Plan. Learners may modify this framework to suit their nature and needs. Name of Learner: Approval (if applicable): Time Frame Start date: Completion date: Funding Requirements (See budget at the …

Everyone who follows this blog knows that I tend to take a softer approach to training that at times may not seem as traditional or as typical of the training principles you are taught in school. I also don’t tend to weigh my page down with off-the-shelf products, although guest writers are more than welcome …

What is Professional Development? I began this article by looking again at the differences between professional development vs training, or trainers and teachers. In A Look at the Education vs Experience Debate and in an earlier post, What’s the Difference Between Training and Teaching, I made a few comparisons. This time, I thought it might …

© Copyright Carter McNamara, MBA, PhD, Authenticity Consulting, LLC. Sections of This Topic Include General Information Accelerated Learning Adaptive Learning Blended Learning Inquiry and Reflection Loops of Learning Social Learning and Networked Learning Virtual Learning (Distance Learning) (Online Learning) Organizational and Group Learning Also consider Related Library Topics Learn More in the Library’s Blogs Related …

More in Human Resources

In this Paychex review, you’ll see how it helps you complete your payroll, tax, and HR tasks in a fast, convenient way. It offers powerful payroll features, scalability, and cost-effective pricing, making it good payroll software for many small businesses. Our Verdict Paychex at a Glance Paychex is an all-purpose payroll software which provides an …

Wave Payroll is an online payroll service that offers basic payroll capabilities, and can help you calculate and file payroll taxes, but only in some states. Although it appears to be a part of the wider Wave Accounting suite, you can also use it as a standalone payroll application. That said, Wave Payroll is best …

Payroll laws determine how you pay your employees, calculate payroll taxes and file them. Failure to comply with these can result in fines, interest on unpaid wages, employment lawsuits, and in the worst case, you may have to shut down your business. Getting yourself familiar with payroll laws might make you feel just a little …

Payroll mistakes can leave a black mark on an otherwise exemplary company profile. Failure to comply with federal, state, or local rules can lead to crippling fees or job applicants looking beyond your business to one more accountable. This article covers 12 common payroll mistakes and the tools you need to avoid them. 1. Being …

One of the first decisions you must make as a business owner is concerning payroll schedule. A payroll schedule determines how often you pay your employees. There are four types of payroll schedules to choose from, and we’ll go through them in this article, looking at their pros and cons and determining which suits what …

Conducting a payroll audit can help your small business reduce employment costs and ensure compliance with federal, state, and local labor laws. Start the process of analyzing your company’s payroll to reveal errors and inefficiencies that reduce your bottom line. How To Conduct a Payroll Audit in 8 Steps Your small business payroll audit should …

Gusto and QuickBooks are payroll platforms designed to make it easy for small business owners to automate several functions of their businesses. If you are comparing Gusto vs. QuickBooks Payroll, consider pricing, features, and customer service. Both platforms perform various vital duties, including setting and processing payroll, filing payroll taxes, and managing employee benefits. While …