Payroll laws determine how you pay your employees, calculate payroll taxes and file them. Failure to comply with these can result in fines, interest on unpaid wages, employment lawsuits, and in the worst case, you may have to shut down your business.

Getting yourself familiar with payroll laws might make you feel just a little overwhelmed. Especially because you find yourself surrounded by legal jargon and technicalities in both federal and state laws.

We’ve summarized the most important payroll laws below in plain language. And although this is a good 7-minute read, consider speaking with a tax professional or financial advisor for the most current laws and advice for your business.

Got confused with payroll laws? check out some of the best payroll services for small businesses

14 Important Payroll Laws You Don’t Want to Break

Here’s a list of the most important payroll laws every business owner should know:

- Minimum wage: Must pay state minimum wage if its higher than federal wage

- Overtime pay: Must pay for non-exempt employees

- Pay frequency: Must pay employees on time

- Payment methods: Must offer multiple options at times

- Payroll Taxes: Must calculate taxes correctly and pay them on time

- Tax forms: Must file payroll tax forms on time

- Paid family leave: Must send paid family leave benefits to the state

- Paid sick time: Must pay for state-mandated paid sick leave

- Worker’s compensation insurance: Must buy for most states

- Wage garnishments: Must manage court-ordered garnishments

- Recordkeeping requirements: Must keep payroll records for at least 3 years

- Paying tipped employees: Must comply with state tip reporting laws

- Final paycheck: Must pay a worker’s last paycheck on time

- PTO payout: Must pay employees for earned but unused paid time off

Minimum Wage

The Fair Labor Standards Act (FLSA) states that you must pay your employees a minimum of $7.25 per hour. However, this might not always be the minimum wage you need to pay your employees.

Some states have higher minimum wage requirements. For instance, if you’re in California, you must pay your employees at least $15 per hour. We recommend you check your state’s minimum wage law and compare them with federal requirements. You are required to pay whichever wage rate is higher.

Overtime Pay

Some employees are exempt from overtime pay, while some are not. You must pay non-exempt employees overtime if they work more than 40 hours a week. According to federal law, employees must be paid one and half times their regular rate for hours worked overtime.

Some states have additional overtime pay laws. For instance, in some states, you may have to pay overtime if an employee works more than 8, 10, or 12 hours daily. You may have to repay the wages along with late fees and penalties if you fail to comply with overtime laws. Not just that, you will have to eventually pay additional taxes on late wages too.

Pay Frequency

There are typically four different payroll schedules businesses choose to use. You may choose to run payroll weekly, biweekly, or monthly. However, each state has a minimum pay frequency law to determine what is the longest period you can have between paydays: a week, two weeks, or a month.

Payment Methods

Usually, you’re free to choose which payment method you use to pay your employees. However, it’s better to check your state law on which payment methods are allowed. For instance, state laws may not let you pay with pay cards or direct deposits if:

- You don’t have the employee’s permission

- You don’t offer additional payment options like paper checks or cash

- You don’t cover payment fees

- You don’t notify employees of the fees

It’s always a good idea to check the payment options you can use before you run payroll to avoid unnecessary trouble.

Payroll Taxes

When running payroll, you must calculate payroll taxes correctly and withhold that money from paychecks. You are also required to pay those taxes on time to stay clear of tax problems.

You have to consider both federal and state tax rates when calculating taxes, and this can at times be tough. This is why we recommend you use payroll software. Payroll software automatically calculates taxes according to your state and pays them in time.

Tax Forms

We’re not done with taxes yet. After correctly calculating and paying taxes, you also need to file them on time. You must report this information to the IRS and relevant tax authorities. This includes submitting the quarterly and year-end tax forms like the W-2 and 1099-NEC.

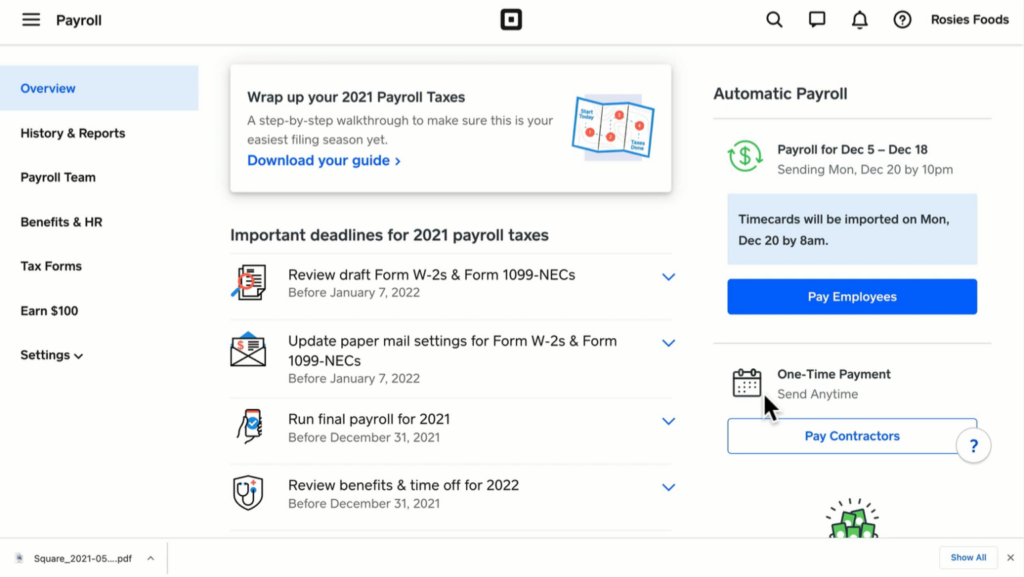

Quality payroll software like Square Payroll can handle tax filing for you on its own. This means you won’t have to face any failure to file penalties.

Paid Family Leave

Some states mandate businesses to give their employees PFL (paid family leave). However, employers don’t have to pay this money on their own. According to the PFL law, employers must withhold funds from employee wages and remit them to the state. The state then sends paid family leave money to workers that qualify.

Paid Sick Time

Not all states mandate employers to provide paid sick time. But this is a popular law and will soon expand to most states. Paid sick time laws ascertain the number of paid hours an employee can use when sick. These laws also determine how employees can use sick time, the maximum number of hours one gets per year, and whether unused paid sick time carries to the next year.

Workers’ Compensation Insurance

Businesses are rarely exempted from this law. Texas is the only state that doesn’t require employers to purchase workers’ compensation insurance.

All other states require you to purchase workers’ compensation to make sure there’s coverage for potential unexpected expenses like on-the-job accidents and employee injuries. So, if you’re starting a business out of Texas, you don’t want to ignore workers’ comp insurance.

Wage Garnishments

Sometimes you may receive a legal notice to withhold funds from an employee’s paycheck. This usually happens when an employee has unpaid debt or is behind on child support and authorities take their funds directly from their employer to cover it. This is not to be taken lightly. You may have to pay that money out of pocket if you fail to act on court orders.

Recordkeeping Requirements

Employers must keep payroll records on file for at least three years. Many employers make the mistake of discarding payroll information sooner than that and may incur penalties if asked to provide records from the past.

The best practice is to keep all relevant information such as paycheck stubs, tax forms, and timesheets for at least four years. An online payroll service like Square Payroll or Gusto can help you in this regard. It records all the relevant information and keeps it safe in an online database so you don’t have to worry about recordkeeping.

Paying Tipped Employees

If you operate a restaurant or any other business where employees frequently receive tips, you should be aware of tip reporting laws. The federal tipped minimum wage is $2.13 per hour. You may be subject to a higher tipped minimum wage by your state, and in that case, you’ll have to go by the state law. Also, we recommend restaurant owners use restaurant payroll software to help them run payroll with ease.

Final Paycheck

This law governs when you pay an employee’s dues if any when you terminate their contract or they quit on their own. States like California require employers to pay all dues to the employee at the time of termination. Other states like Washington and New York give employers until the next payday to clear final paychecks.

PTO Payout

Paid time off (PTO) laws vary from state to state. Some states may not have a PTO policy while some do. According to this law, if you offer paid time off, you have to pay employees for earned but unused paid time off at the end of the financial year or when terminating an employee’s contract (depending on state, of course).

How to Avoid Payroll Lawsuits?

If you’ve just started your business and are still learning what payroll is and how to run it, you should take extra care to avoid payroll lawsuits. The first step would be to familiarize yourself with the most important laws. If you’ve read the sections above, you’ve already done that.

Still, you must be really meticulous if you’re running payroll yourself. There are a lot of minute details you need to consider for both federal and state laws, and it becomes difficult at times to stay updated with them. If you want to know how to do payroll the safe way, go with quality payroll software, or hire a tax advisor.

Investing in payroll software can keep you safe from all kinds of payroll troubles by taking over and automating all aspects of paying your employees. This way, you can rest assure you pay your employees and file taxes correctly and on time.

A quality payroll software automatically considers all the payroll laws your business is subject to by your state. You will no longer have to worry about payroll and spend long hours filing taxes. With payroll automated, you can concentrate on things that matter the most.

Best Payroll Software to Avoid Payroll Problems

We’ve shortlisted some of the best payroll software that helps you comply with all payroll laws with ease.

- Gusto – Best full-service platform

- Square Payroll – Best for ease of use

- Rippling – Best for Mid-sized Businesses

Gusto: Best Full-Service Platform

Gusto is one of the best payroll processing software out there. It lets you expedite all aspects of running payroll from payment processing to filing taxes. Moreover, it also offers other business management features which makes it an all-in-one solution for all your administrative tasks.

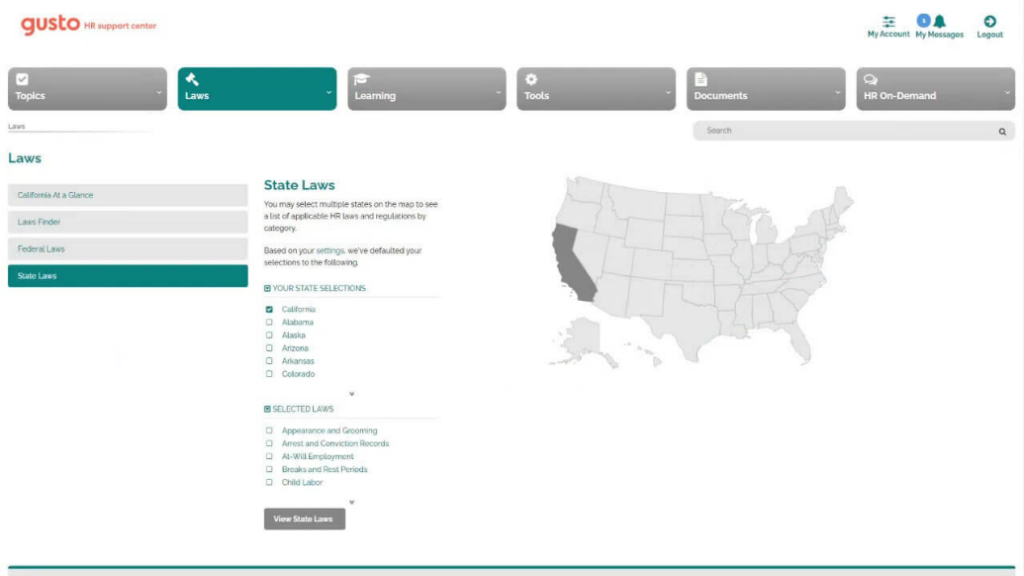

Why we chose it: Gusto offers automatic payroll processing, auto tax filing, HR support with information about payroll laws, and many other features making it an excellent choice for payroll law compliance.

- HR support center with payroll laws information

- Unlimited payroll runs

- Auto processing and submitting payroll taxes

- HR assistance only for Concierge users

- Customer service is slow

- Costlier than other options

Pricing

- Core: $39/month + $6/month per person

- Complete: $39/month + $12/month per person

- Concierge: $149/month + $12/month per person

Square Payroll: Best for Ease of Use

Square Payroll is one of the easiest to use payroll processing software. If you work with hourly wage contractors only, this might be the best option for you. Although it works for both salaried employees and contractors, Square charges no base fee for the contractor-only plan. It also offers useful features like automatic payroll, tax filing, and tax form submission.

Why we chose it: Square Payroll is easy to use, sophisticated, and offers all the features you need to comply with payroll laws in your state.

- Low pricing

- Easy to use

- Integrates with other tools

- Basic HR functionality only

- Slow customer support

- Basic payroll reports

Pricing

- Pay Employees & Contractors: $35 monthly subscription + $5/month/per person paid

- Pay Contractors only: $5/month/per person paid

Rippling: Best for Mid-sized Businesses

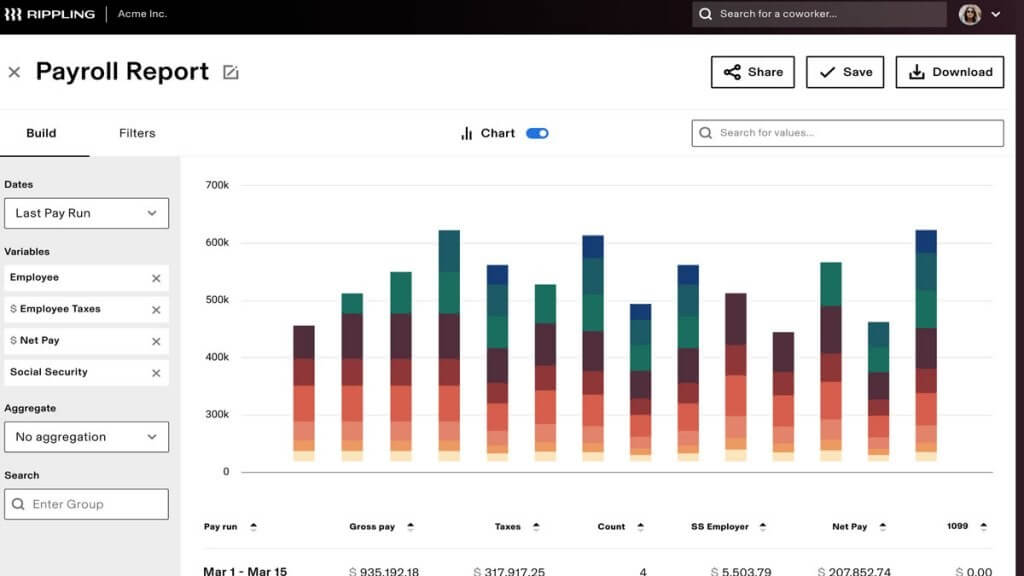

Rippling offers a great combination of HR and payroll functionalities. It is a brilliant option for mid-sized businesses as it lets employers simplify personnel management. It offers a lot of integration options too for syncing with other management services.

Why we chose it: Rippling is great for mid-sized businesses that are looking for greater insight into their payroll and want to streamline their employee payments.

- Reasonable price for mid-sized businesses

- Can pay any employees internationally

- Integrates with hundreds of apps

- Quote-based pricing

- Can’t completely automate payroll

- 1-year minimum contract length

Pricing

Rippling has a quote-based pricing system. Generally, you can expect it to cost $8/month/per person paid.

Frequently Asked Questions (FAQs) for Payroll Laws

Here are some of the most frequently asked questions about payroll laws. Have a quick look at them to resolve any queries you might have.

Bottom Line on Payroll Laws

A payroll nightmare is something you don’t want your business to face. Make sure you follow federal and state payroll laws to stay in the clear. The easiest and most straightforward way to do that is to use a quality payroll processing software that can automatically process payroll and file taxes on its own.

Sections of this topic

Sections of this topic