Starting your own Limited Liability Company (LLC) in Hawaii is like stepping onto a path sprinkled with costs beyond just filing the initial paperwork. Yet, don’t let the thought of these expenses deter you. The road to forming an LLC isn’t as daunting as it might look.

With proper knowledge and resources, like those offered by Tailor Brands, you’ll find strategic ways to manage these costs effectively.

Let’s dive into what makes up the cost of starting an LLC in Hawaii and uncover how to make smart, informed decisions that benefit your budding enterprise.

What Is the Cost of Forming an LLC in Hawaii?

Setting up an LLC in Hawaii comes with a total cost of $51. This includes a $50 state filing fee for the Articles of Organization, the official paper that sets up your LLC, plus an additional $1 for State Archives. This fee covers the entire online filing process through the Hawaii Department of Commerce and Consumer Affairs.

Hawaii Foreign LLC Formation Costs

If your LLC is registered in another state and you’re looking to expand into Hawaii, you must register your existing LLC as a foreign entity in Hawaii.

The cost for registering a foreign LLC in Hawaii is $50. To do this, you must complete and submit an Application for a Certificate of Authority for a Foreign Limited Liability Company (Form FLLC-1).

Annual Cost for LLCs in Hawaii

When thinking about setting up a Limited Liability Company (LLC) in Hawaii, understanding the ongoing costs associated with maintaining your LLC is vital. The primary recurring expense is the Annual Report Fee, which includes a $15 filing fee plus a $1 State Archives Fee, totaling $16.

You must also have a registered agent. You can choose either a professional service or appoint someone personally, such as yourself. The fees for professional registered agent services vary.

Considering these ongoing costs is crucial for the financial planning of your Hawaii LLC. By understanding and budgeting for these expenses, you can make wise decisions that ensure your LLC’s financial health.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Hawaii With the Best LLC Service?

Tailor Brands LLC Formation Cost

The initial cost to file an LLC in Hawaii begins at $51 and can increase depending on your chosen options. Normally, processing takes about 4 to 5 weeks. If you need faster service, expedited processing is available for an additional $50, cutting the wait time to 10 to 12 days. For the quickest option, a rush service costing $100 will get your filing processed in just 7 to 8 days.

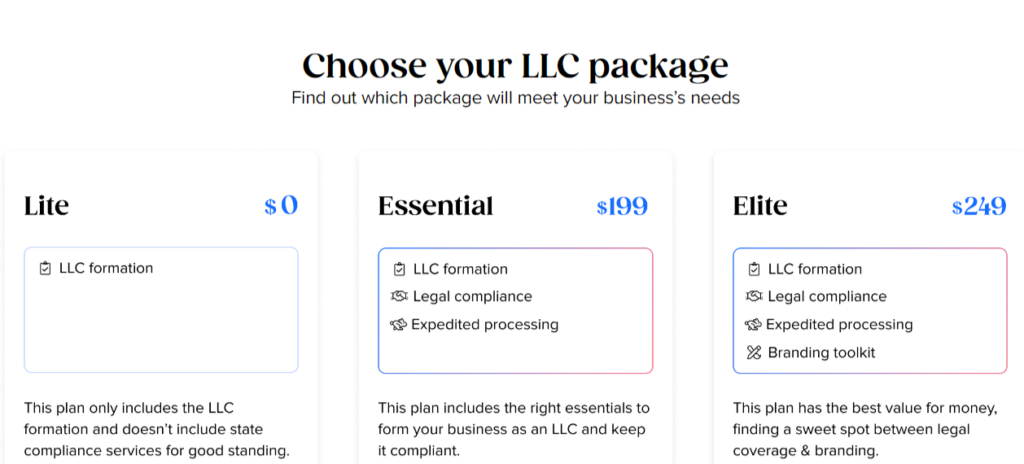

The Tailor Brands Lite LLC plan is the most economical option, providing standard LLC formation services for just the state filing fee. The Essential LLC plan, at $199 plus state fees, offers expedited processing, annual compliance services, and an operating agreement, with a recurring annual fee of $199 to sustain these services.

The Elite LLC plan, Tailor Brands’ premier offering, costs $249 plus state fees. It includes all the benefits of the Essential plan plus additional business tools and services. These additional features encompass a free business domain for the first year, a do-it-yourself website builder, an online store, eight complimentary logos, a digital business card, a business card tool, and a social media post creator. To keep these services active, an annual fee of $249 is required.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Hawaii

Hawaii LLC Name Costs

Registering a name for your Limited Liability Company (LLC) in Hawaii is free of charge. The approval of your Hawaii LLC name is included with the state’s filing of the Articles of Organization at no extra cost.

You may find online sources claiming that LLC Name Reservations are mandatory. However, this is generally not the case for most states, as they don’t require a Name Reservation for LLC formation.

If you want to reserve your preferred name for up to 120 days before you complete your LLC formation, you can fill out the LLC Name Reservation Form (Form X-1) and pay a $10 filing fee.

Hawaii Registered Agent Costs

In Hawaii, the cost for a Registered Agent can range from $0 to $125 each year. If you’re setting up an LLC in Hawaii, state laws mandate the appointment of a registered agent.

This agent can be an individual or a business responsible for accepting legal documents and official notices on behalf of your LLC. They must have a physical address in Hawaii and be available during usual business hours.

You have the option to serve as your own registered agent or choose someone you trust, avoiding additional costs.

Alternatively, you might consider hiring a registered agent service. These services generally charge between $100 and $300 per year. They not only meet the essential requirements of providing a registered agent but also offer extra business services and can assist in maintaining your privacy.

It’s particularly smart to hire a registered agent service if:

- You lack a physical address in the state (Hawaii law mandates that registered agents have a physical address within the state).

- You wish to keep your address private (some services may use their address to keep yours from being publicly listed).

Hawaii Operating Agreement Costs

There’s no fee for creating a Hawaii LLC Operating Agreement, which is a formal document outlining the arrangements among LLC members. This agreement details the LLC’s ownership structure, management guidelines, and profit distribution methods.

It’s recommended that both single-member and multi-member LLCs draft an operating agreement, keep it with their business records, and provide a copy to each member.

Unlike many online platforms that charge between $50 and $200 for LLC Operating Agreements, this service is offered at no cost.

Hawaii EIN Cost

An Employer Identification Number (EIN), also known as a Federal Employer Identification Number (FEIN), fulfills several functions. It’s used for filing income taxes, opening an LLC bank account, and hiring employees, if necessary.

While many online services charge a fee to obtain an EIN for your LLC, you can actually get one for free. The Internal Revenue Service (IRS) allows you to secure an EIN for your LLC at no cost through a quick online application process that only takes a few minutes.

>> Start Your LLC With Tailor Brands >>

Hawaii LLC Taxes

The annual costs for LLCs in Hawaii can vary widely due to the different types of taxes that owners are required to pay.

Some of these taxes include:

Federal Income Taxes

The Internal Revenue Service (IRS) provides different tax treatment options for LLCs. Single-member LLCs are treated as Disregarded Entities, meaning they don’t file separate federal income tax returns. Instead, the owner reports and pays taxes through their personal tax return.

How an LLC is taxed depends on its ownership structure: LLCs owned by individuals are taxed similarly to Sole Proprietorships, whereas those owned by companies are taxed as branches of the parent company.

Multi-Member LLC Taxes

Multi-member LLCs are taxed as Partnerships. They file a Form 1065 Partnership Return and issue Schedule K-1 to each owner, which details their portion of the profits. Owners then report this income on their personal tax return (Form 1040) and pay the corresponding taxes.

Husband and Wife LLC Taxes

In community property states, a husband and wife who own an LLC together have the option to file taxes as a Single-Member LLC (Qualified Joint Venture) instead of as a Multi-Member LLC. However, this option doesn’t exist in non-community property states such as Hawaii.

Electing Corporate Taxation

LLCs have the option to elect corporate tax status instead of the default classifications. They can choose between two types of corporate tax elections: S-Corporation and C-Corporation.

To be taxed as an S-Corporation, an LLC must file Form 2553, which can result in lower self-employment taxes. Alternatively, filing Form 8832 allows an LLC to be taxed as a C-Corporation, though this choice is less common.

Hawaii State Income Tax

In Hawaii, Single-Member LLCs don’t file a state-level tax return; instead, the owner reports the LLC’s profits or losses on their personal state tax return. Multi-member LLCs, on the other hand, may be required to file a state-level Partnership return, while each owner reports their share of the profits or losses on their personal tax returns.

Hawaii State Tax ID Number

Every business in Hawaii needs a State Tax ID Number, which can be acquired online via the Hawaii Department of Taxation or Hawaii Business Express for a fee of $20. Depending on the location, industry, and activities of the business, additional licenses may also be required.

Local Income Tax

Businesses in Hawaii may be subject to local income taxes payable to municipalities. It’s advisable to seek professional help when filing these taxes.

Hawaii General Excise Tax

Hawaii’s General Excise Tax (GET) acts as a substitute for a Sales Tax and is levied on businesses rather than customers. The tax rate varies based on the business activities and industry. Businesses can register for the GET at the same time they obtain a State Tax ID.

Hawaii LLC Payroll Taxes

Hawaii LLCs that employ staff are required to handle payroll taxes. This includes withholding federal and state income taxes, as well as paying into Social Security, Medicare, and unemployment taxes. Registration with the Hawaii Department of Labor is compulsory for these businesses, and it’s recommended to seek professional guidance in managing these responsibilities.

>> Get Started With Tailor Brands >>

Hawaii LLC Cost – FAQs

Conclusion

In conclusion, setting up an LLC in Hawaii calls for a careful assessment of the associated costs. Hawaii offers a favorable business environment due to its strategic location and market opportunities. Still, expenses related to LLC formation include filing fees, registered agent fees, and potential legal or consultancy costs. Services like Tailor Brands provide streamlined options to help navigate this process.

Entrepreneurs need to weigh these financial requirements against Hawaii’s distinctive advantages, such as its cultural allure and economic opportunities, to determine if establishing an LLC there aligns with their wider business goals and financial capabilities.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic