Venturing into entrepreneurship in Massachusetts? It’s more than mere paperwork. If you aim to establish a Limited Liability Company (LLC) in the Bay State, be prepared to tackle various costs. However, these expenses shouldn’t dissuade you from your entrepreneurial pursuits. A deep dive into the specifics of LLC formation here can reveal effective strategies to handle and reduce these costs.

This article will dissect the crucial expenses of setting up an LLC in Massachusetts and spotlight the best LLC services like Tailor Brands. These services provide tactics to make wise financial decisions throughout the process.

Equipped with the right know-how and resources, launching your own business becomes feasible and financially shrewd.

What Is the Cost of Forming an LLC in Massachusetts?

The main expense of starting an LLC in Massachusetts is the $500 fee required to file your LLC’s Certificate of Organization through the Massachusetts Secretary of the Commonwealth’s online portal.

Massachusetts Foreign LLC Formation Costs

If you already have an LLC registered in another state and wish to expand your business into Massachusetts, you must register your LLC as a foreign entity in the state.

The fee for registering a foreign LLC in Massachusetts is $500. You must submit the “Foreign Limited Liability Company Application for Registration” to complete this process. This can be done via traditional mail as well.

Annual Cost for LLCs in Massachusetts

When you set up a Limited Liability Company (LLC) in Massachusetts, it’s crucial to consider the ongoing costs that significantly impact your business budget. Understanding these expenses helps you grasp the total cost of operating an LLC in the state and aids in making informed decisions.

Key continuous financial obligations for maintaining an LLC in Massachusetts include submitting an Annual Report. This report, which updates the Secretary of the Commonwealth on your LLC’s members and activities, comes with a $500 filing fee. This is separate from the initial fee for the Certificate of Organization.

Also, you must consider the Business Certificate Renewal, which depends on local regulations. For example, in Boston, LLCs need to renew their business certificates every four years at a cost of $65.

Appointing a resident agent (known in most states as a registered agent) is mandatory under Massachusetts law. The cost for registered agent services can vary, typically ranging from $100 to $300 annually.

Paying attention to these ongoing costs is essential for managing the finances of your LLC in Massachusetts effectively.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Massachusetts With the Best LLC Service?

Tailor Brands LLC Formation Cost

The state filing fee for setting up an LLC in Massachusetts is $500. The overall cost of forming your LLC with Tailor Brands depends on the plan you select.

Typically, it takes about 2 to 3 weeks to process. But if you’re in a hurry, you can opt for an expedited service. Paying an extra $50 will speed up the process, allowing you to get your documents in 4 to 6 days. If you need them even sooner, a $100 fee will shorten the wait to just 1 to 2 days.

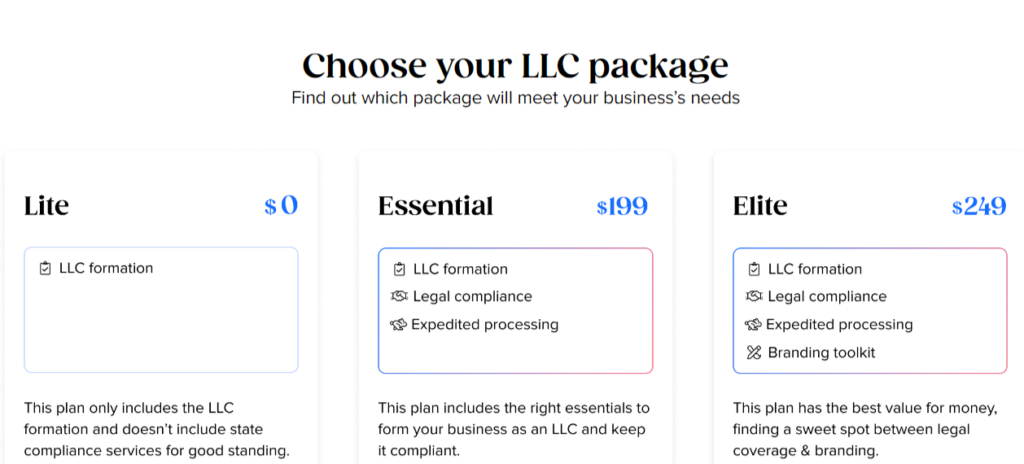

Tailor Brands offers a variety of LLC plans, starting with their Lite LLC plan, which provides basic LLC formation services at standard processing times for only the state filing fee. Their Essential LLC plan, priced at $199 plus state fees, steps it up with expedited LLC formation, annual compliance services, and an operating agreement, along with a yearly maintenance fee of $199.

Their premium offering, the Elite LLC plan, sets you back $249 plus state fees and includes all the perks of the Essential plan plus a slew of business tools. These tools include a free business domain for the first year, a DIY website builder, an online store, eight free logos, a digital business card, a business card tool, and a tool for creating social media posts. To continue enjoying these extra features, an annual renewal fee of $249 is required.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Massachusetts

Massachusetts LLC Name Costs

Registering a name for your Limited Liability Company (LLC) in Massachusetts is free of charge. The state includes the approval of your LLC name with your Certificate of Organization filing without any additional fees.

You may find online sources that talk about the need for LLC Name Reservations, but this is often not required in most states. Typically, forming an LLC doesn’t necessitate a Name Reservation.

If you decide to reserve your preferred LLC name up to 60 days before your company’s formation, you can file an Application of Reservation of Name for a $30 fee. If necessary, you can extend this reservation for another 60 days at an extra cost of $30.

Massachusetts Registered Agent Costs

In Massachusetts, every LLC must have a Registered Agent, who might also be called a Resident Agent. This role is crucial because they handle legal documents and state notifications for your LLC. To serve in this capacity, the agent must have a real address in Massachusetts and be available during business hours.

If you decide to act as your own Registered Agent or appoint a familiar person, it won’t cost you extra. Alternatively, you can choose a Registered Agent service, which typically costs between $100 and $300 annually. These services provide more than just the standard Registered Agent duties; they also include valuable business advice and privacy protection.

It’s a smart move to hire a Registered Agent service, especially if:

- You don’t have a physical address in Massachusetts since the law requires the Registered Agent to have one.

- You prefer to keep your personal address private. Some services allow you to use their address instead, keeping yours out of public records.

Massachusetts Operating Agreement Costs

The LLC Operating Agreement for a Massachusetts LLC is free of charge. This agreement is a crucial document that records the understanding among members regarding ownership, management, and how profits are split.

Both Single-Member and Multi-Member LLCs need to draft an Operating Agreement, keep it with their business records, and give each member a copy. Many websites sell LLC Operating Agreements priced between $50 and $200.

Massachusetts EIN Cost

An EIN Number, also known as an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN), is essential for several tasks. These include filing income taxes, setting up an LLC bank account, and hiring employees, if applicable. Although many websites charge a fee to secure an EIN for your LLC, you can actually get it for free.

The Internal Revenue Service (IRS) offers a quick online filing process that allows you to obtain your EIN at no cost, typically in just a few minutes.

>> Start Your LLC With Tailor Brands >>

Massachusetts LLC Taxes

The expenses associated with Massachusetts LLC taxes can differ widely because owners must pay various yearly taxes. Some of these taxes include:

Federal Income Taxes

The IRS provides several options for determining your LLC’s federal income tax status.

Single-Member LLC Taxes (Default Status)

The IRS treats all Single-Member LLCs as Disregarded Entities for tax purposes. This means that the IRS does not expect the LLC to file its own federal income tax return. Rather, the owner of the Single-Member LLC is responsible for filing the tax return and paying any associated federal income taxes.

How the LLC pays federal income tax depends on who owns it:

- If owned by an individual, the LLC is taxed like a Sole Proprietorship.

- If owned by another company, it is taxed as a branch of the parent company.

Multi-Member LLC Taxes (Default Status)

For LLCs that have two or more owners, the taxation process is similar to that of a Partnership. The LLC is required to file a 1065 Partnership Return and issue a Schedule K-1 to each of its owners. These K-1s detail each owner’s share of the profits, which then “flows through” to them. Following this, each owner reports and pays taxes on their share of the income on their personal tax return (Form 1040).

Husband and Wife LLC Taxes

In some states, if you run a business with your spouse, you can choose to have your LLC treated like a Single-Member LLC, known as a Qualified Joint Venture, rather than a Multi-Member LLC. This choice is only up in community property states. Sadly, it’s a no-go in places like Massachusetts, where they don’t recognize Qualified Joint Ventures.

Electing Corporate Taxation for Your LLC

Beyond the standard options, an LLC may choose to be taxed like a corporation.

It’s recommended to speak with an accountant before opting for a corporate tax status. The two primary types of corporate tax elections are:

- S-Corporation

- C-Corporation

LLC Taxed as an S-Corporation (Elective Status):

Submitting Form 2553 enables an LLC to adopt S-Corporation tax status, which can help established businesses lower their self-employment taxes. This option is typically advisable for businesses that are firmly established and consistently generate substantial revenue (approximately $70,000 in annual net income per LLC member).

LLC Taxed as a C-Corporation (Elective Status):

Filing Form 8832 allows an LLC to elect C-Corporation tax status. This choice can be advantageous for larger employers looking to save on healthcare fringe benefits, although it is not a common selection.

Massachusetts State Income Tax

In Massachusetts, Single-member LLCs usually do not file state-level returns. Rather, the owner reports the LLC’s profits or losses on their personal state tax return. Conversely, Multi-Member LLCs may be required to file a Partnership return at the state level, with owners then reporting their respective shares of profits or losses on their individual returns.

Local Income Tax for Massachusetts LLCs

LLCs or their owners might need to file and pay income taxes at the local municipal level. It is recommended to seek professional help to effectively manage local income tax filings.

Massachusetts Sales Tax

Businesses that sell products to consumers in Massachusetts may need to collect sales tax and secure a Seller’s Permit. This permit, also known as a resale license, wholesale license, or sales tax permit, authorizes the business to collect sales tax. The Massachusetts Department of Revenue (DOR) provides helpful resources for more detailed information.

Massachusetts LLC Payroll Taxes

In Massachusetts, LLCs with employees are responsible for managing payroll taxes. This includes withholding federal and state income taxes and Social Security and Medicare taxes. Employers must establish payroll systems, calculate taxes, and file paperwork with appropriate agencies. Due to the complexities involved, many choose to seek professional assistance to ensure accuracy and avoid potential penalties.

>> Get Started With Tailor Brands >>

Massachusetts LLC Cost – FAQs

Conclusion

Setting up an LLC in Massachusetts goes beyond just paying the initial formation fee. It involves securing the necessary documentation, enlisting the help of registered agents, and meticulously handling key aspects like operating agreements and obtaining an EIN. Effective financial management is crucial in this process, and that’s where the expertise of LLC service providers like Tailor Brands becomes invaluable.

Understanding these varied expenses and leveraging the support of Tailor Brands can equip aspiring business owners to start their Massachusetts LLC journey confidently.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic