If you’re thinking about setting up an LLC in Virginia, you might be concerned about the expenses beyond just the initial filing. Don’t worry, though, the process of establishing your LLC in Virginia doesn’t have to be a major financial burden.

In this detailed guide, we’ll explore all the necessary costs for launching an LLC in Virginia. We’ll highlight ways to save money and discuss how expert LLC services like Tailor Brands can assist you in navigating your LLC setup cost-effectively.

Now, let’s dive into understanding the costs of forming an LLC in Virginia and how you can optimize your budget on your entrepreneurial adventure.

What Is the Cost of Forming an LLC in Virginia?

The basic cost to set up an LLC in Virginia is a $100 fee, which covers the electronic filing of your LLC’s Articles of Organization through the Virginia State Corporate Commission.

Virginia Foreign LLC Formation Costs

If you’re looking to expand your business into Virginia and your LLC is already established in another state, you’ll need to register as a foreign LLC in Virginia. This registration also carries a $100 fee. You can begin this process by submitting a Certificate of Registration to Transact Business in Virginia (Form LLC1052).

Annual Cost for LLCs in Virginia

For continuous operation and legal compliance, a Virginia LLC faces some ongoing costs. Every year, you need to pay a $50 registration fee to the SCC.

Moreover, every Virginia LLC must appoint a registered agent to manage legal documents and official communications. If you opt for a third-party commercial agent, this service can cost between $100 and $300 annually.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Virginia With the Best LLC Service?

Tailor Brands LLC Formation Cost

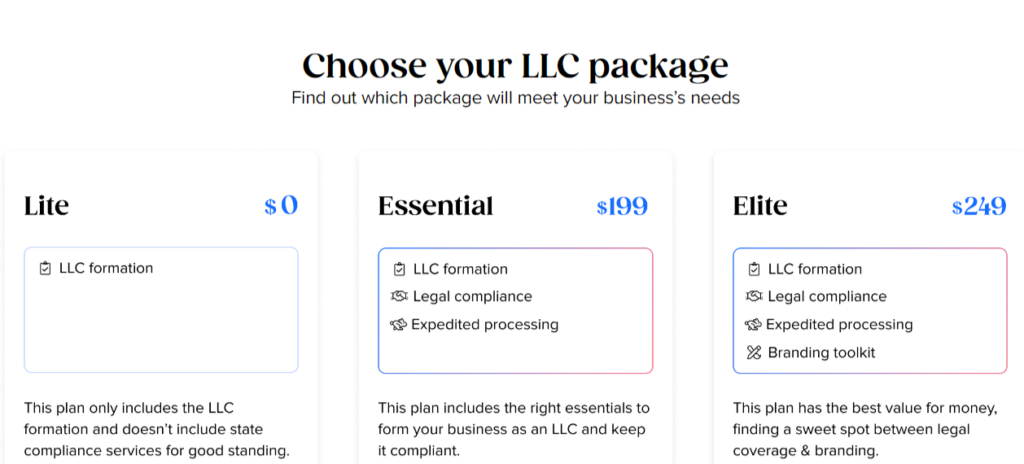

Filing an LLC in Virginia costs $100, though this can vary if you choose extra services. Typically, the process takes 2 to 3 weeks, but you can opt for faster processing: 4 to 6 days for an additional $50 or 1 to 2 days for $100.

The Tailor Brands Lite LLC plan offers customers LLC formation and standard processing times. This plan is the most affordable, costing only the state filing fee. The Essential LLC plan, priced at $199 plus state fees, includes expedited LLC formation, annual compliance services, and an operating agreement. Tailor Brands charges a yearly fee of $199 to maintain these services.

The Elite LLC plan, priced at $249 plus state filing fees, is Tailor Brands’ top-tier option. It includes all the services from the Essential plan, plus additional business tools such as a free domain for the first year, a DIY website builder, an online store, eight free logos, a digital business card, a business card tool, and a social media post maker. An annual fee of $249 is required to continue receiving these benefits.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Virginia

Virginia LLC Name Costs

Choosing a name for your Limited Liability Company (LLC) in Virginia comes without any fees. The approval of your LLC name is included when the state accepts your Articles of Organization filing, and no separate charges apply.

While you may come across mentions of LLC Name Reservations, it’s important to know that many states, including Virginia, don’t require this step. Forming an LLC doesn’t involve reserving a name beforehand. However, if you choose to secure a name for up to 120 days before officially establishing your LLC, you can do so by filing an Application for Reservation of a Business Entity Name (Form SCC631) with a fee of $10. This reservation can be extended for another 120 days by re-filing the same form.

Virginia Registered Agent Costs

In Virginia, you might not pay anything for a Registered Agent, or you could pay up to $125 annually. State rules require appointing a Registered Agent during the LLC formation. This agent handles legal documents and state notices for your LLC, must have a physical address in Virginia, and must be available during business hours.

You can be your own Registered Agent or designate someone you know for this role at no cost. Hiring a Registered Agent service usually costs between $100 and $300 per year. These services not only fulfill the basic duties but might also offer additional business services and help protect your privacy.

Choosing a Registered Agent service might be a good idea if you don’t have a Virginia address or if you prefer to keep your personal address private. Depending on the service, they might let you use their address to preserve your privacy.

Virginia Operating Agreement Costs

Drafting a Virginia LLC Operating Agreement incurs no state fee. This key document, which outlines the LLC’s management structure, ownership, and profit distribution, is vital for both Single-Member and Multi-Member LLCs. It’s recommended that this agreement be drafted and kept, providing copies to all members. While online platforms might charge between $50 and $200 for these agreements, Virginia doesn’t charge a fee for this essential document.

Virginia EIN Cost

Obtaining an EIN for your LLC, also known as an Employer Identification Number or Federal Employer Identification Number, is free. This number is crucial for income tax filing, opening bank accounts, and hiring employees, if applicable.

While many websites might offer to help obtain an EIN for a fee, you can acquire one directly from the Internal Revenue Service (IRS) without any cost through a quick online application process.

>> Start Your LLC With Tailor Brands >>

Virginia LLC Taxes

The yearly taxes for a Virginia LLC can vary widely based on the different types of taxes that owners must pay. These include:

Federal Income Taxes

The IRS has specific tax treatments for Limited Liability Companies (LLCs). Single-Member LLCs are usually seen as Disregarded Entities by the IRS, meaning they don’t file separate federal income tax returns. Instead, the LLC’s owner is responsible for handling and paying federal income taxes directly.

The taxation approach for the LLC hinges on the owner’s status: if owned by an individual, the LLC is taxed similarly to a Sole Proprietorship; if owned by another company, it’s treated as a branch or division of that company.

Multi-member LLCs are typically classified as Partnerships by the IRS. They need to file a 1065 Partnership Return and distribute Schedule K-1s to the owners, who then report their shares of the profits on their personal income tax returns (Form 1040).

Husband and Wife LLC Taxes

In some states, like Texas, a husband and wife owning an LLC can opt to be taxed as a Single-Member LLC, known as a Qualified Joint Venture, rather than a Multi-Member LLC. It’s important to remember, however, that this option isn’t available in states without community property laws, such as Virginia.

Electing Corporate Taxation

Beyond the standard tax classifications, LLCs can choose corporate tax structures. These include S-Corporation and C-Corporation statuses.

- Submitting Form 2553 enables an LLC to be treated as an S-Corporation, potentially lowering self-employment taxes. This choice is typically advised for well-established businesses.

- On the other hand, by filing Form 8832, an LLC can elect to be treated as a C-Corporation. This option may be beneficial for larger businesses, though it’s less frequently selected.

Virginia State Income Tax for Virginia LLCs

In Virginia, Single-Member LLCs typically don’t need to file a separate state-level tax return. Instead, the owner reports the LLC’s profits or losses on their personal state tax return.

For Multi-Member LLCs, the situation requires filing a state-level Partnership return. Meanwhile, each owner must report their share of the profits or losses on their individual state tax returns.

Pass-through Entity Tax

Virginia requires all Multi-Member LLCs, which are recognized as separate entities for federal tax purposes, to file an annual Pass-through Entity Tax Return (Form 502PTET). Single-Member LLCs generally are exempt from this, unless their federal tax classification differs.

Local Income Tax for Virginia LLCs

Both individual LLC owners and the LLCs themselves may need to deal with local income taxes, depending on their location within various Virginia municipalities like towns, cities, or counties. It’s wise to seek advice from an accountant or check with local municipal authorities to ensure you meet all local tax obligations.

Virginia Sales Tax

If your Virginia LLC sells goods to consumers, you’re required to collect sales tax. This necessitates obtaining a Seller’s Permit from the Virginia Department of Taxation, which authorizes you to collect sales tax on in-state transactions.

Virginia LLC Payroll Taxes

Managing payroll for a Virginia LLC with employees involves handling various taxes: federal and state income tax withholdings, Social Security and Medicare taxes, and both federal and state unemployment taxes (FUTA and SUTA), along with any local and county deductions.

Given the complexities and potential penalties for mistakes in payroll tax calculations, many businesses opt to employ payroll services or consult with accountants to ensure their payroll is managed accurately and complies with all regulations.

>> Get Started With Tailor Brands >>

Virginia LLC Cost – FAQs

Conclusion

Forming an LLC in Virginia involves more than the initial fee. The process includes various financial aspects such as securing necessary permits, hiring registered agents, and preparing critical documents like Operating Agreements and an EIN.

For efficient handling of these responsibilities, utilizing services like Tailor Brands can be extremely beneficial. With a thorough understanding of these costs and Tailor Brands’s support, entrepreneurs can confidently start their LLC journey in Virginia.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic