Starting a Limited Liability Company (LLC) in New Hampshire involves various costs that go beyond just the initial filing of paperwork. While setting up an LLC might seem expensive at first, managing your expenses effectively is entirely possible. With the right knowledge and tools, you can handle the process both wisely and economically.

In this guide, we’ll explore the different expenses involved in forming an LLC in New Hampshire and show you how to make smart financial decisions.

Additionally, we’ll highlight excellent LLC service providers like Tailor Brands, which not only simplify the formation process but also help you save money along the way.

What Is the Cost of Forming an LLC in New Hampshire?

The initial cost to establish an LLC in New Hampshire is a $100 fee for filing the Certificate of Formation via the New Hampshire Department of State’s online portal.

New Hampshire Foreign LLC Formation Costs

If your LLC is registered in another state and you plan to expand your operations to New Hampshire, you’ll need to register as a foreign entity in the state. This business registration requires a $100 fee, and you must file an Application for Foreign Limited Liability Company Registration (Form FLLC-1).

Annual Cost for LLCs in New Hampshire

Maintaining an LLC in New Hampshire involves various ongoing expenses. The primary recurring cost is the $100 fee for filing the annual report. Depending on your income and activities in the state, you may be subject to the Business Profits Tax and Business Enterprise Tax.

You also need to maintain a registered agent as mandated by New Hampshire law, which can be yourself at no extra cost, or a professional service that typically charges between $100 and $300 annually. Understanding these continuous costs is vital for proper budget management and ensuring the financial health of your LLC in New Hampshire.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in New Hampshire With the Best LLC Service?

Tailor Brands LLC Formation Cost

Filing an LLC in New Hampshire starts with a basic fee of $100, though this could increase if you opt for additional services. Normally, processing takes about 2 to 3 weeks, but you can expedite this to 7 to 9 days for an additional $50, or even faster to 4 to 5 days for $100.

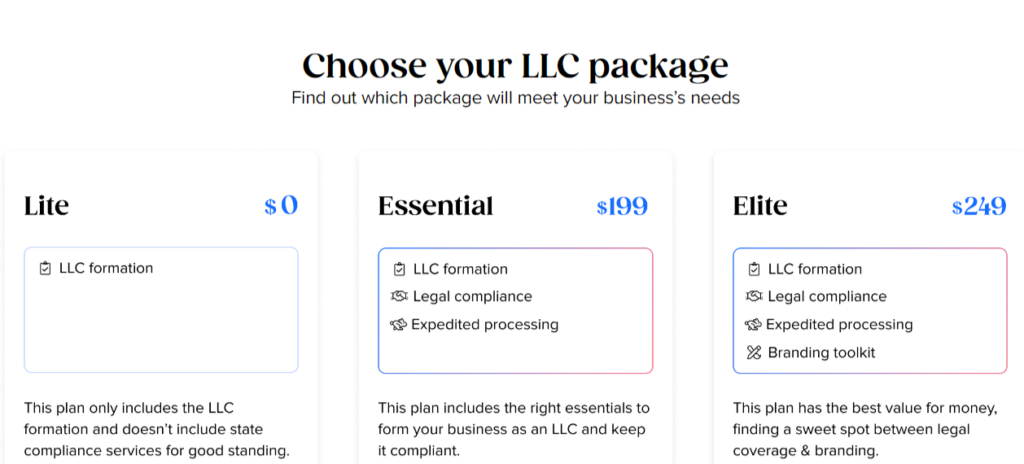

Tailor Brands Lite LLC’s most wallet-friendly option, the Lite plan, offers standard LLC formation at just the state filing cost. For those needing a bit more, the Essential LLC plan, priced at $199 plus state fees, steps up with expedited processing, annual compliance services, and an operating agreement. Maintaining these services costs $199 yearly.

At the pinnacle, the Elite LLC plan rolls in at $249, adding to state fees for an array of tools aimed at business growth. Customers enjoy perks like a free first-year business domain, a DIY website builder, an online store, and a collection of eight distinct logos. Additional features include a digital business card, a business card tool, and a social media post maker. A continuous service fee of $249 per year ensures access to these benefits.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in New Hampshire

New Hampshire LLC Name Costs

Selecting a name for your Limited Liability Company (LLC) in New Hampshire doesn’t incur any fees. When your Certificate of Formation is approved by the state, your chosen LLC name is automatically reserved without extra cost.

You may have read about the need to reserve LLC names, but this often doesn’t apply in most states. Typically, forming a Limited Liability Company doesn’t require a Name Reservation.

However, if you prefer to secure your desired name up to 120 days before formally establishing your LLC, you can do so by filing an LLC Name Reservation application (Form 1) along with a $15 fee.

New Hampshire Registered Agent Costs

In New Hampshire, the Registered Agent fee can be zero if you decide to serve in this capacity yourself, or it can be around $125 annually if you opt for a professional service. It’s mandatory for your LLC to appoint a Registered Agent at the time of its formation.

A Registered Agent in New Hampshire is either an individual or a company tasked with receiving official communications and state notices for your LLC. This agent must have a physical address in the state and be available during standard business hours.

If you or someone you know acts as the Registered Agent, there are no additional costs.

However, you can also choose to hire a professional Registered Agent service, which generally costs between $100 and $300 per year. These services do more than just handle your legal notices; they can offer additional business services and help protect your personal privacy.

It’s particularly smart to consider a professional Registered Agent service if:

- You don’t have a physical address in New Hampshire (since state law requires a local physical address for the Registered Agent).

- You prefer to keep your personal address off public records (some services may allow you to use their address for added privacy).

New Hampshire Operating Agreement Costs

In New Hampshire, drafting an LLC Operating Agreement comes at no cost ($0).

An LLC Operating Agreement is a formal document that outlines the structure of the LLC, including ownership details, management practices, and the guidelines for profit distribution. It’s recommended that both Single-Member and Multi-Member LLCs prepare an Operating Agreement, keep it with their business records, and distribute copies to each member.

While creating an Operating Agreement is free of charge, many online platforms typically charge between $50 and $200 to prepare these documents.

New Hampshire EIN Cost

Getting an LLC EIN Number costs absolutely nothing, it’s free!

An Employer Identification Number (EIN), or a Federal Employer Identification Number (FEIN), plays a crucial role in many business operations such as filing income taxes, setting up a bank account for the LLC, and hiring employees if needed. While some online platforms might charge a fee to assist you in getting an EIN, it’s crucial to know you can obtain one for free.

You can easily acquire an EIN for your LLC straight from the Internal Revenue Service (IRS). The process is straightforward and can be done online in just a few minutes.

>> Start Your LLC With Tailor Brands >>

New Hampshire LLC Taxes

The range of annual costs for New Hampshire LLC owners varies due to the diverse taxes they need to handle.

Federal Income Taxes for LLCs

The IRS offers various tax treatments for LLCs. Single-member LLCs are seen as Disregarded Entities, with the owner responsible for federal tax filings. The tax treatment depends on whether the owner is an individual, taxed as a Sole Proprietorship, or a company, where the LLC is taxed as a branch or division.

Multi-Member LLC Taxes

LLCs with multiple owners are treated as Partnerships by the IRS. They must file a 1065 Partnership Return and provide Schedule K-1 forms to owners, who report their share of profits on their personal tax returns (Form 1040).

Husband and Wife LLC Taxes

In some states, such as Texas, husband and wife LLCs may choose Single-Member LLC taxation (Qualified Joint Venture) rather than Multi-Member status. This option isn’t available in New Hampshire, as it’s not a community property state.

Electing Corporate Taxation for LLCs

LLCs can opt for corporate taxation. Filing Form 2553 allows an LLC to be taxed as an S-Corporation, potentially reducing self-employment taxes for established businesses. Alternatively, filing Form 8832 changes an LLC’s tax status to a C-Corporation, which is less common and suited for specific situations.

New Hampshire State Income Tax for LLCs

Single-member LLCs report their profits or losses on their personal state returns. Multi-member LLCs may need to file a state-level Partnership return, with profits and losses also reported on the personal state returns of the owners.

Business Enterprise Tax and Business Profits Tax

New Hampshire imposes the Business Enterprise Tax (BET) and Business Profits Tax (BPT) on the entity level. BET applies broadly to earnings, while BPT is due from all businesses operating within the state.

Local Income Tax for New Hampshire LLCs

LLCs and individuals may be subject to local income taxes depending on their municipality. Consulting an accountant for guidance is recommended.

New Hampshire Sales Tax

New Hampshire doesn’t have a state sales tax, so LLCs are exempt from collecting sales tax on in-state transactions. However, sales to customers in other states may require sales tax collection based on the customer’s location.

New Hampshire LLC Payroll Taxes

LLCs with employees are responsible for managing payroll taxes, including federal and state income tax withholdings, Social Security, Medicare, and unemployment taxes. Due to the complexity, many businesses opt for professional payroll services or accountants to ensure accuracy and compliance.

>> Get Started With Tailor Brands >>

New Hampshire LLC Cost – FAQs

Conclusion

Forming an LLC in New Hampshire involves more than just the initial filing fee. It requires managing various financial aspects such as obtaining the necessary documentation, hiring registered agents, and addressing crucial details like operating agreements and obtaining an EIN.

Effective financial management is key, and specialized LLC services like Tailor Brands can significantly aid in this process. With a thorough understanding of these financial responsibilities and support from Tailor Brands, aspiring entrepreneurs can confidently start their LLC journey in New Hampshire.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic