Thinking about launching your own LLC in Nebraska? You might be stressing over the potential costs, but there’s no need for your wallet to take a hit. This guide unpacks all the costs you’ll likely face while setting up your LLC in the Cornhusker State. We’ll also spotlight services like Tailor Brands, which are experts in shedding light on your path and steering you toward smart financial decisions.

Concerned about the expenses of starting an LLC in Nebraska? Keep calm, we’ve got your back!

What Is the Cost of Forming an LLC in Nebraska?

Kickstarting an LLC in Nebraska? You’ll only shell out $100, due when you upload your LLC’s Certificate of Organization on the Nebraska Secretary of State’s digital hub.

Nebraska Foreign LLC Formation Costs

If you already own an LLC set up in another state and plan to expand your business into Nebraska, you’ll need to register your LLC as a foreign entity in the state.

Registering a foreign LLC from another state in Nebraska costs $100 online or $110 if done via mail. You’ll have to apply for a Certificate of Authority to officially get your foreign LLC recognized in Nebraska.

Annual Cost for LLCs in Nebraska

Running a Limited Liability Company (LLC) in Nebraska means planning for ongoing costs that affect your financial strategy.

Significant recurring expenses for a Nebraska LLC include filing a biennial report, which costs $13 online or $10 by mail; renewing trade names every ten years for $100; and paying a registered agent fee, typically between $100 and $300 each year, assuming you use a registered agent service to meet state requirements.

Incorporating these consistent expenses into your Nebraska LLC’s financial blueprint is essential for informed decision-making and maintaining its fiscal health.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Nebraska With the Best LLC Service?

Tailor Brands LLC Formation Cost

In Nebraska, the base fee to file an LLC application is $100, which marks the starting point for any additional charges that may accrue. Typically, processing takes between 2 to 3 weeks. However, for those needing faster service, an expedited option cuts the wait to 6 to 8 days for an extra $50, or even down to 3 to 4 days for an additional $100.

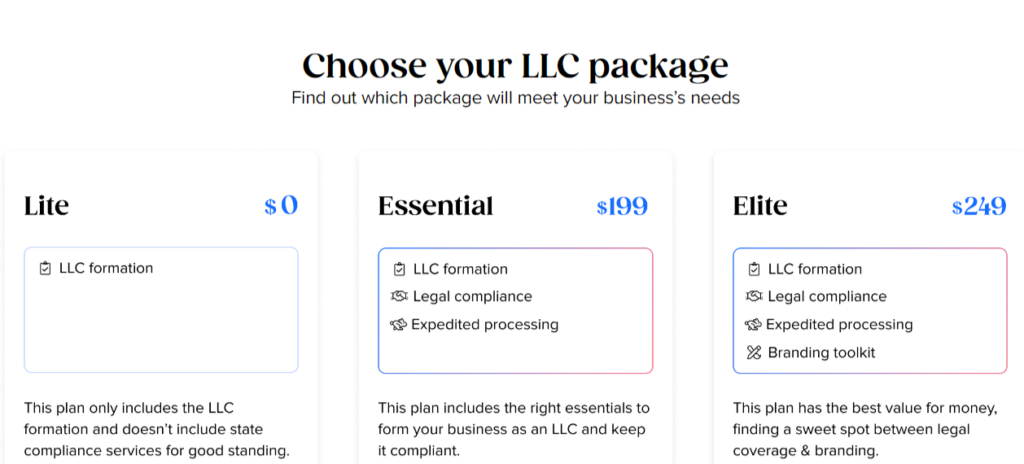

Tailor Brands offers several LLC formation plans, starting with the Lite LLC plan. This entry-level option includes LLC formation service at the standard processing speed, costing only the state filing fee. The Essential LLC plan, priced at $199 plus state fees, adds expedited processing, annual compliance services, and an operating agreement. It requires an annual renewal fee of $199 to maintain these services.

The top-tier Elite LLC plan costs $249 plus state filing fees and includes everything from the Essential plan along with extra business tools like a free domain for the first year, a DIY website builder, an online store, eight free logos, a digital business card, business cards tool, and a social media post maker. An annual fee of $249 is necessary to keep these benefits active.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Nebraska

Nebraska LLC Name Costs

Choosing a name for your Limited Liability Company (LLC) doesn’t cost anything. Your Nebraska LLC name gets approved when you file your Certificate of Organization with the state, and this includes no extra charges.

You may have heard that reserving an LLC name is necessary through official steps. However, this is only true for a few states. Most states don’t require you to reserve a name before setting up your LLC.

If you decide to lock down your preferred name before officially forming your LLC, you can reserve it for up to 120 days. This requires you to file an Application for Reservation of Limited Liability Company Name and pay a $30 filing fee.

Nebraska Registered Agent Costs

In Nebraska, the Registered Agent Fee can be $0 if you decide to serve in this capacity yourself, or it could be about $125 annually. Under Nebraska law, appointing a Registered Agent when forming your LLC is mandatory.

A Nebraska Registered Agent is tasked with receiving legal papers and state communications for your LLC. They must have a physical address in the state and be available during normal business hours.

Choosing yourself or a trusted friend to act as your own Registered Agent comes at no extra cost.

Alternatively, you can hire a Registered Agent service, which typically costs between $100 and $300 a year. These services not only handle your legal notifications but also offer extra business services and can help protect your privacy.

Hiring a Registered Agent is particularly wise if:

- You don’t have a physical address in Nebraska (the state requires Registered Agents to have one).

- You prefer to keep your address off public records (some services may let you use their address for enhanced privacy).

Nebraska Operating Agreement Costs

In Nebraska, creating an LLC Operating Agreement is free of charge.

This agreement acts as a formal contract among the members of the LLC, detailing the ownership distribution, management practices, and profit-sharing strategies. It’s recommended that single-member and multi-member LLCs draft an Operating Agreement, keep it with their business records, and distribute copies to all members.

However, be aware that many online platforms charge between $50 and $200 to provide LLC Operating Agreements.

Nebraska EIN Cost

Getting an LLC EIN Number, also known as an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN), is crucial for activities like filing income taxes, opening an LLC bank account, and hiring employees, if applicable. While some services might charge a fee to obtain an EIN for your LLC, it’s important to know that you can actually get it for free.

The Internal Revenue Service (IRS) provides a no-cost option to acquire an EIN for your LLC through an online application. This process is quick, takes only a few minutes, and doesn’t involve any fees.

>> Start Your LLC With Tailor Brands >>

Nebraska LLC Taxes

The annual expenses for Nebraska LLC owners can vary widely due to the different types of taxes they must pay. These taxes include:

Federal Income Taxes

The Internal Revenue Service (IRS) provides several tax treatment options for your LLC. Single-member LLCs are considered Disregarded Entities, which means they do not file separate federal income tax returns. Instead, the owner files the return and pays the taxes directly. The taxation approach varies with ownership: if owned by an individual, the LLC is taxed as a Sole Proprietorship; if owned by a company, it’s taxed as a branch of the parent company.

Multi-Member LLC Taxes

If your LLC is owned by multiple people, it’s taxed as a Partnership. This requires you to file a Form 1065 Partnership Return and issue a Schedule K-1 to each owner, detailing their portion of the profits. The income then “flows through” to the owners, who are responsible for paying taxes on it through their personal income tax returns.

Husband and Wife LLC Taxes

In certain community property states, a husband and wife who own an LLC together have the option to file as a Single-Member LLC (Qualified Joint Venture) instead of a Multi-Member LLC. However, not all states offer this option, including Nebraska.

Electing Corporate Taxation

An LLC has the option to choose Corporate taxation instead of the default settings, with possibilities including S-Corporations and C-Corporations.

Choosing S-Corp status can aid in reducing self-employment taxes, which might be beneficial after the business is established. On the other hand, electing C-Corp status can be advantageous for larger employers that provide healthcare fringe benefits.

Nebraska State Income Tax

For Single-Member LLCs, the LLC itself does not file a state tax return; instead, the owner reports the LLC’s profits or losses on their personal state tax return. Multi-member LLCs, on the other hand, may need to file a state-level Partnership return, with each owner reporting their share of the profits or losses on their individual state returns. Specific business taxes are applicable to certain industries in Nebraska.

Local Income Tax

Local income taxes might be applicable to you or your LLC depending on your municipality. It’s advisable to seek professional assistance for filing these taxes.

Nebraska Sales Tax

If you engage in retail sales in Nebraska, you’ll likely need a Seller’s Permit to collect sales tax. This permit, issued by the Nebraska Department of Revenue, is also commonly known as a resale, wholesale, or sales tax permit.

Nebraska LLC Payroll Taxes

For LLCs that have employees, managing payroll taxes is intricate. These taxes encompass federal and state income tax withholding, Social Security and Medicare taxes, as well as federal and state unemployment taxes, along with any local deductions. Due to the complexity of these obligations, it’s often necessary to seek professional help to ensure accuracy and avoid potential penalties.

>> Get Started With Tailor Brands >>

Nebraska LLC Cost – FAQs

Conclusion

In conclusion, setting up an LLC in Nebraska requires attention to more than just the initial costs. This process includes obtaining necessary documents, engaging registered agents, and managing crucial aspects like operating agreements and securing an EIN. Expert financial handling in these areas is critical, underscoring the value of specialized services like Tailor Brands.

With a clear understanding of the various expenses and support from Tailor Brands, aspiring business owners are well-prepared to start their Nebraska LLC journey confidently.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic