When setting up an LLC in Minnesota, be prepared for some out-of-pocket expenses beyond just the initial filing of paperwork. But don’t worry, it might not be as costly as you think. We’re diving deep into what it takes to form your LLC in Minnesota, highlighting all the necessary expenses involved.

We’ll also introduce you to top-notch LLC services like Tailor Brands. They help simplify the process and offer insights on managing costs effectively. With their assistance, you can chase your business dreams without putting too much pressure on your wallet.

What Is the Cost of Forming an LLC in Minnesota?

The main expense for starting an LLC in Minnesota is a $155 fee. This amount is for submitting your LLC’s Articles of Organization online via the Minnesota Secretary of State’s office.

Minnesota Foreign LLC Formation Costs

If you already own an LLC registered in another state and want to expand your business into Minnesota, you’ll need to register your LLC as a foreign entity in the state.

The cost to register a foreign LLC in Minnesota is $205 for online submissions and $185 if you opt to send your application through traditional mail. The process includes submitting a Certificate of Authority to Conduct Business in Minnesota for your foreign LLC, which you can also complete via mail.

Annual Cost for LLCs in Minnesota

Setting up your own Limited Liability Company (LLC) in Minnesota involves not only initial costs but also ongoing expenses necessary for maintaining your LLC. These expenses are crucial for understanding the total operating costs of an LLC in this state. Such costs include annual expenses like filing an annual report, which surprisingly carries no fee.

Moreover, if your LLC has multiple members, you might face the MMLLC Partnership Tax, a yearly charge that varies based on factors like Minnesota property, payroll, and sales. This tax increases incrementally and can go up to $210 for revenues below $1,020,000.

For those using an assumed name in Minnesota, remember the annual renewal requirement. It’s free if done on time, but late renewals incur a reinstatement fee ranging from $25 to $45, depending on how you file. Every LLC must maintain a registered agent in Minnesota, which costs about $100 to $300 per year if you hire a professional service or a third-party provider.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Minnesota With the Best LLC Service?

Tailor Brands LLC Formation Cost

Kicking off an LLC in Minnesota? The starting price is $155. Depending on what extra services you choose, this might fluctuate. For those in a hurry, faster options are available: an extra $50 cuts wait time to 4-6 days, while $100 ensures your paperwork is ready in just 1-2 days. Standard processing takes about 2-3 weeks.

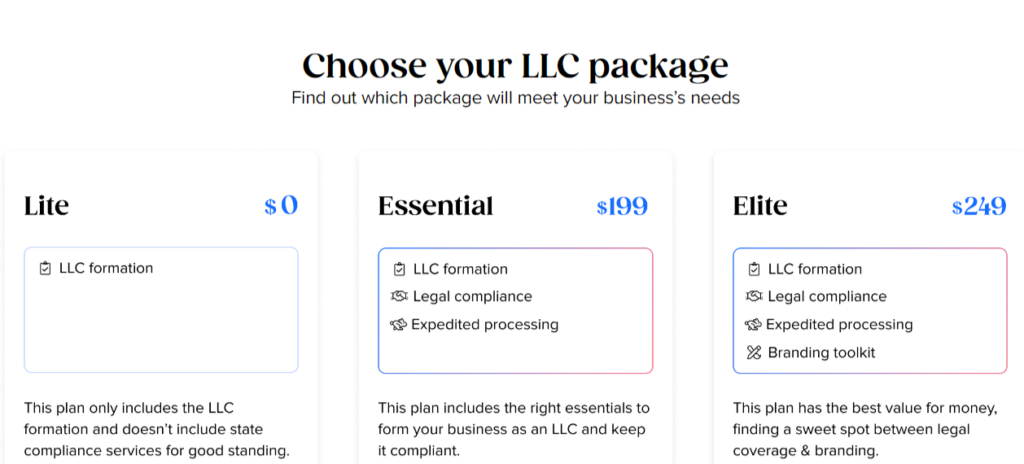

The Tailor Brands Lite LLC plan offers a straightforward LLC formation at just the state filing cost, making it their most budget-friendly option. The next tier up, the Essential LLC plan, sets you back $199 plus state fees. It ramps up the perks with expedited processing, yearly compliance, and an operating agreement. Maintaining these services requires an annual payment of $199 to Tailor Brands.

At the top of the line is the Elite LLC plan, priced at $249 plus the state fees. This premium package not only includes everything from the Essential plan but also throws in a bunch of business tools like a free domain for a year, DIY website and online store builders, eight free logos, a digital business card, a tool for creating business cards, and a social media post maker. To keep these benefits rolling, there’s an annual fee of $249.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Minnesota

Minnesota LLC Name Costs

Choosing a name for your LLC comes free of charge. Once you file your Articles of Organization in Minnesota, the state will approve your LLC name without any extra fees.

You might have seen online mentions about needing to reserve an LLC name, but that’s usually not required in most states. It’s not a prerequisite for setting up your LLC.

However, if you want to hold a specific name for up to 12 months before you formally establish your LLC, you can file a Request for Reservation of Name. This can be done online for a $55 fee or through mail for $35.

Minnesota Registered Agent Costs

In Minnesota, appointing a Registered Agent is a legal necessity when setting up your LLC. You can manage this role yourself at no cost, or you can opt for a professional service that generally costs between $100 to $300 per year. On your Articles of Organization, listing a Registered Agent incurs no additional fees for your Minnesota LLC.

A Minnesota Registered Agent can be an individual or a company tasked with receiving all legal and state communications on behalf of your LLC. They need to have a physical address in Minnesota and be available during typical business hours.

If you decide to serve as your own Registered Agent or assign someone you trust, there are no extra costs. However, hiring a professional Registered Agent service offers perks like enhanced business support and protection for your privacy.

This option becomes especially beneficial if:

- You don’t have a physical address in Minnesota, as state laws require Registered Agents to maintain one.

- You prefer to keep your personal address off public records for privacy reasons; some services allow the use of their address to ensure your privacy remains intact.

Minnesota Operating Agreement Costs

In Minnesota, creating an LLC Operating Agreement is free of charge.

This document details the ownership, management structure, and profit distribution within an LLC and is crucial for both single-member and multi-member LLCs. It’s advisable to keep this agreement in your business records and distribute copies to all members.

While the agreement itself incurs no cost, many online services charge between $50 and $200 to draft LLC Operating Agreements.

Minnesota EIN Cost

Getting an EIN Number for your LLC in Minnesota is completely free.

An EIN, also known as a Federal Employer Identification Number (FEIN), is crucial for various business activities, including filing taxes, opening a bank account for the LLC, and handling employee matters, if applicable.

Although some online services charge a fee to help with obtaining an EIN, you can easily do this yourself at no cost. Simply apply directly through the Internal Revenue Service (IRS). The process is quick, usually taking just a few minutes online.

>> Start Your LLC With Tailor Brands >>

Minnesota LLC Taxes

Annual LLC costs for Minnesota LLC owners can vary widely based on the different taxes they need to pay. Here are some of the taxes that LLC owners might encounter:

Federal Income Taxes

When it comes to taxes for your Limited Liability Company (LLC), the IRS provides several options. For Single-Member LLCs, they’re considered Disregarded Entities, meaning the LLC itself does not file a separate federal income tax return. Instead, the owner handles the tax filing and payments. The type of taxation depends on who owns the LLC: if owned by an individual, it’s taxed as a Sole Proprietorship; if owned by another company, it’s treated as a branch or division for tax purposes.

Multi-Member LLC Taxes

For LLCs that have multiple owners, the taxation structure is similar to a Partnership. The LLC must file a 1065 Partnership Return and provide each owner with a Schedule K-1, which details their portion of the profits. The owners then report this income on their personal tax returns (Form 1040), where taxes are paid based on their individual shares.

Husband and Wife LLC Taxes

In some states, a husband and wife who own an LLC can choose to be taxed as a Single-Member LLC (Qualified Joint Venture) instead of as a Multi-Member LLC. This option is available in community property states. However, in non-community property states like Minnesota, this taxation choice is not available.

Electing Corporate Taxation

Besides the standard options, an LLC can elect to be taxed as a Corporation, choosing between S-Corporation and C-Corporation status.

S-Corporation Taxation: By submitting Form 2553, an LLC can choose S-Corporation status, which can help profitable businesses reduce self-employment taxes. This choice should be carefully considered, ideally with guidance from an accountant.

C-Corporation Taxation: By filing Form 8832, an LLC can opt for C-Corporation status. This is mainly advantageous for larger companies that benefit from healthcare fringe benefits. This option is less frequently chosen.

Minnesota State Income Tax

In Minnesota, owners of Single-Member LLCs report their LLC’s profits or losses on their personal state tax returns. For Multi-member LLCs, there may be a requirement to file a state-level Partnership return in addition to the personal tax returns of the owners.

Minnesota Taxpayer Identification Number

In Minnesota, it’s recommended for most businesses, particularly Multi-Member LLCs, those with employees, those engaged in taxable sales, or those subject to use tax, to obtain a Tax ID number.

Local Income Tax

You or your LLC might be subject to local income taxes, requiring accurate filing and payment. It’s advisable to seek professional help with these obligations.

Minnesota Sales Tax

If you’re selling to consumers in Minnesota, you may need to collect sales tax. This requires obtaining a Seller’s Permit from the Minnesota Department of Revenue (DOR), which is associated with your Tax ID number.

Minnesota LLC Payroll Taxes

In Minnesota, if you’re managing an LLC with employees, you’ve got a bit on your plate handling payroll taxes. This includes withholding for federal and state income taxes along with Social Security and Medicare contributions. Navigating through this can be a bit of a puzzle. Many opt for a payroll service or an accountant’s expertise to ensure everything ticks along accurately and complies with the law.

>> Get Started With Tailor Brands >>

Minnesota LLC Cost – FAQs

Conclusion

In conclusion, setting up an LLC in Minnesota requires a thorough grasp of related costs. Even with Minnesota’s favorable business regulations, potential owners must consider expenses like state filing fees, registered agent fees, and potentially hiring professional help. Choosing established LLC service providers like Tailor Brands can significantly streamline the process.

Entrepreneurs should carefully evaluate these costs against Minnesota’s supportive business climate, legal framework, and strong reputation. Doing so ensures that their decision is well-aligned with their goals and financial means.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic