Thinking about kicking off an LLC in Indiana? You’re on track! Before jumping in, let’s break down the costs you’ll run into while setting up and maintaining your LLC in this state. This guide will cover all the necessary fees plus the ongoing expenses to keep your business ticking. Need some help with the paperwork? Services like Tailor Brands can make sure everything’s squared away right.

Armed with the right know-how and some solid support, you’ll be all set to handle the financial side of launching your LLC in Indiana. Ready to get started? Let’s dive in!

What Is the Cost of Forming an LLC in Indiana?

Starting an LLC in Indiana mainly involves a $95 fee for filing your LLC’s Articles of Organization on the Indiana Secretary of State’s online platform.

Indiana Foreign LLC Formation Costs

If you already have an LLC set up in another state and want to expand your business to Indiana, you’ll need to register your LLC as a foreign entity in Indiana.

It costs $125 to register a foreign LLC online in Indiana, or $150 if you choose to submit your registration by mail. To do this, you must file a Foreign Registration Statement (Form 56369) for your LLC.

Annual Cost for LLCs in Indiana

After setting up your Indiana LLC, understanding the recurring costs for its maintenance is key. The primary ongoing expense is the Business Entity Report, also known as the biennial report, which requires submission every two years at a cost of $31 online or $50 by mail.

Indiana also requires each LLC to have a Registered Agent who handles legal documents and official communications. When planning your budget for your Indiana LLC, it’s crucial to include these costs to make informed decisions and ensure your business’s financial health.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Indiana With the Best LLC Service?

Tailor Brands LLC Formation Cost

The basic cost to file an LLC in Indiana starts at $95, with the possibility of extra charges. Normally, processing takes 2 to 3 weeks. If you need it done quicker, you can opt to speed up the process to 4 to 6 days for an additional $50, or even faster, to 1 to 2 days, for an extra $100.

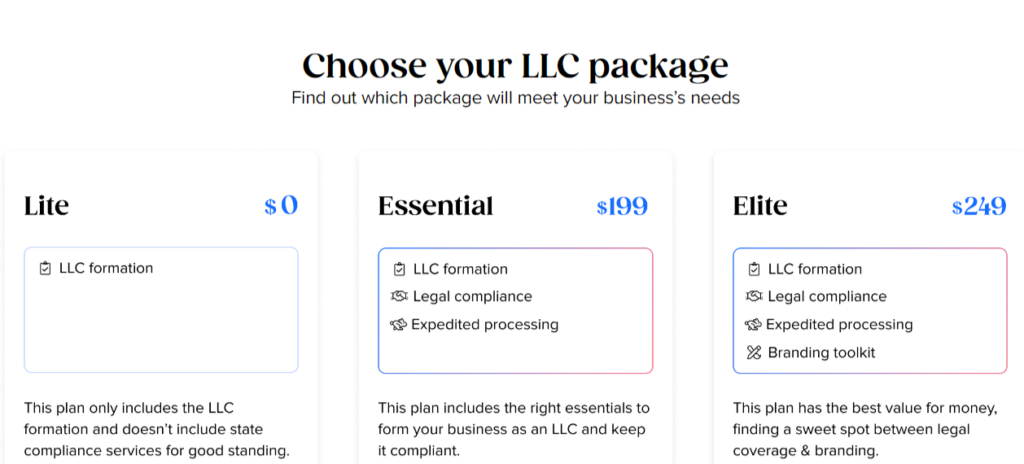

A renowned LLC registration company, Tailor Brands offers three distinct LLC formation plans tailored to different needs. The Lite LLC plan is their most budget-friendly option, charging just the state filing fee. It includes basic LLC formation with standard processing times. Stepping up, the Essential LLC plan comes in at $199 plus state fees. It speeds up the LLC formation process, adds annual compliance services, and includes an operating agreement. Tailor Brands also charges a yearly fee of $199 to maintain these services.

At the top of the line is the Elite LLC plan, priced at $249 plus state filing costs. This plan encompasses all the benefits of the Essential package but throws in a slew of additional business tools and services.

Customers get a business domain free for the first year, a do-it-yourself website builder, an online store, and eight free logos. Also included are a digital business card, a business card tool, and a tool for creating social media posts. To keep benefiting from these features, customers need to pay an annual fee of $249 to Tailor Brands.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Indiana

Indiana LLC Name Costs

Registering a business name in Indiana comes with no charge. Your Indiana LLC Name gets approved for free when the state processes your Articles of Organization.

You might find online claims about the need to reserve an LLC Name, but this isn’t usually required in most states. Typically, forming an LLC doesn’t involve a Name Reservation.

However, if you choose to reserve your LLC name prior to formally establishing the company, you can submit the LLC Name Reservation Form along with a $10 filing fee.

Indiana Registered Agent Costs

In Indiana, the annual fee for a Registered Agent can be either $0 or up to $125. Indiana laws require every LLC to have a Registered Agent on record.

A Registered Agent in Indiana is either an individual or a business entity tasked with accepting official paperwork and state notifications for your LLC. They must have a physical address in Indiana and be available during regular business hours.

If you decide to act as your own Registered Agent or appoint someone you know for the role, there’s no fee involved.

However, you can opt to hire a Registered Agent service, which usually costs between $100 and $300 annually. This service takes care of receiving legal documents for your LLC and may offer additional business services and privacy protection.

Choosing a Registered Agent service might be beneficial if:

- You don’t have an address in Indiana, as state law requires a Registered Agent to have a physical presence in the state

- You prefer to keep your address private, which some services enable by letting you use their address instead

Indiana Operating Agreement Costs

An Indiana LLC Operating Agreement serves as a formal contract among the LLC Members. It includes comprehensive details about ownership, management practices, and profit distribution within the LLC.

It’s advisable for both Single-Member and Multi-Member LLCs to create an Operating Agreement, keep it with their business documents, and provide copies to all Members.

Interestingly, although many online platforms might charge anywhere from $50 to $200 for LLC Operating Agreements, acquiring one for your LLC doesn’t cost anything.

Indiana EIN Cost

An EIN, also known as an Employer Identification Number or Federal Employer Identification Number, fulfills several roles. These include income tax filing, opening a bank account for an LLC, and hiring employees when the need arises.

While plenty of websites will charge you to get an EIN for your LLC, it’s actually free. You can snag an EIN for your LLC through the IRS and wrap up the online application in just a few quick minutes.

>> Start Your LLC With Tailor Brands >>

Indiana LLC Taxes

Indiana LLCs come with various taxes that owners must pay, causing their yearly costs to vary greatly. Some taxes paid by LLC owners include:

Federal Income Taxes

Regarding federal income taxes for your LLC, the IRS provides several classification choices. For Single-Member LLCs, the IRS treats them as Disregarded Entities, so these LLCs don’t file their own federal income tax returns.

Instead, the owner of the LLC files the tax return and remits the federal income taxes. The method of tax handling varies based on the LLC’s ownership structure. When owned by an individual, it is taxed similarly to a Sole Proprietorship. Conversely, if owned by another company, it is taxed as a branch or division of the parent company.

Multi-Member LLC Taxes

When an LLC is owned by multiple individuals, it is treated as a Partnership for tax purposes. This necessitates the filing of a Form 1065 Partnership Return and the issuance of Schedule K-1 forms to each owner. These forms specify each owner’s portion of the profits. The income outlined on the K-1 forms is then passed through to the owners, who pay the applicable income taxes on their personal tax returns using Form 1040.

Husband and Wife LLC Taxes

In community property states such as Texas, a husband and wife who jointly own an LLC have the option to be taxed as a Single-Member LLC (Qualified Joint Venture) instead of a Multi-Member LLC. This option, however, is not available in non-community property states like Indiana.

Electing Corporate Taxation

Besides the default tax statuses, an LLC has the option to elect taxation as a Corporation. This choice requires submitting specific forms to be taxed either as an S-Corporation or a C-Corporation.

Choosing S-Corporation status can reduce self-employment taxes for established businesses, but this comes with extra costs that need careful consideration. Although less common, opting for C-Corporation taxation can offer advantages like healthcare fringe benefits for large employers.

Indiana State Income Tax

Indiana’s approach to taxing LLCs varies based on whether they are Single-Member or Multi-Member.

Single-member LLCs typically don’t need to file a separate state-level return. Instead, the owner reports the LLC’s profits or losses on their personal state tax return.

Multi-member LLCs, on the other hand, are often required to file a Partnership return at the state level, and the owners must include the LLC’s financial details in their personal state returns. Certain sectors might face extra business taxes.

Indiana Tax ID Number

Every business in Indiana needs to secure a state-level Tax ID number. Registration usually happens online via platforms such as INBiz, and it requires an Access Indiana login. Alternatively, you can contact the Indiana Department of Revenue for further information on state taxes.

Local Income Tax for Indiana LLCs

LLCs and their owners may need to fulfill requirements for filing and paying income taxes at the local level, including municipalities, cities, and counties. To fully understand these obligations, it’s advisable to consult an accountant and contact the relevant local authorities.

Indiana Sales Tax

For LLCs that sell products to consumers in Indiana, it might be necessary to collect sales tax and obtain a Seller’s Permit. Also known as a resale license, wholesale license, or sales tax permit/license, this permit allows for the collection of sales tax on retail transactions. The Indiana Department of Revenue issues these permits and offers additional information.

Indiana LLC Payroll Taxes

If your Indiana LLC employs staff, you are in charge of handling payroll taxes. This involves withholding federal and state income taxes, contributions to Social Security and Medicare, and paying federal and state unemployment taxes, as well as any local deductions and employee withholdings.

Setting up payroll correctly, withholding taxes accurately, and making timely filings are critical. Many employers opt to use payroll services or hire accountants to assist with these responsibilities, ensuring compliance and preventing penalties.

>> Start Your LLC With Tailor Brands >>

Indiana LLC Cost – FAQs

Conclusion

In conclusion, setting up an LLC in Indiana requires careful consideration of the associated costs. Indiana’s business-friendly environment, potential tax benefits, and strategic location are advantageous, but forming an LLC does involve specific expenses such as filing fees, registered agent fees, and possible legal or consulting costs.

Streamlined LLC service providers like Tailor Brands offer tailored packages that simplify the incorporation process.

Aspiring business owners must carefully weigh these costs against Indiana’s advantages, like its strong legal framework and business-friendly reputation, to make a well-informed decision that fits their business goals and financial capabilities.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic