Relay is a financial technology company that provides minimal fees for business checking and savings accounts. It’s ideal for business owners looking to streamline their finances and implement a “Profit First” cash flow strategy.

It’s also beneficial for those managing numerous employees or freelancers through multiple bank accounts and debit cards. However, there might be better options than Relay if you need credit cards, loans, or an interest-bearing checking account.

This review delves into the features and drawbacks of Relay’s business checking accounts and services. Read on to learn more.

>> Explore Relay Bank’s Features Now! >>

Relay Bank Review

Relay is a financial technology company that offers FDIC-insured business banking accounts through Thread Bank. Previously, Relay partnered with Evolve Bank and Trust, so some features like cash deposits and savings accounts are exclusive to “Relay 2.0” accounts that opened in 2023 or existing accounts transitioned to Thread-supported services.

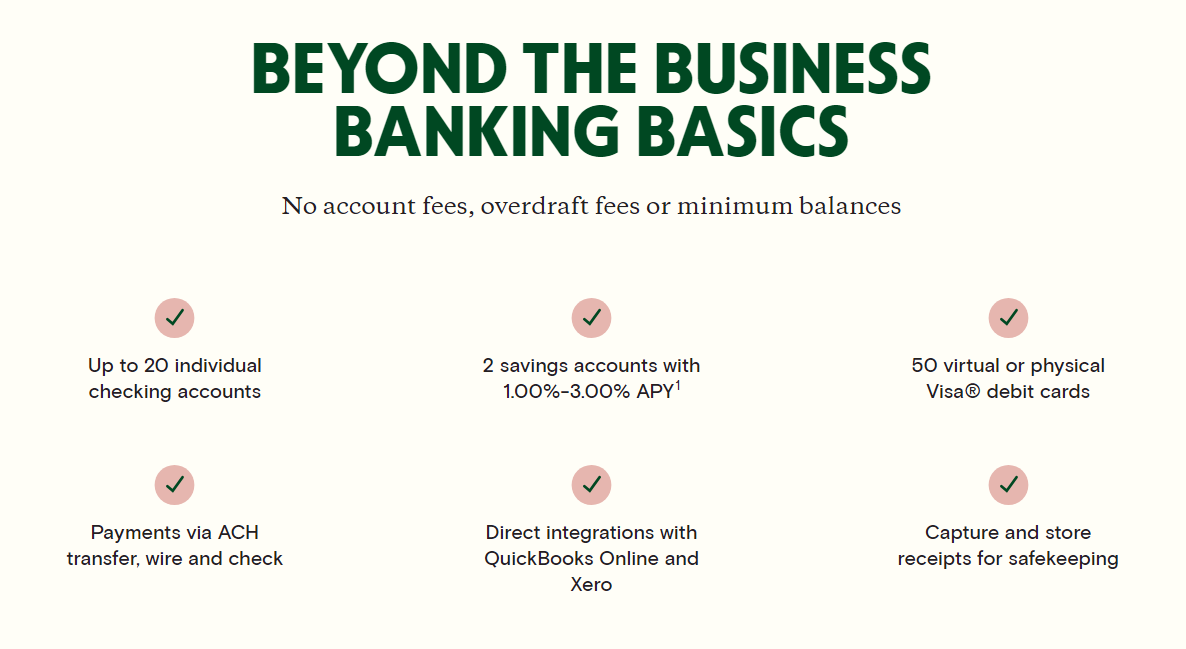

Relay’s offerings include no minimum balance requirements, transaction limits, overdraft fees, free incoming wire transfers, and the ability to deposit cash at compatible AllPoint ATMs.

Relay’s premium account, Relay Pro, costs $30 per month and includes:

- Same-day ACH availability

- Free outgoing wire transfers

- Accounts payable features, such as automatic bill import from QuickBooks Online and Xero

Relay also provides a high-yield business savings account, insured by the FDIC for up to $2.5 million through the Insured Cash Sweep program. This account has no monthly fee or minimum balance requirement but features a tiered interest structure:

- Less than $50,000: 1.00% APY

- Between $50,000 and $250,000: 1.50% APY

- Between $250,000 and $1,000,000: 2.00% APY

- $1 million or higher: 3.00% APY

The business savings account does not come with checks, a debit card, or ATM access. Money

can only be transferred internally between a Relay Checking account and the savings account.

ACH transfers to merchants or other banks are not allowed. However, all Relay business checking customers can open up to two savings accounts.

Relay is ideal for business owners looking for minimal fees, robust digital banking features, and those utilizing a “Profit First” strategy. However, there may be better choices if you require credit cards, loans, or interest-bearing checking accounts.

>> Discover the Benefits of Relay Bank Today! >>

Pros & Cons of Relay Bank

Pros

- The base plan incurs no monthly maintenance fees

- There are no minimum balance requirements

- You can open up to 20 accounts and obtain up to 50 physical or virtual Visa debit cards

- Seamless integration with well-known accounting software and online payment processors

- Enjoy FDIC coverage up to $3 million through the deposit sweep program

- Access 24/7 email support and weekday phone assistance

Cons

- Lack of physical branches

- Absence of lending or credit card products

- Access to accounts payable and faster ACH payments requires a paid plan

- Mobile check deposits may take up to seven business days to process

Relay Business Checking Features

Relay’s integrated accounting and banking tools streamline financial management relatively cheaply. Here are some of its key features:

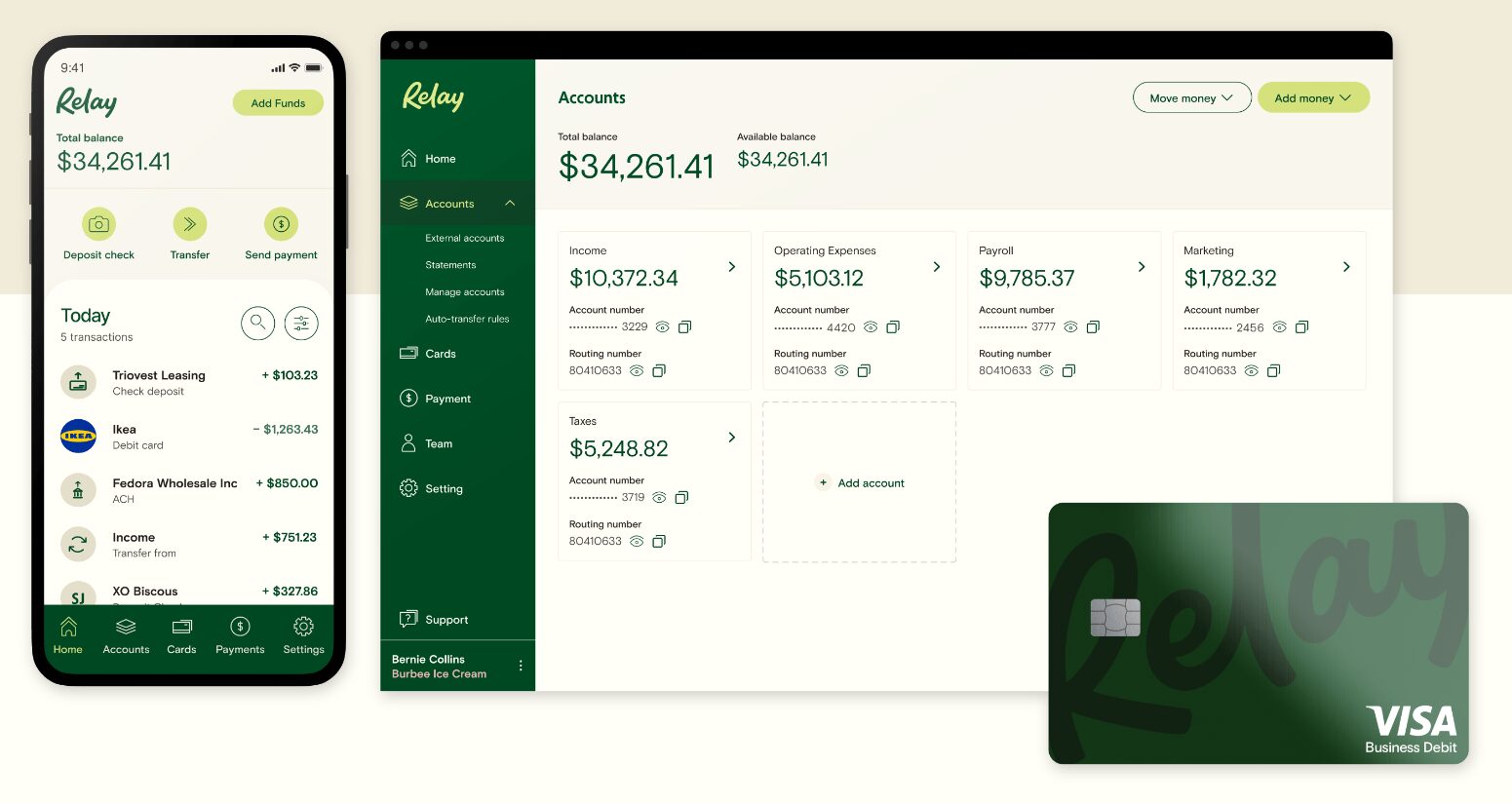

Multiple Checking Accounts

With Relay, LLCs and corporations can create up to 20 individual subaccounts under a single account name, while sole proprietorships can have up to 10. Each subaccount is FDIC-insured and has its own unique account number.

Relay’s system allows for instant money transfers between checking accounts. This feature makes it easy to set up dedicated checking accounts for major business expenses, such as taxes, payroll, and operating costs, providing a streamlined way to manage your finances.

Customizable Debit Cards

After opening an account with Relay, you’ll receive a physical debit card mailed to your business address. You can then issue up to 50 virtual or physical Visa debit cards. Virtual cards are activated instantly, while physical cards are shipped within eight to ten business days to your business or preferred U.S. address. Each debit card must be linked to a specific checking account.

Relay debit cards are accepted anywhere credit cards are. There are no fees for using your card to withdraw or deposit cash at Allpoint ATMs. The card works with Apple, Google, and Samsung Pay for seamless in-person transactions.

Team Member Account Permissions

You can grant team members access to specific subaccounts and debit cards. As the main user, you can monitor card activity and set daily spending and ATM withdrawal limits.

With complete authority over all account permissions, you can ensure team members contribute to financial tasks like paying bills or handling bookkeeping without having excessive control over your business funds. This setup provides both security and flexibility in managing your business finances.

>> Start Banking Smarter With Relay Bank! >>

Accounting Software Integrations

Relay accounts integrate effortlessly with QuickBooks Online and Xero. This means businesses can import transaction data directly into their accounting software, eliminating the need for manual data entry. Small business owners can easily update their bank feeds, gaining a clearer and more accurate picture of their cash flow.

Detailed Transaction History

Each entry in your transaction history provides detailed information, including the amount paid, the recipient company, the debit card used, and the checking account from which the funds were withdrawn.

For account reconciliation, you can search transactions by payment type, merchant, card name, or initiator, making it easier to keep track of your financial activities.

Mobile App

Relay’s mobile app allows you to perform various banking tasks, including:

- Viewing accounts and transactions

- Issuing and activating debit cards

- Editing checking account names

- Adjusting debit card transaction limits

- Depositing checks via mobile check deposit

- Sending payments

- Transferring funds

The app is highly rated, with a 4.7 rating on the App Store from over 800 reviews and a 4.4 rating on Google Play from about 340 reviews. Users appreciate the app’s free business tools, though some have noted occasional glitches in the platform.

High FDIC Insurance Coverage

Relay provides users up to $2.5 million in FDIC insurance protection through a sweep program offered by its partner, Thread Bank. This ensures your deposits are well-protected.

>> Join Relay Bank For Your Business Needs! >>

Other Relay Business Products

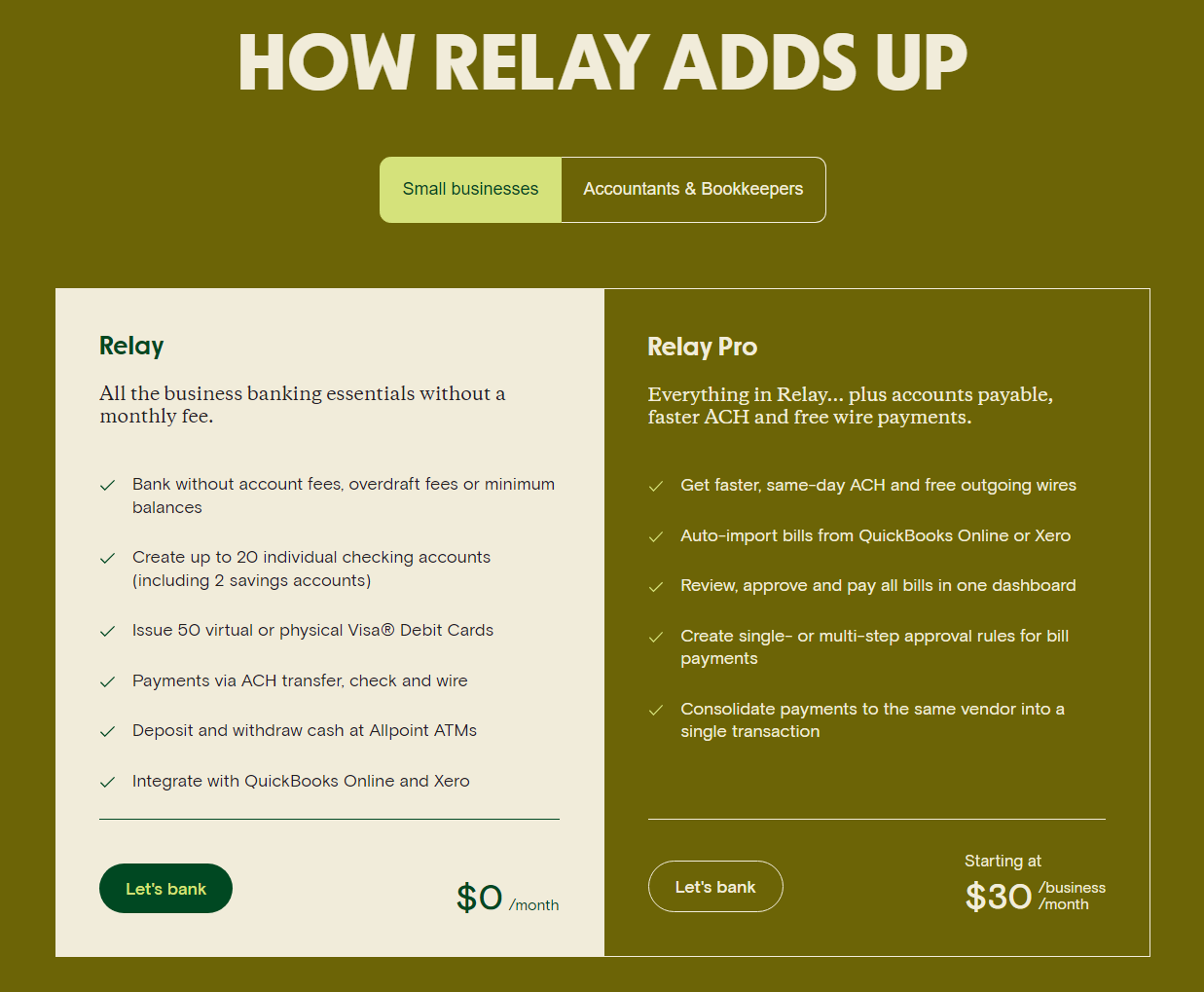

Relay business banking offers a premium service called Relay Pro and a high-yield business savings account.

Relay Pro

Relay Pro costs $30 per business per month and includes these benefits:

- Free domestic & international wire transfers

- 50 same-day ACH transfers

- Batch bill payment

- Automatic bill import from QuickBooks Online and Xero

- Multilevel bill payment approvals

Savings

Relay allows each business to have two savings accounts where idle cash can be transferred. These accounts have no fees or minimum balance requirements. The APY varies based on the account balance:

- 1% APY for balances under $50,000

- 1.5% APY for balances between $50,000 and $250,000

- 2% APY for balances between $250,000 and $1 million

- 3% APY for balances above $1 million

Accounts Payable

Relay allows you to pay bills using free same-day ACH transfers, checks, or domestic and international wires. It includes a built-in currency conversion option, making it convenient for paying international clients. Additionally, you can manage all your payees and upload vendor details, such as W-9 forms, to simplify tax season.

>> Get Started With Relay Bank Today! >>

Relay Business Pricing

Managing finances can be challenging as a small business owner, so it’s important to review Relay’s pricing structure carefully.

Minimum Balance Requirements

One of the advantages of using Relay for your business banking needs is the absence of minimum balance requirements. Whether you opt for Relay’s free account or the paid Relay Pro, you won’t need to worry about maintaining a specific balance in your account.

Monthly Fees

Relay’s basic plan is free at $0 per month, making it an excellent choice for cost-conscious businesses.

If you need additional features, such as faster same-day ACH transfers and advanced billing options, the Relay Pro plan costs $30 per business per month. Both plans allow you to have up to 20 individual checking accounts without monthly fees.

Withdrawals and Limits

Relay offers free, unlimited withdrawals at AllPoint ATMs and fee-free withdrawals at any ATM worldwide. However, be aware that the banks owning those ATMs may charge a fee. For Relay’s physical cards, the maximum daily card transaction limit is $7,000, and the ATM withdrawal limit is $1,000 per card.

Other Fees

Relay generally offers a fee-free structure for most of its services. However, it’s important to identify any specific fees that may apply to your business, such as wire transfer fees. This will help you understand the full cost of using Relay for your business banking needs.

International Transfer Costs

If your business frequently handles international transactions, you’ll appreciate Relay’s user-friendly international transfer system. The pricing is straightforward, with a $10 fee per outgoing transaction. However, if you’re on the Relay Pro plan, this fee is waived, making it more cost-effective.

Currency Conversion Costs

Relay bases its exchange rate on the foreign exchange market, updating the conversion rate every 60 seconds. They apply a rate that is 1% or higher, depending on the currency you’re converting to and the rate at the time of your request. Before completing the conversion, you’ll see exactly what you’ll be charged and what the recipient will receive.

>> Explore Relay Bank’s Features Now! >>

Who Is Relay For?

Relay is a business checking account designed for small business owners and entrepreneurs. It offers accounts with no minimum balance requirements, no fees, and no transaction limits. Business owners can also add employees to their accounts and assign permissions based on their roles.

Relay is an excellent banking solution for e-commerce companies or online businesses, as it seamlessly pulls deposits from payment processors like Stripe and Square. It also integrates easily with QuickBooks and Xero, streamlining cash management.

However, established business owners aiming to scale their companies might find Relay less suitable, as it doesn’t provide access to lines of credit or business loans, which are essential for business growth.

Relay Bank Reviews from Real Users

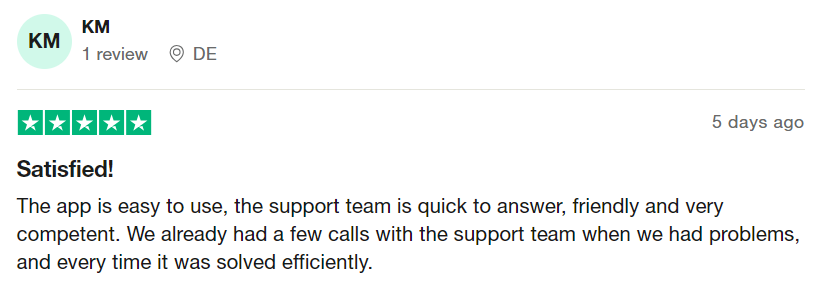

Relay business checking reviews are predominantly positive, with the platform holding a 4.6 rating from over 1,300 reviews on Trustpilot. Users have praised Relay’s responsive customer support team and clear communication.

They also appreciate the ability to open multiple accounts for free and the ease of setting up an account. Here are some comments from Relay users:

Relay Bank Alternatives – Relay Review

Relay is a great choice for business owners, but it has some drawbacks that might make it challenging for some users. Here are two alternatives to Relay that offer many of the same features, along with added benefits such as access to credit and the ability to earn interest:

Bluevine is an online business banking option that offers features similar to Relay, with a few additional services that may appeal to business owners. Account holders can make cash deposits and earn interest up to 2.00% APY (terms apply) on their accounts.

Additionally, Bluevine provides lines of credit, making it an excellent choice for business owners looking to scale their operations.

Lili is a financial technology company offering business checking accounts ideal for digitally savvy business owners who seldom use traditional payment methods like checks. Partnering with Choice Financial Group, Lili provides banking services and insures deposits up to $250,000 through the FDIC.

Originally designed for freelancers when it launched in 2018, Lili has since expanded its online business checking accounts to include most business entity types. The company has also introduced higher deposit and transfer limits to support larger businesses.

With few fees, interest-bearing accounts, and a vast ATM network, Axos Bank is an excellent choice for those who prefer digital banking. Axos offers a broader range of accounts than many online banks, helping you save on fees. While it may not provide the highest savings rates, the yields and rewards on its checking accounts are exceptional.

The Axos Bank Rewards Checking account has no monthly maintenance fee and unlimited domestic ATM fee reimbursements. Additionally, it offers a maximum APY that surpasses many savings accounts. The amount you earn depends on how you use the account and any other Axos Bank accounts you have.

Relay Bank Review – FAQs

Bottom Line – Relay Review

Relay is an excellent choice for businesses looking to simplify cash management with integrated bookkeeping and banking solutions.

The ability to create multiple subaccounts and debit cards makes it ideal for small business owners who want to delegate financial responsibilities to team members. However, if you need access to lending products, you’ll need to consider other options.

>> Start Banking Smarter With Relay Bank! >>

Sections of this topic

Sections of this topic