As a small business owner, you likely want to spend less time on banking and accounting workflows. Most of us deal with the status quo of managing transactions in one system and handling bill payments and money transfers in another. Found’s Small Business Checking aims to revolutionize this process.

Found integrates banking and accounting into one platform, providing comprehensive tools for banking, accounting, invoicing, and tax management, designed specifically for freelancers, 1099 contractors, gig workers, and independent business owners. Read this review to discover Found’s features, benefits, drawbacks, and more.

>> Use Found’s Business Checking Account >>

About Found Banking

Found isn’t a bank; it’s a financial app that partners with Piermont Bank, an FDIC member, to provide banking services. Alongside a business checking account, Found offers tools for tax tracking, expense management, invoicing, and more.

Found’s customer service isn’t available 24/7. You can call or live chat with them Monday to Friday from 8 a.m. to 5 p.m. PT. Additionally, you can message customer service through the app, with responses available from 7 a.m. to 5 p.m. PT on weekdays and from 7 a.m. to 3 p.m. PT on weekends.

Found’s mobile banking app is highly rated, with a 4.5 rating on Google Play and a 4.8 rating on the App Store.

>> Use Found’s Mobile Banking App >>

Found Banking Review

Found’s standout strength lies in its features tailored for small businesses, particularly for self-employed individuals. If you’re open to exploring, many top banks offer attractive perks.

However, there are a few drawbacks. Since Found is a financial app and not a traditional bank, you won’t have access to physical branches to manage your account.

Additionally, Found lacks its own free ATM network. While the app doesn’t charge ATM fees, the ATMs you use might, resulting in extra withdrawal costs. There are also fees for depositing cash into your account.

Almost all of Found’s business checking account features are included in its free plan. However, earning interest on your checking account is only possible with Found Plus, which costs nearly $20 per month or around $150 per year quite expensive for an online checking account.

Found Business Checking Account Pros and Cons

- Early direct deposit

- No monthly service fees

- No monthly fees or minimum opening deposit

- The pockets system helps organize your money

- Unlimited fee-free transactions, no overdraft fees, and free incoming domestic wires

- Free, built-in invoicing, bookkeeping, and tax-planning features

- Integrates with popular business apps, including Stripe, Etsy, and PayPal

- Flexible spending to cover card transactions that would otherwise overdraw your primary balance

- Phone support is available only during business hours

- Must open the account in your name with your SSN; Business EIN can be added later

- No outgoing wires or check payments

- No bill pay feature

- Limited customer service hours

- Online-only with no physical branches

- Doesn’t charge ATM fees but can’t prevent ATMs from charging their own fees

- Fees associated with cash deposits

- Interest can only be earned with a paid plan

- Cash deposits are limited to $2,000 per week and $4,000 per month; a $2 service fee applies

>> Use Found’s Business Checking Account >>

Advantages of Using Found Banking

The Found Free Business Checking Account provides entrepreneurs with a comprehensive digital banking solution. With Found, you don’t need to download separate banking, tax software, and budgeting apps since everything is integrated into one app.

Plus, if you’re already using software like QuickBooks for your company’s finances, you can connect it to your Found account.

The checking account offers several great perks. It allows you to organize your money into “pockets” for different purposes. The account includes two default pockets, “Primary” and “Taxes.”

Found’s “smart percentage” feature automatically allocates a portion of your direct deposits into the taxes pocket to help ensure you have enough funds for quarterly taxes. You can also create and name your own pockets for various savings goals.

Additionally, the account provides early direct deposit and flexible spending features. With early direct deposit, you can receive paychecks up to two days early. The flexible spending feature allows you to overdraw your primary pocket for debit card purchases if your other pockets have sufficient funds to cover the expense.

>> Use Found’s Business Banking Services >>

Key Features of Found Banking

Digital-First Approach

Found operates as an online-only app, bringing both the benefits and drawbacks typical of the best online banks. Its digital nature means you can access Found anywhere at home or while traveling.

However, depositing cash can be more challenging, and getting one-on-one assistance is more complex than traditional brick-and-mortar banks.

Business-Friendly Services

Found offers a range of innovative financial tools designed for small business owners. Its tax assistance is especially useful. The Pockets system helps you automatically set aside funds for quarterly taxes, easing one of the most stressful aspects of self-employment.

For those concerned about tax filing, Found Plus annual members can file taxes through the app at no extra cost.

Security and Reliability

Found ensures secure online banking through its partnership with Piermont Bank. The bank is FDIC insured up to $250,000 per depositor for each account and ownership category, providing peace of mind for your money’s safety.

Additionally, Found encrypts your financial data for security. It offers 24/7 fraud monitoring to protect against identity theft, works exclusively with PCI-DSS certified payment partners, and adheres to a security program that follows the SOC 2 Framework. This security framework is also independently assessed by a third party annually.

>> Use Found’s Mobile Banking App >>

How to Open a Found Business Checking Account

Single-owner businesses can easily open a business checking account through the Found website or app. These accounts are ideal for freelancers, gig workers, and sole proprietors, as they are opened using your personal name and Social Security number.

If you have an EIN, you can add it after the account is opened. This process differs from traditional business bank accounts, which typically require formation documents like a business license or registration and are opened in the business’s name.

What You Need to Open a Found Business Account

To apply for a Found business checking account, you will need the following:

- Legal name, home address, and cell phone number

- Social Security number and date of birth

- Basic business details, including industry and start date

- Estimated business income, tax filing status, and total expected income to estimate your tax bill

While you can apply for an account in minutes, receiving your Found debit card may take up to seven business days. However, you can use a virtual card provided in the app while waiting for the physical card.

Cash deposits can be made via a third-party service at over 79,000 retail locations. Use the Found app to locate the nearest participating store, then request a barcode within the app to scan at the store for your deposit.

Each deposit incurs a $2 fee, lower than the $4.95 fee charged by Green Dot, a service used by several online business checking accounts for cash deposits.

>> Use Found’s Business Checking Account >>

Who Is Found Best For?

Found is the ideal financial partner for those who value flexibility, efficiency, and innovation in banking. It’s designed for freelancers, entrepreneurs, and sole proprietors who operate digitally and need banking solutions that adapt to their unique financial demands.

These individuals often encounter challenges like fluctuating income, simplified tax preparation, and efficient expense management, all of which Found effectively addresses. The platform excels for those who appreciate the convenience of digital banking paired with robust tools that automate and simplify financial tasks.

Whether you’re a freelancer dealing with self-employment taxes or a small business owner seeking streamlined invoicing and expense tracking, Found is tailored to support your financial needs.

With its mobile-first approach, Found ensures users have constant access to their financial data, facilitating real-time decision-making and oversight.

Found Bank Pricing

Found Bank provides various services to meet diverse banking needs. The Basic Banking Account is free and offers essential features like instant deposits, expense management, tax savings, and invoicing.

For more advanced features, you can opt for Found Plus at $19.99 per month or $149.99 per year. This premium account includes unlimited categories, custom rules, photo receipt capture, an APY balance bonus, and priority customer support.

Invoicing services come with different fees based on the payment method: 2.9% plus $0.30 per transaction for debit or credit cards, 1% for direct debit, and 3.1% plus $0.30 for Cash App Pay.

>> Use Found’s Business Checking Account >>

Found Customer Support

Found provides live customer support via phone and chat during regular business hours: Monday through Friday from 8 a.m. to 5 p.m. PT. On weekends, support is available only via email, staffed from 7 a.m. to 3 p.m. PT on Saturday and Sunday, with no after-hours support.

If issues arise outside these support windows, this schedule could leave side hustlers and gig workers who don’t follow traditional hours without assistance.

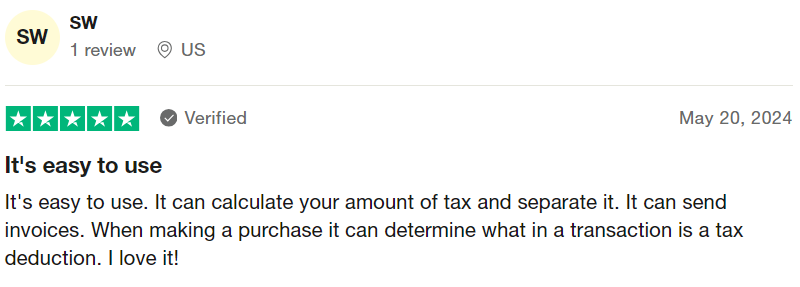

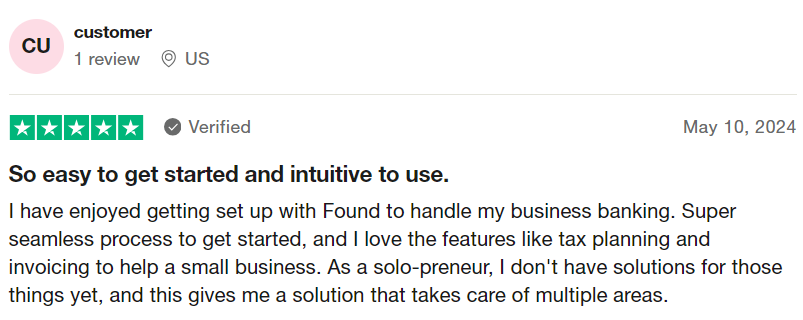

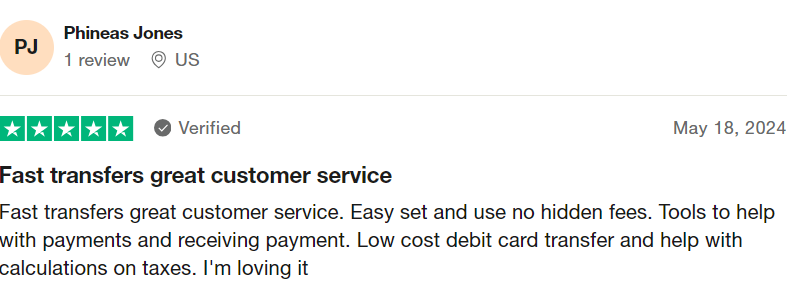

Found Business Banking Review From Real Users – How Legit is Found?

Is Found Bank legit? Check out these reviews from Found users to help you decide.

Found Bank Alternatives

Small business owners deserve a checking account that enhances their daily operations, not hinders them. Bluevine Business Checking might be the perfect fit for some.

While no fees and unlimited transactions are standard for online business accounts, Bluevine offers one of the highest interest rates for a business checking account: 2.00% on balances up to $250,000.

It’s important to note that Bluevine is a financial technology company, not a traditional bank. Their banking services are provided by Coastal Community Bank, which is insured by the FDIC and participates in the Insured Cash Sweep program through the IntraFi network.

Lili is a financial technology company offering business checking accounts ideal for tech-savvy business owners who rarely use checks. Partnering with Choice Financial Group, Lili ensures deposits up to $250,000 are FDIC-insured.

Originally designed for freelancers in 2018, Lili has since expanded to cater to most business entity types. It has also increased its deposit and transfer limits to support larger businesses.

Axos Bank is a solid choice for those who prefer digital banking. It offers low fees, interest-bearing accounts, and a broad ATM network. Axos provides a more extensive range of accounts than many online banks, helping you save on fees. Although it doesn’t offer the highest savings rates, its checking account yields and rewards are impressive.

The Axos Bank Rewards Checking account features no monthly maintenance fees and unlimited domestic ATM fee reimbursements. Additionally, it boasts a maximum APY that surpasses many savings account rates, with earnings depending on account usage and any other Axos Bank accounts you hold.

Found Bank Review – FAQs

Bottom Line – Found Business Banking Review

Found offers a robust free business checking account with features to support self-employed individuals and small business owners. If you’re looking for an app that combines banking, budgeting, invoicing, and tax payment capabilities, Found could be an excellent choice.

Sections of this topic

Sections of this topic