As the world evolves, so do its financial markets. As such, major players in the industry must continually adapt their strategies to remain competitive. This week, two major financial institutions made announcements related to their operations.

Citigroup, a multinational investment bank headquartered in New York City, announced plans to recalibrate its investment banking workforce. This comes in response to shifts in the financial industry and the need for a more agile workforce. Meanwhile, HDFC Bank, one of India’s largest private sector banks, is set to launch a revamped payments banking application in the near future.

Citigroup’s Workforce Recalibration

Citigroup, which has been in operation for over 200 years, is no stranger to adapting to changing markets. In response to shifting trends, the bank has made the decision to recalibrate its investment banking workforce. This announcement was made in a memo to employees from Paco Ybarra, the CEO of the bank’s Institutional Clients Group.

According to the memo, the bank will be making significant changes to its investment banking operations in order to better serve clients and remain competitive in the industry. These changes will include a focus on areas where the bank is already strong, as well as an investment in areas where the bank sees potential for growth.

While it is not yet clear how many jobs will be affected by this workforce recalibration, Ybarra emphasized that the bank will work to ensure that impacted employees are treated fairly and with respect.

This move by Citigroup comes at a time when many financial institutions are feeling the pressure to adapt to new technologies and changing market conditions. As more and more investors move towards digital platforms, traditional investment banking firms are finding themselves in need of new strategies in order to stay relevant.

HDFC Bank’s Revamped Payments Banking Application

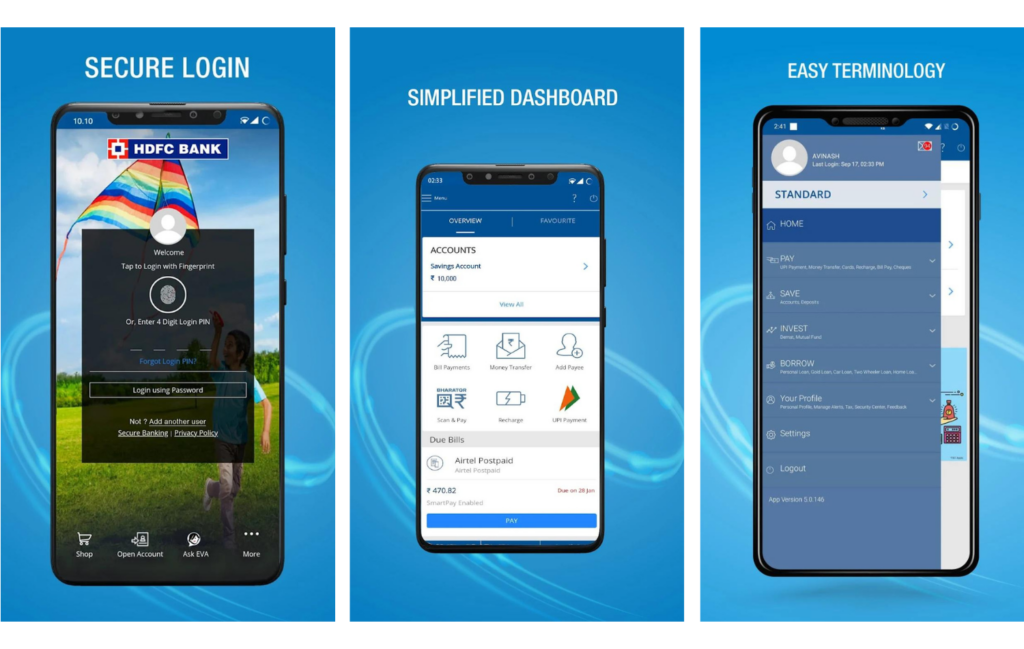

Meanwhile, in India, HDFC Bank is preparing to launch a revamped payments banking application. The new app is set to be rolled out in the coming months and will feature a number of improvements over the bank’s current offering.

According to a spokesperson for the bank, the new app will offer a simpler and more user-friendly interface, making it easier for customers to manage their accounts and make payments. In addition, the app will feature enhanced security features to protect users’ financial information.

This move by HDFC Bank comes at a time when digital payments are becoming increasingly popular in India. With a large population and a growing middle class, India represents a significant market for financial institutions looking to expand their offerings.

In recent years, HDFC Bank has made a concerted effort to position itself as a leader in the digital banking space. The bank has already launched a number of successful digital products, including its mobile banking app and its PayZapp digital wallet. With the launch of its revamped payments banking application, HDFC Bank is hoping to solidify its position as one of India’s top digital banking providers.

The Importance of Adapting to Changing Markets

Both Citigroup and HDFC Bank’s recent announcements highlight the importance of adapting to changing markets. In today’s fast-paced financial world, companies must be willing to pivot their strategies in order to remain competitive.

For Citigroup, this means recalibrating its investment banking workforce to better serve clients and compete with other firms. For HDFC Bank, it means continuing to innovate and improve its digital offerings in order to stay ahead of the curve.

While these moves may not be easy for employees impacted by workforce recalibrations or for banks investing in new technologies and applications, they are necessary steps to ensure continued success in the fast-paced and ever-changing financial industry.

Conclusion

In conclusion, the financial industry is constantly evolving, and major players must adapt to stay competitive. This week, Citigroup announced plans to recalibrate its investment banking workforce, while HDFC Bank is set to launch a revamped payments banking application in the future.

Sections of this topic

Sections of this topic