Introduction

As the popularity of cryptocurrencies grows, so does the need for efficient and reliable crypto tax software. Coinpanda is one of the top solutions in the market, catering to the tax reporting needs of both beginner and experienced crypto traders.

In this comprehensive review, we will delve into the features, integrations, pros, and cons of Coinpanda, along with a comparison to its competitors.

Whether you’re a casual crypto investor or a seasoned trader, this review will help you make an informed decision about using Coinpanda for your crypto tax calculations.

What is Coinpanda?

Coinpanda is a crypto tax software that simplifies calculating taxes for various cryptocurrency transactions. With support for multiple crypto exchanges, wallets, and blockchains, Coinpanda allows users to import their transaction data and generate accurate tax reports. The platform’s user-friendly interface makes it intuitive for traders to navigate and use its features.

Wide Range of Crypto Exchanges Supported

One of the standout features of Coinpanda is its extensive integration with over 800 crypto exchanges. Whether you trade on popular exchanges like Binance, Coinbase Pro, Kraken, or lesser-known platforms, Coinpanda ensures seamless transaction import and accurate tax calculations.

This wide range of supported exchanges makes it convenient for traders to consolidate their transaction data from multiple platforms into one centralized location.

User-Friendly Integrations

Coinpanda prides itself on providing a user-friendly experience for its users. The platform offers easy integration options through API and CSV imports.

Connecting your API or uploading CSV files can effortlessly import your transaction history, saving you time and effort. Coinpanda’s intuitive interface ensures that even beginners can navigate the software without hassle.

Competitive Pricing Model

Coinpanda offers a pricing model that is both reasonable and competitive in the crypto tax software market. The platform’s free plans allow users to try its features and import their transaction data.

Coinpanda offers premium plans starting from $189 per year for users with more extensive transaction histories for users with more extensive transaction histories. This pricing structure caters to casual and high-volume traders’ needs to a wide range of users.

CSV and API Integrations

Coinpanda supports both CSV and API integrations, giving users flexibility in importing their transaction data. With CSV imports, users can upload transaction data from supported wallets and exchanges in a convenient spreadsheet format.

API integrations, however, allow for seamless synchronization of transactions, ensuring that your data is always up-to-date. Whether you prefer manual imports or automated syncing, Coinpanda has you covered.

Excellent Customer Support

Coinpanda prides itself on providing excellent customer support to its users. The support team responds quickly to user issues or questions. Their timely responses ensure that users have a smooth experience with the software.

- A wide range of crypto exchanges are supported, ensuring compatibility with various platforms.

- User-friendly interface and integrations, making it accessible to both beginners and experienced traders.

- Coinpandaa uses a competitive pricing model that caters to different users.

- CSV and API integrations for convenient import of transaction data.

- Have a responsive customer support team with in-depth platform knowledge.

- Not all tax reports work seamlessly, requiring manual adjustments in some cases.

- Lengthy processing time for tax calculations, especially for users with extensive transaction histories.

Who Should Use Coinpanda?

Coinpanda is suitable for beginner and experienced crypto traders who require a reliable and responsive platform for their tax calculations. The software’s user-friendly interface and integrations make it accessible for varying levels of expertise.

Coinpanda provides a straightforward way to import and calculate taxes for their crypto transactions. Experienced traders, on the other hand, benefit from Coinpanda’s wide range of supported exchanges and advanced features for portfolio tracking and tax optimization.

Coinpanda vs. Competitors

To truly understand the value of Coinpanda, it’s essential to compare it with its competitors in the crypto tax software market. Let’s examine how Coinpanda stacks up against other popular options.

Support various crypto exchanges

Limited exchange support

Restricted exchange support

User-friendly interface and integrations

Complex interface and integrations

Complex interface and integrations

Competitive pricing plans

Higher pricing plans

Higher pricing plans

CSV and API integrations

Limited import options

Limited import options

Excellent customer support

Average customer support

Average customer support

Coinpanda’s extensive exchange support, user-friendly interface, competitive pricing, and robust integrations stand out. While competitors may have unique features, Coinpanda offers a well-rounded package for crypto traders looking for reliable and efficient tax software.

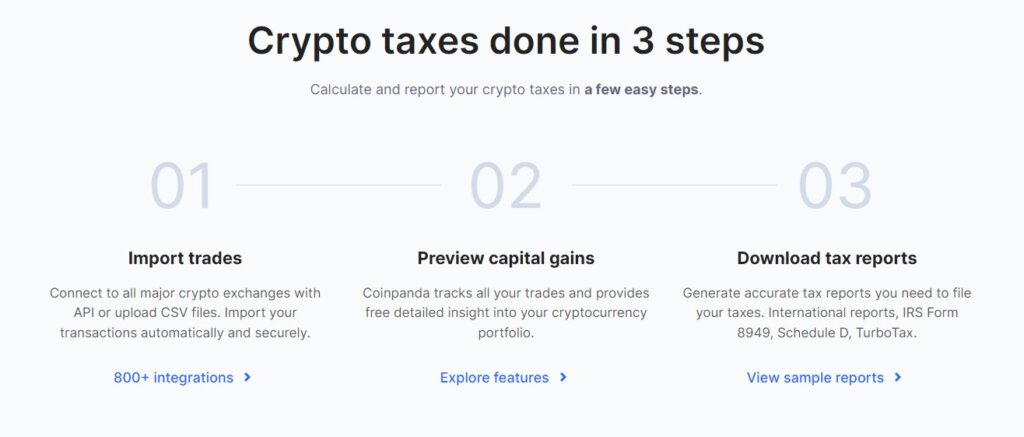

How to Get Started with Coinpanda

Getting started with Coinpanda is straightforward. Here’s a step-by-step guide to help you begin:

- Visit the official Coinpanda website and sign up for an account.

- Provide your name, email, and password to create your account.

- Add crypto wallets and exchanges by connecting through API or uploading CSV files.

- Import your transaction data into Coinpanda using the integration options.

- Coinpanda will automatically calculate your taxes based on your transaction history.

- Review and analyze your tax reports, making any necessary adjustments.

- Download and export your finalized tax reports for filing purposes.

These steps will help you leverage Coinpanda’s features and streamline your crypto tax calculations.

Coinpanda Security and Countries Supported

Coinpanda prioritizes its users’ data security and confidentiality. The platform employs high-end encryption technology to ensure user information’s optimal safety and protection. Payment information is not stored directly on Coinpanda; secure payment processing systems for transactions.

Coinpanda supports users from over 65 countries, including the USA, Canada, the United Kingdom, Australia, New Zealand, Germany, Switzerland, France, Japan, South Korea, and many more. This extensive country support makes Coinpanda accessible to a global user base.

Coinpanda Review: Capital Gains Reports and Portfolio Tracking

One of the critical features of Coinpanda is its ability to generate comprehensive capital gains reports and track users’ crypto portfolios. Let’s explore these features in more detail.

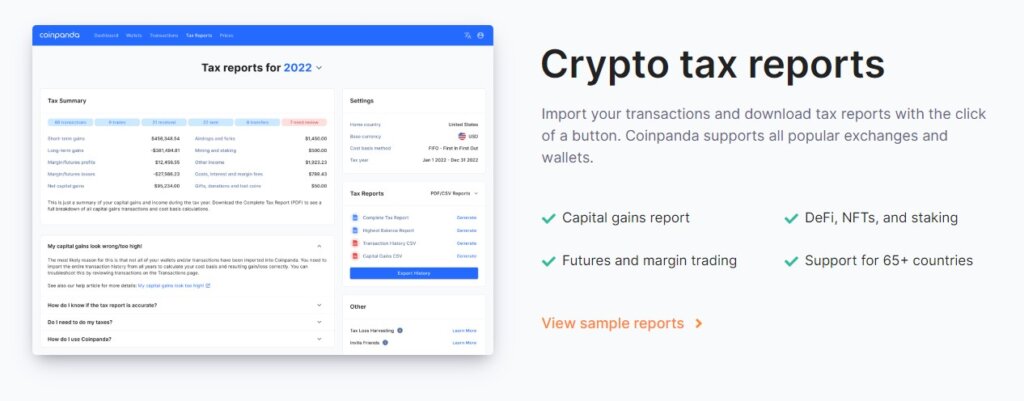

Capital Gains Reports

Coinpanda’s capital gains reports give users an in-depth overview of their cryptocurrency transactions, including profits and losses. They come in an online spreadsheet format, with each transaction accompanied by relevant details such as date acquired, amount, date sold, asset, proceeds, cost basis, gains or losses, transaction type, and holding period.

By analyzing these reports, users can gain valuable insights into their trading and investment habits, identify mistakes or flaws, and optimize their tax obligations.

Portfolio Tracking

Coinpanda’s portfolio tracking feature allows users to monitor and manage their crypto portfolios effectively. The platform automatically syncs transaction history from all connected wallets and exchanges, giving users an accurate overview of their holdings and taxable amounts.

This comprehensive portfolio tracking ensures that users clearly understand their crypto assets and can make informed investment decisions.

Additional Features for Portfolio Tracking

In addition to basic portfolio tracking, Coinpanda offers several additional features to enhance the user experience:

- Analytics: Coinpanda’s analytics feature enables users to track their cryptocurrency portfolios and gain insights into their profit or loss distribution. By analyzing trading and investing patterns, users can identify areas for improvement and optimize their strategies.

- Search Tool: The powerful search tool allows users to browse their transaction history based on specific criteria, such as associated transactions, wallets, coins, exchanges, and more. This feature makes locating and analyzing specific transactions within a large dataset easier.

- Margin Trading Tracking: Coinpanda supports tracking margin transactions across various crypto exchanges, including FTX, Bybit, Binance, and Bitmex. This feature ensures users have a comprehensive overview of their margin trading activities for accurate tax calculations.

- Tax Preview: The tax preview tool provides users with insights into the tax implications of potential trades before they occur. Users can make informed decisions and engage in tax-efficient strategies by simulating the outcomes of transactions.

- Key Tax Reports: Coinpanda allows users to generate and file tax returns and records for capital gains and earnings automatically. Users can download tax reports and fill in local tax documents, such as Schedule D and Form 8949.

- Tax Reduction: Coinpanda’s tax reduction tool aims to minimize the tax users must pay by optimizing cost-basis calculations and utilizing tax strategies.

With these advanced portfolio tracking features, Coinpanda empowers users to manage their crypto portfolios effectively and optimize their tax obligations.

Coinpanda Review: Adding Transactions and Calculating Capital Gains

To take full advantage of Coinpanda’s features, users must add their crypto transactions and accurately calculate their capital gains. Here’s how you can do it:

- Visit the Coinpanda platform and sign in to your account.

- Navigate to the “Wallets” section and add your wallets and exchanges by connecting through API or uploading CSV files.

- Ensure you import all your transaction data, including spot trades, margin trading, and futures trading, into Coinpanda. This step is crucial for accurate tax calculations.

- Coinpanda will automatically compute your capital gains by obtaining market rates for your cryptocurrency holdings. The software utilizes different cost-based calculation methods, such as FIFO, ACB, LIFO, and HIFO, to determine accurate tax liabilities.

- Review your capital gains reports and ensure that your transactions are accurate. Coinpanda’s software provides helpful tools to spot discrepancies and make necessary manual adjustments.

- Once you are satisfied with the accuracy of your capital gains reports, you can download and export them in various formats for filing purposes.

Following these steps can ensure that recorded crypto transactions and capital gains calculations are accurate by using Coinpanda.

>>Recommended Reading: 5 Crypto Tax Solutions<<

Frequently Asked Questions FAQs

>>Recommended Reading: 21 Best Crypto Websites to Make Informed Decisions<<

Coinpanda Review: Bottom Line

Coinpanda is a top choice for crypto traders seeking reliable and efficient tax software. With its wide range of supported exchanges, user-friendly interface, competitive pricing model, and excellent customer support, Coinpanda provides a comprehensive solution for all your crypto tax needs.

Whether you’re a beginner or an experienced trader, Coinpanda’s features, including capital gains reports and portfolio tracking, empower you to manage your crypto investments effectively.

By integrating Coinpanda into your crypto tax workflow, you can streamline your tax calculations and ensure compliance with tax regulations.

Sections of this topic

Sections of this topic