Introduction

In the world of cryptocurrency, managing taxes can be a complex and time-consuming task. With the increasing popularity of cryptocurrencies, investors are seeking reliable solutions to track their transactions and ensure compliance with tax regulations.

CoinLedger is an intuitive crypto tax software that aims to simplify the process of transaction tracking and tax reporting for cryptocurrency investors. In this in-depth review, we will assess the features, pricing, and overall user experience of CoinLedger and discuss its pros and cons.

Whether you are a novice investor or a seasoned trader, this review will help determine if CoinLedger is the right solution for your crypto tax needs.

CoinLedger Overview

CoinLedger, formerly known as CryptoTrader.The tax was founded in 2018 by David Kemmerer, Lucas Wyland, and Mitchell Cookson. The founders, who were developing automated trading systems for crypto exchanges, realized the difficulties of tracking and reporting hundreds of transactions.

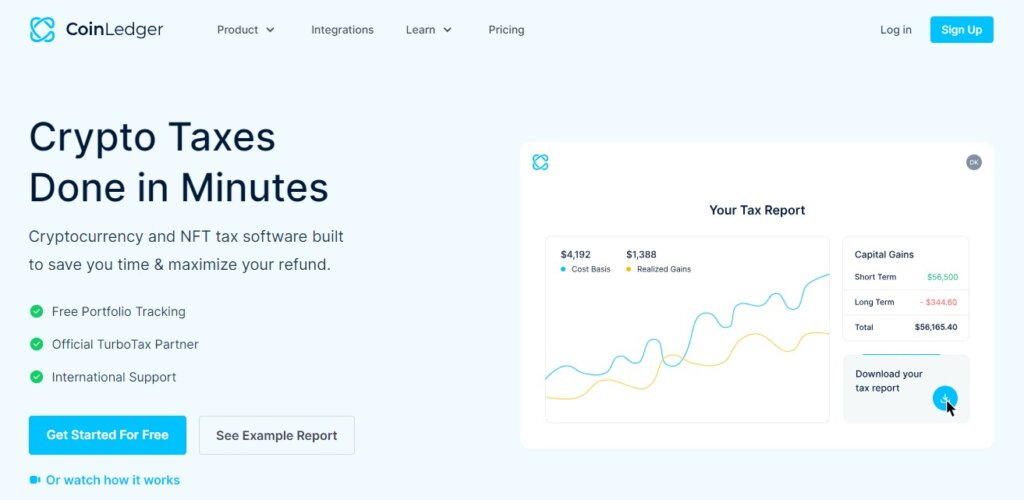

They saw a need for a platform that could automate the process of crypto tax reporting and provide investors with an easy-to-use solution. CoinLedger allows users to import transaction data from exchanges and wallets, generate tax reports, and seamlessly integrate with popular tax filing software such as TurboTax.

With its user-friendly interface and comprehensive features, CoinLedger has gained recognition as one of the industry’s leading crypto tax software providers.

CoinLedger Features

CoinLedger offers a range of features designed to simplify the process of tracking crypto transactions and preparing tax reports. Let’s explore some of the key features provided by CoinLedger:

Tax Reports

One of the primary features of CoinLedger is its ability to generate tax reports for cryptocurrency transactions. Users can import their transaction data from exchanges and wallets, and CoinLedger automatically calculates the gains, losses, and income for tax purposes.

The platform provides a variety of tax reports, including gain and loss reports, tax loss harvesting reports, cryptocurrency income reports, IRS Form 8949, and audit trail reports. You can export these reports to popular tax filing software or submit them directly to regulatory authorities.

Portfolio Tracker

CoinLedger offers a free portfolio tracking tool that allows users to monitor their cryptocurrency holdings and track their portfolio performance. The platform consolidates all transactions from various exchanges and wallets into one dashboard, providing users with a comprehensive view of their crypto assets.

Users can monitor trading data, portfolio value, and income from staking, lending, and liquidity mining activities. The portfolio tracker is available to both free and paid users, providing valuable insights into the performance of their crypto investments.

NFT Tax Software

With the rise of non-fungible tokens (NFTs), CoinLedger has introduced a feature allowing users to track their NFT transactions’ tax implications. Users can sync their wallets and NFT exchanges to consolidate their NFT holdings and track gains and losses from trading NFTs.

This feature sets CoinLedger apart from many other tax software providers, as NFT transactions require specific attention due to their unique nature.

Crypto Taxes 101

Understanding the tax implications of cryptocurrency investments can be perplexing, especially as regulations continue to change. CoinLedger provides comprehensive tax guides and educational resources to help navigate the intricacies of crypto taxes.

The platform offers country-specific tax guides, covering in-depth tax information and breakdowns of more intricate activities such as margin trading and donations.

Whether you are a beginner or an experienced investor, CoinLedger’s educational resources can help you stay informed and compliant with tax regulations.

Tax Professionals Suite

CoinLedger offers a suite of tools specifically designed for tax professionals. Tax professionals can invite clients to use CoinLedger and guide them through importing transaction data and generating tax reports.

The platform allows tax professionals to customize their workflow and streamline the tax preparation process for multiple clients. With the Tax Professionals Suite, tax professionals can efficiently assist clients with their crypto taxes, ensuring accuracy and compliance.

CoinLedger Pricing & Fees

CoinLedger offers cost-efficient pricing plans to accommodate investors of all levels. The platform provides four pricing tiers, each offering the same features but differing in the number of transactions supported. The pricing plans are as follows:

- Hobbyist: $49/year, supports up to 100 transactions

- Day Trader: $99/year, supports up to 1,500 transactions

- High Volume: $159/year, supports up to 5,000 transactions

- Unlimited: $299/year, supports complete transactions

CoinLedger offers a free platform version that provides access to many powerful features, including portfolio tracking and transaction data import.

However, unpaid users cannot generate tax reports and must upgrade to a paid plan to access this feature. CoinLedger’s pricing structure caters to investors with varying transaction volumes, making it accessible to casual and high-frequency traders.

CoinLedger Company Background

CoinLedger was founded in 2018 by David Kemmerer, Lucas Wyland, and Mitchell Cookson. The company is in Kansas City, Missouri, and its mission is to provide essential tools for the crypto revolution.

Since its inception, CoinLedger has processed over $70 billion in user transactions and has gained recognition as a leading crypto tax software provider. The company’s executive team’s focus is building a secure and user-friendly platform that simplifies crypto tax reporting.

How Does CoinLedger Work?

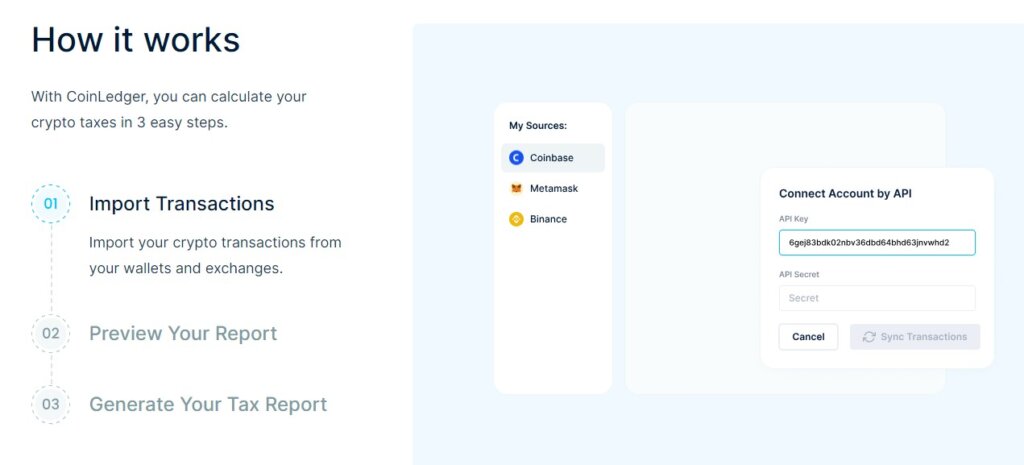

CoinLedger simplifies the process of crypto tax reporting by automating the tracking and calculation of transaction data. Users can import their transaction history from exchanges and wallets by syncing their accounts or using APIs provided by the platforms.

Once you import the transaction data, CoinLedger automatically calculates the gains, losses, and income for tax purposes.

Users can then generate tax reports, export them to popular tax filing software, or submit them directly to regulatory authorities. CoinLedger’s user-friendly interface and automated features make it easy for investors to be tax regulation compliant.

CoinLedger Supported Crypto Exchanges

CoinLedger supports integration with a wide range of crypto exchanges, allowing users to import their transaction data seamlessly. Some of the supported exchanges include:

- Coinbase

- Binance

- Gemini

- Kraken

- BlockFi

- KuCoin

By linking their exchange accounts to CoinLedger, users can import their transaction data in real time, eliminating the need for manual data entry. This integration streamlines the tax reporting process, saving users time and effort.

CoinLedger Supported Wallets

CoinLedger also supports integration with several popular crypto wallets, enabling users to import transaction data and track their crypto holdings. Some of the supported wallets include:

- Exodus

- MetaMask

- Trust Wallet

- Abra

- Trezor

- Ledger

By syncing their wallets with CoinLedger, users can consolidate their transaction data and track their portfolio performance in one place. This integration enhances the user experience and provides a more comprehensive view of their crypto investments.

Security: Is CoinLedger Safe & Secure?

Security is a top priority for CoinLedger. The platform implements several security measures to protect user data and ensure a safe experience.

Complex encryption standards hash passwords and credentials and protect data with 256-bit encryption. A virtual private cloud (VPC) hosts CoinLedgers servers, limiting network access from unauthorized individuals.

By following industry best practices, CoinLedger has maintained a robust security infrastructure and has not experienced any major security breaches.

Customer Support: Contacts & How to Get Help

CoinLedger provides extensive customer support options to answer any questions or issues users may encounter. Users can write to the support team by emailing [email protected] or by using the AI chat feature available on the platform.

CoinLedger has a comprehensive help center with a wealth of information and resources to guide users through various platform aspects. While live chat support is unavailable, CoinLedger’s customer support channel objective is to provide timely and helpful assistance to users.

CoinLedger is for various cryptocurrency investors, from beginners to experienced traders. The platform’s user-friendly interface and comprehensive features make it accessible to casual investors and high-frequency traders.

CoinLedger’s free version provides valuable portfolio tracking capabilities, making it a helpful tool for investors who want to monitor their crypto holdings.

Additionally, CoinLedger’s tax reporting features cater to the needs of investors who want to ensure compliance with tax regulations. Whether you are an individual investor or a tax professional, CoinLedger offers a range of features that can simplify the process of crypto tax reporting.

- CoinLedger offers a free version, allowing users to access valuable portfolio tracking features at no cost.

- The platform provides geographically tailored tax reports, ensuring compliance with local tax regulations.

- CoinLedger offers a 14-day money-back guarantee, allowing users to try the platform risk-free

- CoinLedger has limited support for crypto wallets, with only a limited number of options available for integration.

- Unpaid users cannot generate tax reports, limiting the functionality of the platform’s free version.

- CoinLedger does not accept cryptocurrency as a payment method, which may be inconvenient for some users.

Competitors Comparison

CoinLedger operates in a competitive market, with several other crypto tax software providers offering similar services. Some of the main competitors of CoinLedger include:

- TaxBit: TaxBit provides crypto tax software that automates the tax reporting process and gives users a comprehensive view of their crypto holdings.

- ZenLedger: ZenLedger offers crypto tax software that allows users to import transaction data from exchanges and generate tax reports for filing.

- CryptoTrader.Tax: CryptoTrader.Tax, the former name of CoinLedger, offers tax software specifically designed for cryptocurrency investors.

- Accointing: Accointing provides crypto portfolio tracking and tax software that helps users track their investments and generate tax reports.

When comparing these competitors, it is essential to consider factors such as pricing, features, user experience, and customer support to determine which platform best suits your needs.

>>Recommended Reading: 5 Best Crypto Tax Software in 2023<<

Frequently Asked Questions (FAQs)

>> Recommended Reading: The Ultimate Guide to Crypto Accounting <<

Bottom Line: Reviewing CoinLedger

CoinLedger is an intuitive crypto tax software that provides a range of features to simplify the process of tracking crypto transactions and preparing tax reports.

With its portfolio tracking tool, NFT tax software, and compatibility with popular tax filing software, CoinLedger offers a comprehensive solution for investors of all levels.

While there are limitations, such as limited wallet support and the inability to pay with cryptocurrency, CoinLedger’s user-friendly interface and robust security features make it a reliable choice for crypto tax reporting.

Whether you are a beginner investor or an experienced trader, CoinLedger can help streamline your crypto tax process and ensure compliance with tax regulations.

Sections of this topic

Sections of this topic