If you’re looking for assistance in determining the appropriate forms to file and deductions to claim while filing your tax, TurboTax could be your ideal tax filing software.

However, it’s important to note that there are many invitations to upgrade or add on extra features throughout the program. Let’s examine TurboTax’s strengths and pricing structure to help you determine whether it might be a suitable option for your 2024 tax filing needs.

Who Is TurboTax Best For?

TurboTax offers a valuable solution for individuals with complex tax circumstances who require professional help in preparing their returns and will invest in premium services. It’s also an ideal option if you prefer to delegate your tax documents to experts who will handle all the tasks on your behalf.

Small business owners using QuickBooks for their accounting needs may find TurboTax appealing due to its seamless integration with the same company’s platform.

TurboTax Pros & Cons

- Provides step-by-step guidance throughout the process

- Option to upgrade for immediate access to an expert

- Suitable for relatively complex tax situations where assistance with deductions and forms is needed

- Not all users may qualify for a $0 filing option

- Often the most expensive choice for many tax scenarios

- Difficulty in determining eligibility for free or low-price options until the completion of the process

How Much Does TurboTax Cost?

TurboTax typically has a higher price point than other tax preparation services. Apart from the basic version, the additional packages can total at least $100 for federal and state returns.

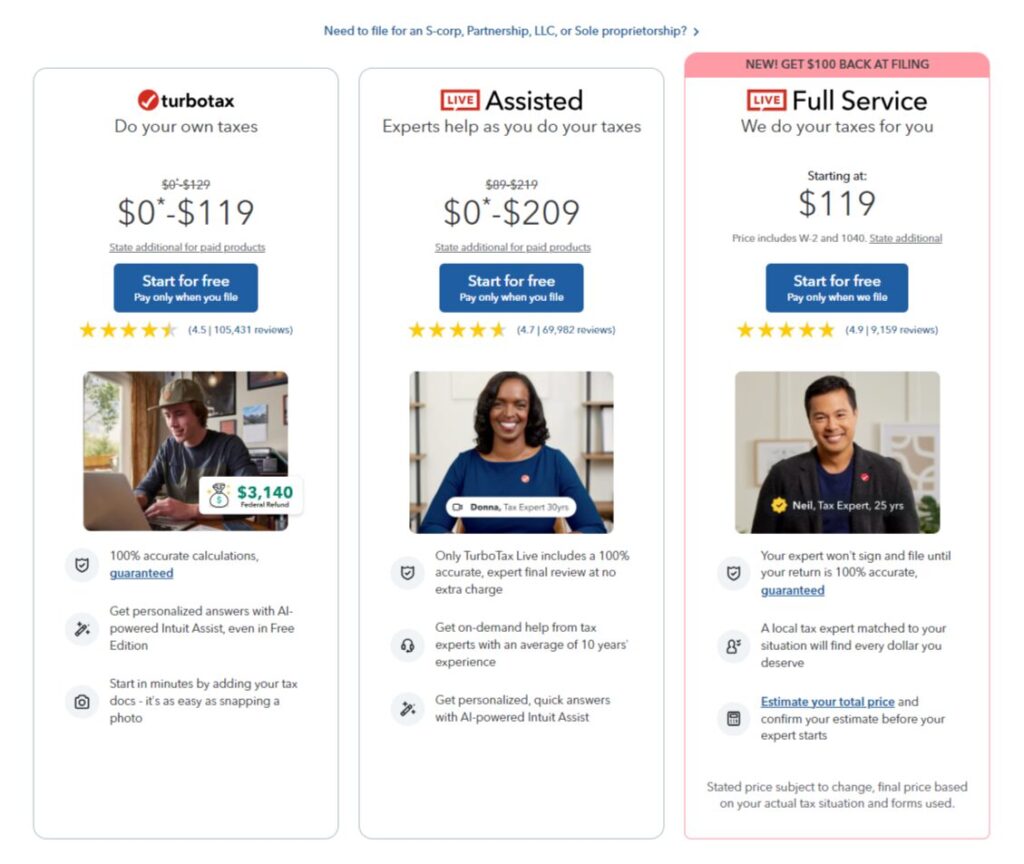

Four different options are available when filing your taxes with TurboTax online based on your tax requirements. Except for the desktop computer software version, all others allow you to enter your information without any charges.

Payment is only required when you file your federal and state tax returns at the end of the process.

- Do-it-Yourself: $0-$119 (approximately 37% of taxpayers qualify for free filing, Form 1040 + limited credits only). The basic edition encompasses W-2 income, unemployment income, retirement distributions, limited 1099 interest and dividends, the Earned Income Tax Credit (EITC), and the child tax credit (CTC), but doesn’t permit itemizing deductions. There may be more suitable packages if you intend to claim student deductions or credits.

- Live Assisted: $0-$209. This service tier includes everything in the basic edition and the ability to itemize deductions, account for mortgage interest, and handle other more intricate tax scenarios. The basic version applies only to individuals with simpler tax situations. State returns at this service level cost $49.

- Full Service: $119-$459. TurboTax’s highest-tier plan connects you with a local expert tailored to your situation to complete your taxes as early as January 8. You can communicate with the tax professional via phone or video conference. With this option, the tax professional handles your taxes, signs the return, and files it on your behalf.

Extra Fees You Might Have to Pay With TurboTax

- State Filing Required: If you reside in one of most states mandating state income tax returns, you may need to pay an additional $59 or $64 per state, depending on your tax situation. You might have to pay for multiple state returns if you lived or worked in multiple states.

- Upgrade to TurboTax Live: You can access instant, live assistance from a tax expert for a premium fee.

- Opt for TurboTax Live Full Service: You can enlist a tax expert to manage everything for as approximately double the cost of filing. The cost ranges between $119 and $459 for a federal return.

- Payment via TurboTax from Your Refund: If you expect a tax refund, TurboTax will inquire whether you wish to use a portion to cover its tax preparation services. While it may seem more convenient than using a debit or credit card immediately, be aware that a $40 processing fee is applied.

>> Check Out the Best Pricing for TurboTax >>

TurboTax’s Handy Features

To broaden your options, you can transition from another service provider. TurboTax can import electronic PDF versions (not scanned copies) of tax returns from providers such as H&R Block, TaxAct, TaxSlayer, Liberty Tax/Tax Brain, and ezTaxReturn.

- Auto-import Tax Documents: You can automatically import W-2 information from your employer if it’s partnered with TurboTax. Alternatively, you can snap a picture of your W-2 and upload it to transfer the data to your return. The Premium version also lets you upload 1099-NECs and 1099-Ks from clients via photo and import income and expenses from platforms like Square, Uber, and Lyft. TurboTax boasts a wide array of import partners.

- Cryptocurrency Support: TurboTax’s Premium package addresses a major pain point for cryptocurrency investors by eliminating manual entry. Users can import up to 20,000 crypto transactions simultaneously.

- Donation Calculator: The Deluxe and Premium packages incorporate ItsDeductible, a feature and standalone mobile app, useful for quickly determining the deduction value of donated items such as clothes and household items.

- Platform Accessibility: Like many other providers, TurboTax allows you to access and work on your return across various devices, including your computer, via the website or your phone and tablet.

- Spanish Language Support: A new addition this year, TurboTax now offers users of its online products the option to complete their taxes in Spanish if preferred.

TurboTax’s Human Tax Help

TurboTax Live Assisted

TurboTax offers a tax help feature called TurboTax Live Assisted, which can be added to any package for an extra fee. This service provides screen sharing and phone or chat access to tax professionals who can assist with any questions that may arise while filling out your tax return.

From January 29th until the April deadline for filing taxes, you can access this feature seven days a week between 5 a.m. and 5 p.m. Pacific time. When using TurboTax Live Assisted, taxpayers are matched with a professional based on their questions or concerns.

If you’re still looking for an alternative to the assigned expert, request a new one. According to TurboTax, their professionals have either been certified as tax experts, or they’re employees who have undergone thorough vetting and internal training processes. Once connected with your designated pro, you will also be able to view their credentials.

Besides providing help throughout preparing your taxes, the Live Assisted option includes the benefit of having a final review conducted by one of TurboTax’s experienced tax professionals before submitting your filing return.

TurboTax Live Full Service

Besides its tax software, TurboTax provides a service called Live Full Service that eliminates the need to use the software altogether. Instead, users can upload their tax documents and have a human expert assemble their tax returns.

Users are paired with a tax preparer, with whom they can meet via video or phone call before the preparer works on their taxes. Once the return is ready for review, another meeting with the preparer will be held.

The preparer handles filing the return on behalf of the user. If users opt to use Full Service again in future years, they even have the option to request working with the same tax professional if they’re available.

The TurboTax pricing for Live Full Service ranges from $169 to $359, covering Form W-2 and Form 1040. State returns will incur an additional fee. TurboTax states that final pricing may vary based on each individual’s tax situation and which forms are used or included in their return.

Intuit TurboTax Verified Pro

Introducing a new feature for this season, TurboTax now offers Full-Service filers the opportunity to collaborate with a tax professional in their local area. According to Intuit, the company carefully screens and approves these professionals.

However, it’s important to note that you will step outside the TurboTax platform when choosing this option. As a result, there may be variations in the working hours and services these professionals provide compared to what is advertised by TurboTax.

How Does TurboTax Work?

TurboTax provides personalized guidance on tax preparation based on your circumstances. The user-friendly interface offers step-by-step instructions for completing various tax forms. Whether you prefer to work on your taxes via the TurboTax mobile app or web version or switch between the two, TurboTax accommodates your needs.

One convenient feature of TurboTax is the ability to import tax forms directly from banks and investment companies. With the mobile app, you can photograph supported forms and upload them into the system.

You can upload your previous year’s tax return. Should you require live support during the process, upgrading is always available.

For receiving your refund, TurboTax offers multiple choices. You can opt for direct deposit into your bank account, receive a refund check in the mail, or load it onto a prepaid debit card. During early tax season, TurboTax also provides refund advance loans.

TurboTax stands behind its accuracy guarantee and promises to cover any IRS penalties and fees resulting from calculation errors. However, this guarantee only applies if you enter the correct information.

Is TurboTax Safe to Use?

Intuit ensures the security of your data and maintains your privacy by employing cutting-edge technology and protocols. The company continuously enhances its cybersecurity measures through collaboration with global security researchers.

It offers protective features like multi-factor authentication and AES-256 data encryption to fortify the safety of your information.

When inputting personal details, such as your Social Security number or birth date, on a website, it’s advisable to take extra precautions for added safety. One such measure is utilizing a trusted network, like your own home Wi-Fi network, which can provide additional protection.

TurboTax Ease of Use

When you use TurboTax to prepare your tax return, it’s similar to consulting a professional tax preparer. The software guides you through preparing and filing your taxes by asking interview-style questions.

To provide an accurate review, we completed the process of preparing three samples returns. Here’s how long it took us to go from starting the process to filing for each one:

- For a single taxpayer with no dependents, W-2 income, and claiming the student loan interest deduction, the process takes approximately 13 minutes.

- For a married couple filing jointly with one dependent, two W-2s, and claiming the Child Tax Credit and child and dependent care credit, it takes around 20 minutes.

- For a single taxpayer with no dependents, self-employment income, and federal and state estimated tax payments, the process typically lasts 30 minutes.

Throughout the process, a banner displayed at the top of the screen continuously updates the estimated federal and state refunds or amounts due.

>> File Your Taxes With TurboTax Today! >>

Does TurboTax Check Your Return?

Upon completing your data entry, TurboTax thoroughly examines your return to ensure its accuracy and promptly notifies you of any errors or omissions that may have occurred. If you owe taxes rather than receive a refund, you can conveniently withdraw the funds directly from your checking account.

Alternatively, you can pay through the IRS’s Direct Pay site. You must contact your revenue department for further guidance and instructions regarding state tax obligations.

Can You Do Your Taxes on Your Phone With TurboTax?

TurboTax’s iPhone, iPad, and Android mobile apps allow you to handle your tax preparation and filing, even if you have a complicated tax return involving investment sales or self-employment.

These apps are visually appealing and user-friendly, providing a seamless experience. They closely resemble the desktop version’s functionality and offer convenient options for entering and importing data. This is indeed commendable.

>> Start Using TurboTax Now! >>

TurboTax Review – Is TurboTax Legit?

Below are genuine testimonials from buyers and customers of TurboTax, providing valuable insights to assist you in making a well-informed and advantageous choice.

TurboTax Alternatives – TurboTax Review

TaxSlayer stands out as an ideal small business tax software when it comes to filing taxes. It offers competitive pricing among the major players and excels in handling complex returns. Along with its user-friendly platform, TaxSlayer provides a priority phone line and commendable customer service.

One of the standout features of TaxSlayer is the ability to customize the level of help you receive. With the guided interview option, you can be led through a step-by-step process that ensures quick and accurate filing.

However, if you prefer a more independent approach, TaxSlayer allows direct navigation to specific tax forms where you can swiftly input your income and deductions. This flexibility caters to users who appreciate comprehensive guidance and those who are experienced enough to navigate directly toward what they need.

Regardless of your preference, TaxSlayer guarantees a seamless tax filing experience for small businesses at an affordable price point compared to its competitors in the market.

While H&R Block is widely known for its physical offices across the United States, it also provides online filing options and downloadable computer software. Opting for an online package allows individuals to conveniently handle their taxes using the mobile app designed for both Android and iOS devices.

With a user-friendly interface, H&R Block caters to many tax filers by offering a modern and easily navigable platform. Like other tax-preparation services, this platform guides users through a series of inquiries regarding their household income and potential deductions and tax credits available to them.

TaxAct is an ideal choice for individuals seeking a cost-effective solution without compromising the software quality they use to file their taxes. With TaxAct, you can enjoy an efficient and user-friendly interface without paying a premium price.

If you prefer a more independent approach and require little assistance, TaxAct’s software alone will meet your needs.

However, it’s important to note that all of TaxAct’s plans now include access to experts who can provide guidance and answer any questions you may have during the filing process. This added benefit was introduced last year, making it even more valuable for users.

While TaxAct may not be as budget-friendly as TaxSlayer, its tax document upload and import features have proven more reliable than those offered by TaxSlayer. If you’re willing to invest in this time-saving feature, choosing TaxAct could be well worth it.

TurboTax Review – FAQs

Bottom line – TurboTax Review

TurboTax sets the benchmark in the do-it-yourself tax preparation industry due to its user-friendly interface and wide range of customer support options.

While its products are highly regarded, individuals self-assured in filing their taxes might discover rival companies offer a more advantageous cost-to-benefit ratio.

Sections of this topic

Sections of this topic