Are you considering a budget-friendly alternative for your next tax filing? TaxSlayer proposes an affordable, self-service online platform for tax preparation, which might be free of cost. Yet, is it equipped to manage your specific taxation requirements?

Therein lies our critique of TaxSlayer’s digital application, analyzing its ideal user base, pricing structure, and ease of use.

What Is TaxSlayer?

TaxSlayer is a financial services corporation specializing in tax preparation software, boasting solutions for individual taxpayers, businesses and tax professionals. Its platform assists users with efficiently handling, filing, and managing their taxes.

The company extends a range of packages and functionalities tailored to accommodate various taxing scenarios. These include options for free filing applicable to simpler returns and more exhaustive packages geared towards intricate tax situations.

Users can input their personal tax details into the system, which then calculates their due payments or potential refunds. They can also file these returns electronically straight from TaxSlayer’s own platform. To further support its customers, TaxSlayer provides ongoing help during every step of the taxation process.

>> File Your Taxes Online With TaxSlayer >>

Who Is TaxSlayer For?

TaxSlayer simplifies the task of filing returns for those who prefer minimal guidance. If you’re well-versed in reporting various income types and understand the deductions and credits applicable to you, there’s no need to sift through loads of irrelevant interview screens, simply fast-forward to your relevant sections.

Should you need additional help, rely on the software queries that steer you through tax-related topics associated with your situation. It’s possible to opt for a more expensive package that includes professional tax help.

TaxSlayer’s array of offerings makes it an appealing tool for those keen on attempting self-filing while having access to support if they encounter difficulties or have queries.

Additional groups who may find TaxSlayer beneficial include:

- Students: Given their potential eligibility for free filing.

- Self-employed individuals: TaxSlayer’s Classic edition incorporates all tax forms, encompassing Schedule C for business or freelance income reporting, Schedule E for rental or pass-through entity income, and Schedule F for farming. Unlike many other software solutions that require users to upgrade to a pricier package to file Schedule C, TaxSlayer offers the option to upgrade to the Self-Employed version, which provides extra guidance and support from tax experts.

>> File With TaxSlayer Today! >>

- It stands out as one of the most affordable choices for tax filing

- It presents exceptional value, especially for self-employed individuals seeking a cost-effective solution

- Active-duty military personnel can file their federal return for free, regardless of their tax circumstances

- The free version enables you to claim education credits and deduct student loan interest

- Access to expert assistance is limited to higher-priced packages

- The interface lacks the intuitiveness found in pricier options like H&R Block or TurboTax

- The free version doesn’t support uploading or importing tax documents

- There’s no provision for a tax expert to prepare or review your return

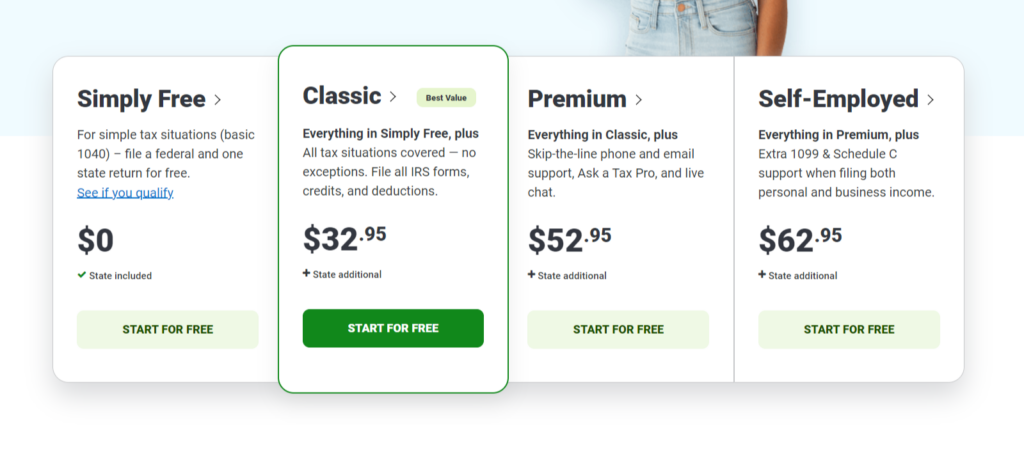

How Much Does TaxSlayer Cost?

TaxSlayer offers a more affordable solution compared to other tax preparation services. It’s particularly advantageous for those with straightforward tax circumstances or individuals who are at ease navigating filing taxes.

Note: Often, tax preparation firms provide early-season markdowns on their offerings, and it’s usual for their prices to fluctuate. Checking the firm’s official online portal can give you an update on ongoing deals.

Simply Free: Eligible customers don’t have to pay any charges. This applies to straightforward returns, encompassing income from W-2 or unemployment, deductions for education costs and student loan interest. It also includes a complimentary state return at no extra charge. However, there’s a drawback: you can’t digitally import your W-2 details.

They must be manually entered, or you will need an upgrade to the Classic plan. On the bright side, service members on active duty are entitled to file both federal and state returns free of cost regardless of their tax circumstances without any limitations.

Classic: Priced at $32.95, TaxSlayer’s most sought-after offering is versatile enough to cater to virtually any tax scenario. If you’re secure in navigating your tax filings with little help, this package offers the best value for money. Features include the ability to import W-2 or upload PDFs.

Premium: Priced at $52.95, the package incorporates all the elements of the Classic scheme with a few added perks. These include premium customer service features such as real-time chat support for technical issues, priority access to email and phone help from tax specialists, and a three-year commitment to IRS audit aid. It’s an excellent fit for those dealing with complex scenarios who may require some assistance throughout their journey.

Self-Employed: Individuals who are self-employed can opt for either the Classic or Premium packages for filing their taxes, with this specific plan tailoring the system to navigate through tax payments associated with self-employment. This option proves to be more affordable than similar services offered by other major tax preparation firms and comes complete with personalized help from a trained taxation expert.

>> Check Out the Best Pricing for TaxSlayer >>

TaxSlayer Features

TaxSlayer offers high-end tax preparation programs at reduced rates. Let’s delve deeper into its offerings:

Guided Navigation

TaxSlayer provides step-by-step guidance in all areas of its program. This includes updates on the latest tax legislation alterations and changes to IRS limits. These enhancements in navigation make TaxSlayer more comparable to pricier alternatives like TurboTax, H&R Block, and TaxAct.

Specific Examples of Legitimate Deductible Expenses

TaxSlayer offers insightful “How this works” articles that shed light on deductible expenses, making it significantly simpler for individuals to grasp the deductions they’re eligible for. Coupled with additional superior features such as “Ask a Pro”, tax filers can make informed decisions about their eligibility for credits or deductions.

Many companies integrate “knowledge articles” into their software. However, TaxSlayer distinguishes itself through the exceptional quality and relevancy of these pieces.

All Forms Supported At Classic Level

TaxSlayer Classic is compatible with all significant forms and schedules, making it an ideal choice for those generating income from self-employment or property rentals. Considered a premium software, its value for money takes a lot of work to beat. Other competitors typically charge approximately five times more for offering similar tax filing capabilities.

Pro Support Included With Premium

TaxSlayer Premium offers limitless personalized help from a tax expert. This help is readily available either through phone conversation or live chat. Remarkably, the comprehensive cost for Premium, inclusive of this support service, is more economical than what you’d shell out solely for software at leading rivals in the market.

IRS Inquiry And Audit Support

The Standard tier of TaxSlayer offers support for IRS inquiries for a span of one year. Upgrading to the Premium version grants users access to IRS audit aid from qualified tax experts for a period extending up to 3 years.

On another note, the Self-Employed package provides comprehensive protection and legal advocacy from an experienced tax professional in situations involving an IRS audit, valid for up to 3 years after the acceptance of the return. Surprisingly, these services come as costly supplementary features with most rival platforms.

>> TaxSlayer: Get the Tax Help You Deserve >>

How Does TaxSlayer Work?

TaxSlayer operates as a branch of Rhodes-Murphy & Co., holding a prominent position in the history of digital tax preparation services.

The process to join TaxSlayer is straightforward. You initiate by creating an account using your email and personal details, subsequently, you’ll be prompted with several financial queries regarding the specific tax year. Required documents include W-2s, 1099s, 1098-Ts, and any other proofs of income or potential deductible expenses. Although TaxSlayer provides an option for document uploading, it only supports certain form types.

Once all inquiries have been responded to, TaxSlayer undertakes the task to determine your refund amount or assess if there are taxes due on your part.

TaxSlayer’s Human Tax Help

The pricing structure for TaxSlayer’s services is determined by the level of help provided, rather than its capabilities. It’s worth mentioning that, while technical support via phone and email come at no cost, the more sought-after service, tax advice, is complimentary solely for Premium and Self-Employed users.

This feature, known as ‘Ask a Tax Pro’, allows users to submit their queries through their TaxSlayer accounts; in contrast to some competitors who provide an interactive on-screen experience. The tax professional responds within one business day via phone or email.

Tax professionals employed by TaxSlayer are enrolled agents with the IRS or IRS-certified individuals. Interestingly enough, there are other tax software rivals out there that hire certified public accountants as well. Users of the Self-Employed package have access to these pros who possess expertise specializing in self-employment circumstances.

If you’re audited

Being subject to an audit can be a terrifying experience, thus understanding the level of support your tax software provides is crucial. Firstly, you must comprehend the distinction between “support” and “defense”.

In most scenarios, audit support (or “assistance”) implies providing guidance on what to expect and how to prepare, that’s all there is. Audit defense, conversely, offers comprehensive representation from a tax professional in front of the IRS.

The Classic package promises help with IRS queries for up to one-year post-acceptance of the return. Clients using this tier can avail of additional audit help services at $29 as required. The Premium and Self-Employed packages from TaxSlayer come bundled with free-of-charge audit help for three years. The Self-Employed option further includes audit defense which ensures legal representation by a tax expert during an IRS inquiry for up to three years.

Customers who choose lower-tier plans can purchase additional protection through audit defense when they bundle it with SecurelyID, their partner firm specializing in identity safety measures. This beneficial add-on comes at an extra cost of $44.

If you’re getting a refund

Regardless of your method of filing, there are numerous alternatives for receiving your tax refund:

The swiftest method is a direct deposit into a bank account. TaxSlayer offers the convenience of dividing refunds among various bank accounts. Another choice is to load it onto a Visa Green Dot Bank prepaid debit card (consider checking if your state provides a similar prepaid card option for state tax refunds) or opt to receive it through traditional mail in the form of a paper check.

There are also other choices, such as carrying forward the refund amount towards next year’s taxes or instructing the IRS to purchase U.S. savings bonds using your refund.

Lastly, you can cover software costs from your refund itself. However, please note that there’s an associated fee of $39.95 for this service.

Is It Safe And Secure?

TaxSlayer adheres to the most stringent security standards in the industry. To gain access, users must pass multiple authentication checks, and all data is encrypted by their servers. However, their security measures were only sometimes this robust.

Back in 2015, we experienced a data breach where 8,800 customers had their information compromised. This incident catalyzed an overhaul of their security protocols which now includes mandatory multi-factor authentication.

Most clients can put their trust in TaxSlayer for its strong safety measures and secure services. When dealing with any online platform there remains a slight risk factor concerning your financial transactions.

It’s advisable to use distinct passwords for every website and adhere to all cybersecurity recommended practices so as to ensure maximum protection of your personal information.

How Do I Contact TaxSlayer Support?

TaxSlayer offers an array of assistance features. The most comprehensive help is available to customers on the Premium and Self-Employed levels. All clients have access to their customer service email form, real-time chat feature, or they can dial their support line at 706-922-6741.

Online reviews reflect that TaxSlayer enjoys a strong standing in terms of client service. The company boasts a score of 4.3 out of 5 on Trustpilot, aggregated from over 24,000 consumer feedbacks. Most grievances revolve around problems stemming from errors during submission, implying some users experience bewilderment throughout the filing procedure.

TaxSlayer Alternatives

Larson Tax Relief’s wide range of business tax services, including payroll and federal tax issues, conflicts with your revenue officer, and worker classification issues, make them an excellent choice for business and corporate tax debt relief.

Larson Tax Relief works with many tax debt relief services, from personal IRS tax debt relief to corporate tax help and even assistance with delaying or preventing bank levies.

Besides the many positive reviews the company receives on customer review sites, Larson stands out for its business tax services. The company can handle just about everything about business tax preparation, including paperwork for payroll taxes and corporate income taxes.

Anthem Tax Services is a provider of both relief services for IRS tax debt and corporate tax preparation. The firm assists you in applying for every program related to IRS tax debt relief, including Offers in Compromise (OIC), innocent spouse relief, and the status known as “currently not collectible.”

Interestingly, they also extend their help with filing for release from wage garnishment and tax levy, a service that isn’t typically offered by their competitors.

One of Anthem’s standout features is its exceptional money-back guarantee, which sets it apart within the industry of tax debt relief. They pledge to return all your money if they fail to achieve any form of resolution from the IRS, be it a decrease in payment amounts or complete forgiveness of debt.

However, it’s crucial to remember that this guarantee doesn’t encompass the initial investigation fee which often starts around $350 based on your specific case details.

Community Tax provides complimentary consultations and investigation services with reasonable charges, typically falling between $295-$500.

The primary focus of Community Tax relief is aid for IRS tax debt. However, they extend a limited amount of help in the area of state taxes. Similar to comparable businesses in the industry, Community Tax manages applications for various solutions including installment agreements and offers in compromise but not innocent spouse relief.

Community Tax sets itself apart as one of the rare companies on the roster that provide bilingual support both via their digital platform and through their customer service representatives.

Beyond tax debt assistance, Community Tax further extends its services to include tax filing procedures, bookkeeping tasks, and business accounting requirements. They offer cost-free consultations which are backed by an A+ BBB rating alongside many positive feedbacks and prompt complaint resolution times with customers.

TaxSlayer – Frequently Asked Questions

TaxSlayer Review: The Bottom Line

While TaxSlayer might not be as well-known as industry giants like TurboTax or H&R Block, it provides appealing and user-friendly software at competitive prices. If having immediate access to a tax professional is crucial for you, you may find its competitors more enticing.

Sections of this topic

Sections of this topic