If you’re already considering the upcoming tax season and want to find affordable tax filing software, TaxAct could be a suitable choice. However, determining the exact cost of tax filing may require some effort, particularly if you need more clarification about your income, deductions, and eligible tax credits.

To assist you in making an informed decision and understanding the potential expenses involved, we present our evaluation of TaxAct’s self-directed tax filing software.

What Is TaxAct?

TaxAct is a software designed to assist people and businesses in accurately and efficiently completing their tax returns. It provides various products and services that cater to different tax scenarios, such as basic filing for individuals, self-employed individuals, small businesses, etc.

The platform offers step-by-step help, tax calculators and error detection tools to ensure users can optimize their deductions and credits while minimizing mistakes. Furthermore, TaxAct allows users to access its software either online or by downloading it, granting them the flexibility to choose the option that suits them best.

- Effortlessly navigate between sections without the need to repeat interview questions

- Access to complimentary assistance from CPAs, enrolled agents (EAs), and tax attorneys for all users

- Import your W-2 electronically into the software

- Access to expert help is included in every filing package

- Free federal and state filing includes student and child tax credits

- Enjoy an efficient and user-friendly interface

- Easily upload and import tax documents for streamlined data entry

- Increased charges for state returns compared to rival services

- Frequent attempts to encourage upgrades or additional purchases

- The mobile app can be used for filing, but only under specific circumstances

- Limited guidance and explanations regarding tax concepts

- Considered a moderate option in terms of pricing

Who Is TaxAct Best For?

TaxAct is the ideal choice for individuals who prefer not to spend extra money on premium software options like H&R Block or TurboTax, but still want an efficient and user-friendly interface for filing their own taxes at a lower cost.

Those who are self-sufficient and don’t require much help will benefit from using TaxAct software alone. All of TaxAct’s plans include complimentary access to experts who can answer any questions during the filing process. This added value was introduced last year and has been highly appreciated by users.

While TaxAct may not be as affordable as TaxSlayer, it has a better track record for features like tax document upload and import. If you’re willing to pay a bit more for this time-saving capability, choosing TaxAct could be a wise investment.

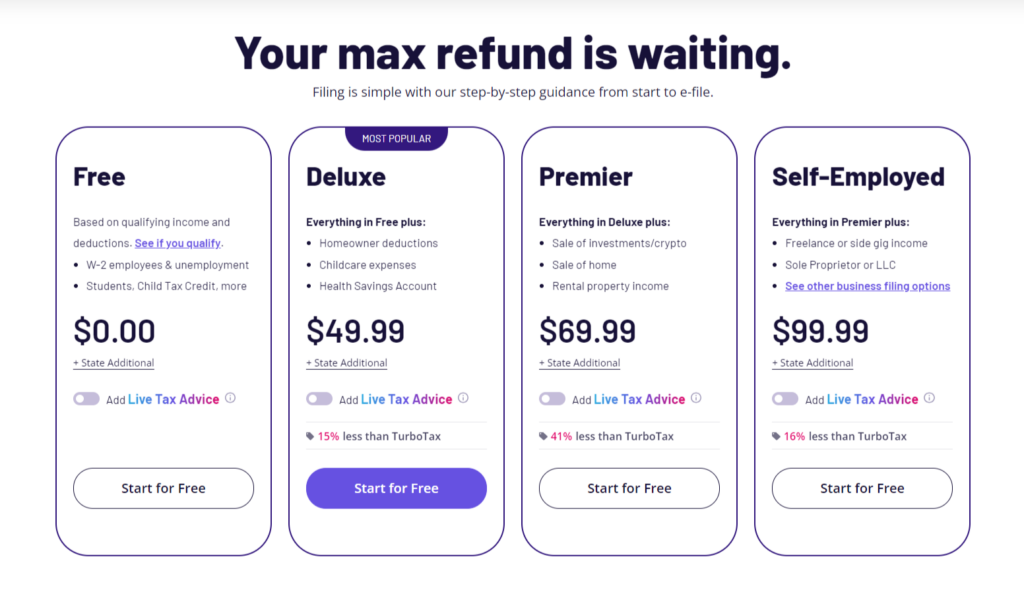

TaxAct Pricing

- Free (for eligible individuals): This plan is available to those receiving W-2 income or unemployment benefits, seeking basic child tax credits and the earned income tax credit (EITC). Notably, it doesn’t cover childcare expense credits.

- Deluxe: Priced at $49.99, the Deluxe package extends coverage to include childcare expense credits, as well as deductions and credits for homeowners, health savings account holders, and individuals paying student-loan interest.

- Premier: At $69.99, the Premier package caters to individuals with investment income, rental property earnings, and foreign bank accounts. It’s also suitable for those who have sold a home during the tax year.

- Self-Employed: Priced at $99.99, the Self-Employed package is designed specifically for self-employed individuals. Given the unique tax circumstances faced by this group, including varying credits and deductions based on business structure and industry, TaxAct’s Self-Employed package is tailored to address these needs.

Circumstances That May Require Additional Fees

- Expert assistance needed: TaxAct offers live expert assistance for all packages at a cost of $59.99, even for those utilizing the free federal filing option.

- State filing requirement: For residents of states mandating state income tax filings, additional fees apply. Depending on the package chosen, state filing fees range from $39.99 to $59.99 per state. Individuals who lived or worked in multiple states may incur charges for multiple state returns.

- Payment from refund option: TaxAct provides the option to pay for its tax preparation services using a portion of your expected tax refund. While this may seem convenient, there’s a significant processing fee associated with this payment method.

>> Check Out the Best Pricing for TaxAct >>

How Does TaxAct Work?

TaxAct, like many other tax software options, employs a question-and-answer format to assist users in completing their tax returns. To provide answers, you will fill out empty fields, select tiles on a grid, respond to yes or no inquiries, or make selections from drop-down menus.

After obtaining your personal details, TaxAct will proceed to ask a series of queries regarding your income. This step aids TaxAct in determining which specific tax forms require completion. However, you don’t actually view the personalized task list; instead, TaxAct notifies you about the next form it will inquire about based on the information provided, for example: unemployment (1099-G) or retirement distributions (1099-R).

Note that TaxAct doesn’t permit uploading files other than your previous year’s tax return and current W-2 form. Besides this restriction, you must manually input each Employer Identification Number (EIN) for every W-2 form. Should you possess multiple 1099-MISC or 1099-NEC forms requiring submission as well; these too must be entered manually into the system.

At any point during your TaxAct session, you have the option to opt out of the guided experience. Simply click on the federal or state links located in the left-hand navigation panel. This will allow you to directly access specific subsections such as income, deductions, and credits. While the guided questionnaire process is thorough, it can also be a bit cumbersome. You may find yourself answering questions that aren’t applicable to your tax situation.

On a positive note, TaxAct offers excellent free help and resources compared to others in the industry. By selecting the Help tab, you gain access to an extensive library of guides along with a tax glossary and links to IRS publications through a panel on the right-hand side.

Located at the top of the assistance panel is a widget tool that allows users to swiftly search for topics or IRS forms. Upon searching, relevant support will be provided in the form of contextual links, aiding individuals as they complete their tax returns. The remaining portion of the Help panel consists of default-related article links and various contact support options.

Most times, scheduling a call with a product specialist will be necessary for further help. However, live chat services are only available for inquiries regarding navigation through TaxAct during the tax return process.

Beyond the confines of the Help panel, users will notice an “i” enclosed in a circle adjacent to certain form boxes. Clicking on this symbol offers additional contextual help through pop-ups. Some answers may prove more useful than others in these pop-ups. For personalized tax guidance, Xpert Assist can be accessed at an additional cost.

Is TaxAct Safe to Use?

TaxAct collaborates with the IRS and state agencies to adhere to widely accepted protocols and standards for both physical and online security. They have incorporated numerous safety measures to confirm your status as the rightful account holder. The platform mandates strong passwords and provides additional protection through multi-factor authentication for your account.

TaxAct’s Handy Features

If you’re currently using a different provider, TaxAct offers the convenience of importing your previous year’s tax return from TurboTax or H&R Block. This can be done by providing a PDF copy of your 1040 return.

- Auto-import feature for tax documents: TaxAct allows you to import W-2s directly or capture them via a photo with a QR code import option. If you have 1099-B information from your broker in a spreadsheet format (CSV file), you can upload it. This feature eliminates the need to enter numbers from individual boxes manually.

- Donation calculator: TaxAct’s Deluxe, Premier, and Self-Employed packages include the Donation Assistant tool, facilitating quick determination of the deduction value for donated items such as clothing, household goods, and more.

- Platform mobility: TaxAct’s online software enables users to access their accounts from various devices, providing flexibility to work on their tax returns intermittently. However, TaxAct no longer offers a dedicated mobile app.

How Does TaxAct Deal With Self-Employment?

TaxAct approaches self-employment income and expenses similarly to the rest of their website. The comprehensive Q&A and accompanying information provide guidance on what needs to be reported, and they offer data entry pages or import tools for forms such as 1099-NEC and 1099-K that you may have received.

You’re required to enter your gross receipts total. TaxAct covers all the necessary questions outlined in Schedule C, including your choice of accounting method (cash or accrual).

This particular section also addresses other important aspects like depreciation, home office deductions, self-employed health insurance deductions, and Qualified Business Income (QBI) deductions.

It assists you in filling out the expenses section of Schedule C by providing fields for inputting your business costs. TaxAct ensures that any loose ends are tied up by asking about additional tax considerations such as the self-employed tax adjustment and potential state or local tax refunds. Once completed, it summarizes all your entries within this section.

Additional support and advice regarding self-employment would be greatly appreciated. It would be beneficial if the information provided were more consolidated rather than scattered across various sections of the website through multiple hyperlinks. As previously mentioned, the company is actively addressing this issue.

TaxAct’s user experience may seem uneven at times and it needs to possess the seamless transitions found in TurboTax. Nevertheless, it remains a dependable platform with a strong track record of delivering exceptional service.

>> File Your Taxes With TaxAct Today! >>

Does TaxAct Check Your Return?

TaxAct’s Double Check feature is regarded as one of its finest attributes. This feature thoroughly examines your tax return, searching for any incomplete or inconsistent information, accuracy issues, and opportunities to reduce your tax liability in order to potentially increase your refund.

It then identifies the problematic pages and presents them to you so that you can make the necessary corrections before moving on to the prior-year comparison reports and ultimately filing.

If you owe a balance, there are several payment options available through TaxAct. You have the choice of paying via direct withdrawal, credit card, or check. TaxAct offers assistance in setting up IRS payment plans using Form 9465. Another option is submitting your payment through the IRS’s Direct Pay site. For state taxes owed, it’s advisable to contact your state department of revenue for further instructions.

TaxAct Refund Options

Regardless of how you choose to file your taxes, there are multiple options available for receiving your refund:

The quickest option is to have the refund directly deposited into your bank account. Alternatively, you can opt to load it onto an American Express Serve prepaid debit card (if available for state tax refunds as well) or receive it as a paper check.

You also have the choice of applying the refund towards next year’s taxes or using it to purchase U.S. savings bonds. If you prefer, you can even pay for the software using your refund, although this incurs a fee of $17.99.

TaxAct Reviews – Is It Legit or Not?

Here are a few genuine customer reviews that could assist you in making a more educated and improved choice.

TaxAct Tax Software Alternatives

TurboTax

Intuit TurboTax stands out as the top choice for online tax software designed for small businesses. Its user-friendly interface, vast database of deductions and credits, and dedicated support catered towards startups make it the ideal solution.

This comprehensive software is suitable for businesses of any scale or industry, even though it may come at a higher cost compared to other tax programs. Within the Intuit TurboTax range, small business owners should consider either the TurboTax Self-Employed online package or the TurboTax Business application as their preferred options.

>> File Your Taxes Online With Intuit TurboTax >>

TaxSlayer

For small business filers, TaxSlayer stands out as an excellent choice due to its ability to handle complex returns at a competitive price compared to other major players in the market. It offers various benefits such as a priority phone line, efficient customer service, and a user-friendly platform for tax filing.

TaxSlayer provides customizable help based on your needs. If you prefer guidance throughout the process, their guided interview option will take you through each step methodically for quick and accurate filing.

If you’re confident in navigating specific tax forms independently and inputting your income and deductions directly, this can be a faster alternative. TaxSlayer’s versatility makes it suitable for those who require extra support and those who possess expertise in tax matters.

>> File Your Taxes Online With TaxSlayer >>

H&R Block

While H&R Block is widely known for its physical offices across the United States, the company also provides options for online filing and downloadable software. Opting for an online package allows you to conveniently handle your taxes using the mobile app available on both Android and iOS devices.

H&R Block caters to a large number of tax filers with its modern and user-friendly interface. Similar to other tax-preparation services, the platform guides users through a set of inquiries regarding their household income, along with potential deductions and tax credits.

>> File Your Taxes Online With H&R Block >>

TaxAct Review – Frequently Asked Questions

Bottom Line

TaxAct’s range of products is consistently priced lower than those offered by other providers. This is great news for individuals who prioritize functionality and affordability, and appreciate the option of affordable human assistance when needed.

Sections of this topic

Sections of this topic