Navigating the complexities of tax filing can be daunting, especially with the many options available. Fortunately, you don’t have to navigate the labyrinth of IRS forms alone. The top-notch tax software guides you through the entire process, simplifying the submission of your returns.

Numerous tax software solutions exist in the market. This Liberty Tax review aims to assist you in determining whether their online filing service is best suited for completing and submitting your 1040 forms to the government. Let’s delve into this online tax service and immediately explore its offerings.

What Is Liberty Tax?

Since its establishment in 1998, Liberty Tax has become a prominent player in the tax industry, with numerous branches across the United States and Canada.

While opting for an in-person appointment can provide efficient and cost-effective service, it’s important to note that Liberty Tax’s DIY tax software may need to be revised. Their software interface could be more user-friendly than other online tax preparation packages.

The navigation within the software primarily relies on self-guidance, making it less intuitive for beginners. However, experienced filers should be able to navigate through it easily. Nevertheless, those who prefer more visually appealing software might find Liberty Tax’s offering less enticing.

If you start your tax return using their online platform but are dissatisfied with the experience, a solution is available. You can transfer your filing process to one of Liberty Tax’s physical offices at no additional cost.

By providing this flexibility between online and in-person services and addressing potential frustrations along the way, Liberty Tax ensures customer satisfaction throughout their tax preparation journey.

Who Is Liberty Tax Good for?

Liberty Tax’s online software is primarily suited for self-assured filers comfortable navigating the tax filing process independently. It caters well to experienced individuals who thoroughly understand their tax obligations and seek minimal assistance in organizing their returns, albeit at a relatively higher cost.

However, you fall into the category of filers who require some guidance but prefer to avoid engaging the services of a professional. In that case, you may have better choices than Liberty Tax.

In scenarios involving complex tax situations, exploring alternative options such as TurboTax and H&R Block is advisable. These platforms offer superior support, comprehensive features, and enhanced customer service. They provide access to audit defense products unavailable through Liberty Tax.

Individuals with straightforward tax requirements seeking free solutions will find numerous alternatives that outperform Liberty Tax regarding value-for-money. For instance, Cash App Taxes offers completely free services across all levels.

Unless having access to physical offices for assistance or verification purposes is crucial for you, there are limited advantages offered by Liberty Tax that cannot be obtained elsewhere at more favorable terms.

Pros & Cons of Liberty Tax

- Option for direct deposit of tax refunds

- Utilization of user-friendly online tools and resources

- A diverse range of services is offered, encompassing in-person and online tax preparation

- Professional guidance is accessible for intricate tax scenarios

- Comprehensive tax courses are available for individuals interested in learning tax preparation

- Specialized services like tax debt resolution and advisory services are offered

- Pricing may be higher in comparison to certain online-only services

- Experience may vary inconsistently across different franchised locations

- Limited transparency regarding specific service fees on the website

- Some users may find the multitude of services overwhelming

Liberty Tax Features

- In-Person and Online Services: Liberty Tax provides the flexibility of opting for professional in-person tax preparation at their locations or utilizing convenient online tax filing options.

- Comprehensive Form Support: The service supports various tax forms and schedules, addressing various tax situations from simple to complex.

- Easy Advance Loans: Clients can obtain advance loans on their tax refunds, allowing for expedited access to funds through Liberty Tax’s Easy Advance service.

- Tax Debt Resolution: Liberty Tax offers a specialized service that assists clients in resolving tax debts, delivering expert guidance and tailored solutions.

- Mobile App: The Liberty Tax mobile app lets users conveniently manage their finances and tax preparation tasks directly from their smartphones.

- Educational Resources: Liberty Tax provides educational courses and resources to aid clients in comprehending and navigating the complexities of tax laws and filing requirements.

- Payroll and Advisory Services: Small business owners can take advantage of Liberty Tax’s payroll management and advisory services, which offer customized financial solutions tailored to their needs.

- Tool Integration: Liberty Tax’s service integrates various financial tools and applications, enriching the overall user experience and enhancing efficiency.

What Kind of Help Does Liberty Tax Offer?

Liberty Tax’s online assistance could be more extensive. Users can chat with technical support specialists or submit their questions via email. Alternatively, they can utilize the search feature by inputting specific words or phrases. However, the search results often yield only links to various forms.

On occasion, a search may produce a few frequently asked questions (FAQs) related to the desired topic, although sometimes these FAQs may be unrelated. Some interview pages contain links that open help windows with brief explanations.

There are instances where small warning windows pop up as well. For instance, if you enter real estate taxes into Liberty Tax’s system, it will caution you to ensure that you have yet to enter this information elsewhere.

In certain cases (though only sometimes), the website delves deeper into topics and provides additional information. As an example of this depth, it poses inquiries to determine whether your dependent qualifies for the Child Tax Credit.

While there are instances where Liberty Tax provides in-depth guidance on its site, more often than not, users may find themselves needing more assistance on specific subjects when compared to platforms like TurboTax and H&R Block.

These competitors excel at offering an extensive amount of clearly written and context-sensitive guidance throughout their platforms.

How Does Liberty Tax Work?

Liberty Tax is committed to streamlining the tax filing process for individuals by providing various online options for submitting tax returns.

Whether your tax situation is straightforward, involves claiming the child care tax credit for your family, or encompasses complex elements like self-employment income, Liberty ensures that you won’t incur significantly higher costs when using their services.

What sets Liberty apart from other tax filing providers is its reasonable pricing for complex returns and its extensive network of over 3,000 locations offering in-person assistance. Moreover, customers can benefit from complimentary double-check services at select locations, ensuring their returns’ accuracy with tax professionals’ expertise.

Additional features include audit assistance if needed, a 100% accuracy guarantee, and the ability to import previous years’ returns from competitors at no cost, saving time on this year’s filing.

Liberty goes above and beyond by covering IRS penalties and interest resulting from mathematical errors and refunding tax preparation fees if another service would have secured a larger refund.

With Liberty’s user-friendly software, online tax preparation becomes simplified, with the potential to complete your paperwork in as little as 15 minutes.

>> File Your Taxes With Liberty Tax Today! >>

How Much Does Liberty Tax Cost?

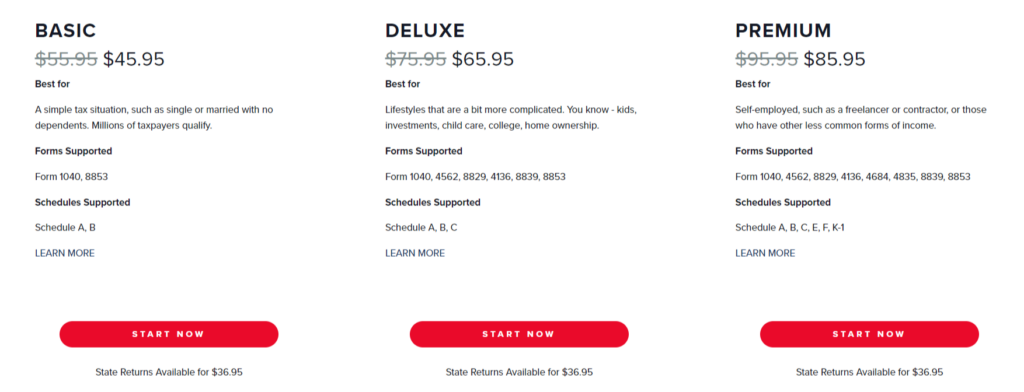

Liberty Tax provides a variety of options for individuals filing their taxes online. These options are categorized into three plans: basic, deluxe, and premium. The premium plan is designed to cater to individuals with more intricate tax situations, such as the self-employed, small business owners, those requiring a Schedule C filing, or real estate investors.

Its affordable pricing structure sets Liberty apart from other online filing programs. Even if you have unconventional sources of income, the highest tier offered by Liberty Tax only costs $85.95. In contrast, other programs charge significantly more for higher complexity returns.

However, it’s important to note that regardless of which program you choose, there will be an additional cost for state returns. Regardless of your chosen plan, state filings will require an extra fee.

Liberty Tax offers competitive pricing and tailored solutions for individuals with diverse tax circumstances through its range of online filing options.

Basic Tax Filing Services

Liberty offers a basic tax filing service with a price tag of $45.95 for federal returns and $36.95 for state returns. This service includes the necessary forms such as 1040, 8853, Schedule A, and Schedule B. However, it does not allow you to itemize deductions or claim any investment or retirement income.

If you fall into the category of single filer, married with no dependents, and only have W-2 income, unemployment income, or interest income below $1,500, this option may suit you.

The great news is that even with this entry-level tier of service from Liberty’s Basic tax filing service, you can still claim the earned income tax credit. Additionally, if you have received a taxable scholarship or fellowship grant, earned tips, or received dividends from the Alaska Permanent Fund, this option still applies to your situation.

Note that your total income must be at most $100,000 to qualify for this particular tier of Liberty’s services.

Deluxe Tax Filing Services

Liberty’s Deluxe service comes at $65.95 for federal tax returns, while the price for a state return is $36.95. With this upgraded program, you can submit additional forms such as Forms 1040, 4562, 8829, 4136, 8839, and 8853. The program also supports Schedules A, B, and C.

If you have capital gains from investments or retirement income and must file taxes accordingly, this program could be an ideal choice. If you want to claim education tax breaks or deductions for IRA contributions, alimony payments, or retirement expenses, Liberty’s Deluxe service can also cater to these needs.

One notable feature of the Deluxe service is the option to itemize deductions. This makes it particularly advantageous if you have significant medical expenses or high mortgage interest payments. This option becomes even more appealing if your total deductible expenses exceed the standard deduction amount.

By opting for Liberty’s Deluxe service, you gain access to comprehensive support and benefit from its flexibility in accommodating various financial situations that may arise during tax filing season.

Premium Tax Filing Services

Liberty’s Premium service is an excellent option if you’re in a particularly complex situation. It’s priced at $85.95 for federal returns and $36.95 for each state return. With the Premium service, you can file a wide range of forms and schedules, including Forms 1040, 4562, 8829, 4136, 4684, 4835, 8839, and 8853, as well as Schedules A, B, C, E, F, K-1.

This tax filing service is suitable if you have income from self-employment, business deductions, rental or farming income, income from an estate, unreported tips, or income from other less common sources. If your taxable income exceeds $100,000, choose the premium tax filing service.

>> Check Out the Best Pricing for Liberty Tax >>

How to Sign Up With Liberty Tax

The sign-up process for Liberty Tax is slightly more extensive compared to other services. You must provide your name, email address, phone number, password, and security questions in a single form.

Like other tax software packages, a verification code is necessary to complete the setup. This code is sent to you via email by Liberty Tax. Once you enter the code successfully, you can initiate a new tax return.

You can import data from a competitor by indicating who prepared your taxes or simply upload files from your computer if needed. After completing these initial steps, you can verify the information and complete the remaining forms.

How to Contact Liberty Tax

If you require assistance locating a nearby office, you can contact Liberty Tax by phone at 866-871-1040. Alternatively, for inquiries regarding their online services, you can email [email protected]. If you intend to find a local office, contacting them via email at the office @ libtax.com is appropriate.

While Liberty Tax doesn’t offer an online chat feature for customer support, they provide the option of visiting one of their numerous local offices. With over 3,000 locations available, you can speak with a tax preparer who can address any concerns or questions that may arise during your visit.

Liberty Tax Alternatives – Liberty Tax Review

Larson Tax Relief is highly recommended for resolving business and corporate tax debt. They offer a comprehensive range of services, such as assistance with payroll and federal tax issues, addressing conflicts with revenue officers, and resolving worker classification matters.

Regarding tax debt relief, Larson Tax Relief excels in providing solutions for both personal IRS tax issues and corporate taxes. They’re even capable of assisting clients in delaying or preventing bank levies.

Apart from receiving numerous positive reviews on customer review sites, Larson Tax Relief stands out for its exceptional business tax software. They have the expertise to handle all aspects of business tax preparation, including managing paperwork related to payroll taxes and corporate income taxes.

Their proficiency in these areas makes them an excellent choice for businesses seeking professional assistance with their taxation needs.

Anthem Tax Services provides a range of services, including IRS tax debt relief and corporate tax preparation. The company assists individuals in applying for various IRS tax debt relief programs, such as offers in compromise (OIC), innocent spouse relief, and achieving a “currently not collectible” status.

What sets Anthem apart from its competitors is its additional support for wage garnishment filing and tax levy release – services that other companies only sometimes provide. Furthermore, Anthem’s money-back guarantee stands out as one of the most favorable in the tax debt relief industry.

If Anthem fails to secure any form of resolution from the IRS, whether it be a reduction in payment amounts or complete forgiveness of debt, they offer a full refund. It’s worth noting that this guarantee does not cover the initial investigation fee, which typically starts at $350, depending on your specific case details.

Community Tax provides complimentary consultations and reasonably priced investigation fees, which range from $295 to $500. The primary focus of Community Tax relief is the resolution of IRS tax debt, although it does offer some assistance with state taxes.

Like other companies in this industry, Community Tax manages applications for various solutions such as installment agreements and offers in compromise; however, it does not handle innocent spouse relief cases.

Setting itself apart from competitors, Community Tax is one of the rare companies offering bilingual assistance online and through their representatives. In addition to their tax debt relief services, Community Tax also provides services for tax filing, bookkeeping, and business accounting.

They offer free consultations and boast an A+ rating with the Better Business Bureau (BBB), supported by numerous positive reviews from satisfied clients who appreciate their prompt response to customer complaints.

FAQs About Liberty Tax – Liberty Tax Review

Final Thoughts – Liberty Tax Review

Liberty Tax provides a trustworthy solution for various tax requirements, combining the ease of online filing with the reassurance of in-person support.

With its dedication to delivering professional service and ensuring customer contentment, Liberty Tax is a formidable option for individuals seeking guidance in tax preparation. To delve deeper into what Liberty Tax has to offer, click here.

Sections of this topic

Sections of this topic