The internet has simplified the process of starting up a business through website builders, online marketplaces, and an abundance of tools. However, these platforms only scratch the surface of the business savvy required to run a company. Instead, it takes an understanding of key words and phrases to find success. This article contains 50 business statistics terms you absolutely must know before starting a new business.

Starting a New Business & the Havoc!

Even with the help of the internet, there’s nothing easy about starting up a new business. The entire process can be overwhelming, from determining your business structure and operating state to choosing vendors and deciding how to sell your product or service. To top all that off, you have to wade through all sorts of business jargon that you can’t possibly hope to understand.

Take a deep breath. Everyone creating a company for the first time experiences this same mix of emotions. What may seem like Greek right now will someday be crystal clear. By being here, you’re on the right path to making that dream a reality.

How Will Business Statistics Terms Help You?

With so many businesses rising up all the time, it can be a challenge to stand out in the crowd. Even if your products or services mirror some other company, your level of business knowledge may just be what sets you apart.

Having a detailed understanding of business statistics terms will help you build the company you’ve been dreaming about for some time. Being able to track finances, monitor customer retention, and deal with financing can help you visualize the direction your company is headed through cold hard facts. Knowing how to process the information allows for a course correction that would otherwise sink a fledgling business.

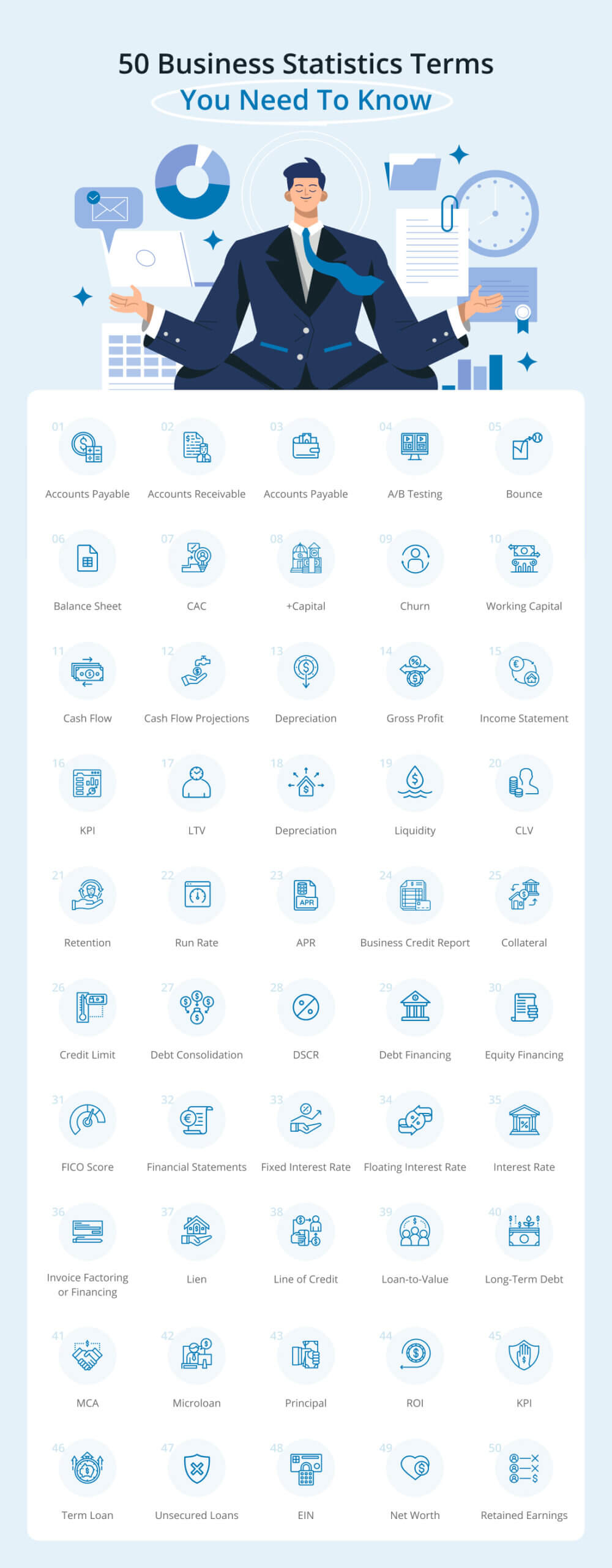

50 Business Statistics Terms You Need To Know!

Below you’ll find 50 of the most common business statistics terms used by companies. You’ll want to learn these as quickly as possible to give your business the best chance to succeed.

1. Accounts Payable

Accounts payable refers to short-term debt that your company owes vendors or suppliers. It constitutes the sum of all purchases made on credit that your business has not yet settled payments with. Such expenses must be paid off within the appropriate time frame to avoid repercussions.

Business owners should always keep detailed records of credits and debits into accounts payable to avoid issues. Many businesses have an accounts payable team with the sole purpose of handling monies owed to other ventures. Note that accounts payable do not include long-term debts from loans or large capital purchases.

Amounts in accounts payable show up as credits while you prepare for funds to go out. Once paid, debit accounts payable and credit the appropriate cash account.

2. Accounts Receivable

Similar to accounts payable, accounts receivable represents funds other entities own your business for services provided or products delivered. These amounts are assets coming into your business to use as part of your overall working capital. Each organization you supply goods or services to has a legal obligation to pay within an allotted time.

After providing your products or services, it is your responsibility to send an invoice with mutually agreed payment terms. In most cases, terms range between 30 and 60 days for the transfer of funds. Should customers fail to make timely payments, it’s possible to charge fees or impose penalties.

Your accounts receivable list will show as debits until you receive payments. At that point, you’ll credit the accounts receivable column and debit your cash account.

3. Accruals

In accounting, accruals showcase adjustments to your company’s net income before payments have been sent or received. Every time your business purchases an item on credit or supplies a product or service, an accrual takes place on your income statement. They only apply to instances where an exchange of cash has not yet happened.

Accruals can be revenues earned by your business or expenses incurred. Recording these types of transactions throughout a cycle makes invoicing a much simpler process when it comes time to bill. It also ensures you won’t have any surprises when you receive a charge from one of your vendors.

4. A/B Testing

A/B testing is a means for businesses to compare two scenarios surrounding a single variable to see which works better. Such a test, also known as split or bucket testing, can prove valuable in determining the direction or approach your company should go with a particular matter. The key is modifying only one variable at a time to see its effect on the overall picture.

For instance, business owners can attempt two different versions of a website popup to see which one draws the most attention. You then show one version with green text to a random group of users and the same popup with blue text to a different random group. By keeping all other components the same, it becomes clear from testing which color customers prefer.

5. Bounce

Bounce or bounce rate measures the length of time customers spend on your website at any given time. The higher this number is, the faster people are exiting your page and moving on to other things. In an ideal world, the features on your page will keep shoppers engaged and happy while browsing your wares.

If you have a high bounce rate, your company may not see the numbers you were hoping for from online sales. All hope is not lost, as you and your team can redesign a site to become more pleasing to peruse. Keep in mind also that customers will vanish if they have trouble navigating or prompts are too convoluted to understand.

6. Balance Sheet

Your company’s balance sheet equates to a financial snapshot of how business is going at any given time. The document contains all your assets and liabilities alongside any shareholder equity at that moment. Most organizations study these numbers at the end of a quarter or fiscal year.

Balance sheets help identify the financial health of your business by listing its overall worth. At a glance, you’ll see all your assets, such as cash, inventory, and accounts receivable. These will appear next to liabilities in the form of rent, loan payments, and other accounts payable. The balance sheet also records shareholder equity from capital or invested income.

In all instances, balance sheets should actually balance. To determine if this is the case, businesses use the following formula:

Assets = Liabilities + Shareholders’ Equity

7. CAC

CAC stands for customer acquisition cost. This is an estimated value of how much your company has to spend in order to acquire a paying customer. To calculate such a number, you’ll need to identify every expense in marketing and sales that go toward bringing individuals to your business. Divide this amount by the number of customers your company had over the same period of time.

It’s imperative that the cost of bringing in customers doesn’t outweigh how much you’re making on the products or services you sell. Taking the time to understand your customer base can help bring these costs down.

8. Capital

Many people equate capital with dollar bills, but it extends well beyond the amount of money your company has. The term encompasses your overall wealth as an organization and includes physical assets such as equipment, vehicles, and buildings. More recently, capital has grown to include intangible things such as intellectual property.

Each of the items that make up your company’s capital generates some sort of value that helps create income. Business owners often assign a capital type, such as debt, equity, trading, or working. Businesses can help raise capital by issuing stocks and bonds to investors.

9. Churn

Churn rate, also known as attrition, depicts the frequency that customers stop doing business with you. This could be losses in the number of subscribers to a service or a record of customers who have not made a purchase over a specific length of time. To qualify for churn, individuals must have purchased something from your business at least one time.

There’s no way to maintain your entire clientele each cycle, so some churn should be expected. For a healthy business, the customer growth rate must exceed the number of customers you lose in a set period.

Businesses may also use this term to indicate employee turnover in a given window. You can use churn to track quality of life in your work environment and make improvements as needed.

10. Working Capital

A subset of capital, working capital consists of the assets a company needs to run its day-to-day operations. Working capital helps financial teams understand how well an organization can handle financial challenges as they appear. In general, more working capital allows companies to compensate for day-to-day changes that could upset smooth operations.

It takes knowledge of current assets and liabilities to calculate a value for working capital. A simple subtraction of the totals from those two columns reveals the working capital for your business. Low values should be a source of concern and remedied as soon as possible.

11. Cash Flow

No business can survive without a healthy amount of cash. Cash flow captures how money flows both into and out of your company. Positive cash flow occurs when more cash enters your business than goes out, whereas companies with negative cash flow see the opposite happen.

Free cash flow indicates the amount left over after covering all expenses for a particular financial period. Businesses can hold these funds for issues that may arise or invest them back into the company. Ventures with high free cash flow are generally quite profitable and on a solid financial path.

12. Cash Flow Projections

Cash flow projections help estimate the money expected to move into and out of your business. Unplanned expenses aside, you can use accounts receivable and payable to get an idea of any additional cash your company has to play with once you’ve paid the bills.

Items such as rent and employee salaries typically remain the same, providing a solid baseline for cash flow out of the business. Past months often serve as a guideline for costs due to materials or income from sales. You can use this data to project trends that reveal whether you’re paying too much or have funds to reinvest.

13. Depreciation

Your pieces of equipment will feel wear and tear over time, and each will eventually reach the end of its useful life. You can use depreciation to track the reduction in the cost of expensive items through their lifespan in a quantifiable way. Few assets, like land, appreciate in value over time instead.

There are a few different methods for calculating depreciation. You have some control over depreciating your items, but the most common approach is a constant amount over its life cycle. However, it is also possible to adjust the value based on workload or at a varying rate.

14. Gross Profit

Gross profit is a measure of your company’s remaining earnings after removing the cost of goods sold from your revenue. It is an indication of the income left over after factoring out any expense necessary to sell your product or service. You’ll need to consider manufacturing costs, labor, raw materials, transportation, and even marketing as part of your total expenses.

Studying your gross profit numbers can help determine where funds are going in the sales process. You’ll have a better idea of how efficient your systems are and may indicate areas in need of improvement.

15. Income Statement

Your business’s income statement closely looks at your bottom line, revealing how much you’ve earned and spent over a particular period. With a careful focus on incoming revenue and outgoing expenses, the statement is a great way to visualize profit or loss. Obviously, it’s a good show to see numbers indicating more money comes in than goes out.

In addition to the information it provides you, other entities use income statements to see how viable your business has become. Investors love to see this document when deciding whether to invest capital into your business.

16. KPI

KPI stands for key performance indicators and is a general term for the guidelines you and others use to measure your business. These measurable values allow you to keep tabs on all areas of your company. You can see where you’re doing well and also areas in need of some improvement.

Each KPI should relate to a specific business outcome. As you begin planning out your KPIs, ask yourself which objectives mean the most to you at your current stage. By tracking the metric each cycle, you can gauge whether current initiatives are working as planned.

Common examples include gross profit, churn rate, and customer acquisition cost.

17. LTV

LTV constitutes the lifetime value of your customers. In other words, it provides an idea of how much revenue the average customer will generate over the entire time they shop with you. With this information, you can have a better handle on customer needs and how to effectively market your products.

To discover lifetime value, you’ll first need to look at the average monthly revenue from an individual consumer. Dividing that value by churn rate (in percent) will obtain your LTV. As an example, a customer paying $100 per month for a subscription with a churn rate of 10% can expect to earn you $1,000 over time.

18. Liability

Liabilities cover any and all debts your company owes to some other entity. Usually, sums of money can be current (such as accounts payable or wages) or long-term (often business loans or a mortgage). In either case, a liability comes with a legal obligation to make said payment within the appropriate amount of time.

Having a detailed record of your company’s liabilities is key to understanding where your hard-earned funds are going. Keeping an up-to-date balance sheet can help identify unnecessary liabilities that can instead become free cash flow.

19. Liquidity

Everything within your business holds some sort of cash value. Liquidity indicates the ease and quickness you can turn one of those business assets into cash. Having high liquidity allows your company a measure of financial flexibility in the event a need for funds arises. Those with low liquidity may not have the means to drum up quickly in an emergency situation.

Having a good amount of liquidity points directly to the health of your business. It may not be wise to hold onto too much cash lest you miss out on growth opportunities or decisive investments. Being able to access what you need when you need it is a vital feature for any business.

20. Customer Lifetime Value

While all customers are great, they aren’t all equal. For example, one customer can consistently return to your business to purchase additional items. On the other hand, another customer may only purchase from your business once. For this reason, the first customer has a higher lifetime value than the second customer.

Customer lifetime value (CLV) is the total dollar amount a customer spends on your business or products. Since it costs less to keep existing customers than it is to acquire new ones, increasing your CLV is an excellent way to drive profitability and growth.

By comparing your CLV to customer acquisition costs, you can quickly estimate a customer’s profitability and long-term business sustainability.

21. Retention

As you just learned with CLV, retaining existing customers is crucial for sustainable growth. It’s typically cheaper to get existing customers to make repeat purchases than to find new customers. Retention, or customer retention, is a business metric that measures customer loyalty and the ability of a company to keep its customers over time.

This is important because it helps you identify loyal customers and predict repurchase behavior, customer satisfaction, and customer engagement. Therefore, customer retention is a strategy that involves increasing a company’s repeat customer rate and extracting additional value from those shoppers.

The overall goal of retention is to make sure a customer makes additional purchases, is happy with your product or service, and does not run to a competitor.

22. Run Rate

Whenever businesses talk about run rates, they extrapolate data from one time period to make predictions about a more extended period of time. In general, companies use run rates to see what a key performance indicator like revenue or profits would be for a year, using data from a quarter or month.

For example, you can calculate your annual run rate based on quarterly data by multiplying by four. The same can be done by multiplying the monthly run rate by 12. However, the primary issue with run rate is the underlying assumption that current conditions will extend throughout the forecast period.

Therefore, you should use run rate with a grain of salt for future financial projections.

23. Annual Percentage Rate

The annual percentage rate (APR) is the yearly interest rate charged on loans, including fees such as broker fees, closing fees, and discount points. APR differs from interest rates because interest rates don’t consider the additional fees associated with a loan. Therefore, the APR is always greater than or equal to the nominal interest rate.

Since APR is more inclusive of all the fees involved with a loan, it paints a clearer picture of the total borrowing costs of a loan. You should pay close attention to the APR when deciding which lender you want to borrow money from because it describes the actual cost of financing.

24. Business Credit Report

A business credit report contains a snapshot of the financial health of a business. It typically includes the company’s background information, financial profile, banking history, liens, and legal filings. The business credit report also consists of a credit score, indicating your business’s creditworthiness and the risk level taken by future creditors.

Therefore, creditors use business credit reports to assess the risk they take if they offer your business a loan or credit card. It’s also important to note that business credit reports are public information for anyone to access. The three primary credit bureaus conducting business credit reports are Equifax, Experian, and Dun & Bradstreet.

25. Collateral

Collateral is a specific item of value or monetary amount a lender can seize from a borrower if he or she cannot repay the loan according to the agreed-upon terms.

With a home mortgage, the bank typically asks the borrower to provide their home as collateral. This means that if the borrower fails to comply with the repayment terms of the mortgage, the bank has the right to take ownership of the home.

The bank can sell the home to recoup the money lent to the borrower since they failed to meet the repayment terms. Therefore, collateral acts as a guarantee that the lender can receive their money back even if the borrower does not repay the loan.

26. Credit Limit

A credit limit defines the maximum amount of credit a financial institution or lender can extend to a client on a line of credit or credit card. Lenders typically set credit limits based on the borrower’s credit score and credit report. The lender may also examine your personal income, loan repayment history, and other financial information.

Furthermore, lenders usually give high-risk borrowers with low credit scores lower credit limits because they lack the reputation to repay the debt. On the other hand, low-risk borrowers receive higher credit limits, providing more spending flexibility.

27. Debt Consolidation

Debt consolidation is when you combine multiple debts into a single payment. Businesses use debt consolidation to get a lower overall interest rate which helps reduce the total debt. Furthermore, debt consolidation helps to reorganize multiple bills, making the payback process much more manageable and efficient.

It’s a good idea to consider debt consolidation if you have good credit and qualify for low-interest rate debt consolidation loans. Also, you can deploy debt consolidation if your monthly debt payments don’t exceed 50% of your monthly gross income. This way, you have consistent cash flow to cover debt payments.

28. Debt Service Coverage Ratio

A debt service coverage ratio (DSCR) measures a company’s available cash flow to pay current debt obligations. Investors view a company’s DSCR to see if it has enough cash flow to repay its debts.

In essence, the debt-to-service coverage ratio indicates a company’s financial health, especially businesses that are levered and carry a lot of debt. The ratio measures a business’s total debt obligations to its operating income.

DSCR = Net Operating Income / Total Debt Service

You can calculate net operating income by subtracting certain operating expenses (COE) from revenue. The total debt service is a company’s current debt obligation.

29. Debt Financing

Whenever a company borrows money to be repaid at a future date with interest, it’s known as debt financing. It can be in the form of a secured or unsecured loan. If a business needs funds, there are three ways to obtain them: take on debt, sell equity, or a combination of the two.

If the company chooses debt financing, it sells fixed income securities such as bonds, notes, or bills to investors to acquire the money needed to grow its operations.

In essence, debt financing is the use of a bond issuance or loan to obtain funding for a company. Companies use debt financing to buy assets, acquire other entities, or obtain additional working capital.

30. Equity Financing

As the inverse of debt financing, equity financing is when companies raise capital by selling shares. Companies deploy equity financing when they have a short-term need to pay off expenses or a long-term goal of growing the business with additional capital.

Furthermore, equity financing can come from several sources. For instance, businesses can raise money through investors, friends and family, or an initial public offering. Equity financing is different from debt financing because debt financing involves borrowing money. On the contrary, equity financing involves selling a portion of the equity in the business.

31. FICO Score

A FICO score is a credit score determined by the Fair Isaac Corporation (FICO). Lenders use a customer’s FICO score with other financial reports to evaluate credit risk and decide whether to extend credit. The FICO score uses payment history, types of credit used, new credit accounts, length of credit history, and the current level of indebtedness to establish creditworthiness.

Simply put, lenders use FICO credit scores to quantify and evaluate a person’s creditworthiness. For example, FICO scores are used in over 90% of mortgage application decisions in the US. Furthermore, companies can improve their credit scores by using less than 30% of available credit, paying expenses on time, and having a combination of different types of credit.

FICO scores range from 300 to 850, with scores ranging from 670 to 739 considered to be “good” FICO credit scores.

32. Financial Statements

Financial statements are a group of summary-level reports about a company’s financial management. They include a company’s income statement, balance sheet, and statement of cash flows.

A balance sheet delivers an overview of a company’s assets, liabilities, and shareholders’ equity as a snapshot in time. The income statement provides a picture of a company’s revenues and expenses over a fixed time period. Lastly, the cash flow statement measures if the company is able to generate enough cash to pay its debt obligations, fund additional investments, or fund its operating expenses.

Investors, creditors, and market analysts use financial statements to evaluate a company’s financial performance and earnings potential.

33. Fixed Interest Rate

A fixed interest rate means you have to pay an unchanging amount of interest on a loan or line of credit. This means your loan’s interest rate won’t fluctuate over the lifetime of your loan. Therefore, you know exactly how much each monthly payment is and how much it will cost to cover your total loan based on the fixed interest rate.

The primary benefit of a fixed-rate loan is knowing that unpredictable market conditions won’t impact your loan. You can typically find fixed interest rates with student loans, mortgages, auto loans, credit cards, and home equity loans.

34. Floating Interest Rate

A floating interest rate, also known as a variable interest rate, is the opposite of a fixed interest rate. By definition, a floating interest rate changes periodically based on current economic or financial market conditions and typically moves in tandem with a specific index or benchmark.

These interest rates are usually carried by credit card issuers and are commonly seen with mortgage loans. The best time to take on a loan with a floating interest rate is when you perceive that the base rate will either stay consistent or reduce over time. As such, your loan’s interest will either stay the same or decrease.

35. Interest Rate

Unlike the annual percentage rate, the interest rate is the percentage you pay to borrow money from a lender for a certain time period. While the APR includes all the fees associated with the loan, the interest rate is the sole percentage of the principal paid to the lender to borrow money, and it doesn’t include all the fees you pay for the loan.

The fees not calculated with the interest rate include discount points, origination fees, broker fees, underwriting fees, and mortgage insurance premiums. This is why APR is often higher than the interest rate.

36. Invoice Factoring or Financing

Invoice factoring and invoice financing are alike and often used interchangeably. Also known as accounts receivable financing, invoice factoring involves the sale of unpaid invoices to another organization. The organizations that purchase unpaid invoices are known as factors, lenders, or factoring companies.

Similarly, invoice financing involves borrowing money against outstanding accounts receivable. A lender provides a portion of your unpaid invoices upfront, in the form of a line of credit or loan. After the client pays your invoice, you pay the lender back the amount loaned along with fees and interest.

Small businesses that need help managing cash flow issues or covering short-term expenses should consider using invoice factoring or invoice financing.

37. Lien

A lien is a formal and legal declaration that your company owes money to another entity. This could be a bank, lender, or other company. Although it’s similar to collateral, a lien is a legal filing that gives a lender the right to your property or assets if you fail to honor the repayment terms. Therefore, you can get rid of a lien by paying off the debt or filing for bankruptcy.

The asset itself is what’s known as the collateral, and the lien is the legal right for the lender to take possession if the borrower fails to repay the loan. As such, liens and collateral go hand-in-hand in loan agreements. Different types of liens include tax, consensual, judgment, and mechanic’s liens.

38. Line of Credit

A business line of credit (LOC) is a set borrowing limit a borrower can withdraw on at any time the line of credit is open. For example, if a lender extends a $10,000 line of credit, you can borrow up to $10,000. If you borrow $5,000, you can only borrow another $5,000. This means you have to pay back the initial amount before you can continue borrowing.

The lender sets the payment timings, size of payments, and interest rates. Furthermore, some lines of credit let you write checks, while others include a debit or credit card.

The main benefit of a line of credit is its built-in flexibility. Although you have a fixed maximum borrowing limit, you don’t have to use it all. Instead, you can borrow on an as-needed basis based on current expenses and operating expenditures.

39. Loan-to-Value

The loan-to-value (LTV) ratio is a financial metric that compares the borrowed money to the market price of the asset being bought. Financial institutions and other lenders use LTV ratios to assess lending risk before approving a mortgage. Generally, loan assessments with a high LTV ratio are considered high-risk loans.

Although lower LTVs are more optimal for lenders, they require borrowers to come up with larger down payments to offset the lower interest rates.

LTV Ratio = Mortgage Amount / Appraised Property Value

40. Long-Term Debt

In accounting, long-term debt refers to an organization’s loans and other liabilities that won’t be due within one year of the balance sheet date. For example, let’s say your company has a mortgage loan with a principal balance of $200,000 with 120 monthly payments remaining. This means your loan payments due in the next 12 months include $12,000 of principal payments.

On the balance sheet, $188,000 of the $200,000 mortgage loan should be filed as a long-term debt or noncurrent liability. You should report the other $12,000 as a current liability. If all or a portion of the long-term debt comes due within one year, the value will move to the current liabilities section on the balance sheet, classified as the current portion of long-term debt.

41. Merchant Cash Advance

Small businesses use merchant cash advances (MCA) as an alternative to traditional bank loans. With a merchant cash advance, borrowers receive an upfront lump sum from a merchant cash advance provider, and the borrower then repays the advance with a percentage of the company’s sales.

Merchant cash advances offer fast access to cash and flexible repayment terms without needing to put up collateral. You can also get approved for a merchant cash advance without strong credit or a lot of paperwork. However, you likely need to pay higher interest rates for the convenience of the merchant cash advance.

Merchant cash advances are only available for businesses that process credit cards for payments. This is because the funding provider gets paid back by taking a portion of your future credit card sales.

42. Microloan

Microloans are small loans typically up to $50,000 lenders issue to small businesses. These small business loans usually have short repayment terms and varying interest rates depending on the situation.

Microloans are helpful for startups and businesses facing challenges with credit access. In addition, you can use a microloan to pay for anything your business needs, such as new equipment or operating costs.

Furthermore, you can find microloans from several organizations, including the US Department of Agriculture (USDA), Small Business Administration (SBA), and other online or alternative lenders.

43. Principal

In any loan or investment, the principal is the original sum of money borrowed or deployed. For example, the principal is the initial size of a loan or bond in the context of borrowing. In terms of investing, the principal is the original amount committed to purchasing the assets.

If you take out a $100,000 mortgage, the principal is $100,000. After you pay off $50,000, the principal balance is the remaining $50,000. Furthermore, the principal dictates how much interest you pay on the loan. Whenever you make monthly payments on a loan, the money first goes toward accrued interest. Then, the remaining balance is applied to the principal.

44. Return on Investment (ROI)

As one of the most commonly used financial metrics in business, return on investment evaluates the performance of an investment. It’s expressed as a percentage and calculated by dividing an investment’s net profit by its original cost.

ROI = (Current Value of Investment – Cost of Investment) / Cost of Investment

For example, let’s say you invest $10,000 into a new business venture and generate $20,000 of profit. Using the formula above, the ROI of this new business venture is 200%. Companies use ROI to compare different investment opportunities and analyze the performance of current investments.

45. Secured Loan

Secured loans are personal or business loans that require some form of collateral as a borrowing condition. This collateral typically includes physical assets such as vehicles and property or liquid assets such as cash. For example, if you get a mortgage for a home, the loan is secured by the property you’re purchasing. The same can be said with a car loan.

Therefore, if you fail to meet the repayment conditions, the lender can seize the collateral used to secure the loan. In a mortgage loan, this involves initiating a foreclosure proceeding. The lender would auction off the home and use the proceeds to pay the required amount on the defaulted mortgage.

46. Term Loan

Term loans provide a one-time lump sum payment you can use for personal and business expenses. For this reason, term loans are an excellent choice for both short and long-term financing obligations.

With a term loan, the lender provides the one-time lump sum payment, and you repay the loan with interest over the specified time period. Your specific interest rate can be fixed or variable, depending on the loan terms.

Furthermore, term loans are secured borrowings, meaning you must put up assets as collateral against payment to ensure payments are made on time. More importantly, term loans may be challenging to qualify for and require rigorous approval.

47. Unsecured Loans

While secure loans require collateral, unsecured loans do not. Rather than relying on collateral, lenders approve unsecured loans based on the borrower’s creditworthiness. Therefore, unsecured loans are riskier than secured loans for lenders and require higher credit scores for approval.

If the borrower defaults on the unsecured loan, the lender can commission a collection agency to collect the debt or take the borrower to court. Unsecured loans include student loans, personal loans, and most credit cards. In addition, these loans tend to have higher interest rates than secured loans because of the greater level of risk involved.

48. Employer Identification Number (EIN)

An employer identification number is a unique nine-digit number, formatted as XX-XXXXXXX, given to a company. The Internal Revenue Service uses employer identification numbers to identify business entities for tax reporting purposes. Therefore, all businesses that meet a specific criteria need an EIN before they can begin operations.

The employer identification number is also known as a Federal Tax Identification Number. You must have an EIN if you have employees, operate as a partnership or corporation, file certain tax returns, or withhold taxes from income other than wages.

49. Net Worth

Net worth is the sum of all an individual’s or corporation’s owned assets minus the liabilities they owe. Assets include cash in your business checking or savings account, stocks and bonds, an ownership stake in a company, and property. Liabilities include a credit card balance, student loan balance, or mortgage balance.

Companies use net worth to provide a snapshot of their current financial health in business. Net worth is also known as book value or shareholders’ equity.

50. Retained Earnings

Retained earnings is an important accounting concept that measures a business’s cumulative net earnings or profits after deducting dividend payments. In other words, it’s the amount of net income left after a company pays out dividends to its shareholders.

Companies focused on rapid growth have high retained earnings as they may not pay much or any dividends. This way, these companies can reinvest the retained earnings in further growth and expansion. Retained earnings is a powerful financial metric because it helps assess a company’s financial health.

Learn From Scratch!

No one enters the business world with complete knowledge of every business term needed to ultimately succeed. While some may be further along than others, there are so many aspects of business you can only grasp as you begin the process of building your own company. Whatever your business literacy is, it’s never too late to start learning the words and phrases you can use to obtain your goals.

Conversely, your chances of making it as a business owner are slim to none without an understanding of the many business statistics terms that cover the business landscape. As soon as you can, start learning the words and phrases you don’t know so you’ll be ready when you need them most.

If you’re striving to start a business without an iota of financial sense, that’s okay too. Start learning the most important business statistics terms from scratch as quickly as possible so you don’t drown along the way.

Tips to Have a Successful Start

There’s no cookie-cutter method for starting out a business. These tips can help provide the groundwork you’ll need to get up and running.

1. Do Your Homework

Starting a business without careful research is a recipe for disaster. You need to learn the market you hope to sell in and what your potential customers are looking for. Above all else, having a thorough understanding of key business statistics terms can provide a stable foundation to stand on when starting out.

If you’re stuck on the initial product or service offering, a few trending types of businesses include the mental health and cyber security niches.

2. Get Organized

There’s a lot going on in a new business, and it can be hard to figure out where to begin. You won’t get far if you’re unable to stay organized. Create a list of tasks you need to tackle and mark things off as you accomplish them. Having this sense of direction should keep you focused and less stressed.

3. Keep Detailed Records

It’s essential to make note of every transaction, expense, customer concern, and which things are working well. This way, it’s easy to see at a glance how you’re doing financially and possibly detect issues before they occur.

4. Follow the Money

Your balance sheet and income statement are two great sources you can use to see how money moves through your business. It goes without saying that more should be coming in than going out, but having line-by-line expenses can reveal unnecessary expenses or ways to boost income. These documents can also provide good insight into the health of your business.

5. Measure Important Metrics

Numbers don’t lie. Creating metrics to track things like customer churn rate can clarify a gap in your marketing strategy or a price point that turns shoppers away. You can similarly watch profits to ensure numbers are moving in the right direction.

6. Provide Memorable Service

There needs to be something memorable about your business that will draw customers in and keep them coming back for more. For the amount you spend to obtain a single customer, you want to maximize the return on investment you’ll receive down the road.

Sections of this topic

Sections of this topic