Your credit score plays a crucial role in many aspects of life, impacting your ability to secure home loans, car loans, and credit cards. If your credit score is different from where you’d like it to be, it can make these financial milestones challenging.

The Credit People, a credit repair service, claims it can significantly boost your credit score, by as much as 187 points. The company also reports that 78% of its customers successfully secured car loans after utilizing their services.

If you’re thinking about enlisting The Credit People to improve your credit, it’s important to understand what their services entail and how they might benefit you. Here’s what you should consider before signing up.

>> Get Started With The Credit People >>

What Is The Credit People?

The Credit People is a credit repair agency that has been assisting individuals with disputing and improving their credit scores for over 20 years.

While it’s true that anyone can legally dispute items on their credit reports, the process can be lengthy and requires careful planning. Incorrect handling of disputes can lead to increased collection efforts or lawsuits from lenders.

The Credit People simplifies this process for you. They conduct a thorough review of your credit history to pinpoint discrepancies and issues that could be dragging your score down. Once identified, they actively work to dispute any inaccuracies, taking the burden off your shoulders and potentially improving your credit score.

Founded in 2001 and based in Cottonwood Heights, Utah, with additional offices in Chicago, Illinois, and Orlando, Florida, The Credit People offers straightforward credit repair services. Their experts analyze your credit reports to pinpoint errors or inaccuracies and then dispute these mistakes with the credit reporting agencies.

If these disputed items are proven incorrect, they can be removed from your credit reports, potentially boosting your FICO score. According to The Credit People’s website, customers might see an estimated credit score increase of between 50 to 100 points.

The company’s pricing structure is clear and transparent. Clients pay an initial fee of $19 and can then choose between two plans: a Standard Plan at $79 per month or a Premium Plan at $99 per month. There’s also a six-month Premium Plan available for a one-time fee of $499. Couples who sign up together receive a discount, with each partner saving $20.

The Credit People’s Services

The Credit People specialize in meticulously reviewing your credit reports to verify the accuracy of the information reported by creditors and lenders. They actively dispute any inaccuracies or items that do not belong to you.

To keep you informed about your progress, The Credit People provides an online account portal that you can access 24/7. Additionally, they offer flexibility with their service; if you’re not satisfied, you have the option to cancel at any time.

What Credit People Offers

- Once you sign up with The Credit People, you gain 24/7 access to an online account. This platform allows you to view your credit reports and scores, monitor your progress, and receive updates when your reports have been modified. You can pose questions directly through your online account.

- Unlike some companies that require you to obtain your own credit reports, The Credit People provides you with your credit reports and scores from Experian, TransUnion, and Equifax at no extra cost at the beginning of your service. This helps you understand your starting point and set realistic goals for improving your credit.

- The Credit People also offers unlimited credit disputes, which is a notable advantage over some other credit repair services that limit the number of disputes per cycle.

- For those who choose the month-to-month payment option, The Credit People provides a 90-day money-back satisfaction guarantee. This policy is competitive with offers from other companies and includes the option to cancel at any time, with refunds available for the first and last month of service. Customers who opt for the six-month Premium plan receive a six-month satisfaction guarantee, ensuring further peace of mind.

>> Check Out The Credit People >>

What The Credit People Doesn’t Offer

- The Credit People offers a streamlined approach with just one service package. While this simplicity can be appealing, it also means there needs to be a variety of tiers and pricing that many competitors offer. If you’re searching for advanced features like score tracking, identity theft protection, or personal finance tools, consider other providers.

- While The Credit People enables you to track the progress of disputes they file for you, they do not provide ongoing credit monitoring services. Regular monitoring of your credit reports is crucial for identifying any unusual or fraudulent activities early, allowing you to address them before they impact your credit score significantly.

- The Credit People does not offer add-on services that can enhance and maintain a healthy credit score, such as cease and desist letters, goodwill intervention letters, financial management tools, or debt validation services. If these features are critical to your credit repair journey, you may need to explore other credit repair organizations that offer a broader range of services and tools.

The Credit People Pros & Cons

Pros

The Credit People offers a few customer-friendly options that make trying out their services virtually risk-free:

- Free Seven-Day Trial: They provide a seven-day trial period at no cost, allowing you to test their services to see if they meet your needs. This trial includes a free credit consultation and monitoring services to give you a comprehensive look at what they offer.

- Satisfaction Guarantee: You have the flexibility to cancel your subscription at any time without penalty. For those on the monthly plan, The Credit People will refund the fee for the month you cancel and the fee for the previous month, ensuring you can try their services without financial risk.

- Discounts for Couples: Couples who sign up together or within three days of one another each receive a $20 discount on their first payments. This incentive makes it more affordable for both you and your spouse to start improving your credit scores together.

>> Sign Up for The Credit People >>

Cons

- Package Options: The Credit People provides two payment plans: a monthly subscription and a flat-rate plan. The flat-rate plan, priced at $419, is a one-time fee that doesn’t offer any extra services or benefits beyond the standard package. For many customers, this high-cost option may not be necessary given the lack of additional features.

- Poor Customer Service: In terms of customer support, The Credit People’s options are more limited compared to other companies. They do not offer 24/7 customer service and support is only available via phone or email, with no options for online chat or a mobile app for more convenient access.

- Few Optional Add-Ons: The Credit People offers a basic suite of credit repair services without the possibility of adding on extras. Compared to some competitors who provide additional features such as identity theft insurance, The Credit People does not offer any optional add-ons, which may be a drawback for those looking for a more tailored credit repair experience.

Company Features

The Credit People provides several features designed to help customers improve their credit:

- Free Credit Repair Consultation: When you sign up, you’ll receive a phone consultation with a representative to review your credit reports and discuss your credit score, helping you understand the steps needed to improve it.

- Credit Monitoring: You can monitor your credit directly through your online account with The Credit People, allowing you to keep track of changes and updates to your credit report.

- Money-Back Guarantee: If you’re not satisfied with the service, you can cancel at any time and receive a refund for the current month’s fee as well as the previous month’s cost, making it a risk-free option.

- Educational Materials: The Credit People’s website offers a variety of educational materials, including articles on how to build good credit, providing you with valuable information to help manage and improve your credit score effectively.

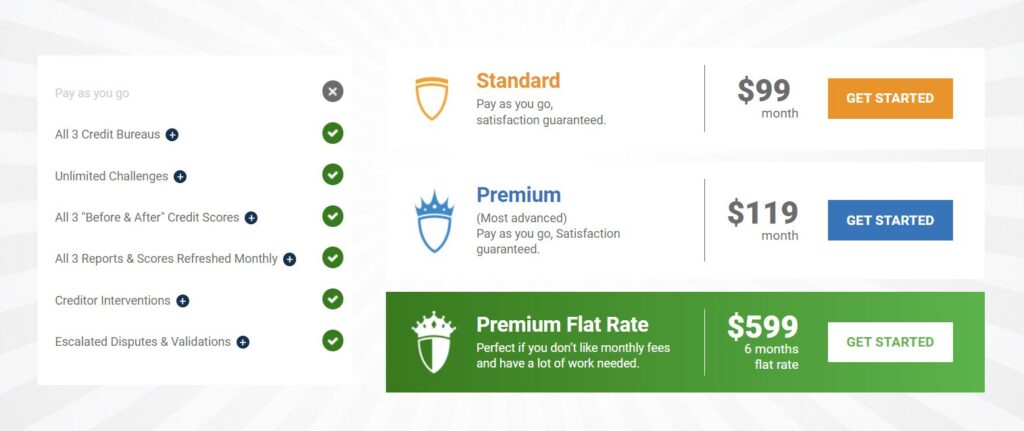

The Credit People Pricing

The Credit People provides three tailored pricing plans to suit various credit repair needs:

- Standard Plan: Priced at $79 per month, this plan offers a comprehensive approach to continuous credit improvement, making it suitable for those who need regular credit repair assistance.

- Premium Plan: For $99 per month, this plan includes all the features of the Standard Plan along with additional services designed to speed up the credit repair process.

- Premium Six-Month Plan: This one-time payment plan of $499 offers a cost-effective solution for those committed to a six-month credit repair journey, providing substantial savings over monthly billing.

Select the plan that best meets your financial goals and start your journey toward improved credit with confidence.

>> Sign Up for The Credit People >>

How Does The Credit People Work?

Getting started with The Credit People is straightforward. Initially, you pay a $19 fee, and they promptly retrieve your credit reports and scores for you. These are then uploaded into your personal online account, where a custom strategy is crafted specifically for your credit situation, and the credit repair process begins immediately.

You’ll have access to your online account where you can view your credit reports and all three credit scores. A credit repair specialist from The Credit People will start addressing issues on your credit report right away.

Improvements to your credit score typically become noticeable within the first 60 days, and your credit continues to improve each month for as long as you remain with the service. The Credit People are committed to working diligently on your behalf to achieve the best results possible. Should you need to, you can contact customer service at any time to cancel your service.

The Credit People’s Credentials

Like all credit repair companies, The Credit People is subject to regulation by the Consumer Financial Protection Bureau (CFPB), a federal agency established to shield consumers from deceptive, unfair, and abusive practices.

The Credit People is regulated under the Credit Repair Organizations Act (CROA), a consumer protection law enacted by Congress. This law is designed to prevent credit repair organizations from engaging in deceptive or misleading behavior, ensuring that consumers receive honest and transparent services.

Regulatory or Legal Actions

There are no government or regulatory actions involving The Credit People that have been found in media searches or within the Consumer Financial Protection Bureau’s databases.

While we strive to provide accurate and up-to-date information on regulatory and legal actions, we cannot guarantee the completeness or current status of this information. As always, it’s advisable to conduct your own research and due diligence before making any purchasing decisions.

The Credit People’s Accessibility

The Credit People offers its services across the entire United States. Customers can reach out to them via phone and email. While the agency does not currently offer a mobile app or online chat options, it does provide an online account portal.

This online account allows all customers to access their credit reports and track the progress of their credit repair journey conveniently. This feature helps ensure that customers can stay informed about their credit status and any changes as they occur.

Availability

The Credit People provides customer support through phone or email, allowing for personal interaction to assist with any inquiries or issues. Customers benefit from 24/7 access to their online accounts, where they can monitor their credit repair progress and access their reports at any time.

For those interested in exploring their services, The Credit People also offers a free consultation. Prospective customers simply need to fill out a form to get started, making it easy to learn more about how they can benefit from the credit repair services offered.

Contact Information

You can reach The Credit People through various methods to suit your preference:

- Phone: Call them at 866-382-3410

- Fax: Send a fax to 1-866-361-5721

- Email: For general inquiries, email [email protected]

- Online Form: Fill out the form available on the “Contact Us” page of their website for direct inquiries.

Additionally, for specific concerns or feedback, you can use the following email addresses:

- Comments and Feedback: [email protected]

- Investor Relations: [email protected]

These contact options provide multiple avenues to get in touch with The Credit People, whether for service inquiries, feedback, or investor relations.

User Experience

Most customer complaints regarding The Credit People stem from dissatisfaction with the service, particularly if they do not observe progress in their credit repair efforts after at least three months or if they experience a decrease in their credit score after enrolling with the company.

Such feedback highlights the importance of setting realistic expectations and understanding the potential variability in credit repair outcomes.

>> The Credit People – Best Credit Repair Company >>

The Credit People Reviews From Real Users – How Legit Is It?

The Credit People is recognized as a reputable online LLC formation service, receiving many favorable reviews from its satisfied customers. Let’s explore some of the testimonials posted on Customer Affairs.

The Credit People has an overall rating of 3.9 out of 5. 71% of its users and customers are satisfied with the services.

Alternatives to The Credit People

CreditRepair.com has been operating for a decade and has successfully facilitated the removal of 8.2 million items since it started. The company focuses on addressing discrepancies in customers’ credit reports across all three credit bureaus, requires creditors to verify reported negative items, and actively monitors customers’ credit to assist them in achieving their financial objectives.

Customers can choose from three distinct packages, each tailored to different needs, and can start with a free consultation to determine the best fit. The packages are priced from $69.95 to $119.95, with a startup fee that matches the monthly service fee. A significant advantage of choosing CreditRepair.com is that each package includes credit monitoring, a feature not universally offered by all credit repair services.

Lexington Law has been a prominent player in the credit repair industry for over 15 years, earning a reputation as one of the most trusted companies. It was established with the mission to transform the credit repair sector by offering ethical and effective services to those in need.

Lexington Law helps clients navigate their credit improvement journey through three tailored service packages, each designed to provide a clear path to achieving financial goals.

To bolster customers’ credit, Lexington Law focuses on four key areas: credit report analysis, credit disputing, dispute escalation, and credit score analysis and monitoring.

Clients can benefit from no setup fees and access service packages starting at $95.95. Lexington Law supports veterans and active military personnel by offering a 50% discount on the first-work fee. There’s a family or household discount available, providing a one-time 50% discount for a customer’s spouse when both sign up for services together.

Credit Saint has established itself over 17 years as a reliable entity in the credit repair industry, bolstered by a strong reputation. They provide a free consultation for new customers, handling all interactions with the credit bureaus once a service package is selected.

Customers have the option to choose from three different packages, starting at $79.99 per month with a minimum setup fee of $99, offering a range of services tailored to diverse credit repair needs.

Sky Blue has been providing credit repair services since 1989, boasting over 30 years of experience. Their approach to credit repair is consistent with industry standards. Once you complete the sign-up process, Sky Blue will examine your credit report to identify any items that could be disputed. During this initial review, they also offer practical, personalized advice to help you begin rebuilding your credit.

Following this, Sky Blue will challenge incorrect entries with the three major credit bureaus. If these disputes are not initially accepted, the company will continue the effort by automatically sending repeat dispute letters. This persistence aims to enhance your chances of achieving a credit score increase.

The Credit People Review – Frequently Asked Questions

Bottom line

If you’re looking to improve your credit but need more time, The Credit People can handle the dispute process for you and work directly with your creditors. You can choose a monthly payment plan, which you can cancel at any time.

The Credit People offers a satisfaction guarantee, providing you with peace of mind and assurance that they’re committed to helping you manage your finances effectively.

Sections of this topic

Sections of this topic