Considering Optima Tax Relief for your IRS debt issues? Before you decide, check out this review!

Dealing with tax debt can be incredibly stressful, and finding the right help is crucial. We’ve explored the ins and outs of tax debt relief and discovered that while there’s a mix of good and bad, Optima Tax Relief stands out as the real deal.

Here’s a detailed look at the pros, cons, and essential details about Optima Tax Relief to help determine if they’re the right choice for easing your tax debt.

>> Optima Tax Relief for Tax Relief Service >>

What is Optima Tax Relief?

Optima Tax Relief is a firm that specializes in helping both individuals and businesses tackle tax challenges and IRS debt issues across the United States. They support a range of tax-related concerns, including tax debt, back taxes, IRS audits, tax penalties, and more.

Optima Tax Relief Cost

Optima Tax Relief offers a fee structure that starts with a free initial consultation to evaluate a client’s tax situation. Following this, they charge a $295 investigation fee to assess further and understand the case’s complexity.

The total cost for their services can vary significantly depending on the specific tax issue and its complexity, with resolution fees generally ranging from $995 to $5,000.

It’s crucial to note that these fees can change and may differ based on individual circumstances and the extent of work needed to resolve the tax problems. Clients can contact Optima Tax Relief directly for the most precise and current fee information.

>> Get Help Now with Optima Tax Relief! >>

Optima Pros and Cons

Pros

Well-established and reputable

Optima Tax Relief is recognized as a well-established and reputable company in the tax relief industry. They boast an A+ accreditation from the Better Business Bureau (BBB) and have received an “excellent” A rating from the Business Consumer Alliance (BCA). Both organizations assess factors such as the company’s longevity and complaint history to determine their ratings.

Free Initial Consultation

Optima Tax Relief offers a free initial consultation where a tax professional will review your financial and tax situation and outline potential services that could assist you. There’s no obligation to engage their services following this consultation. However, should you choose to proceed, the investigative phase can cost several hundred dollars and might take up to four weeks to complete.

Nationwide Service

Operating online allows Optima Tax Relief to assist taxpayers all over the United States. The company is headquartered in California and is available to new or prospective clients from Monday through Saturday, from 7 a.m. to 6 p.m. PST.

Expert Team

While many might consider hiring an attorney for IRS issues, Optima Tax Relief employs a dedicated team of attorneys and enrolled agents who specialize in tax matters. They offer a more tailored approach and ensure clients are regularly updated throughout the process.

Money-Back Guarantee

Optima offers a unique 15-day money-back satisfaction guarantee. If you’re not satisfied cancel the services within the first 15 calendar days during the Investigation Phase. When Optima contacts the IRS and reviews your options, you’ll receive a full refund without any penalties or obligations. This phase is critical as it often involves a comprehensive review of your situation, which can be highly stressful.

>> Ease Your Taxes with Optima Today! >>

Cons

Minimum tax debt of $10,000 is required

Optima Tax Relief sets a minimum tax debt requirement of $10,000 to work with clients. This threshold is common in the tax relief industry, though some competitors may have lower minimum debt requirements.

Pricing Variability

Optima Tax Relief does not list its prices on its website, as costs depend on the complexity of each case, which can vary widely. Reviews on the BBB website suggest that prices generally range from $1,000 to $5,000, but some customers have reported receiving quotes that differ significantly from this range.

Time to See Results

Tax relief processes with the IRS take time and can be slow, which might be frustrating. Optima uses a two-phase system to address this.

Initial Actions

The first step in their process is to tackle the most pressing issues. This often involves helping clients catch up on filing back taxes for multiple years.

This initial phase is crucial because you can only negotiate a settlement like an Offer in Compromise with the IRS once all your tax returns are filed. Knowing that Optima prioritizes getting these urgent matters sorted can provide significant relief, reassuring you that they’re actively working on your behalf.

Optima Tax Relief offerings

Optima Tax Relief positions itself as a comprehensive solution for your tax issues. Here are the key services the company provides:

Tax Consultation

Before engaging with Optima Tax Relief, you can initiate a free consultation through their website. It’s wise to familiarize yourself with relevant tax questions to maximize this session.

During this consultation, you’ll discuss your tax obligations and possible debts with a team member. Preparing your tax filing documents beforehand is advisable to provide necessary information during the meeting efficiently. The consultant will estimate the cost of their services and suggest possible tax relief strategies.

Tax Preparation

Optima Tax Relief assists with tax preparation, ensuring your documents are ready for filing, including late and state tax returns. If you only require basic tax preparation, it’s beneficial to compare their services against top tax software to gauge your options better.

The team at Optima Tax Relief includes various tax professionals enrolled agents, certified public accountants (CPAs), and attorneys all authorized to represent clients before the IRS. Enrolled agents are IRS-certified and must undergo extensive tax planning exams and continuous education.

CPAs are state-licensed, following rigorous exams and specific work experiences. State courts license attorneys upon earning a law degree and passing the bar exam. Exploring free tax filing options is recommended for those unable to afford tax preparation services.

Tax Relief

Optima Tax Relief targets individuals with a minimum of $10,000 in tax debt. Eligible clients will undergo an initial investigation where Optima’s team compiles and submits all necessary documentation to meet IRS compliance standards. They aim to secure your best possible financial outcome by presenting a strong case to the IRS.

>> Start Using Optima Tax Relief Now! >>

Tax Resolution

The resolution process with Optima can span three to nine months. After a thorough investigation and exploration of your situation, they will outline potential solutions, including:

- Offer in Compromise (OIC) or partial pay installment agreements to reduce tax debts for those unable to pay within the IRS’s ten-year statute of limitations

- Penalty abatement to lessen or eliminate penalties for non-compliance

- Installment agreements for paying off debt in smaller, more manageable amounts

- Tax lien discharge to remove specific property from a tax lien

- Bank levy release to prevent the IRS from seizing bank funds

- Innocent spouse relief for those unknowingly impacted by a spouse’s tax misreporting

Tax Settlement

Optima Tax Relief’s team will negotiate with tax authorities on your behalf to potentially reduce your tax amount or alter payment structures based on current laws and your circumstances. Settlements can be paid in a lump sum or installments, and reaching an agreement places you “in good standing” with the IRS for related tax years.

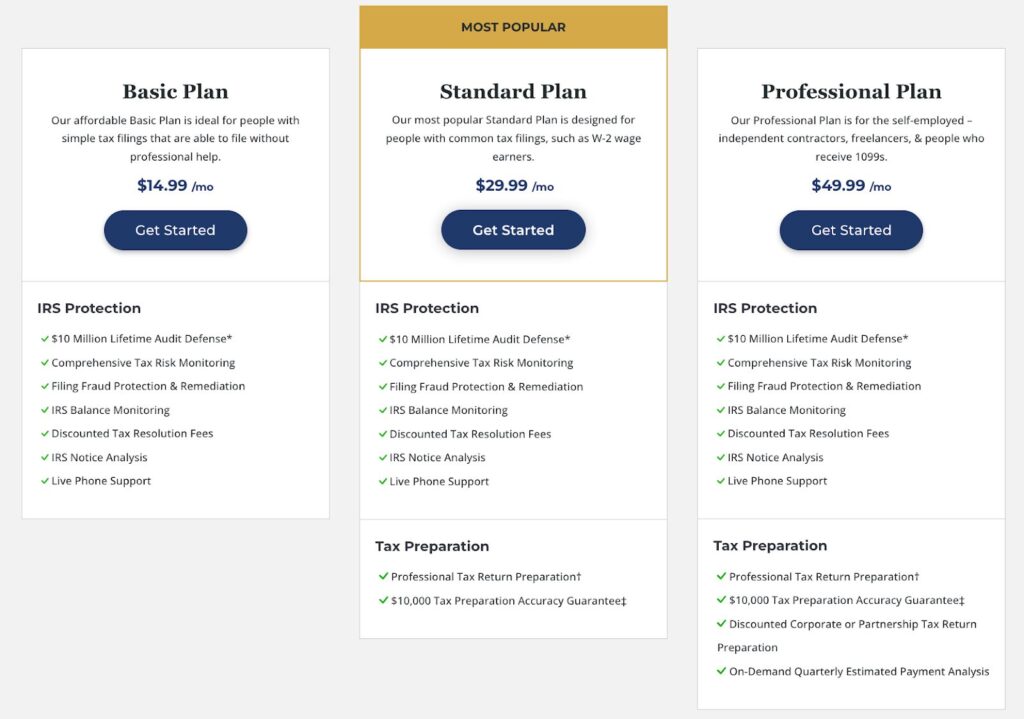

Protection Plan

Optima offers ongoing tax support plans for clients who have resolved their tax issues with the company. These plans include audit defense, IRS balance monitoring, monthly tax risk reports, and discounts on future resolution services. Tax preparation support varies by the plan level:

- Basic: Access to tax preparation software and audit defense, suitable for independent filers.

- Standard: Personal preparation of state and federal returns for wage earners, with a $10,000 accuracy guarantee.

- Professional: Comprehensive tax preparation for self-employed individuals with 1099s, including the same accuracy guarantee as the standard plan.

Optima Tax Relief Accessibility

Availability

Optima Tax Relief is based in Santa Ana, California, and while it does not operate branch locations, it effectively serves U.S. taxpayers across all states and those residing abroad through remote services.

Contact information

- Optima Tax Relief offers convenient access through its mobile app. Additionally, you can contact the company using the following methods:

- Email: [email protected]

- Phone: (800) 536-0734, available Monday to Saturday, 7 a.m. to 6 p.m. PT.

- Mailing Address: 3100 S. Harbor Blvd., Suite 250, Santa Ana, CA 92704.

>> Resolve Tax Issues with Optima Now! >>

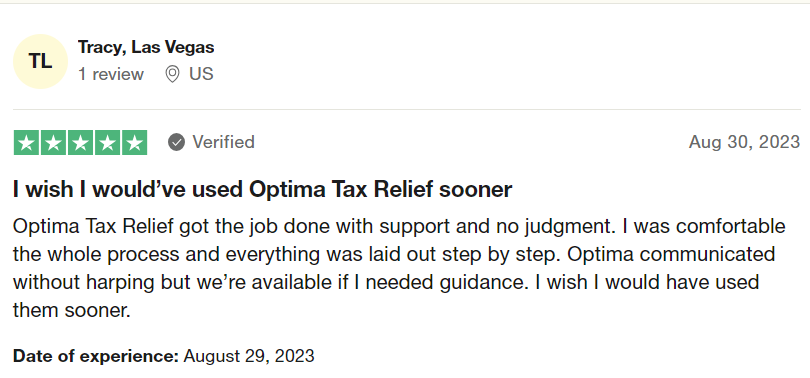

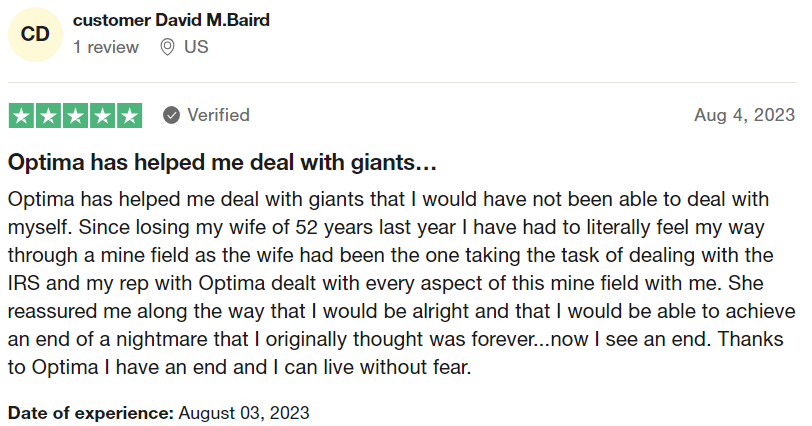

Optima Tax Relief’s Reviews from Real Users – How Legit is it?

To evaluate the legitimacy and effectiveness of Optima Tax Relief, we thoroughly examined online reviews, analyzing personal experiences shared by actual users.

This approach allows us to provide a detailed understanding of the service Optima Tax Relief offers, helping you determine if they’re a reliable and effective company.

Have you checked out Optima’s reviews on Trustpilot? The company boasts an impressive number of positive feedback, with over 2,382 5-star reviews!

Optima Tax Relief has held accreditation with the Better Business Bureau (BBB) since 2012 and maintains an A+ rating. With over 2,000 customer reviews on the BBB website, the company has achieved an average rating of 4.4 out of 5 stars.

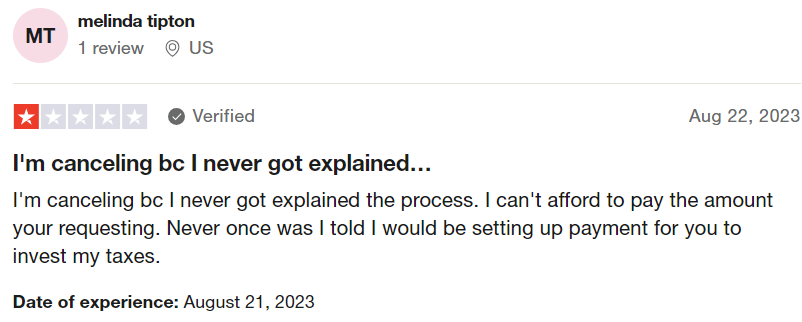

Positive reviews of Optima Tax Relief often highlight the company’s knowledgeable staff and the quality of its services. On the other hand, some complaints point out that Optima Tax Relief did not achieve the promised results and criticize the company for lacking transparent pricing.

Alternatives to Optima Tax Relief

Larson Tax Relief

Larson Tax Relief offers a comprehensive array of business tax services, including handling payroll and federal tax issues, resolving conflicts with revenue officers, and addressing worker classification issues, making it a strong option for business and corporate tax debt relief.

The company provides a wide range of tax debt relief services, catering to both personal IRS tax debt relief and corporate tax assistance, as well as helping to delay or prevent bank levies.

Anthem Tax Services

Anthem Tax Services specializes in IRS tax debt relief and corporate tax preparation. The company assists clients in applying for all available IRS tax debt relief programs, including offers in compromise (OIC), innocent spouse relief, and obtaining a “currently not collectible” status.

Anthem also stands out in the tax debt relief industry with one of the best money-back guarantees. They offer a full refund if they fail to secure any form of resolution from the IRS, such as a reduction in payment amounts or debt forgiveness.

However, it’s crucial to note that this guarantee does not cover the initial investigation fee, which typically starts at $350 and may vary based on the specifics of your case.

Community Tax Relief

Community Tax provides free consultations and charges affordable investigation fees that range from $295 to $500. The company primarily focuses on IRS tax debt relief, but it offers some state tax assistance.

Similar to other firms in the industry, Community Tax manages applications for various solutions, including installment agreements and offers in compromise, although it does not handle innocent spouse relief.

They serve customers facing tax debts starting at $10,000. Community Tax’s money-back guarantee varies by state, offering a full refund within three to ten days if they fail to resolve your tax issues.

Optima Tax Relief Review – Frequently Asked Questions

Here’s a quick FAQ that addresses key questions about Optima Tax Relief, a company specializing in tax debt relief services.

Final Thoughts on Optima Tax Relief Review

Optima Tax Relief is renowned for offering solutions to individuals with tax debts exceeding $10,000. According to its website, the company has successfully negotiated with the IRS for thousands of clients and has resolved over $1 billion in tax liabilities.

Optima Tax Relief provides services remotely to clients across all 50 states and offers a free initial consultation. However, the requirement for a high minimum tax debt may exclude many people who need tax relief assistance.

Moreover, some customers have voiced concerns on the Better Business Bureau (BBB) website about the company’s lack of transparent pricing and discrepancies between the tax settlements promised and those actually delivered.

While Optima Tax Relief is a respected entity in the tax relief industry, it may not be the best fit for every situation. Therefore, we recommend exploring and consulting with multiple tax relief services before making a decision.

Sections of this topic

Sections of this topic