Jackson Hewitt is renowned for its face-to-face tax preparation services, available at almost 6,000 physical locations across the United States, with 3,000 conveniently situated within Walmart stores. In addition to providing in-person assistance, Jackson Hewitt allows customers to file their tax returns online independently.

This evaluation presents our analysis of Jackson Hewitt’s online tax filing software. We aim to determine if this solution suits your needs and provide insights into the associated costs.

Jackson Hewitt at a Glance

Jackson Hewitt boasts a longstanding presence in tax preparation, mirroring H&R Block’s nationwide office network. In 2014, it introduced its software for self-directed online filing, aligning with its business ethos of catering to customers who may find tax returns daunting.

These individuals can still avail themselves of nearby physical locations and consult with tax professionals face-to-face.

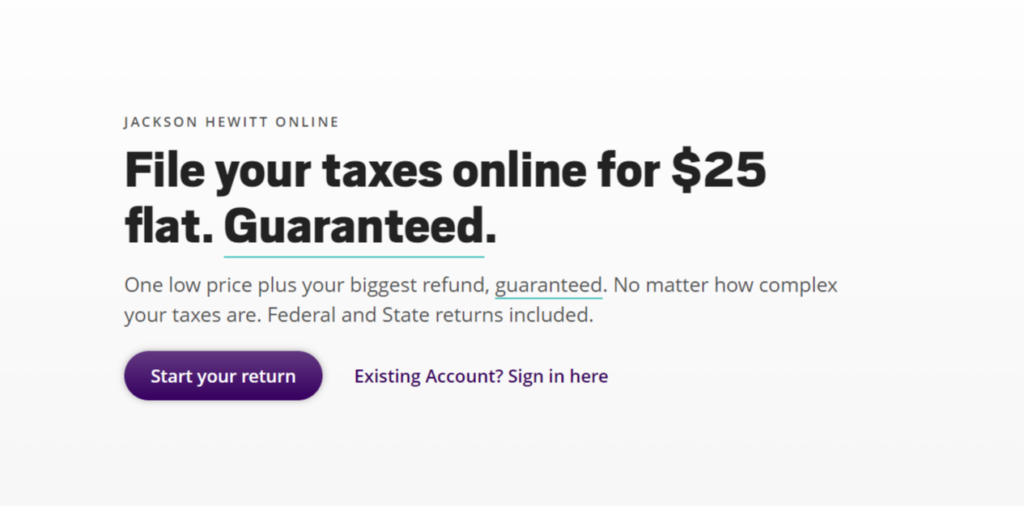

For those comfortable managing their returns, Jackson Hewitt offers a competitively priced flat rate of $25, covering federal filing, accommodating any required state filings, and access to live chat assistance.

Operating on a cloud-based platform accessible via desktop or mobile devices, Jackson Hewitt’s system doesn’t offer offline software for users preferring to store their returns locally.

Regarding value, Jackson Hewitt presents an appealing proposition compared to its competitors’ premium options. For instance, TurboTax Deluxe, lacking live chat support, commands $69 plus $59 per state, while a similar H&R Block service costs $35 plus $37 per state.

Diverging from its rivals, Jackson Hewitt eschews tiered pricing based on the complexity of returns, maintaining a consistent rate regardless of whether it’s a straightforward 1040 form, investment-related gains and losses, or business expenses incurred by gig workers.

>> File Your Taxes Online With Jackson Hewitt >>

- Compared to other tax filing tools, it only sometimes upsells you

- Jackson Hewitt offers a flat fee of $25 to file your federal and state returns, including multiple state returns

- The software features an intuitive interface where you can easily navigate the sections you must complete

- It provides a three-year price lock guarantee, allowing you to file for the same price in 2022, 2023, and 2024

- You can’t import or upload a W-2 or 1099

- Customer support is unable to offer tax advice

- It doesn’t provide free tax filing, even for simple returns

How Much Does Jackson Hewitt Online Cost?

Previously, Jackson Hewitt provided three online DIY tax preparation options at different price points. However, they have now consolidated their offerings into a package priced at $25, including filing for federal and state returns.

This pricing is significantly lower than most other online tax services, as they typically charge higher fees for filing a federal return. Jackson Hewitt supports all major IRS forms and schedules, allowing users to complete even complex returns that involve self-employment and investment income.

For comparison purposes, H&R Block Self-Employed offers a similar set of forms and schedules but comes with a suggested retail price of $85. State returns are an additional $37 each.

TurboTax Self-Employed charges $89 for federal filing and an additional $39 per state return. TaxSlayer Self-Employed costs $52.95 plus an extra fee of $39.95 per state return.

Lastly, TaxAct Self-Employed’s rates are set at $69.99 for federal filing and an added cost of $39.99 for state returns. It’s important to note that prices for any or all of these services may increase later in the filing season, as this is customary yearly.

However, all these alternative options offer better user experiences and more comprehensive assistance compared to what you would receive from Jackson Hewitt’s online DIY tax preparation service.

>> Check Out the Cost for Jackson Hewitt >>

Is Jackson Hewitt Safe to Use?

Jackson Hewitt, like its rivals, implements a multi-tiered approach to security. While not mandatory, they offer support for multi-factor authentication and ensure that all data transmitted from your devices is encrypted. Moreover, the service promptly notifies you of account activity, such as password resets or e-file submissions.

When providing personal or financial information on websites, PCMag advises taking additional precautions to safeguard oneself. These include utilizing a trusted network like your home Wi-Fi network.

How Does Jackson Hewitt Work?

Tax preparation websites operate similarly, although their user experiences and guidance resources can differ significantly. Jackson Hewitt takes an approach akin to that of a human preparer by conducting an “interview” with you.

During this process, it asks about your income and expenses from the previous tax year using a tool resembling a wizard. To answer these questions, enter data, click buttons, or select options from lists on each page before moving forward. Notably, you won’t directly encounter official IRS forms and schedules.

Behind the scenes, Jackson Hewitt handles all necessary calculations and transfers your responses onto IRS documents. Throughout the process, various forms of assistance are available to aid you along the way.

Once you’ve completed all relevant tax situations (tax topics), the website reviews your answers for potential errors or omissions. The final step involves paying for the service while receiving support in printing or electronically filing your return.

>> Jackson Hewitt: Get the Tax Help You Deserve >>

How Do You Get Started With Jackson Hewitt?

To begin, you must create an account and establish your security preferences. Afterward, Jackson Hewitt commences with a comprehensive Q&A session that requests personal information such as your family members’ birthdates and Social Security numbers and your filing status.

The platform can import that data if you use Jackson Hewitt for your 2022 tax filings. Compared to other online tax preparation websites, excluding Jackson Hewitt and Liberty Tax, importing data from a competing website used in the previous year for filing purposes is impossible.

Once you have completed this initial step in preparing your tax return, you can further address income, deduction, and credit matters. This is accomplished through a combination of checklists and guided question-and-answer formats.

How Does Jackson Hewitt Deal With Self-Employment?

Jackson Hewitt provides a comprehensive Q&A section that covers all the tax topics related to Schedule C, which is the primary form for self-employment. This includes various sources of income such as 1099-K, 1099-NEC, and 1099-MISC, as well as other income not reported on these forms.

It addresses general expenses like advertising and office supplies, vehicle expenses, and the business use of the home. Even gig workers who earn a modest amount of around $5,000 by driving for Uber can benefit from Jackson Hewitt’s thorough coverage because they can offset their income with allowable expenses.

>> Handle Self-Employment With Jackson Hewitt >>

What Products Does Jackson Hewitt Offer?

Jackson Hewitt provides tax preparation services online and at physical locations, including approximately 2,600 Walmart stores throughout the United States. The cost of filing taxes with Jackson Hewitt in person can vary based on factors such as income type, filing status, and required forms.

One notable feature of Jackson Hewitt’s DIY filing option is its fixed fee of $25. This fee covers both federal and unlimited state returns.

The package includes all necessary IRS forms and schedules; however, you must ensure the completion of each required form relevant to your specific circumstances while maintaining accurate information. It should be noted that the software offers limited guidance when it comes to filling out complex forms.

Other Notable Features of Jackson Hewitt

Jackson Hewitt’s online tax preparation software provides several noteworthy assurances:

- 100% Accuracy Guarantee: Jackson Hewitt commits to covering IRS penalties and interest incurred due to software calculation errors. Customers must write to Jackson Hewitt within ten days of receiving an IRS notice. They are responsible for filing the amended return themselves.

- Maximum Refund Guarantee: If customers find a larger refund with another service, Jackson Hewitt refunds the $25 fee.

Jackson Hewitt’s tax assistance tools and support may be less noteworthy, but the help section contains a helpful search function at the bottom of the page. This feature allows you to quickly access forms by conducting a keyword or form number search.

For example, entering “child care” in the search bar will take you directly to IRS Form 2441 for child and dependent care expenses. However, it’s important to have a good understanding of your taxes to make full use of this functionality.

One standout feature of Jackson Hewitt is its Security Center. Accessed through the My Account link, this page offers a comprehensive range of options. You can configure or change multifactor authentication settings here, view current and historical session data, and add or remove trusted devices.

Should you decide that Jackson Hewitt’s service is not suitable for your needs after creating an account, deleting your account is a simple process. By clicking on the My Account tab and scrolling down to the bottom of the page, you can select “Delete your account.”

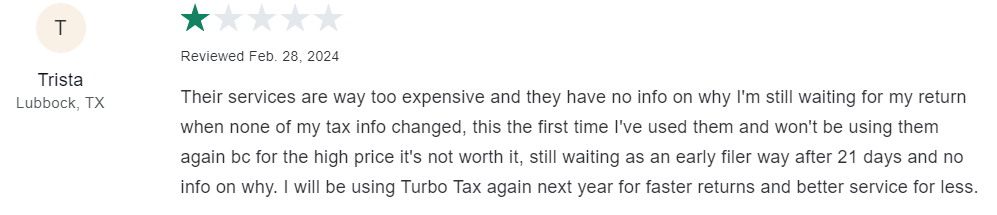

Jackson Hewitt Tax Software Reviews – Is It Legit or Not?

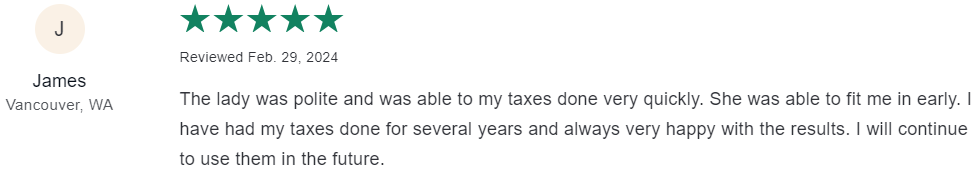

If you have any lingering uncertainty regarding the legitimacy of Jackson Hewitt after reviewing all the information, take solace in these genuine customer reviews that share their firsthand experiences with the company.

Jackson Hewitt Tax Software Alternatives

TurboTax

Intuit TurboTax is our top choice for small businesses looking for online tax software. This is due to its user-friendly interface, extensive database of deductions and credits, and dedicated support for startups.

It provides a comprehensive solution that caters to businesses of all sizes and types, although it may come at a higher cost than other tax software programs.

When selecting from the various service tiers Intuit TurboTax offers, small business owners should opt for either the TurboTax Self-Employed online package or the TurboTax Business application. These options are specifically designed to meet the needs of small business owners.

>> File Your Taxes Online With TurboTax >>

TaxSlayer

TaxSlayer is an excellent choice for small business filers due to its ability to handle complex returns while offering competitive pricing compared to other major players in the industry. With TaxSlayer, you can expect a priority phone line, top-notch customer service, and a user-friendly platform that simplifies tax filing.

What sets TaxSlayer apart is its customizable level of assistance. The guided interview feature provides a step-by-step walkthrough, ensuring quick and accurate filing.

However, if you prefer more independence, you can directly navigate to specific tax forms to efficiently input your income and deductions. This alternative proves especially beneficial if you know what information is required.

>> File Your Taxes Online With TaxSlayer >>

H&R Block

While H&R Block is widely known for its physical office locations across the United States, it also provides online filing options and downloadable computer software. If you opt for their online package, you can conveniently manage your taxes using their mobile app, which is available for both Android and iOS devices.

With a user-friendly interface, H&R Block caters to many tax filers by guiding them through a series of questions about their household income and potential deductions and tax credits. Similar to other tax-preparation services, they aim to simplify the process and ensure users can easily navigate it.

>> File Your Taxes Online With H&R Block >>

FAQs – Jackson Hewitt Tax Software Review

Final Thoughts – Jackson Hewitt Tax Software Review

Jackson Hewitt offers an online tax preparation software that provides all the tools for filing taxes at an affordable cost.

This software is most suitable for individuals who prefer to handle their tax returns, are knowledgeable about their tax situation, and can accurately report their income, deductions, and credits. However, those seeking additional support and guidance may find the software needs to improve in these areas.

Sections of this topic

Sections of this topic