If you’re seeking tax software on a budget, this is the one for you. FreeTaxUSA is an online platform that allows you to prepare, print, and electronically file your taxes without any cost. This applies specifically to filing your Federal income tax return. It seems like a reliable option for online tax preparation software, and it even offers a minimal fee for state returns.

Now let’s delve into our FreeTaxUSA return and by the end of it all, you’ll have a clear idea if this software meets your needs for filing taxes.

What Is FreeTaxUSA?

FreeTaxUSA offers a tax software solution that streamlines filing both federal and state tax returns. This tool effectively removes the burden and anxiety faced by small and midsize businesses in managing their taxes.

What sets FreeTaxUSA apart is its highly competitive pricing. Among other tax software options, it boasts one of the most affordable plans available in the market. Users can take advantage of a 30-day free trial or opt for the free version, although this version comes with certain limitations. For those looking for more comprehensive features, the Deluxe version is an inexpensive option that provides access to all functionalities not found in the free version.

One of FreeTaxUSA’s key strengths lies in its array of features designed to simplify various aspects of tax filing, reviewing, and modifying processes. With these tools at your disposal, navigating through your taxes becomes much easier and more efficient.

Who Should Use FreeTaxUSA Tax Software?

For taxpayers with straightforward returns and no need to file a state return, FreeTaxUSA is an obvious choice. It’s also ideal for those with multiple 1099 forms, unemployment income, or dependents. These particular tax situations can often push people into paid tiers when using services like TurboTax, H&R Block, or TaxSlayer.

Individuals who received long-term care or death benefits from insurance companies or the government should also consider FreeTaxUSA. This software supports Form 1099-LTC, which isn’t typically offered in other free tax software options.

If you earned a significant amount of money in foreign countries, FreeTaxUSA includes Form 1116 for claiming the foreign tax credit, another feature that sets it apart from other free tax software programs available on the market today.

FreeTaxUSA could be a great option for self-employed individuals who are looking for an affordable way to file their taxes. Typically, tax preparation services tailored to gig workers and freelancers can be quite expensive.

However, FreeTaxUSA stands out because it allows users to enter as many 1099 forms as they need without any additional charges. CashApp Taxes also offers this same benefit, but their professional tax support needs to be improved.

For freelancers who require assistance from a tax professional well-versed in self-employment taxes, TaxSlayer may be worth considering. They offer a broader range of services at a reasonable price.

It’s important to note that there are some rare tax situations that FreeTaxUSA doesn’t cover. These include nonresident alien returns (Form 1040NR), at-risk limitations (Form 6198), and business-related casualty or theft gain or loss, as well as donations of property over $5,000.

However, if you’re specifically looking for free live chat features or an entirely free option for filing your taxes, you may need more than FreeTaxUSA to meet your needs.

Pros & Cons of FreeTaxUSA

- Free federal electronic filing, low-cost state filing

- Compatible with all primary forms and schedules

- Abundant assistance avenues

- Superb mobile website

- Reasonably priced professional tax assistance

- Unable to import the majority of 1099s

- Help documentation lacks clarity, particularly regarding Q&A pages

FreeTaxUSA Features

Discover the advantages of utilizing FreeTaxUSA for the preparation and electronic filing of your income tax returns.

Even Complicated Tax Situations Are Covered By Both Editions

When it comes to tax preparation software programs, many require you to purchase a premium version to handle specific types of income sources like self-employment, rental real estate, capital gains transactions, and K-1-related income. However, FreeTaxUSA stands out by offering the capability to handle these on both their Free and Deluxe editions.

Unlike other major players in the tax software industry, FreeTaxUSA doesn’t limit access to certain forms based on your chosen version. The upgraded version simply provides additional support rather than additional forms. This means that with the free option, you can likely file all the necessary tax forms without any issues.

Accuracy Guaranteed

Similar to other tax preparation software available online, FreeTaxUSA provides a guarantee on the accuracy of their tax calculations. If you’re assessed by the IRS due to an error in their software’s calculation, they will cover any interest and penalties incurred.

FreeTaxUSA Security

FreeTaxUSA, an IRS e-file provider, safeguards your personal information by encrypting it on their platform. Moreover, they ensure security and privacy verifications via Truste, Norton, and SecurityMetrics.

Online Backup and Account Rollover

FreeTaxUSA offers the convenience of online backup for your completed tax returns, even with their free version. If you use the software two years in a row, the free version automatically transfers last year’s information to your current year’s taxes.

Even if you didn’t file with FreeTaxUSA in the previous year, there’s still an option to import some of your tax information from another service. This new feature allows for a PDF import of your prior year’s tax returns.

We tested out this year’s software and tried the PDF import option. We found it incredibly user-friendly and it seamlessly uploaded my personal information and details about my previous employer. This feature definitely helps save time during tax preparation.

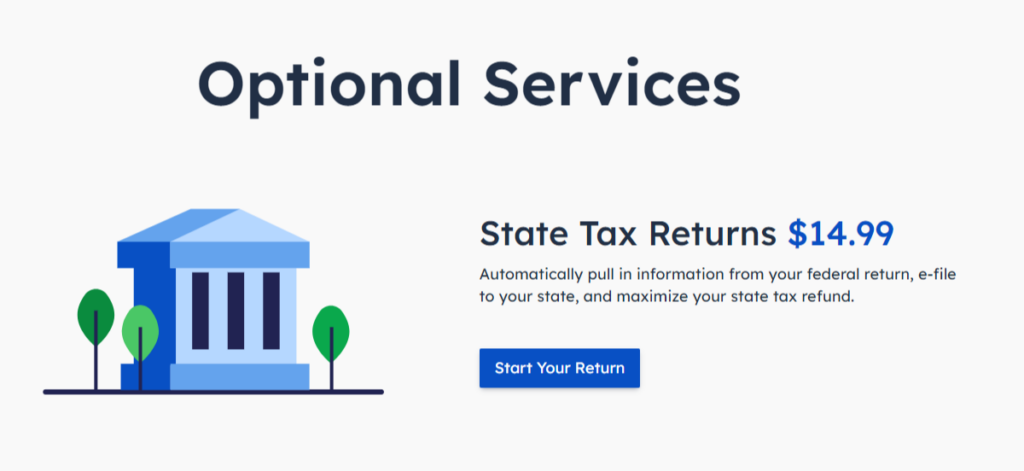

Inexpensive State Returns

Like other tax preparation software services, there’s an additional fee for e-filing your state tax return with FreeTaxUSA. However, the cost of filing state returns through their platform is comparatively affordable. This year, you only need to pay $14.99 to file your state returns using the information from your federal tax return and any additional details you provide.

Interface & Ease of Use

FreeTaxUSA’s interface may not be as flashy as some other pricier software options, but it still offers all the essential features. These include a refund tracker that updates in real-time and convenient tabs for different sections of your tax return.

Unlike certain other software choices, FreeTaxUSA doesn’t allow you to jump ahead. You’ll need to follow a sequential order. However, once you’ve entered information in a section, you can always go back to previous sections and make any necessary changes or additions.

If you plan on completing your taxes all at once, this limitation should be manageable. However, if you’re like me and prefer entering each form as it comes in, there may be more efficient options for you than FreeTaxUSA. Nonetheless, it ensures that no sections are missed when filing your taxes.

What Products Does FreeTaxUSA Offer?

FreeTaxUSA promotes its tax software with four distinct service levels: Basic, designed for straightforward tax returns. Advanced, tailored for homeowners and those who claim itemized deductions; Premium, ideal for landlords and investors; and Self-Employed, specifically crafted for freelancers, contractors, and gig workers.

What sets FreeTaxUSA apart from its top competitors is that all of its plans include free federal returns. In our opinion, this eliminates the need for tiered pricing. All plans use the same software. Once you begin the tax preparation process with FreeTaxUSA, there will be no further references for the different tiers.

How Does FreeTaxUSA Work?

FreeTaxUSA has launched a beta edition of its W-2 form upload feature this year, which enhances the user experience by automating certain parts of the data entry process. However, there’s still a need for manual input for information that isn’t automatically captured and other tax forms.

Despite having the fancy interfaces found in its more expensive competitors and needing more direct recommendations for tax filing statuses, FreeTaxUSA makes up for these shortcomings with its comprehensive and complimentary integrated help features.

These features include contextual questions in their support center, providing valuable guidance without requiring users to open new tabs or windows. The software follows a guided question-and-answer format that’s efficient and straightforward, leading users through different sections of the tax return process. It only allows skipping ahead to different sections once they’re reached within the guided process.

Although FreeTaxUSA doesn’t have a dedicated mobile app, its mobile browser version works effectively. It allows for easy syncing of data between devices and includes a link to preview or download the 1040 form.

>> File Your Taxes With FreeTaxUSA Today! >>

How Much Does FreeTaxUSA Cost?

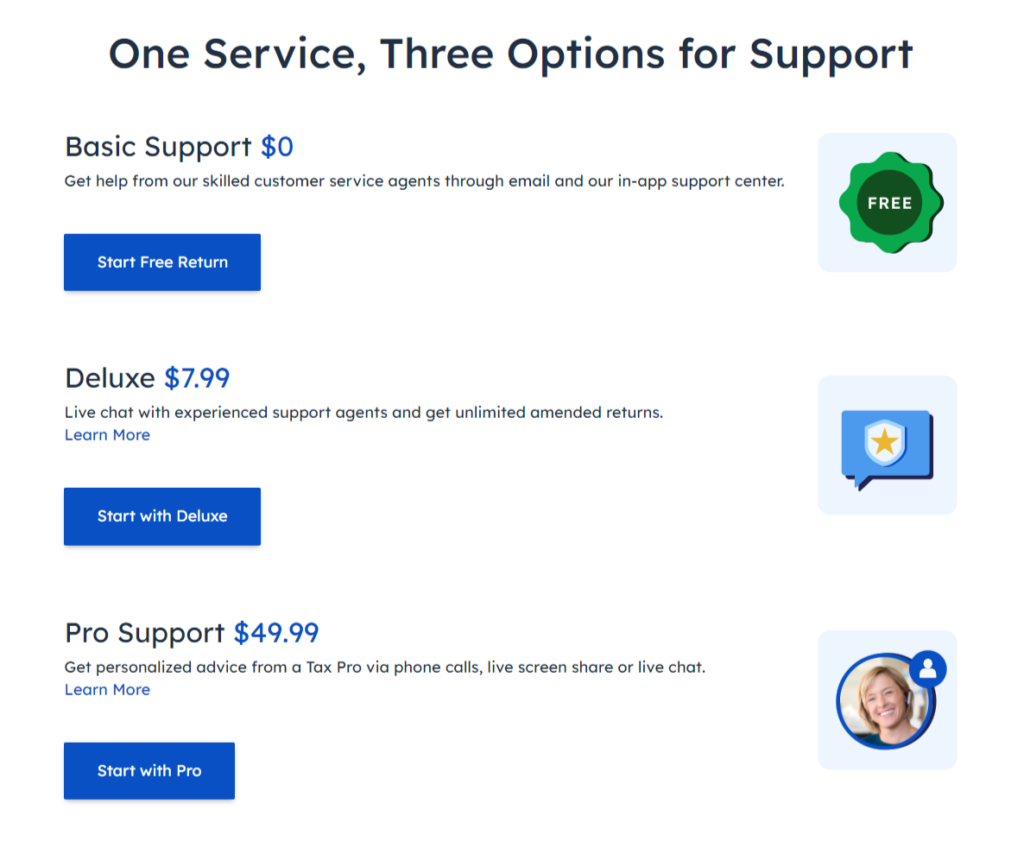

FreeTaxUSA offers free federal returns, while state returns cost $14.99. If you opt for the Deluxe version at $7.99, you’ll receive advanced support. However, if you want to ask professional tax-related questions by phone, chat, or screen share regarding both federal and state taxes, it will cost you $49.99.

On the other hand, Cash App Taxes have always been free for both federal and state returns but need comprehensive customer support. FreeTaxUSA stands out in comparison with its extensive online guidance.

Many tax software providers offer free versions; however, these only cover basic tax situations. To report self-employment income and expenses accurately, one may have to pay over $100 for their federal return alone and additional fees for state returns as well.

Considering what is included in their services, FreeTaxUSA offers relatively low rates compared to other alternatives available in the market today.

>> Check Out the Best Pricing for FreeTaxUSA >>

Is FreeTaxUSA Safe to Use?

FreeTaxUSA, an approved provider of IRS e-file services, affirms that it fulfills or surpasses the security criteria established by the IRS. By utilizing SSL certificates, the website encrypts your connection and ensures the protection of sensitive data.

Stringent data security measures are implemented to safeguard against payment information theft. The company undergoes annual evaluations of its privacy practices and supports Multi-Factor Authentication (MFA). Your information is in capable hands with FreeTaxUSA.

How Does FreeTaxUSA Deal With Self-Employment Income and Expenses?

FreeTaxUSA stands out as one of the two online platforms for tax preparation that offers free filling of Schedule C forms. This is especially beneficial for independent contractors such as Uber drivers and Etsy sellers, who could save over $100 compared to other websites like TurboTax and H&R Block, which charge additional fees for filing Schedule C.

These competing tax preparation services provide more extensive guidance specifically tailored to sole proprietors than what FreeTaxUSA currently offers. However, by diligently following the instructions provided on the site and using its available resources, FreeTaxUSA may still be sufficient for your needs.

The FreeTaxUSA’s Schedule C section begins by asking some initial questions and then presents fields and boxes where you input the corresponding details from your 1099-NEC and 1099-MISC forms. Unlike TurboTax, you can’t simply upload copies of the forms to have the data automatically extracted. Any income that wasn’t previously reported on these two forms, including 1099-K totals, should be entered on a separate page.

After reporting all your income, you must provide the amount you spent on various business expenses grouped by category, such as office expenses, advertising, utilities, and travel.

There’s an option to include miscellaneous expenses. If you still need to organize and keep track of your tax-deductible business costs throughout the year, be prepared for a lengthy session. There are additional pages dedicated to collecting information about costs related to vehicles, health insurance, and home office deductions, among others.

>> File Your Tax With FreeTaxUSA >>

Does FreeTaxUSA Check Your Return?

Once you have entered all the information regarding your income and expenses, FreeTaxUSA provides an additional feature called the Refund Maximizer. This tool identifies any possible opportunities for reducing your income tax liability.

Similar to other online tax services, FreeTaxUSA conducts accuracy checks throughout the process. However, it goes a step further by conducting a final review after you have completed your state return.

If you owe money to the IRS instead of receiving a refund, there are several options available for making payment. FreeTaxUSA offers convenient methods such as credit card payments or direct withdrawals from your bank account. Alternatively, you can make payment directly to the IRS using either a credit/debit card or bank account through their Direct Pay site.

FreeTaxUSA Reviews – Is It Legit or Not?

If you’re still unsure about the legitimacy of FreeTaxUSA, we have gathered genuine customer reviews to address your concerns.

FreeTaxUSA holds a rating of 3.1 stars, reflecting a mix of positive and negative experiences from users. While many customers rave about their exceptional service, others express frustration regarding refund matters.

FreeTaxUSA Alternatives

Intuit TurboTax stands out as our top choice among online tax software for small businesses. Its user-friendly interface, vast database of deductions and credits, and tailored support for startups make it the ideal solution.

Regardless of the size or type of your small business, TurboTax offers an effortless and all-inclusive experience. While it may come at a slightly higher cost compared to other tax software programs, its value is undeniable.

Within the Intuit TurboTax platform, small business owners should consider either the online package designed specifically for self-employed individuals or the dedicated TurboTax Business application.

TaxSlayer stands out as an excellent choice for small business filers due to its ability to handle complex returns at a competitive price compared to other major players. The platform offers a priority phone line, efficient customer service, and a user-friendly interface, making tax filing hassle-free.

Moreover, TaxSlayer allows you to personalize the level of assistance you receive. Opting for the guided interview option guides you through each step of the process, ensuring quick and accurate filing.

Alternatively, if you’re confident in your knowledge and don’t require extra guidance, you can directly access specific tax forms to input your income and deductions. This streamlined approach is ideal if you already know what information is required.

TaxSlayer provides an all-inclusive solution tailored for small businesses seeking efficient and cost-effective tax filing services. With its range of features and customizable options, it simplifies the process while ensuring accuracy in reporting financials.

While H&R Block is widely known for its physical offices across the United States, it also provides online filing options and downloadable software. Opting for their online package allows you to manage your taxes using their mobile app available on both Android and iOS devices.

H&R Block caters to a large number of tax filers by offering a user-friendly interface that’s modern and easy to navigate. Similar to other tax preparation services, the platform guides users through a series of inquiries regarding their household income, along with opportunities for deductions and tax credits.

FreeTaxUSA: FAQs

Here are some common questions about FreeTaxUSA:

Final Thoughts

If you’re looking for a straightforward and mostly free method of electronically filing your taxes, FreeTaxUSA is a reliable choice. While the Deluxe version offers additional support features, if you have good bookkeeping skills and have kept your paperwork organized before filing time, the basic version is perfectly sufficient.

Although there are some mentioned drawbacks, if you want to minimize expenses as much as possible, FreeTaxUSA will help you reach the point of filing without causing any financial strain.

Sections of this topic

Sections of this topic