Community Tax Relief is a comprehensive tax debt relief company providing various services to help you manage tax debt. Whether it’s negotiating tax liabilities, planning future taxes, filing returns, or optimizing your business’s accounting practices, Community Tax is equipped to assist. With a track record of serving over 100,000 clients and managing over $800 million in debt, their experience is extensive.

In this blog, I’ll cover everything you need to know about Community Tax services to help you determine if they’re the right choice for you.

>> Consider Community Tax for Tax Relief >>

Established in 2010, Community Tax is committed to delivering comprehensive tax resolution, preparation, and bookkeeping services. The company has built a strong reputation for tackling complex tax issues with professionalism and deep expertise, catering to individuals and businesses.

Community Tax’s primary goal is to ease the stress and uncertainty often accompanying federal and state tax problems. It focuses on resolving various tax challenges, including back tax debts, and offers services such as Offers in Compromise, installment agreements, and guidance on various IRS programs.

Community Tax is ideally suited for individuals and businesses facing significant tax challenges or those needing advanced tax preparation and strategic guidance. This includes those struggling with tax debts or seeking effective tax planning and compliance solutions.

Pros & Cons of Community Tax

Pros

Community Tax offers a no-charge chat for anyone curious about their services. They cover a range of options, including tax prep, bookkeeping, accounting, and tax resolution services.

This firm covers a vast area and is proud of its top-tier customer service, complete with a handy mobile app. They’ve been around the block, serving over 100,000 clients and managing over $800 million in tax debt since their start.

Pros include:

- Nationwide service coverage

- Commitment to customer clarity with free, unlimited initial consultations

However, not everything is sunshine and roses. One snag is their opaque pricing. Community Tax keeps the cost details under wraps on its website, which might put off folks looking for quick cost info. Also, a sparse selection of public case studies or testimonials makes it tough to measure their full effectiveness across different tax issues.

For a company that’s a whiz at tax management, a clearer pricing structure and more robust case studies or testimonials on their website would really up their game. This way, potential clients can better grasp what they’re diving into, helping them make more informed choices.

How Does Community Tax Work?

Community Tax kicks things off with a gratis consultation, a vital first move to grasp the tax challenges individuals or businesses face, assessing their eligibility. There’s a catch, though; clients need at least $7,000 in tax debt.

The squad at Community Tax, stocked with enrolled agents and CPAs, dives into many tax dilemmas. While fees differ, the firm commits to clear pricing. For those wanting a deeper dive into tax services, the Community Tax Assurance Program (TAP) is up for grabs at $39 monthly. How long it takes to resolve tax issues varies, as it hinges on the complexity of each specific case.

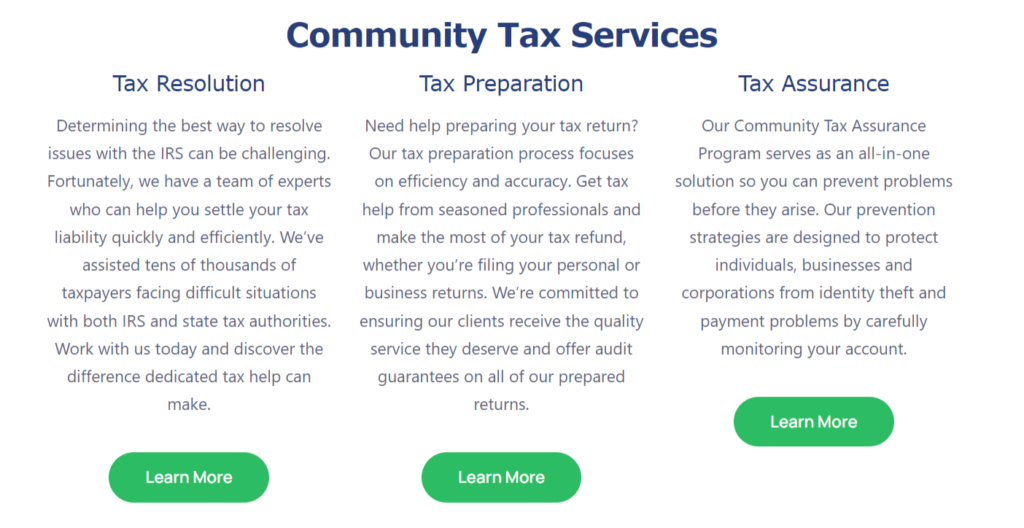

What Services Does Community Tax Offer?

Community Tax stands out with its all-encompassing array of services to meet diverse tax-related demands. Their integrated approach merges tax resolution, preparation, and assurance into a seamless package. Here’s what they offer:

- Tax resolution: They excel at settling tax debts through personalized strategies like Offers in Compromise and installment agreements, tailoring their services to the unique needs of each case.

- Tax preparation: Community Tax also handles tax prep for individuals and businesses, ensuring all filings are accurate and strictly adhere to tax laws.

- Bookkeeping: For businesses, their bookkeeping services are crucial for maintaining precise financial records, which helps make well-informed decisions.

- Community TAP: For a monthly fee of $39, TAP provides ongoing support, which includes yearly tax planning and audit defense, underscoring their dedication to the sustained success of their clients.

- Federal and state tax assistance: They offer customized solutions for both federal and state tax issues, providing a level of versatility that’s rare in the sector.

- Audit defense: In case of an audit, Community Tax is ready to offer expert representation and guidance, helping clients navigate through the process.

What Makes Community Tax Different?

Community Tax differentiates itself with its Tax Assurance Program (TAP). This initiative supports clients who have overcome past tax issues in maintaining ongoing compliance with the IRS. TAP isn’t just for those who’ve faced tax troubles; it also acts as a preventative measure to shield you from future tax problems.

How Much Does Community Tax Cost?

Community Tax tailors its pricing to the complexity and specific details of each client’s tax scenario. The company keeps the same pricing on its website due to the variable nature of tax problems, which means costs can vary widely.

For example, addressing straightforward tax debts might cost less than more complex cases requiring detailed negotiation and documentation.

- Tax resolution services: Fees vary depending on the amount of tax debt and the complexity of the case

- Tax preparation and bookkeeping: Pricing depends on the individual requirements and complexity of each case

- Community TAP: Priced at $39 per month, this program offers continuous tax support, including yearly tax planning and audit defense

- Additional services: Costs for further services are evaluated individually

>> Get Started With Community Tax >>

How Much Can Community Tax Save Me?

Community Tax offers considerable financial benefits by effectively managing tax debts and disputes, helping clients avoid accumulating penalties and interest. Their strategies, particularly with Offers in Compromise and installment agreements, often lead to a reduced overall debt burden.

The extent of savings is influenced by the amount of debt and the client’s financial situation. The initial free consultation provides a projection of potential savings before any fees are required, giving a clear picture of the possible financial relief.

Beyond just financial gains, Community Tax also provides peace of mind and saves valuable time for clients, freeing them from the hassle of navigating complex tax issues.

How Do You Start Working With Community Tax?

- Schedule a free consultation: Reach out to Community Tax for a no-cost evaluation of your tax records and situation.

- Undergo analysis: Supply the necessary documents so Community Tax can assess your situation and create a forecast of outcomes and advantages.

- Review the final presentation and decide: After reviewing the comprehensive breakdown provided by Community Tax, including any potential deductions or savings, make an informed decision on whether to engage their services.

The duration of each step can vary, depending on the complexity of your tax issues and the depth of the review process.

Community Tax Customer Experience

Community Tax excels in customer service and is accessible through multiple channels:

- Their website is user-friendly, well-structured, and packed with resources.

- Expanded call center support is available, with a live team member accessible from Monday to Saturday.

- The firm offers robust multi-channel support, engaging with clients through virtual chat assistants, email, social media, and traditional communication methods like fax and postal services.

- A wealth of resources is available on their platform, including tax and business news updates, detailed blog posts, FAQs, and other helpful guides.

- A distinctive mobile app enhances customer experience, underscoring Community Tax’s commitment to top-notch service.

>> Consider Community Tax for Tax Relief >>

Community Tax User Reviews

See what some customers say about Community Tax Services on Trustpilot.

Community Tax Relief Alternatives

Larson Tax Relief excels in providing a comprehensive suite of business tax services, which includes managing payroll and federal tax issues, addressing conflicts with your revenue officer, and handling worker classification issues. These services make them stand out for business and corporate tax debt relief.

Larson Tax Relief caters to a broad spectrum of tax debt relief needs, from personal IRS tax debt relief to corporate tax support and strategies to delay or prevent bank levies.

Anthem Tax Services specializes in IRS tax debt relief and corporate tax preparation. The company assists clients in applying for various IRS tax debt relief programs such as offers in compromise (OIC), innocent spouse relief, and achieving “currently not collectible” status.

Anthem sets itself apart with one of the industry’s strongest money-back guarantees. If they obtain no form of resolution from the IRS, a reduction in payment amounts, or total debt forgiveness, they offer a full refund. However, this guarantee doesn’t cover the initial investigation fee, which typically starts at $350, depending on your case’s specifics.

Community Tax Service – FAQs

Bottom Line

Community Tax is a prime choice for anyone needing help with tax collection issues, tax return filings, or planning for future tax responsibilities. The firm is particularly suited for those who appreciate extensive experience and transparent processes.

A DIY approach might be best if your tax debt is minimal and you’re confident in dealing with the IRS alone. However, it could be advantageous to consider a reputable tax debt relief company like Community Tax, which boasts seasoned professionals and knows the contacts to handle IRS negotiations effectively. Starting with their no-cost consultation is a smart move.

Sections of this topic

Sections of this topic