Looking to file your tax return at no cost in 2024? Cash App Taxes is a fresh addition to the realm of self-service tax software this filing season, although it could be more novel. Square, Inc., the parent organization behind the financial services application Cash App, purchased Credit Karma’s complimentary do-it-yourself tax filing service and revamped the platform.

Prior to creating an account, let us provide you with a thorough evaluation of Cash App Taxes. We’ll discuss who would benefit most from using it and assess its user-friendliness.

What Is Cash App?

Cash App, previously known as Credit Karma Taxes, is a personal finance company that assists individuals in sending and overseeing money. Established in 2007 and headquartered in San Francisco, Cash App employs numerous staff members and boasts millions of users.

Its primary distinguishing factor is its commitment to providing all services free. Rather than charging its customers, Cash App generates revenue through partnerships with other companies, ensuring users have unfettered access to all features, including tax-related services. This means you can effectively manage your finances with no financial burden.

The company aimed to revolutionize the tax planning industry by offering completely cost-free federal and state tax filing options. There are no concealed fees or attempts at upselling users on additional paid plans.

Everyone has access to the same features under the singular free plan. No exclusive perks or benefits are reserved for those who choose to pay. It’s an equal playing field for all users on Cash App’s platform.

>> File Your Taxes Online With Cash App >>

Who Is Cash App Taxes Best For?

Cash App Taxes is an ideal choice for individuals who can independently file their tax returns and prefer a simple process. The user-friendly interface guides you through the filing process step by step, eliminating any overwhelming feeling.

Unlike other tax services, Cash App Taxes is completely free regardless of whether you have a basic tax situation, are self-employed, or have earned investment income.

Unlike TurboTax or H&R Block, Cash App Taxes doesn’t offer specialized packages for expert help or specific tax situations. Users will need to locate the necessary tax forms on their own and possess confidence in their understanding of taxes to use this platform effectively.

Cash App Taxes Pros & Cons

- Filing taxes at no cost

- User-friendly interface

- Accommodates various tax scenarios and major IRS forms

- Complimentary audit defense

- Unable to submit multiple state returns

- Absence of assistance from tax professionals

- Restricted customer service availability

- Necessity of a Cash App account

Cash App Taxes Pricing

Cash App Taxes provides completely free services with no paid tiers or additional features. However, you might wonder if there’s a catch. Currently, there isn’t one, except because Cash App Taxes aims to encourage customers to use more of Square’s products.

This makes it an excellent choice for individuals seeking genuinely free tax filing help. As long as the software is compatible with all the necessary forms for your filing requirements, you can take advantage of these benefits:

- Free federal and state filing: While many of Cash App Taxes’ competitors restrict free filing to those with straightforward returns, such as W-2 income and standard deduction claims, others may provide free federal filing but charge for state returns.

- No fees deducted from your federal refund: Unlike competitors who deduct tax preparation fees from refunds and charge convenience fees, Cash App Taxes are entirely free, ensuring no deductions from your refund.

- No pressure to purchase expensive add-on features: Unlike other “free” tax filing options that push customers to upgrade for priority support, tax professional review, audit defense, and additional services, Cash App Taxes doesn’t offer paid add-ons.

- Free audit defense: Every Cash App Taxes user receives a complimentary audit defense. In the event of an IRS or state tax authority audit, a Case Resolution Specialist will review and respond to tax notices and represent you before the IRS.

>> Check Out the Best Pricing for Cash App >>

Cash App Taxes Features

Cash App Taxes provides complimentary tax filing services for most individuals, although the software offers a greater range of capabilities than its price suggests. Here are some notable features of this product.

Completely Free Federal And State Filing

For tax software companies, most of them have very limited options in their free tier. This often results in taxpayers having to upgrade to a paid tier. However, Cash App Taxes stands out from the rest by offering all of its features for free. All users need to do is download the Cash App, and they will have access to robust software without any additional charges.

Customized Filing Experience

At the beginning of the filing process, users are required to fill out a brief questionnaire. This helps to streamline the process by eliminating the need for them to go through information that’s not applicable to their situation.

Required Multi-Factor Authentication

Cash App Taxes place a strong emphasis on security and prioritize the use of multi-factor authentication. This added layer of protection, which isn’t commonly required by many other companies, includes the use of a physical second form of authentication.

Free Audit Support

Cash App Taxes offers complimentary Audit Support (via a third-party) to individuals who utilize Cash App Taxes for filing their taxes. This support encompasses the arrangement of tax paperwork, correspondence with the IRS, and representation at audit-related hearings.

Cash App Taxes Ease of Use

Filing your taxes with Cash App Taxes is a breeze. This user-friendly software will guide you through a series of questions about yourself, your spouse, any dependents you may have, and the specific types of income, deductions, and tax credits applicable to your situation. It tailors the process to display only the relevant sections that require completion.

If at any point you realize you need to include an additional section, simply navigate to the bottom of your “Tax Home” page where there’s an option to explore other forms or sections for inclusion.

Is Cash App Taxes Really Free?

Absolutely, Cash App Taxes is completely free. In fact, there’s no requirement for you to pay for the service or opt for premium support. The way this product generates revenue is through targeted advertising for other financial services.

Cash App Taxes also enroll individuals into the payment service called Cash App, which earns money through various means like charges from retailers’ hardware, transaction fees, and the sale of bitcoin.

What’s the Catch?

Cash App Taxes, a newly established tax planning service, is still a work in progress. One area where it could improve is its limited support for tax forms. If you’re new to filing taxes or need assistance understanding the intricacies of the process, you may find that Cash App lacks the extensive educational resources found in other services.

It offers few additional features or tools. While these extras aren’t essential for filing taxes, they can streamline and ease the overall experience.

Another downside is Cash App’s customer service. As tax planning is just one aspect of their business, their customer support doesn’t specialize in providing guidance for tax-related inquiries. Unfortunately, there are no on-hand tax advisors available to offer personalized or legal advice.

Even though Cash App Taxes itself comes at no cost to users, signing up requires creating an account for the entire Cash App platform. This means that along with access to their tax services, users also gain access to credit score and report facilities, whether or not they want them. Some individuals may perceive this requirement as unnecessary or bothersome.

How Do I Contact Cash App Taxes Support?

When using tax software that’s completely free, there are certain compromises that should be expected. With Cash App Taxes, one of these compromises is the limited availability of support options.

While Cash App provides a dedicated Help Center specifically for Cash App Taxes, it cannot upgrade to higher tiers that grant access to tax professionals, a feature commonly offered by premium tax software companies.

If you encounter any technical issues with the app, you can contact the company’s main customer service at 1-800-969-1940. However, if you require help from experts regarding tax-related queries, opt for an alternative tax software solution.

Is It Safe And Secure?

When it comes to tax software, there are always risks involved. However, Cash App stands out from other tax companies by prioritizing security. Drawing on its expertise as a banking and brokerage company, Cash App goes the extra mile to safeguard user data.

To ensure the safety of your information, use distinct passwords for each site you visit, especially for financial platforms like banking and tax applications. If you find yourself filing taxes on a public WiFi network, consider investing in a VPN for added protection against potential threats.

>> Cash App: Get the Tax Help You Deserve >>

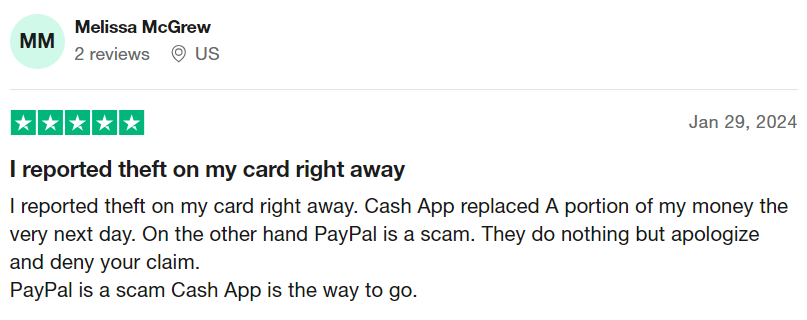

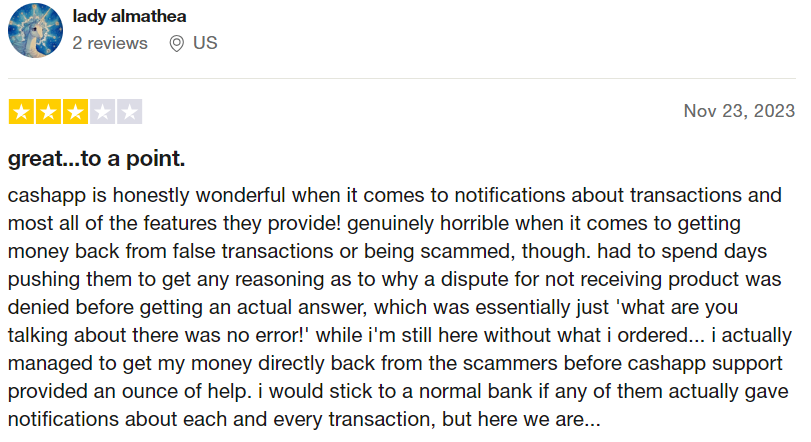

Cash App Review – Is It Legit or Not?

Check out these authentic testimonials from satisfied customers of Cash App who are eager to share their personal experiences. If you’re still on the fence about whether this service is right for you, these insightful remarks could aid in your decision-making process and lead to a more informed choice.

Cash App Alternatives

TaxSlayer stands out as an excellent choice for small businesses seeking to file their taxes. What sets it apart is its ability to handle complex returns at a competitive price compared to other major players in the industry.

Not only does TaxSlayer offer a priority phone line and reliable customer service, but it also provides a user-friendly platform that simplifies filing your taxes. TaxSlayer allows you to personalize the level of help you receive. If you prefer a guided approach, their interview option will lead you through each step, ensuring quick and accurate filing.

If you’re confident in your tax knowledge and don’t require hand-holding, you can bypass the interview process entirely and directly access specific tax forms for entering income and deductions. This streamlined method can save valuable time if you already know what information is needed.

In summary, TaxSlayer caters to small businesses with its comprehensive services and affordable pricing structure while offering flexibility in terms of guidance during tax preparation.

H&R Block is widely known for its physical offices across the United States, but the company also provides online filing options and downloadable software. If you opt for their online package, you can conveniently manage your taxes using their mobile app, which is available on Android and iOS devices.

With a user-friendly interface, H&R Block caters to the needs of most tax filers by offering a modern and easy-to-navigate platform. Similar to other tax-preparation services, it guides users through a series of inquiries regarding their household income while also highlighting potential deductions and tax credits.

TaxAct is the ideal choice for individuals who are seeking a cost-effective and user-friendly software interface to file their taxes without paying a premium for higher-end options.

Users who are self-sufficient and don’t require extensive guidance will find TaxAct software highly beneficial. All of TaxAct’s plans include complimentary access to experts who can address any queries during the filing process, which was introduced as an added advantage last year.

Although TaxAct may not be as affordable as TaxSlayer, its tax document upload and import functions have shown a stronger track record of reliability compared to those of TaxSlayer. If you’re willing to invest more in this time-saving feature, choosing TaxAct could prove worthwhile.

Cash App Taxes Review – FAQs

Bottom Line: Should You Use Cash App Taxes?

If you’re looking to save money while filing your taxes, Cash App offers an affordable option worth considering. However, Cash App Taxes may have fewer features than other filing services and need more educational content. This could be a deciding factor for those who are new to taxes or have a more complex tax situation and feel they need more confidence in filing.

If you’re comfortable with handling your own taxes, Cash App Taxes being free can be a major advantage to take advantage of. So, weigh the pros and cons before deciding what best suits your needs and level of expertise when it comes to tax filings.

Sections of this topic

Sections of this topic