Buying life insurance is a key component of financial planning. However, it’s tough to choose the best life insurance with so many companies offering various policy types and features. If you’re looking to buy life coverage, look no further because we’ve got it all summed up for you.

7 Best Life Insurance Companies

- State Farm – Best Overall

- Banner Life – Best for Low-Cost Insurance

- Bestow – Best for Ease of Application

- Nationwide – Best for Customer Satisfaction

- Lincoln Financial – Best for Term to Universal Policy Conversion

- Haven Life – Best for Same-day Coverage

- Northwestern Mutual – Best for Financial Stability

We considered several different factors to evaluate and rank the best life insurance companies. We considered the cost of insurance, offered policy types, ease of application, third-party ratings, and reputation in the process. Go through the methodology section for an in-depth look.

Company

Sample monthly cost*

AM Best rating

J.D. Power Customer Satisfaction Rank

Online Tools

No medical exam policy

Policy types

*Sample monthly cost is for a healthy 35-year-old female for a $1 million coverage policy on a 20-year term. The sample cost gives a comparative overview of life insurance costs from different providers. The exact cost for you might be a lot different from the ones quoted here.

State Farm is best known for its car and home insurance products but its life insurance policies are also at the very top of the competition. With top-of-the-line customer satisfaction, several policy types, sound financial strength, and low premiums, it’s our Best Overall pick for Life Insurance companies.

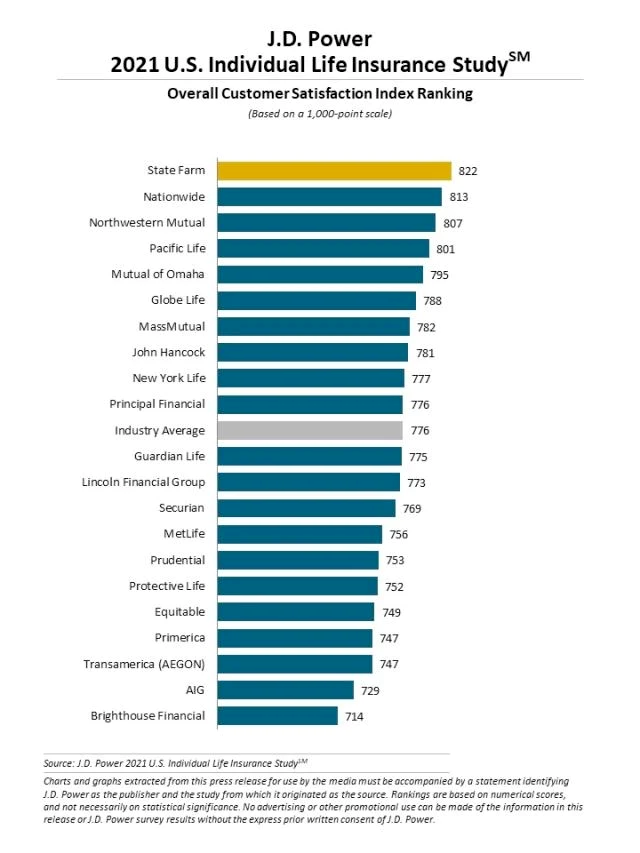

State Farm holds an A++ rating from AM Best which is sound evidence of its financial health. On top of that, the coverage provider ranked No. 1 on J.D. Power’s Customer Satisfaction ranking, which is a very strong indicator of its high-quality service.

Although its premiums are not the lowest in the industry, it offers policies at affordable prices. You may find its term insurance more costly than other options, however. The provider currently doesn’t operate in Massachusetts and Rhode Island. Also, to purchase a State Farm plan, you have to connect with an official company agent.

Why we chose it: State Farm has an A++ rating from AM Best and has ranked No. 1 on J.D. Power Customer Satisfaction rankings which makes it the most credible insurer. This along with its low cost of insurance makes it our top best life insurance pick.

- Affordable life insurance

- Offers term, whole, and universal policies

- Universal insurance available for ages up to 85 years

- Policies can only be purchased from a State Farm agent

- Not available in Massachusetts and Rhode Island

- Most policies require medical exams

Cost of Insurance

State Farm is not the cheapest life insurance provider but its premiums are still on the lower end of the spectrum. Some may find its term coverage policies to be very expensive, especially if you’re in poor health.

Offered Policy Types

The insurer provides term coverage for 10, 20, and 30 years. It also offers whole life coverage which includes Limited Pay Whole Life and Single Premium Whole Life where you pay the entire premium once. State Farm’s universal life insurance includes Survivorship and Joint Universal Life.

Ease of Application

While online tools are available for all policies, you’d have to connect with an official State Farm agent to purchase some policies. You can easily check whether you can apply online for a plan on the website. State Farm’s site also has a premium calculator that lets you see what term insurance will cost for you after you input some information.

Banner Life insurance now operates under the name Legal & General. It offers term and universal insurance policies at some of the lowest rates in the market. The same monthly cost, which is for a healthy 35-year-old woman, is only $46.63 for a $1 million coverage on a 20-year term. It’s the lowest monthly premium out of all our top picks.

This insurance company also enjoys a strong A+ AM Best rating. It wasn’t ranked by J.D. Powers in its Customer Satisfaction Index Ranking. However, some other credible sources suggest Banner Life has a low number of complaints, which means a high level of customer satisfaction.

Since it operates along with William Penn Life Insurance under the Legal & General umbrella, Banner Life covers all 49 states except New York, which is covered by Willam Penn. It has limited rider options which means there’s little space for customization. You may also find the website to be a bit old-fashioned and difficult to navigate, especially compared to other insurance providers.

Why we chose it: Banner Life has the lowest premiums for term life insurance policies. The low cost paired with its high customer satisfaction makes it an excellent option.

- Very low-cost term coverage

- Terms up to 40 years

- Low number of complaints

- Limited rider options

- Low coverage for universal life insurance

- Website tough to navigate

Cost of Insurance

As mentioned above, Banner Life is a very low-cost insurance provider, especially when it comes to term insurance policies. Note that getting a quote is a little tough and you might need to get an agent on call to acquire one.

Offered Policy Types

Banner Life only offers term and universal insurance policies. It offers a wide range of terms which start from 10 years and can go up to 40 with 5-year intervals.

Ease of Application

Banner Life, or better yet, Legal & General’s website is a bit old-fashioned but it does offer online tools for its coverage policies. You can’t buy insurance online and will have to get in touch on the phone to get an accurate quote and move things forward.

If you’re looking for a speedy and convenient life insurance application process and don’t want to be poked with needles for medical tests, Bestow is a good option for you. The company only sells term insurance policies and you can apply and buy a plan within minutes from the comfort of your home.

Bestow offers coverage of up to $1.5 million which is much higher than most other medical exam-free alternatives. However, it’s not flexible with its plans and has an applicant age limit of 60.

It’s a great option if you’re young and looking to buy insurance hassle-free. But if you’re a senior, Bestow’s premiums can get really expensive. It also offers very limited riders so there’s little space for customization.

Why we chose it: Bestow stands out for its fast and convenient online application process. You can apply and buy a plan in no more than a few minutes. It’s an excellent choice for young applicants who want to skip the bother of medical exams.

- Medical exam-free coverage of up to $1.5 million

- Speedy online application process

- 30-day trial

- No riders

- Offers only term life insurance policies

- Enrollment age limit of 60

Cost of Insurance

Considering the convenience and quality of service offered by Bestow, its cost of insurance is quite affordable. However, as with any insurer, premiums go up with age. But since there’s an enrollment cap at 60 years of age, we don’t get a chance to see very high insurance premiums on Bestow’s site.

Offered Policy Types

The company only offers term policies from 10 to 30-year periods and has no riders. This is a major drawback for customers who prefer a wider range of options or may want to convert from term to universal later on.

Ease of Application

The ease of application Bestow offers is one of its strongest selling points. Bestow claims the entire application and purchasing process doesn’t take more than a few minutes which is attractive to busy individuals.

Ranking second on the J.D. Power Customer Satisfaction Index, Nationwide offers a range of life insurance policy types including term, whole, universal, and variable options. The insurer is a well-established name in the finance industry for its wide variety of services.

Nationwide offers a range of other insurance and financing options from business insurance, and business banking services to auto and pet insurance products. Apart from its exceptional financial strength and customer satisfaction ratings, the insurer offers a lot of flexibility when it comes to policy types.

On top of that, it even offers medical exam-free policies with up to $5 million in coverage, arguably the highest in the insurance sector. You can also get discounter premiums on Nationwide’s auto or homeowners insurance if you are a life insurance customer.

Why we chose it: Nationwide is the only insurer after Banner Life with the highest customer satisfaction. Along with a wide range of policy types and riders, its incredible set of features makes it one of the best companies on this list to buy insurance from.

- High customer satisfaction ranking

- Medical exam-free coverage of up to $5 million

- Discounts available if bought together with auto or homeowners insurance

- Limited eligibility

- Lacks live chat

- Limited online quotes

Cost of Insurance

The cost of insurance from Nationwide is around or below the industry average. While the price factor doesn’t make Nationwide a particularly attractive option, its additional features and riders for different illnesses make it worth the cost.

Offered Policy Types

Nationwide’s wide range of policy types and additional riders make its product range one of the most comprehensive ones out there. It offers term, whole, universal, and variable policies. Term policies come in 10, 15, 20, and 30-year periods.

Ease of Application

You can get quotes online, but not for all policies on the insurance provider’s website. To apply, you need to get in touch with Nationwide or an insurance agent. You can’t buy a plan online but it does offer other conveniences like digital document processing and delivery.

Lincoln Financial offers flexible life insurance packages with high coverage caps and some no-medical-exam policies. It offers affordable premiums but is not the cheapest insurance provider out there.

All in all, the company is a great choice for anyone looking for term or universal life insurance or who would consider converting a term policy into a universal one in the future. Especially, if you’re a boomer (ages 57-72), Lincoln’s universal policies give you more time to build cash value and term policies offer higher maximum ages for guaranteed renewability or conversion to universal insurance.

The company has an A+ rating from AM Best so it’s good to go with on the financial strength front. But when it comes to customer satisfaction, Lincoln Financial ranks lower than the industry average. Its below-par performance on this front can easily dissuade a potential customer.

If you’re looking to buy insurance over the phone, you can expect a smooth and expedited policy buying experience. Through Lincoln Financial’s Tele-App process, an advisor meets with you over the phone and helps you purchase a suitable policy. You’re likely to qualify for a medical exam-free policy if you’re under 60 and want coverage less than $1 million.

Why we chose it: Lincoln Financial stands out for its flexible offerings for senior applicants, especially when it comes to term-universal policy conversion. That along with its exceptional over-the-phone application process makes it an insurer worth considering.

- Affordable term life insurance

- No medical exam policies available

- Term policies can be easily converted to universal

- Doesn’t offer whole life policies

- Application process involves working with a Lincoln Financial professional

- Low Customer Satisfaction ranking

Cost of Insurance

You’ll find affordable term life insurance policies from Lincoln Financial, however, its universal ones aren’t as low cost. That said, there are cheaper options available on the market.

Offered Policy Types

The company offers term and universal life insurance. The term policies include Lincoln TermAccel® and Lincoln LifeElements® which are available in 10,15, 20, and 30-year options. Permanent policies include Universal, Indexed Universal, and Variable Universal.

Ease of Application

Lincoln Financial offers online tools for all its policy types. On top of that, its Tele-App process makes the insurance application process a cakewalk.

Haven Life is an online-first insurance company that offers high coverage caps for online applications and medical exam-free options. It was established in 2014 which makes it a new addition to the insurance sector but with an A++ rating from AM Best, we can trust its credibility.

Haven Life isn’t a part of the J.D. Power ranking as it’s an online service primarily powered by MassMutual which ranks seventh. It has much fewer customer complaints than the industry average.

The coverage company stands out when it comes to speed of service, convenient application process, and the possibility of same-day coverage. However, since it doesn’t offer any other policy type other than term, customers have limited options. Also, there’s an applicant age limit at 64 years, which is still higher than Bestow’s limit at 60.

Why we chose it: Haven Life is powered by MassMutual, an industry giant that ranks 7th on the J.D. Power customer satisfaction index. However, the best part about it is the company’s quick service which also makes it possible for customers to get same-day coverage.

- Apply online for up to $1 million in coverage

- Offers same-day coverage

- Very few customer complaints

- Offers only term life insurance

- Limited riders

- Applicant age limit at 64

Cost of Insurance

Haven Life’s premiums are higher than most other companies on our list. The sample monthly cost lies at a high $81.16 compared to Banner Life’s $46.63 or State Farm’s $54.79. The prices may also increase exponentially if you’re a smoker or have any other health condition.

Offered Policy Types

It only offers term life insurance policies which include Haven Term and Haven Simple. Haven Simple offers coverage up to $500,000 and requires no medical exam. But if you want higher coverage of up to $3 million, you’d have to go with Haven Term which mostly comes with medical exams.

Ease of Application

Haven Life is a digital insurance company which means it pays importance to a seamless online application process. You can apply online for coverage up to $1 million. The company also claims to have a quick approval process that can give you same-day coverage.

Northwestern Mutual is one of the most well-established insurers out there. It was established in 1857 and has been serving in the American finance and insurance market even since. Its years of experience also make it the largest seller of life insurance in the country.

The provider isn’t very transparent with quotes which is a huge drawback for any insurance provider. Unlike other companies on this list, Northwestern doesn’t have a premium calculator and you have to get in touch with an agent to see how much insurance will cost. This can take a day or two in back and forth compared to getting an instant quote on their site.

Northwest ranks third on J.D. Power’s Customer Satisfaction Index which makes it the best in the industry after State Farm and Nationwide. But it has its drawbacks too. Unlike modern insurance providers like Bestow and Haven Life, you can only purchase a plan through agents.

Why we chose it: Northwest Mutual is one of the oldest insurance companies and has an A + + rating from AM Best which means it’s very stable financially. On top of that, it has a high customer satisfaction ranking making it an option worth considering.

- Highest financial strength rating

- High customer satisfaction

- Multiple policy options

- Limited pricing information on website

- Plans can only be purchased through an agent

- Most options require a medical exam

Cost of Insurance

Northwestern Mutual offers no information on its premiums at all. You will have to contact an agent in person to get a quote.

Offered Policy Types

This company offers term, whole, universal, and variable universal life insurance. It also offers a range of optional riders, more than other insurers on this list, so you can easily access benefits under special circumstances.

Ease of Application

Ease of application is one area Northwest Mutual lacks in. You can’t get a quote online and will have to get in touch with an agent, whereas State Farm offers online tools. Most insurance options require you to take a medical exam. Note that not all life insurance products are available in all states which makes things more complicated than they need to be.

Methodology for the Best Life Insurance

Picking an insurer for life insurance can be very difficult given the variety of factors you need to consider and the countless options available. However, we at Management Library use our research and industry expertise to help you make the right decisions. We carefully considered data from multiple sources on several different factors to come up with this list of life insurance providers. Here are the criteria we considered when ranking the best life insurance companies:

- Cost of insurance: The price factor most often weighs the heaviest when it comes to making any financial decision. The insurance providers that offer the same or higher value coverage for a lower premium rank higher than those with higher premiums.

- Offered policy types: Customers don’t want to have limited options to choose from. Plus, they also want the freedom to switch between different policies in the future. Companies that offer more policy types and freedom rank higher than those with limited options.

- Ease of application: Convenience and speed of service are important factors. Customers prefer seamless online application and approval. Plus, no medical exam alternatives are preferred over those that require it.

- AM Best rating: AM Best is a credit rating agency that ranks insurance companies for financial strength on a scale of A++ (superior) to D (poor). We only chose the companies with a rating of A or higher to include in our list.

- J.D. Power Customer Satisfaction Index ranking: J.D. Power releases an annual study on the top life insurance providers and ranks them according to the customer complaints and satisfaction statistics it compiles from authentic sources. The ranking is a valuable measure of how well an insurance company performs on the customer satisfaction compared to the industry average.

- Reputation: Last but not least, we considered the historical reputation of each company. This includes how long they’ve been in business, any significant problems they’ve had over the years, and their performance when it comes to other services in the financial and insurance industry.

Frequently Asked Questions (FAQs) for Best Life Insurance

Here are some of the most commonly asked questions about the top life insurance companies.

Bottom Line on the Best Life Insurance Companies

You have quite a few very good options to choose from. While different insurance companies suit different needs, State Farm is our best overall choice for its very low cost of insurance and strong third-party ratings. But if you’re looking for a lower cost, you can go with Banner Life.

However, the cost is not the only factor. You must also consider the insurer’s financial stability, customer satisfaction rating, and the policy types it offers. We’ve ranked each of the best life insurance companies according to what they’re best for to make your choice simpler.

Sections of this topic

Sections of this topic