The Employee Retention Credit (ERC) is a valuable tax credit program designed by the U.S. government to support businesses during challenging times, such as the COVID-19 pandemic.

To fully leverage the benefits of ERC, engaging the expertise of ERC specialists is essential. This comprehensive guide explores the best ERC Specialists review so that you can choose the best specialists for your business. Keep reading to know more.

Top ERC Specialists

Quick View

- ERC Specialists: Best Overall Specialist for ERC Expertise

- Omega Accounting Solutions: Best ERC Specialists

- Lendio: Best Specialist for ERC Funding

- Innovation Refund: Best Specialist for Audit Protection

- Stenson Tamaddon: Best Specialist For ERC & Other Tax Credits

ERC Specialists

Pricing

Processing Time

Qualifying Process

Top ERC Specialists: Quick Verdict

ERC Specialists: Best Overall ERC Specialist

ERC Specialists is a company that’s majorly focused on Employee Retention Credit (ERC). They are known for their innovative approach to simplifying complex tax incentives for small and medium-sized businesses.

ERC Specialists has a team of experts who understand payroll taxes and the ERC program, to help you achieve amazing results. The best part is, their qualifying process is easy to understand and straightforward.

When it comes to pricing, they offer a free analysis to see if you qualify, and if you do, they charge a fee depending on how you want to pay. If you pay upfront, it’s 10%, and if they deduct it from your refund, it’s 15%.

Another standout feature of ERC Specialists is their expertise in providing a swift and efficient application process for ERC refunds.

Their process is simple and it usually takes about two to three weeks to fill out and send in the tax forms, and then you can expect your IRS refund check in around 20 weeks.

Their main goal is to assist clients in getting the most money for their businesses under the ERC program without any stress.

ERC Specialists is a specialized company that excels in obtaining ERC refunds. With a team of experienced professionals who possess in-depth knowledge of payroll taxes and a thorough understanding of the ERC program, ERC Specialists has a proven track record of delivering the highest possible credit refunds to its clients.

What sets ERC Specialists apart is its straightforward and streamlined application process, eliminating any confusion when applying for an ERC refund.

Pricing

ERC Specialists offers a complimentary analysis to determine if your business qualifies for the ERC tax credit. Following this analysis, their fees range from 10% to 15% of your ERC refund amount, which is in line with industry standards.

The exact fee amount depends on your chosen payment method. If you decide to pay upfront, you will be charged 10% of your total ERC refund. Alternatively, if you prefer to have the fee deducted from your refund, you will pay 15% of the refund amount. Notably, if you have paid upfront and the IRS does not release your credit for any reason, ERC Specialists provides a 100% money-back guarantee.

Processing Time

On average, ERC Specialists takes approximately two to three weeks to complete and submit your tax forms for the ERC refund. After submission, it typically takes a minimum of 20 weeks to receive your refund check from the IRS.

Qualifying Process

ERC Specialists has devised a five-step process to facilitate the receipt of your ERC refund.

The initial step involves filling out a questionnaire on their website to assess your eligibility for the tax credit.

Subsequently, you will need to submit relevant documentation, such as payroll records and details about any PPP loans your business has obtained.

Afterward, ERC Specialists will meticulously analyze and review your documents, working diligently to maximize your refund. This analysis typically takes around two to three weeks.

Once your documentation has been thoroughly evaluated, ERC Specialists will provide you with the necessary documents for signing and returning.

These documents will also include the final credit amount. Upon completing the signing process and obtaining approval, ERC Specialists will submit your documents and maintain communication with the IRS throughout the process, ensuring minimal potential delays.

Why We Chose Them

We selected ERC Specialists due to their unwavering commitment to maximizing ERC refunds. The company boasts an impressive track record of recovering 10% to 20% more credits compared to other providers who may not possess the same level of expertise in handling ERC claims.

- Complimentary analysis to determine qualification

- Discount available for upfront payment of fees

- User-friendly application process

- Lengthy phone hold times

- Lack of clarity regarding pricing fees

Omega Accounting Solutions offers a solution for businesses that cannot afford to wait up to a year for their Employee Retention Credit (ERC) refund. In addition to successfully securing ERC refunds for over 2,000 clients, the company provides ERC bridge loans, enabling businesses to access immediate cash flow.

Omega Accounting Solutions also assists businesses in claiming other tax credits, such as the Research and Development (R&D) tax credit and the High-Road Cannabis Tax Credit (HRCTC), offering comprehensive support for maximizing available tax benefits.

Pricing

You should reach out to Omega Accounting directly for a personalized quote as the fees for ERC refunds are not disclosed on their website.

Processing Time

Omega Accounting Solutions strives to expedite the filing of your tax return in order to facilitate a prompt refund. But receiving a refund via check may involve a waiting period of several months, possibly up to a year, due to IRS delays.

However, Omega Accounting Solutions offer an alternative solution for eligible clients in the form of an ERC bridge loan, allowing them to access cash earlier.

Qualifying Process

To get started with Omega Accounting Solutions for your ERC refund, first fill out a quick form online. Omega Accounting will then contact you for a short phone call. The phone call will last only about ten minutes. If you qualify for an ERC refund, you’ll need to upload information and documents via Omega’s secure online portal.

Once Omega has received all the necessary information, they will work on preparing and filing your amended quarterly returns. Finally, you’ll need to wait for your check from the IRS to arrive.

Why We Chose Them

Omega Accounting Solutions offers an ERC bridge loan, providing qualifying businesses with immediate funding while they await their refunds.

Already filed claims can receive up to 60% of the expected refund within two weeks, while businesses yet to file can receive advance funds in approximately 45 days.

- Prepare and submit revised documents

- Obtain ERC bridge loans for immediate cash infusion

- Simple and secure application procedure

- Can help with the acquisition of other tax credits

- Pricing is not transparent

- Their client base is small

Lendio, renowned for its small business loans, provides a convenient ERC funding marketplace solution that effectively connects you with the ideal ERC service for your business.

Lendio distinguishes itself by offering a wide range of financing options to keep your company thriving. Whatever you require funds for, Lendio has tailored solutions for you and in the majority of cases, you can expect to receive cash within 24 hours.

Pricing

Lendio offers free ERC eligibility assessment without any charges. Only when your application is processed by the IRS, you will be required to pay for Lendio’s services. Upon processing, Lendio will deduct a fee of 15% from your refund.

Processing Time

Typically, Lendio takes approximately two to eight months to process ERC refunds. However, the extended processing time is primarily caused by the backlog of ERC claims that the IRS has received.

Qualifying Process

To begin Lendio’s ERC refund program, all you need to do is complete a straightforward application on their website. This application will assess your eligibility for the tax credit.

If you meet the requirements, Lendio will connect you with one of their trusted ERC partners who will guide you through the application process. Lendio streamlines each stage, simplifying the submission of documents, tax forms, and providing regular updates on the status of your refund. Lendio aims to file most applications within 25 days.

Upon processing of your application, you can expect to receive your refund directly from the IRS.

Why We Chose Them

Lendio simplifies ERC refund acquisition with an easy application process and expert support. It stands out for competitive rates, charging only 15% of the refund upon payment. Additionally, Lendio offers access to other business funding options while waiting for the refund.

- Transparent pricing with no hidden fees

- Competitive rates for services

- Payment is made upon receiving your refund

- The filing process for ERC applications may take 25 or more days

- Lenders offer limited information

Innovation Refunds simplifies the process of obtaining ERC refunds by connecting you with a dedicated refund specialist. With a team of independent tax attorneys and CPAs, Innovation Refunds provides expert services for securing your ERC refund, starting from determining your business’s eligibility to filing your claim with the IRS.

Moreover, Innovation Refunds offers assistance in case you undergo an IRS audit in the future.

Pricing

Innovation Refunds offers a complimentary refund analysis. If you decide to proceed with obtaining your ERC refund, Innovation Refunds charges a fee of 25%, without any upfront or hidden expenses.

Processing Time

Innovation Refunds follows the average processing time for ERC refunds set by the IRS, which usually ranges from four to seven months. However, it’s important to note that this timeline can vary and may be shorter or longer than the standard duration.

Qualifying Process

Innovation Refunds has streamlined the qualifying process, which can be completed in under ten minutes. Once you have provided the necessary details about your business and successfully qualified, you will need to submit the required documentation to proceed with your claim.

Once Innovation Refunds has received all your information and documents, they will file your claim, and the final step is to await your refund check from the IRS.

Why We Chose Them

We chose Innovation Refunds because they provide a dedicated and comprehensive audit protection and have independent tax attorneys available to defend your claim if it undergoes an IRS audit.

- Exclusive ERC refund specialist

- Payment upon receiving your refund

- Audit protection

- High rates

- Does not provide loan options

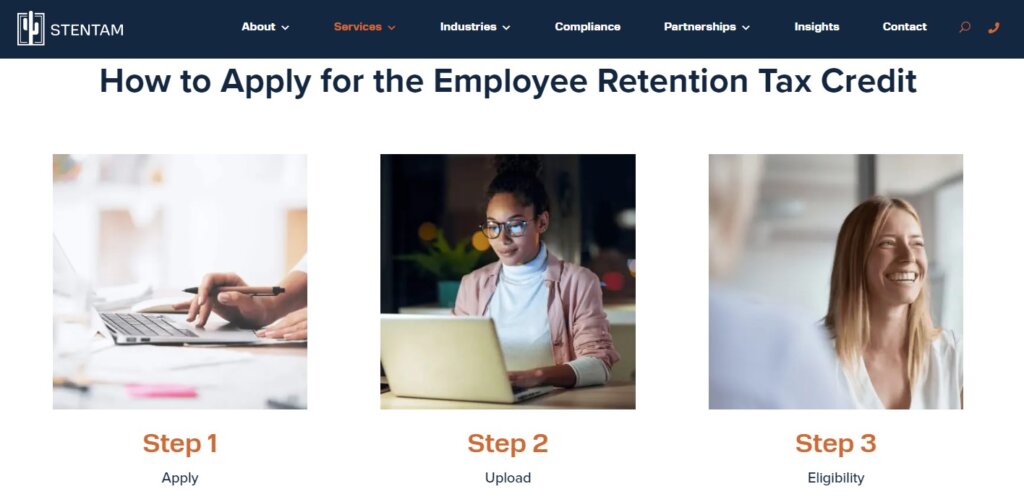

Stenson Tamaddon specializes not only in ERC refunds but also in assisting you with claiming other tax credits that you may not have been aware of. Alongside the ERC, they can evaluate your eligibility for Research & Development Tax Credits and Work Opportunity Tax Credits.

Over 4,000 companies have trusted Stenson Tamaddon, resulting in more than $3.4 billion in secured tax credits. Their expertise can help your business determine if you qualify for these money-saving credits.

If you require immediate funding, Stenson Tamaddon also offers ERC advances, with the potential to receive your advance within 72 hours of filing your ERC claim.

Pricing

For details regarding ERC refund fees, it is recommended to contact Stenson Tamaddon directly through their secure form. This will allow you to initiate the ERC refund process and obtain information about pricing and fees.

Processing Time

The exact refund processing time is not disclosed by Stenson Tamaddon. However, to expedite your ERC refund, it is crucial to maintain effective communication with the company and provide all the necessary information. Once your amended return is prepared, it may take 12 months or longer to receive your refund from the IRS.

Qualifying Process

To begin the process, you can complete a brief form on the Stenson Tamaddon website. A representative will then assist you in determining your eligibility. If you qualify, you will be guided to upload required documentation and information via the company’s secure portal.

After receiving all the necessary materials, Stenson Tamaddon will prepare and file your amended returns with the IRS. Once processed, your ERC refund check will be sent to you by mail.

Furthermore, after filing your claim, you may be eligible to receive ERC Advanced Funding. To obtain more information, it is advisable to contact Stenson Tamaddon directly.

Why We Chose Them

Stenson Tamaddon was chosen because, in addition to helping you claim your ERC refund, they offer expertise in identifying other tax credits that can save money for your business.

The Work Opportunity Tax Credit allows you to receive up to $9,600 per eligible employee, and the R&D Tax Credit can result in savings of up to $250,000. These savings are in addition to the substantial amount you may qualify for through the ERC credit.

- Application process is secure and straightforward

- Assistance provided in claiming other tax credits

- ERC advances are available

- Pricing details are not transparent

- Processing time is undisclosed

Understanding ERC Specialists

Role and Responsibilities of ERC Specialists

To navigate the complexities of the ERC and ensure businesses maximize their benefits, the role of ERC specialists has become crucial. Their responsibilities typically include:

Eligibility Assessment

ERC specialists evaluate businesses to determine their eligibility for the credit. They analyze factors such as revenue decline, government orders, and full or partial suspension of operations to ascertain if the business meets the ERC criteria.

Data Collection and Analysis

ERC specialists collaborate with clients and internal teams to gather relevant financial and payroll data. They analyze this data to identify qualifying wages, qualified expenses, and other necessary information for calculating the ERC.

Claim Preparation and Submission

ERC specialists assist businesses in preparing and submitting ERC claims to the IRS. They ensure that all required documentation and calculations are accurate, supporting the claim for maximum allowable credit.

Compliance and Recordkeeping

ERC specialists guide businesses in maintaining records and documentation to substantiate their ERC claims. They ensure compliance with IRS requirements and assist in responding to any inquiries or audits related to the credit.

Client Advisory and Education

ERC specialists provide comprehensive guidance to clients, explaining the intricacies of the ERC program, potential benefits, and compliance obligations. They stay updated with changes in ERC regulations and communicate these updates to clients, helping them make informed decisions.

Qualifications and Expertise of ERC Specialists

ERC specialists are professionals who possess a deep understanding of tax regulations, employment laws, and government incentive programs.

They typically have a background in accounting, finance, or taxation, and are well-versed in various aspects of employee retention credits. Their qualifications may include:

Education

ERC specialists often hold a bachelor’s or master’s degree in accounting, finance, or a related field. A strong foundation in tax principles, business law, and financial analysis is essential to excel in this role.

Experience

Prior experience in tax planning, compliance, or consulting is valuable for ERC specialists. This experience equips them with a practical understanding of tax regulations and enables them to provide tailored advice to businesses seeking ERC benefits.

Knowledge of ERC Regulations

ERC specialists possess comprehensive knowledge of the ERC provisions outlined in the Internal Revenue Code (IRC), as well as related guidance issued by the Internal Revenue Service (IRS).

They stay updated with the latest changes and interpretations of the ERC to ensure accurate and up-to-date guidance to their clients.

Analytical Skills

ERC specialists must have strong analytical skills to assess a company’s eligibility for the credit, identify qualifying wages and qualified expenses, and calculate the maximum allowable credit amount.

They analyze financial records, payroll data, and other relevant documentation to ensure compliance with ERC requirements.

Communication and Collaboration

Effective communication is vital for ERC specialists as they interact with clients, internal teams, and government authorities. They must be able to explain complex concepts in a clear and concise manner, providing guidance and support throughout the ERC process.

Collaborating with stakeholders such as accountants, HR professionals, and business owners is essential to gather necessary information and ensure accurate calculations.

ERC Specialist Certifications and Accreditation

To enhance their credibility and demonstrate their expertise in ERC matters, many specialists pursue certifications and accreditations.

While there isn’t a specific certification exclusively for ERC specialists, there are several relevant designations that showcase their knowledge and proficiency. These certifications include:

Certified Public Accountant (CPA)

A CPA credential is widely recognized and respected in the accounting profession. ERC specialists with a CPA designation possess a strong foundation in accounting principles and tax regulations, which proves beneficial when advising clients on ERC matters.

Enrolled Agent (EA)

An EA is a tax professional authorized by the IRS to represent taxpayers before the agency. EAs demonstrate expertise in taxation and are well-equipped to handle various tax-related issues, including ERC claims and compliance.

Certified Payroll Professional (CPP)

The CPP certification is awarded to professionals who demonstrate proficiency in payroll management and related compliance matters. ERC specialists with a CPP credential possess a solid understanding of payroll processes, which is essential for calculating qualifying wages under the ERC.

Society for Human Resource Management – Senior Certified Professional (SHRM-SCP)

ERC specialists who hold the SHRM-SCP certification exhibit a deep understanding of employment laws, labor relations, and HR practices. This knowledge is valuable when advising clients on ERC eligibility and compliance from an HR perspective.

ERC Specialists Review: Evaluating the Top Players

Criteria for Selection

When evaluating ERC specialists, it’s crucial to consider several key factors to ensure you partner with a reputable and knowledgeable professional. The following criteria can help you make an informed decision:

Key Factors in Choosing ERC Specialists

Expertise in ERC

Look for specialists who have extensive experience and expertise specifically in the Employee Retention Credit.

ERC specialists should have a deep understanding of the ERC provisions, eligibility criteria, calculation methods, and compliance requirements. Prior experience handling ERC claims for businesses in your industry can be an added advantage.

Qualifications and Certifications

Consider specialists who hold relevant qualifications and certifications, such as Certified Public Accountant (CPA), Enrolled Agent (EA), Certified Payroll Professional (CPP), or Society for Human Resource Management – Senior Certified Professional (SHRM-SCP).

These credentials demonstrate their commitment to professional development and their ability to provide accurate and reliable guidance.

Industry Knowledge

ERC specialists who have familiarity with your industry can offer tailored advice and insights. They understand the specific challenges, nuances, and opportunities that may affect your eligibility for the credit.

Look for professionals who have worked with businesses similar to yours or have a solid understanding of your industry’s dynamics.

Track Record and Success Stories

Evaluate the track record of ERC specialists by considering their past clients and success stories. Review case studies or testimonials that showcase their ability to secure maximum ERC credits for businesses.

A proven track record indicates their proficiency in navigating complex ERC regulations and delivering favorable outcomes.

Collaboration and Communication Skills

Effective collaboration and communication are crucial when working with ERC specialists.

They should be responsive, attentive, and able to explain complex concepts in a clear and understandable manner. Consider their ability to listen to your specific needs and tailor their approach accordingly.

Qualifying Process

A reliable ERC specialist will conduct a thorough qualifying process, analyzing your business’s financial records, payroll data, and operational changes to determine eligibility.

They should customize the assessment to your specific circumstances and provide guidance on the documentation required to support your eligibility.

Pricing

When evaluating ERC specialists, consider their pricing structure and transparency. Different specialists may charge hourly rates, fixed fees, or a percentage of the ERC credit obtained.

Ensure you understand the fees involved, any additional costs, and the value you will receive for the price charged.

Processing Time

The processing time offered by ERC specialists is crucial, as businesses often seek to access the ERC benefits promptly.

Look for specialists known for their efficiency in completing calculations, preparing documentation, and submitting claims. They should provide estimated timelines and maintain proactive communication to ensure a smooth and timely process.

Importance of Client Reviews and Ratings

Client reviews and ratings are invaluable when assessing the performance and reliability of ERC specialists. They provide insights into the client experience and satisfaction levels. Here’s why client reviews are important:

Authentic Feedback

Client reviews offer authentic feedback on the services provided by ERC specialists. They highlight both the strengths and weaknesses of the specialist, giving you a balanced perspective.

Quality of Service

Reviews provide an indication of the quality of service offered by the specialist. Look for consistent positive feedback regarding their knowledge, responsiveness, professionalism, and ability to deliver results.

Trust and Credibility

Positive reviews and high ratings build trust and credibility. When multiple clients share positive experiences, it demonstrates the specialist’s expertise and reliability.

Case Studies and Success Stories

Some ERC specialists may share case studies or success stories on their website or other platforms.

These testimonials provide concrete examples of their ability to secure significant credits for businesses. Review these success stories to assess the potential impact they can have on your business.

Comparison and Decision-making

Client reviews allow you to compare multiple ERC specialists and make an informed decision based on the experiences and feedback of their past clients.

Consider both the overall ratings and the specific aspects highlighted by clients to determine which specialist aligns best with your requirements.

The Process of Working with ERC Specialists

Here is the typical process of working with ERC specialists:

Initial Consultation and Assessment

The engagement with ERC specialists typically begins with an initial consultation and assessment. During this phase, the specialist aims to understand your business’s unique circumstances, challenges, and goals related to the ERC.

The key steps involved in this stage are:

Needs Identification

The ERC specialist will ask relevant questions to identify your business’s specific needs, such as the impact of COVID-19 on your operations, changes in revenue, and any potential eligibility concerns.

Documentation Gathering

You will be asked to provide essential financial and payroll records, tax filings, and other relevant documents. The specialist will review these materials to assess your eligibility for the ERC.

Eligibility Assessment

Based on the information gathered, the ERC specialist will evaluate your eligibility for the credit, considering factors like revenue decline, government orders, and operational changes. They will determine the potential credit amount you may be eligible to claim.

Tailoring ERC Solutions for Specific Needs

After the initial assessment, ERC specialists tailor ERC solutions to meet your specific needs. This phase involves developing strategies to optimize your ERC benefits while ensuring compliance with applicable regulations.

The key elements of this stage include:

Customized Strategies

ERC specialists will create tailored strategies based on your eligibility status, industry-specific considerations, and overall business objectives. They will identify opportunities to maximize the credit while adhering to IRS guidelines.

Calculation and Documentation

The specialist will calculate the eligible wages, qualified expenses, and the maximum allowable credit for your business. They will assist in organizing and documenting the necessary information to support your ERC claim.

Execution and Implementation of ERC Strategies

Once the ERC strategies are developed, the specialist will guide you through the execution and implementation process. This phase involves taking the necessary steps to claim the ERC and secure the available credits.

The primary activities include:

ERC Claim Preparation

The ERC specialist will compile the required documentation, complete the necessary forms, and prepare the ERC claim. They will ensure accuracy and compliance with IRS guidelines to maximize the chances of a successful claim.

Claim Submission

The specialist will submit the ERC claim to the IRS on your behalf. They will track the progress of the claim and address any inquiries or requests for additional information from the IRS.

Ongoing Support and Monitoring

Even after the ERC claim is submitted, ERC specialists provide ongoing support and monitoring to ensure compliance and maximize the long-term benefits for your business.

The key aspects of ongoing support include:

Compliance Assistance

ERC specialists will help you maintain compliance with ERC requirements, including recordkeeping, documentation, and any changes in regulations or guidance.

Monitoring and Updates

They will stay updated with the latest developments in ERC regulations and communicate any changes that may impact your business. This ensures your strategies remain effective and aligned with the evolving guidelines.

Support for Audits and Inquiries

In the event of an IRS audit or inquiry related to your ERC claim, the specialist will provide guidance, assist in preparing the necessary documentation, and represent your interests throughout the process.

ERC Specialists and Industry Verticals

ERC in Healthcare

ERC specialists provide valuable guidance and solutions specifically tailored to the healthcare industry. For instance,

ERC Solutions for Hospitals and Medical Facilities

ERC specialists play a crucial role in identifying eligible wages and qualifying expenses for the ERC. They carefully analyze the different roles within healthcare organizations, such as front-line healthcare workers, administrative staff, and support personnel, to determine which wages qualify for the credit.

Additionally, they assist healthcare organizations in identifying qualifying expenses related to pandemic-related operational maintenance, such as personal protective equipment (PPE), cleaning supplies, and technology enhancements.

By understanding the unique dynamics of the healthcare sector, ERC specialists ensure that hospitals and medical facilities can maximize their benefits under the ERC program.

Addressing Compliance and Regulatory Issues

ERC specialists recognize the complex compliance and regulatory landscape that healthcare organizations must navigate. They are well-versed in the specific regulations and guidelines applicable to the healthcare industry, such as the Health Insurance Portability and Accountability Act (HIPAA), Stark Law, and Anti-Kickback Statute.

ERC specialists also work closely with legal and compliance teams to ensure that ERC strategies and incentives comply with these laws. They guide healthcare organizations in collecting and handling employee data while maintaining compliance with HIPAA regulations.

Furthermore, they assist in aligning ERC strategies with Medicare and Medicaid considerations for organizations that receive reimbursements from these programs.

With a thorough understanding of healthcare compliance requirements, ERC specialists provide documentation support and help healthcare organizations prepare for potential IRS audits or inquiries related to the ERC.

Their expertise ensures that healthcare organizations can confidently navigate compliance and regulatory challenges while maximizing the benefits of the ERC program.

Case Study of Successful ERC Implementation in Healthcare

A dental practice consisting of multiple entities discovered the potential eligibility for the Employee Retention Credit (ERC) and decided to pursue it. By successfully claiming the ERC, the dental practice was able to save over $400K in payroll taxes.

They diligently documented the necessary information to support their credit claims, ensuring proper substantiation of the claimed credits.

This efficient process allowed the dental practice to maximize their benefits under the ERC program and achieve significant savings.

ERC in Finance and Banking

Finance and banking institutions face unique challenges also. Here is how ERC plays a crucial role in managing risk and ensuring financial stability through tailored strategies;

Managing Risk in Financial Institutions

Effective risk management is essential for financial institutions to maintain stability and navigate uncertainties. ERC specialists collaborate closely with banks, credit unions, and other financial organizations to identify and mitigate risks.

Through comprehensive risk assessments, analysis of market volatility, regulatory compliance, and financial indicators, these specialists develop customized strategies to manage risk effectively.

By leveraging their expertise and the benefits of the Employee Retention Credit (ERC) program, they help financial institutions optimize their risk management practices and ensure long-term stability.

ERC Strategies for Ensuring Financial Stability

To ensure financial stability, ERC specialists work closely with finance and banking institutions to develop customized strategies tailored to their unique needs.

They assist in workforce retention planning, optimizing cash flow management, and ensuring compliance with regulatory requirements.

By leveraging the benefits of the Employee Retention Credit (ERC) program, these strategies enhance stability by minimizing disruptions in critical operations and fostering long-term financial resilience within finance and banking institutions.

Real-world Example of ERC in the Finance Sector

A California bank heavily invested in software development projects to improve internal workflows, automation, and customer interactions.

As commercially available solutions were inadequate for their unique needs, the bank developed these projects from scratch, committing substantial resources with uncertain ROI.

However, with ERC, the bank successfully secured $2MM in federal credits, followed by favorable determinations from the state. The bank now has over $10MM in federal and state tax savings, with an audit success rate exceeding 90% each year.

ERC in Manufacturing and Supply Chain

The Employee Retention Credit (ERC) provides vital support to manufacturing and supply chain by:

Minimizing Disruptions in the Supply Chain

By providing financial support to eligible businesses, the ERC enables them to retain their workforce and maintain operational continuity.

This is particularly important in industries heavily reliant on supply chain management, where disruptions can have cascading effects on production, distribution, and overall business operations.

The ERC helps manufacturers and supply chain businesses maintain stability and mitigate the impact of disruptions, ensuring the smooth flow of goods and services.

Mitigating Risks in Manufacturing Processes

Retaining a skilled workforce through the ERC can help manufacturers ensure consistent operations, reduce the likelihood of errors or disruptions, and maintain product quality.

This credit provides financial support that allows manufacturers to invest in training, process improvements, and equipment upgrades, enhancing efficiency, productivity, and ultimately, mitigating risks associated with manufacturing operations.

Case Study of Successful ERC Integration in Manufacturing

During the COVID-19 pandemic, factories and warehouses faced challenges in creating safe workspaces and managing staffing shortages.

In response, an Ohio-based robotic cell manufacturer experienced a surge in demand for their custom automation and robotic cell services.

This led to a rapid shift in their production focus, resulting in increased engineering hours, prototype supplies, and the involvement of third-party contractors.

Through their ERC efforts, the company secured a $300k federal credit and the company anticipates further growth in their activities within the robotics and automation market in the future.

ERC in Technology and IT

The Employee Retention Credit (ERC) provides vital support to technology and IT by:

ERC Approaches for Data Security and Privacy

In the technology and IT sectors, data security and privacy are of paramount importance. The Employee Retention Credit (ERC) can be utilized by businesses to implement robust approaches for data security and privacy.

This includes investing in cybersecurity measures, conducting regular risk assessments, implementing encryption protocols, and providing employee training on data protection.

By utilizing the ERC, businesses can strengthen their data security measures, safeguard sensitive information, and ensure compliance with privacy regulations, contributing to the overall resilience of the technology and IT sectors.

Managing Cybersecurity Threats

Cybersecurity is a critical concern in the technology and IT sectors, and the Employee Retention Credit (ERC) can be leveraged to effectively manage cybersecurity threats.

Businesses can utilize the ERC to invest in robust cybersecurity infrastructure, implement advanced threat detection and prevention systems, conduct regular security audits, and provide comprehensive employee training on cybersecurity best practices.

By utilizing the ERC, organizations can bolster their defenses against cyber threats, protect sensitive data, and ensure the continuity of their technological operations in the face of evolving cybersecurity challenges.

Example of Effective ERC Practice in the Tech Industry

An Ohio-based mobile app developer with a company established in 2019, was focused on developing a groundbreaking mobile app for the healthcare industry.

As the software was still under development in 2020, the company had no sales but incurred significant expenses in employee wages.

Through a comprehensive ERC study, they were able to secure a federal credit of $60K by efficiently documenting the qualifying activities and substantiating the eligibility of each project for the credit.

Benefits and Impact of ERC Specialists

The benefits and impact of ERC specialists include:

Enhancing Organizational Resilience

ERC specialists help identify and maximize the benefits of the Employee Retention Credit (ERC), allowing organizations to retain their workforce, maintain operations, and adapt to changing market conditions.

By providing guidance on eligibility requirements, conducting thorough assessments, and developing tailored strategies, ERC specialists enable businesses to strengthen their resilience, mitigate risks, and emerge stronger from economic uncertainties.

Cost Reduction and Financial Impact

ERC specialists help organizations reduce payroll tax liabilities, resulting in substantial cost savings. The ERC can provide significant financial relief, allowing businesses to allocate resources to other critical areas such as innovation, expansion, and strategic initiatives.

ERC specialists leverage their expertise to accurately calculate eligible credits, identify qualifying expenses, and ensure compliance with regulations. This financial impact contributes to the long-term sustainability and growth of organizations, improving their competitive edge in the market.

Frequently Asked Questions (FAQs)

Conclusion: Choosing the Right ERC Specialist

Choosing the right ERC specialist is crucial for businesses seeking to optimize their benefits under the Employee Retention Credit (ERC) program.

When choosing an ERC specialist, businesses should consider factors such as knowledge of ERC regulations, ability to tailor solutions, commitment to compliance, pricing, processing time, and availability of ongoing support.

By carefully evaluating these factors, businesses can make an informed decision, ensuring maximum benefits and compliance with regulatory requirements.

Sections of this topic

Sections of this topic