If inaccurate information on your credit report is affecting your FICO score, Sky Blue Credit Repair might be a solution. Serving clients nationwide, Sky Blue actively disputes credit reporting errors and interacts with creditors to ensure erroneous information is corrected.

Comprehensive reviews are available for those interested in learning more about Sky Blue Credit Repair that detail the services offered and how they could help improve your credit. These reviews can provide a deeper understanding of what to expect when working with Sky Blue and how they might enhance your credit profile.

>> Get Started With Sky Blue >>

What Is Sky Blue Credit Repair?

Sky Blue is a credit repair company dedicated to helping individuals scrutinize their credit reports and challenge any inaccuracies or outdated information.

Although anyone may dispute errors on their credit reports, and you can request a free credit report annually, the process can often be intricate and time-consuming. This is where the expertise and experience of credit repair companies like Sky Blue become invaluable. They navigate the complexities of credit disputes, making the process smoother and potentially quicker for you.

Sky Blue, established in 1989 and based in Boca Raton, Florida, focuses on assisting customers with low credit scores. They aim to help clients improve their scores, enabling them to qualify for home purchases or secure better interest rates. Their offerings include customized disputes, 35-day dispute cycles, score help, and debt validation. Sky Blue provides on-call coaches to guide customers out of poor credit situations.

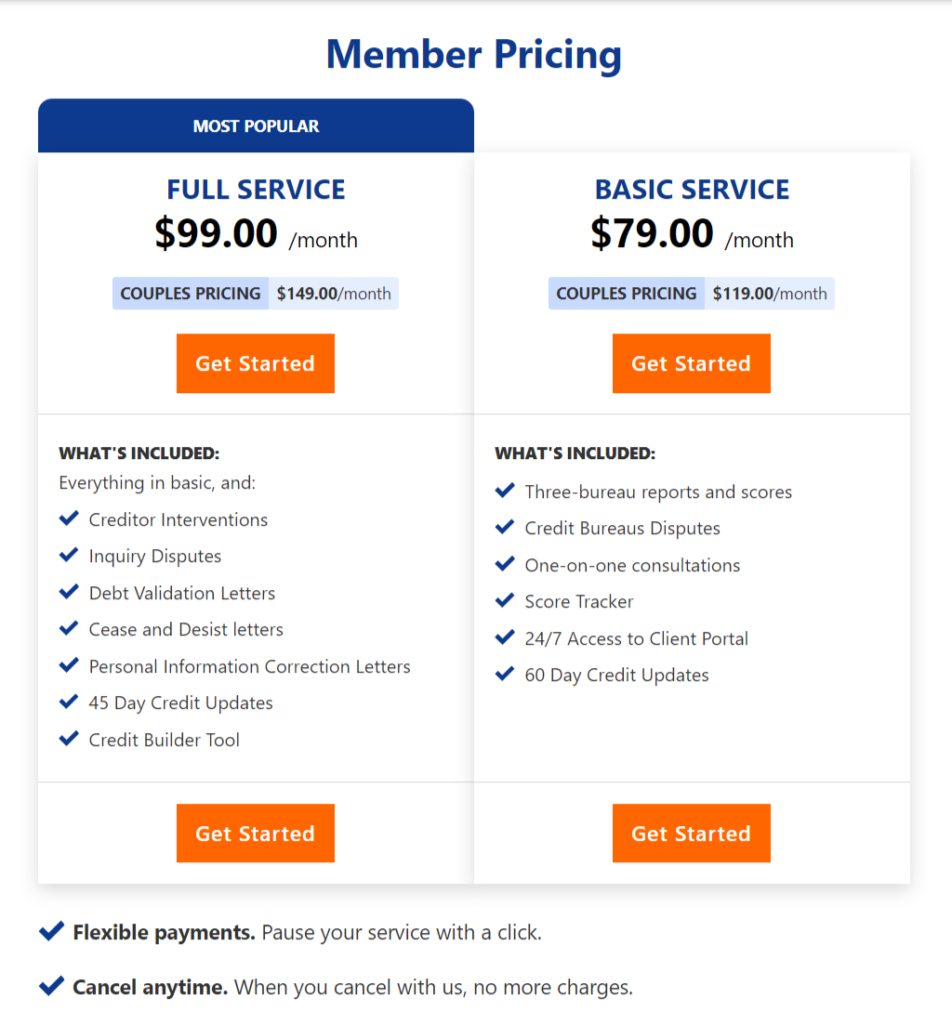

The service is available for individuals at a standard monthly fee of $79. Couples benefit from a 50% discount, paying only $119 monthly.

Sky Blue also offers a 90-day satisfaction guarantee, allowing new members to receive a full refund if unsatisfied with the services. Members can pause their membership and associated fees at any time through Sky Blue’s online portal, adding a layer of convenience and control.

Sky Blue’s Services

Sky Blue offers various services to challenge discrepancies in your Experian, TransUnion, and Equifax credit reports. Initially, they review your reports to identify errors or inaccuracies and assess whether disputing these items is advisable.

Sky Blue crafts custom dispute letters that clearly articulate the grounds for each dispute and uses 35-day dispute cycles to expedite the process. They also provide on-demand coaching sessions to help you understand and improve your credit-rebuilding strategies.

What It Offers

- Pro Analysis – Sky Blue thoroughly reviews your credit reports to identify errors and determine potentially risky disputes, such as accounts within the statute of limitations that could trigger collection efforts or litigation if disputed.

- Faster Disputes – Setting itself apart from other credit repair agencies, Sky Blue employs a 35-day dispute cycle, which is about 10 days quicker than most of its competitors. This sped up approach can speed up the removal of items from your credit report, potentially reducing your expenses on monthly fees.

- Custom Disputes – Sky Blue drafts tailored dispute letters that clearly outline the reasons for disputing incorrect items and include any necessary supporting evidence. This also applies to any follow-up disputes needed to address unresolved issues.

- Statute of Limitations (SOL) Research – Sky Blue investigates whether any collections fall within the SOL. If so, you will be consulted before any disputes are filed to avoid provoking increased collection actions or lawsuits.

- Score Assistance – After disputes are resolved, Sky Blue offers guidance on how to manage your finances more effectively, such as paying down balances or suggesting secured credit cards that can be opened regardless of credit history.

- Credit Rebuilding – Should Sky Blue’s credit experts determine that opening new credit card accounts could improve your score, they provide help with selecting and managing these new accounts.

- Coaches-on-Call – Sky Blue makes expert credit coaches available for consultations on credit offers, applications, or any other credit-related inquiries.

- Extra Services – Beyond basic disputes, Sky Blue provides additional services such as crafting goodwill letters, validating debts, sending cease and desist letters, and negotiating debt settlements to support your credit improvement goals further.

>> Get Started With Sky Blue >>

What It Doesn’t Offer

- Monthly Credit Monitoring – One notable limitation of Sky Blue is that it does not offer credit monitoring services to alert you of changes in your credit report. This oversight is a disadvantage since actively monitoring your current credit status is as crucial for enhancing credit scores as disputing past inaccuracies.

- Budgeting Support – Although Sky Blue doesn’t provide direct budgeting tools, it offers resources through its education center, including guides on how to create and manage a budget. This can be beneficial for individuals looking to improve their financial literacy and establish better spending habits as part of their overall credit improvement strategy.

Company Features

Sky Blue Credit provides several appealing features:

- Fast Dispute Cycle: Unlike many competitors that operate on a 45-day cycle for sending disputes, Sky Blue accelerates this process with a 35-day cycle. This quicker timeline could speed up the improvements to your credit report.

- Discount Opportunities: Sky Blue offers a significant incentive for couples who sign up together. They receive a discount on both the review/setup fee and the monthly service fee, both priced at $119 when applied jointly.

- Money-Back Guarantee: Sky Blue stands behind its service with a 90-day money-back guarantee. If you’re not satisfied within the first three months of enrollment, you can request a full refund.

- Pause Membership: For those who need to halt their credit repair journey temporarily, Sky Blue allows you to pause your membership. You can resume the service later with no need to pay the setup fee again, providing flexibility to manage your credit repair as your circumstances change.

Sky Blue’s Pricing

Sky Blue offers its credit repair services at a straightforward rate:

- Individuals: Sky Blue charges a flat fee of $79 per month for individuals, with an initial review/setup fee of $79.

- Couples and Cohabitants: For couples or individuals sharing financial responsibilities, Sky Blue provides a discounted rate of $119 per month, with a $119 review/setup fee, even if they don’t enroll simultaneously.

- Payment Schedule: The first payment is due six days after enrollment, with monthly charges beginning one month thereafter. These rates are competitive within the industry, as many other credit repair companies often charge higher monthly rates for similar services.

- 90-Day Money-Back Guarantee: Sky Blue backs its service with a no-conditions 90-day refund policy. While it doesn’t guarantee specific results, it offers a refund of any fees paid within the first 90 days if you’re not satisfied or decide to discontinue for any reason.

- Flexible Membership Options: You can pause or permanently cancel your membership at any time without incurring additional charges. Cancellations can be handled via email, phone, or through your account message center. It’s important to note that if one person in a couple’s plan cancels, the remaining member will automatically switch to an individual plan.

How Do You Sign up for Sky Blue Credit Repair?

Before considering a credit repair service, it’s crucial to obtain copies of your credit report from each of the three major credit bureaus. Normally, these reports are free once per year, but until the end of 2024, you can request them weekly at no charge.

Once you have your credit reports, review them thoroughly for any inaccuracies dispute, such as misreported late payments, duplicate accounts, or typographical errors. You can choose to dispute these errors directly with the credit bureaus or enlist the help of a credit repair service if you prefer not to handle it yourself. Only incorrect, unfair, or unverified information can be disputed. Accurate negative information cannot be removed simply because it’s undesirable.

If you decide to go forward with Sky Blue, you can start the process by visiting skybluecredit.com and clicking “Get Started.” You’ll need to provide some personal details like your name, address, and social security number. Although payment isn’t required immediately upon enrollment (not until six days after signing up), a valid credit or debit card is needed to complete the registration.

Sky Blue’s Credentials

Credit repair services like Sky Blue are governed by federal regulations. The primary regulatory body for this industry is the Consumer Financial Protection Bureau (CFPB), established to safeguard consumers against fraudulent or predatory actions by lenders, banks, and other financial institutions.

Licenses and Registrations

Sky Blue operates under the guidelines of the Credit Repair Organizations Act (CROA), which is a federal consumer protection law. This legislation was specifically designed to prevent credit repair agencies from engaging in deceptive or misleading advertising practices.

Awards and Certifications

We couldn’t locate any awards or certifications for Sky Blue.

Third-Party Ratings

Sky Blue is no longer accredited by the Better Business Bureau (BBB), as companies must pay annual fees to maintain their BBB rating. When it was accredited, however, it held an A+ rating and a customer review score of 3.67 out of 5.

Regulatory or Legal Actions

We found no pending regulatory or government actions involving Sky Blue.

Sky Blue’s Accessibility

Sky Blue provides its services to residents across all 50 states, Puerto Rico, Guam, the Virgin Islands, and to military personnel stationed globally.

Availability

Sky Blue can be reached only via phone or email since it does not operate physical locations. Members can manage their accounts through Sky Blue’s online portal. Those interested in learning more about the services can arrange a free consultation via the company’s Contact Us page.

Contact Information

Customers can reach Sky Blue either by emailing through its Contact Us page or by calling its customer service at (800) 790-0445. The phone lines are open Monday through Friday, from 9:00 a.m. to 5:00 p.m. EST.

User Experience

Among the limited complaints from Sky Blue customers, the initial fee of $79 is considered high. However, this fee is actually one of the lowest among the top credit repair companies included in our evaluation.

Moreover, Sky Blue offsets this initial cost with a flat monthly fee and promises as stated by the company no hidden charges in the future. Customers also have the flexibility to pause their membership whenever necessary or cancel it at any time without penalty.

The Sky Blue website is user-friendly, offering detailed information about its services. It also features an education center that explains the fundamentals of credit restoration and summarizes how long the process typically takes.

Sky Blue Credit Repair Reviews From Real Users – How Legit Is It?

Sky Blue Credit Repair is recognized as a reputable online LLC formation service, receiving many positive reviews from satisfied users. Let’s explore some reviews posted on Customer Affairs.

Sky Blue Credit boasts an impressive 4.7 out of 5-star rating, indicating that a remarkable 91% of their customers are content with the service they provide.

Alternatives to Sky Blue Credit Repair

For the past decade, CreditRepair.com has been operating and has successfully resolved 8.2 million issues since its establishment. The company’s main aim is to challenge any discrepancies in customers’ credit reports with every credit bureau, urging creditors to validate any negative items they have reported and closely monitoring customers’ credit progress as they strive to achieve their financial goals.

CreditRepair.com offers three distinct packages for customers, along with a complimentary consultation service, enabling individuals to select the package that best suits their requirements. These packages range in price from $69.95 to $119.95 per month, with an initial fee equivalent to the monthly charge for each specific service rendered.

One notable advantage of CreditRepair.com’s packages is that all of them include credit monitoring, a feature not commonly found among other credit repair services available in the market today.

With over 15 years of experience, Lexington Law has established itself as one of the most reliable credit repair companies. Their mission is to revolutionize the credit repair industry by providing ethical and effective solutions to consumers in need. Offering three distinct service packages, Lexington Law provides clients with a clear path toward building their credit and achieving their financial goals.

The company’s focus lies in four key areas: analyzing credit reports, disputing inaccurate information, escalating disputes when necessary, and closely monitoring credit scores.

Lexington Law offers flexible pricing options starting at $95.95, allowing customers to avoid any setup fees. Veterans and active military personnel are eligible for a special discount of 50% off their initial fees. They extend a generous offer for families or households where both partners can sign up for services together; this entitles the customer’s spouse to receive a one-time 50% discount on their fee.

With its extensive experience and commitment to customer satisfaction, Lexington Law is dedicated to helping individuals rebuild their credit profiles while offering competitive pricing options that cater to various needs.

With a solid 17-year track record, Credit Saint has established itself as a reputable player in the industry. For new customers, they provide a complimentary consultation and take charge of all interactions with credit bureaus should the customer decide to sign up for one of their packages. The three available packages begin at $79.99 per month and require a minimum setup fee of $99.

The Credit People stands apart from its competitors by offering clear and prompt timelines for customer results. Unlike other companies, they don’t keep you waiting; they work on your credit improvement almost immediately. In fact, they even claim that some customers can see positive changes within just 60 days.

As an added benefit, The Credit People provides your credit scores and reports right after signing up, ensuring that you have a comprehensive understanding of your current credit situation from the very beginning. This starting point is invaluable for tracking your progress as time goes on.

Sky Blue – FAQ

Bottom Line

Sky Blue Credit Repair is a dependable companion in your journey toward improving your credit. Their dedication to being open and honest, tailoring strategies to individual needs, and delivering effective outcomes has established them as a reliable ally in credit repair.

If you’re determined to enhance your credit score and access fresh financial prospects, consider turning to Sky Blue Credit Repair as your preferred solution. Begin taking strides towards a more prosperous financial future today.

Sections of this topic

Sections of this topic