Contemplating the approaching tax season and uncertain if you possess the capabilities to manage your return independently or require expert assistance? H&R Block offers a variety of tax filing solutions, catering to those who prefer a do-it-yourself approach and those who opt to entrust their tax returns to a professional, whether virtually or in person.

Let us evaluate H&R Block’s online software features, functionality, and pricing. This assessment aims to assist you in determining whether using their services for filing your taxes may be advantageous.

>> File Your Taxes Online With H&R Block >>

What Is H&R Block?

H&R Block, a top-notch tax preparation company, provides an array of services for both individuals and businesses. Their offerings encompass precise tax preparation, streamlined tax filing, strategic tax planning, and help during audits. With their presence in physical offices and online platforms, H&R Block caters to the diverse needs of their clients by offering detailed guidance every step of the way.

They excel at optimizing deductions and credits while ensuring full compliance with all relevant tax regulations. H&R Block goes beyond taxes by providing an extensive range of financial products and services. This makes them a comprehensive resource for navigating the intricate world of taxes and financial planning with ease.

Who Should Use H&R Block Tax Software?

If you’re looking to save a few bucks by opting out of TurboTax, H&R Block offers a suitable alternative that will feel familiar.

This year, H&R Block is simplifying the transition from TurboTax with its Direct Import feature. This tool allows H&R Block users to easily import their TurboTax data by entering the phone number linked to their Intuit account.

While you may miss out on a slightly better user experience with TurboTax, finding a free option that rivals the smoothness of H&R Block is challenging. The Free Online edition caters to both students and adults with simple tax returns and provides a wider range of credits and tax forms compared to its competitors.

If you’re looking for the convenience of meeting with a tax preparation professional face-to-face, H&R Block is worth considering. Similar to TurboTax, H&R Block charges per state tax return. Therefore, if you need to file multiple state returns, it may be beneficial to explore other options.

H&R Block’s Handy Features

If you’re currently using a different provider, H&R Block makes it easy to switch. They can import your previous year’s tax return from either an H&R Block or TurboTax data file, as well as from a PDF of your tax return created by any other provider.

- Auto-importing tax documents: You can import your W-2 from your employer either via PDF or direct import if your payroll provider is affiliated with H&R Block. This feature allows you to avoid the time-consuming process of manually entering data from individual boxes. You can upload a photo of your W-2 for convenience. Various types of 1099 forms can be imported, and the Self-Employed version allows direct import of your 1099-K or 1099-MISC from Uber if you have a driver’s account.

- Donation calculator: The Deluxe, Premium, and Self-Employed packages are equipped with DeductionPro, an integration that aids in calculating the deduction value of donated items such as clothes and household items.

- Crypto support: H&R Block’s recent collaboration with CoinTracker addresses a significant challenge for cryptocurrency investors by eliminating the need for manual data entry. Premium and Self-Employed users can now connect their CoinTracker accounts to import their cryptocurrency transactions seamlessly.

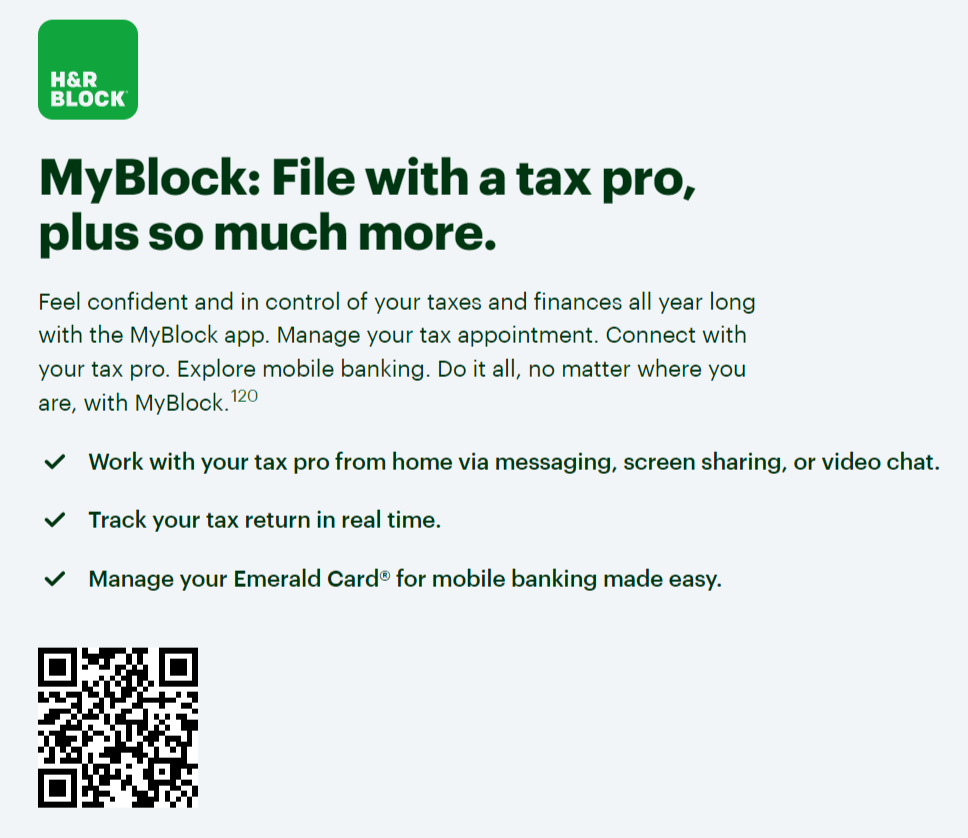

- Platform mobility: As the software operates online, users have the flexibility to log in from various devices to work on their tax returns at their convenience. A mobile app is available for added accessibility.

>> File Your Taxes Online With H&R Block >>

H&R Block Pricing

When it comes to filing taxes, H&R Block provides a cost-effective option that’s cheaper than TurboTax but more expensive than other popular tax-preparation services like TaxSlayer, TaxAct, or Cash App Taxes.

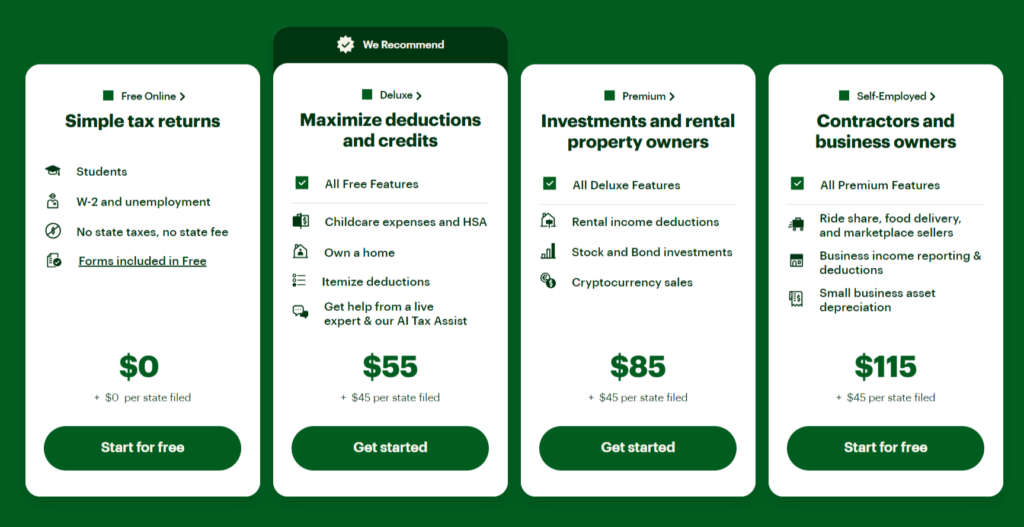

H&R Block offers four primary methods for tax preparation and filing: online DIY packages, the ability to add Online Assist for additional expert help, full-service assistance from a tax preparer, and downloadable computer software.

Each of these options has different pricing based on the specific tax forms required. With all versions except the computer software option, you have the opportunity to prepare your return at no cost. Payment is only required when it’s time to file your taxes.

- Free Online: $0. This option supports various income sources including W-2, unemployment, interest, and dividend income, as well as retirement distributions. It also covers deductions such as student loan interest, tuition and fees, the child tax credit, and the earned income tax credit (EITC). However, itemized deductions aren’t available, which is typical of most free tax-preparation software. Notably, H&R Block’s free version includes student deductions, unlike some competitors.

- Deluxe Online: $55. This package includes all features of the free version and adds the mortgage interest deduction and health savings accounts. It also allows users to itemize their deductions.

- Premium Online: $85. Building on the Deluxe version, this package supports rental property income and freelance/contractor income below $5,000. Users can also import mileage and other expenses from common tracking apps.

- Self-Employed Online: $115. This is the top-tier online package offered by H&R Block, tailored for self-employed individuals including small business owners, partners, and contractors earning more than $5,000.

Extra Fees You Might Have to Pay With H&R Block

- State filing required: If you live in one of the states where state income taxes are mandatory, you’ll need to pay an additional fee of $37 per state return. If you have lived or worked in multiple states, you may have to pay for multiple state returns.

- Upgrade to Online Assist: This option is quite similar to the online filing options mentioned earlier, but it allows you to chat and share your screen with a tax expert instantly. The service starts at $70 and can go up to $195.

- Upgrade to full-service preparation: With this option, you can hand over your tax documents to a professional, either in person or virtually, who will handle the preparation and filing of your return. Prices for these services start at $89 for a federal return.

- Pay from your refund: If you anticipate a tax refund, H&R Block may offer the option to use part of it to cover their tax preparation services. While this sounds convenient, be aware that a $39 processing fee applies.

>> Check Out the Best Pricing for H&R Block >>

Is H&R Block Safe to Use?

H&R Block ensures the safety of its websites through various security measures, such as employing web-browsing encryption technology and multi-factor authentication. They prioritize protecting your data by monitoring it constantly, with 24/7 surveillance.

The company also conducts audits and risk assessments with the help of external security experts. To add an extra layer of security, their data centers, networks, and servers are housed in secure facilities.

When you provide personal and financial information online for tasks like tax preparation and filing, PCMag advises taking simple safety precautions. One such precaution is to only use a trusted network like your home Wi-Fi network. By doing so, you can further safeguard your sensitive information from potential threats

Exceptional Help

For many years, H&R Block has been a reliable source of help for taxpayers. One of its standout features is its proactive approach. Unlike TaxAct, which offers helpful tools but lacks cohesion, H&R Block centralizes guidance in a vertical pane on the right side of the screen. The language used by H&R Block is straightforward and easy to understand, with minimal references to IRS instructions, an important factor.

H&R Block introduces topics on multiple pages by providing explanations of what will be discussed. Clickable links are available for related explanations as well. What sets it apart from other online tax services is that the Help pane always displays context-sensitive help specific to the current page being viewed, a feature that competitors usually require you to click on separate links for.

This year, H&R Block has introduced an additional layer of assistance called AI Tax Assist. Instead of simply providing search results in list form as traditional search engines do, AI Tax Assist engages in conversation with users and is powered by an artificial intelligence engine.

Although it performed well during testing, it could offer more advantages over the site’s standard help search tool which provides relevant links to related pages and frequently asked questions (FAQs).

In conclusion, taxpayers can rely on H&R Block for exceptional support due to its proactive nature and centralized guidance system. The language is user-friendly and avoids overwhelming users with excessive references to IRS instructions.

Features such as introductory explanations and context-sensitive help contribute further convenience compared to other online tax services. While AI Tax Assist may seem promising at first glance, it ultimately only provides substantial benefits beyond what can be achieved through standard search tools available on the site.

Excellent Mobile Apps

The tax preparation capabilities of the H&R Block Android and iOS mobile apps are widely appreciated. These apps provide a user-friendly interface and seamless navigation tools that closely resemble the desktop version.

All features, including those for self-employment, are present and work smoothly. The mobile platform offers standard help options and effective AI Tax Assist functionality. It’s important to note that any delay in responsiveness caused by device performance isn’t a result of H&R Block’s app design.

How Does H&R Block Work?

While H&R Block is best known for its physical offices in the United States, it also provides online filing options and downloadable software. If you opt for their online package, you can conveniently handle your tax matters using their mobile app compatible with Android and iOS devices.

H&R Block caters to a wide range of tax filers by offering a modern and user-friendly interface. Like other tax preparation services, the platform guides users through questions regarding their household income and provides opportunities to identify deductions and tax credits.

In addition to answering these questions, input information from your employer, as well as any other sources of income you may have. You will also need to include details from various tax forms such as 1099s, 1098s, and W-2s, which may arrive in physical or digital format.

If you’re worried about making errors on your taxes or missing out on deductions due to confusion with the complex forms involved, H&R Block offers an additional service where they can connect you with one of their network professionals for an extra fee.

>> Start Using H&R Block Now! >>

H&R Block Alternatives

Intuit TurboTax is our top recommendation for online tax software designed for small businesses due to its user-friendly interface, vast database of deductions and credits, and dedicated support tailored to startup enterprises.

This all-inclusive solution caters to businesses of any scale or industry, despite its higher price compared to other tax software options. Within the range of Intuit TurboTax services, small business owners should opt either for the TurboTax Self-Employed online package or the TurboTax Business application.

Both choices offer seamless integration and comprehensive features necessary for managing taxes efficiently in a small business setting.

TaxSlayer stands out as a top choice for small business tax filers due to its ability to handle complex returns at an affordable price compared to other major players. With TaxSlayer, you’ll have access to a priority phone line, excellent customer service, and an intuitive platform that simplifies the tax filing process.

What sets TaxSlayer apart is the level of customization it offers. If you prefer a guided approach, the software provides step-by-step instructions that ensure quick and accurate filing. If you’re familiar with tax forms and know exactly what you need, you can navigate directly to those specific forms to enter your income and deductions, a faster option for experienced users.

TaxSlayer’s versatility caters to different needs while maintaining user-friendly functionality. Whether you require comprehensive assistance or prefer more independence in managing your taxes, TaxSlayer has got you covered.

H&R Block Frequently Asked Questions

Bottom Line

H&R Block caters to individuals with varying tax needs, whether they prefer filing their taxes online independently, seeking expert guidance, or opting for professional assistance. Although their prices may not be the lowest in the market, the exceptional user experience justifies the slightly higher cost.

The inclusion of AI Tax Assist as an optional service on H&R Block’s platform enhances the tax filing process for paying customers by providing intuitive guidance.

In addition to these features, H&R Block offers a range of valuable services for taxpayers including two mobile apps, useful tax calculators, and several options for receiving tax refunds.

Sections of this topic

Sections of this topic