Starting a business usually begins with deciding to set up a Limited Liability Company (LLC). Those looking to start their business in the beautiful state of Vermont need to know the costs involved. The cost to form an LLC in Vermont includes more than the simple filing fees; it requires a careful spending plan.

Yet, starting an LLC doesn’t have to be overly expensive. Using the right tools, like services from companies such as Tailor Brands, can lead to significant savings when forming an LLC.

This article explains the different expenses involved in the cost of forming an LLC in Vermont and shows ways to make forming an LLC more affordable.

What Is the Cost of Forming an LLC in Vermont?

The expense of starting an LLC in Vermont is the $125 fee to submit your LLC’s Articles of Organization online via the Vermont Secretary of State’s website.

Vermont Foreign LLC Formation Costs

If you own an LLC already registered in another state and want to expand your business into Vermont, you must register your LLC as a foreign entity in Vermont.

The cost to register a foreign LLC in Vermont is $125. You can complete this business registration through the Vermont Secretary of State’s official website.

Annual Cost for LLCs in Vermont

When planning to start a Limited Liability Company (LLC) in Vermont, it’s important to understand the ongoing costs associated with keeping your LLC compliant and legally recognized. Knowing these expenses helps you budget properly and protects your LLC’s financial health.

The main recurring costs for a Vermont LLC include a $35 annual report filing fee, an annual business entity income tax that varies depending on income (with a minimum of $250), a $40 renewal fee for Assumed Business Names (ABNs) every five years, and the choice to have a registered agent.

While there’s no state-required fee for a registered agent, the average annual cost ranges from $100 to $300 if you choose third-party registered agent services. These ongoing fees are crucial for your financial planning and for maintaining the financial stability of your Vermont LLC.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Vermont With the Best LLC Service?

Tailor Brands LLC Formation Cost

The initial fee to establish an LLC in Vermont is $125, and there might be extra charges based on the options you choose. Normally, processing takes 2 to 3 weeks. However, you can pay an additional $50 for accelerated processing, which reduces the wait to 4 to 6 days. For the fastest service, rush processing is available within 1 to 2 days for an extra $100.

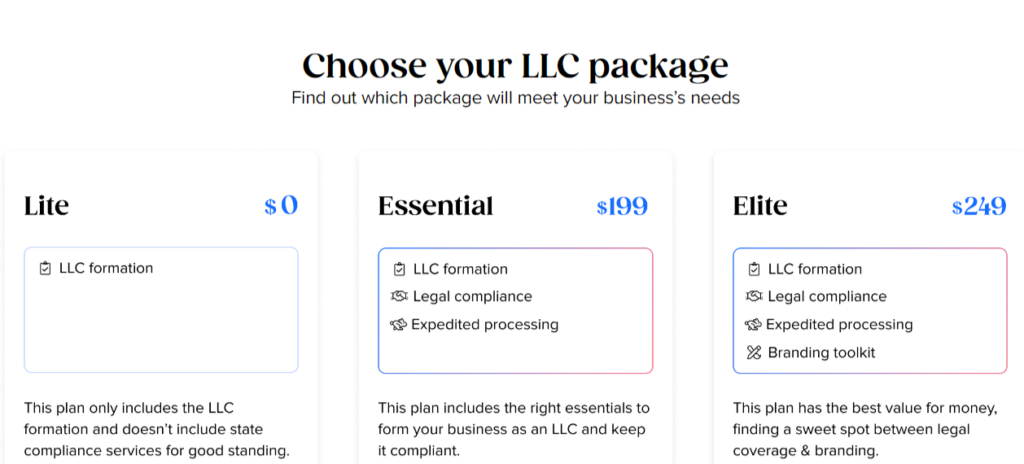

The Lite LLC plan from Tailor Brands is the most affordable option, offering LLC formation service with standard processing times and only requiring the state filing fee. The Essential LLC plan, priced at $199 plus state fees, includes expedited processing, annual compliance services, and an operating agreement, with an annual maintenance fee of $199.

The highest tier, the Elite plan, LLC costs $249 plus state fees. It encompasses all the features of the Essential plan along with additional business tools such as a free domain for one year, a do-it-yourself website builder, an online store, eight free logos, a digital business card, a business card tool, and a tool for creating social media posts. An annual fee of $249 is necessary to continue these services with Tailor Brands.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Vermont

Vermont LLC Name Costs

Choosing a name for your LLC is free. Once the state approves your LLC’s Articles of Organization, your Vermont LLC Name is officially approved without any extra charges.

You may have heard that reserving an LLC Name is required, but this is usually not true in most states. There’s typically no requirement to reserve a business name before forming an LLC.

If you want to reserve your chosen name for up to 120 days before forming your LLC, you can file for an LLC Name Reservation through the Secretary of State’s online platform. This process requires a $20 filing fee.

Vermont Registered Agent Costs

The Vermont Registered Agent Fee maybe $0 if you decide to serve as your own agent or have someone you trust to do it, or it may be up to $125 annually. Vermont law requires you to appoint a Registered Agent when forming your LLC.

A Vermont Registered Agent acts as the contact for legal papers and state communications for your LLC. To be a Registered Agent, one must have a physical address in Vermont and be available during normal business hours.

Choosing yourself or someone you know as your Registered Agent costs nothing extra. However, hiring a Registered Agent service typically costs between $100 to $300 per year. These companies not only handle your legal documents but also offer additional business services and can protect your privacy.

It’s wise to think about using a Registered Agent service because:

- You need a physical address in Vermont as required by state law for Registered Agents.

- If you want to keep your address private, some service providers can help by letting you use their address.

Vermont Operating Agreement Costs

The fee for the LLC Operating Agreement is $0. This agreement is a contract among Vermont LLC Members that details ownership, management structure, and how profits are divided. It’s recommended that both Single-Member and Multi-Member LLCs draft and keep an Operating Agreement, and each Member should be provided with a copy.

Many online platforms usually charge between $50 to $200 for similar agreements.

Vermont EIN Cost

The fee for getting an LLC EIN Number is $0.

An EIN, or Employer Identification Number (also known as FEIN or Federal Employer Identification Number), is essential for income tax filing, setting up an LLC bank account, and hiring employees (if applicable). Although many platforms charge fees to obtain an EIN, you can get one for your LLC for free. This involves a quick online filing with the Internal Revenue Service (IRS) and can be completed within minutes.

>> Start Your LLC With Tailor Brands >>

Vermont LLC Taxes

The yearly costs linked to various Vermont LLC taxes can vary greatly because LLC owners must pay several types of taxes.

Some of these taxes include:

Federal Income Taxes

When handling federal income taxes for your LLC, the IRS applies different rules based on the LLC’s structure. For Single-Member LLCs, the IRS views them as Disregarded Entities, meaning they don’t have to file their own federal income tax returns. Instead, the owner must file the return and pay the federal income taxes.

The type of taxation depends on who owns the LLC: if an individual owns it, it’s taxed as a Sole Proprietorship, but if a corporation owns it, it’s taxed as a branch or division.

Multi-Member LLC Taxes

The IRS classifies LLCs that have two or more members as partnerships. Such LLCs are required to file a Form 1065, the Partnership Return, and issue a Schedule K-1 to each member, detailing their portion of the profits. This income is then “passed through” to the members, who must declare and pay taxes on it via their individual income tax returns (Form 1040).

Husband and Wife LLC Taxes

In certain states, such as Texas, a husband and wife who own an LLC together can choose to be taxed as a Single-Member LLC (Qualified Joint Venture) instead of as a Multi-Member LLC. This option, however, isn’t available in Vermont because it’s not a community property state.

Electing Corporate Taxation

Besides the standard options, an LLC can choose corporate taxation. This choice includes two types: S-Corporation and C-Corporation.

The S-Corporation can help profitable businesses cut down on self-employment taxes, whereas the C-Corporation may benefit larger employers with healthcare fringe benefits. It’s wise to talk to an accountant before making this decision.

Vermont State Income Tax

In Vermont, owners of single-member LLCs must file a state return that reports the LLC’s profits and losses. For multi-member LLCs, a partnership return is typically required at the state level, and each owner must report their portion of the profits and losses on their personal state tax returns. LLCs taxed as Partnerships or S-Corporations are subject to the Business Entity Tax (BET).

Local Income Tax

Local income taxes may apply to both you and your LLC, requiring you to file and pay taxes at the municipal level. It’s advisable to hire an accountant for a smoother process.

Vermont Sales Tax

If you engage in selling products in Vermont, you may need to collect sales tax and acquire a Seller’s Permit. This permit enables you to apply sales tax to retail transactions. The Vermont Department of Taxes manages the issuance of these permits.

Vermont LLC Payroll Taxes

If your Vermont LLC has employees, you must submit payroll taxes. This includes federal and state income tax withholdings, Social Security and Medicare taxes, and unemployment taxes at both federal and state levels, as well as any local or county deductions and employee deductions.

Setting up and managing payroll and tax submissions can be complex, so it’s recommended to hire a payroll company or consult an accountant to ensure accuracy and avoid penalties.

>> Get Started With Tailor Brands >>

Vermont LLC Cost – FAQs

Conclusion

Setting up an LLC in Vermont involves more than just paying an initial fee. It requires navigating a detailed financial landscape, which includes getting necessary documents, working with registered agents, and handling essential items like operating agreements and obtaining an EIN.

Effective financial management is crucial in these areas, where the specialized knowledge of LLC services like Tailor Brands proves essential. With a full grasp of these diverse costs and support from Tailor Brands, aspiring business owners can confidently start their LLCs in Vermont.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic