Starting an LLC in South Dakota involves costs that go beyond submitting the initial paperwork. However, this process is often more affordable and financially sensible than it seems.

This guide will cover the expenses of setting up an LLC in South Dakota and provide important key tricks for saving money.

Our detailed guide aims to show smart entrepreneurs how to use the best LLC services like Tailor Brands to keep the cost of forming an LLC in South Dakota manageable without losing quality.

What Is the Cost of Forming an LLC in South Dakota?

Starting an LLC in South Dakota mainly involves a $150 cost. This fee pays for the online filing of your LLC’s Articles of Organization with the South Dakota Secretary of State.

South Dakota Foreign LLC Formation Costs

If you own an LLC registered in another state and want to expand your business into South Dakota, you must register your LLC as a foreign entity in the state.

The cost to register a foreign LLC in South Dakota is $750 for online registration and $765 for mail registration. To register a business, you need to submit an Application for a Certificate of Authority online.

Annual Cost for LLCs in South Dakota

When setting up a Limited Liability Company (LLC) in South Dakota, understanding the ongoing costs associated with maintaining your LLC’s legal status and compliance is essential. Knowing these costs helps you budget wisely and ensures the financial health of your LLC.

The main ongoing expenses for a South Dakota LLC include: first, filing an annual report, which costs $50 online and $65 by mail; second, renewing a DBA name registration every five years for $10; and third, the registered agent fee. If you act as your own registered agent, there’s no cost, but using a third-party service can cost between $100 and $300.

Considering these costs is crucial for planning your LLC’s finances in South Dakota, which helps you make smart decisions and maintain your LLC’s financial success.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in South Dakota With the Best LLC Service?

Tailor Brands LLC Formation Cost

The initial cost to start an LLC in South Dakota is $150, which may vary based on certain needs. Normally, processing takes 2 – 3 weeks. However, you can choose faster options: 4 – 6 days for an extra $50 or 1 – 2 days for $100.

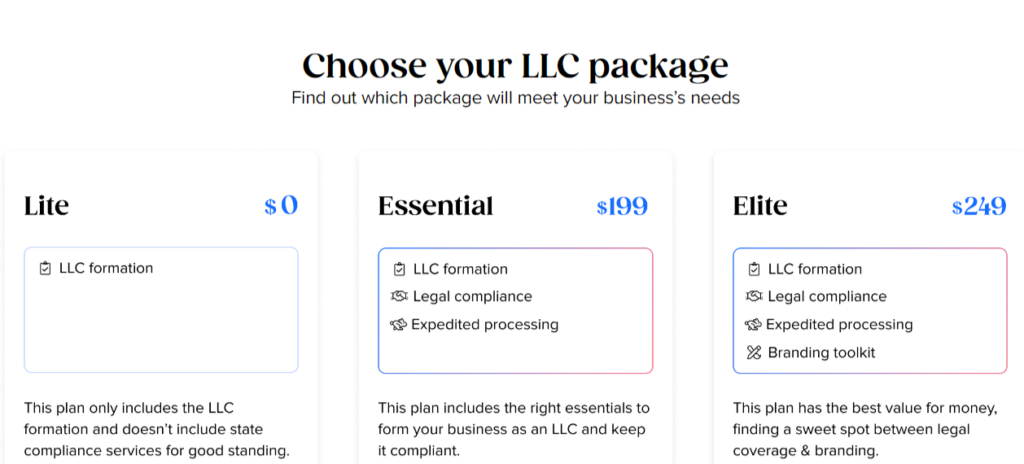

The Tailor Brands Lite LLC plan offers LLC formation with standard processing times and costs only the state filing fee. The Essential LLC plan, priced at $199 plus state fees, includes expedited processing, annual compliance services, and an operating agreement. Tailor Brands also charges an annual $199 fee to maintain these services.

The Elite LLC plan, the highest tier at Tailor Brands, costs $249 plus state fees. It includes all services from the Essential plan along with extra business tools such as a free business domain for one year, a DIY website builder, an online store, eight free logos, a digital business card, a business cards tool, and a social media post maker. To continue receiving these services, customers must pay an annual fee of $249 to Tailor Brands.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in South Dakota

South Dakota LLC Name Costs

Choosing a name for your Limited Liability Company (LLC) in South Dakota is free. The state will approve your chosen name when you submit your Articles of Organization, with no extra charges.

You might have come across information stating that reserving an LLC name is mandatory, but this is frequently not the case in many states. Most states don’t mandate a name reservation for LLC formation.

If you want to reserve a name for up to 120 days before you form your LLC, you can file an Application for Reservation of Name and pay a $25 filing fee.

If a foreign LLC finds that its name is already taken in the state, it can pick a new name by filing an Application for Registration of Name and paying a $25 filing fee.

South Dakota Registered Agent Costs

According to state regulations, when establishing your LLC in South Dakota, you must pay the South Dakota Registered Agent Fee, ranging from $0 to $125 annually.

Your South Dakota Registered Agent is responsible for accepting legal documents and official notices for your LLC. This individual or company must have a valid street address within South Dakota and be available during standard business hours.

If you opt to serve as your own Registered Agent or appoint someone you know, there are no additional charges.

Alternatively, you can employ a Registered Agent service, which typically costs between $100 to $300 per year. These services may offer additional business support and help safeguard your privacy.

It’s wise to consider a Registered Agent service when:

- If you don’t have an address in the state, South Dakota law requires Registered Agents to have a physical address there.

- If you want to keep your address private, some companies may let you use their address instead.

South Dakota Operating Agreement Costs

In South Dakota, creating an LLC Operating Agreement, which is a detailed contract describing LLC ownership, management, and profit sharing among members, carries no cost.

Both Single-Member and Multi-Member LLCs need to make an Operating Agreement, keep it in their business records, and give each member a copy. Online platforms usually charge between $50 and $200 for LLC Operating Agreements.

South Dakota EIN Cost

Obtaining an EIN Number for your LLC, which stands for Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN), doesn’t incur any fees.

An EIN is crucial for filing income taxes, setting up a bank account for your LLC, and hiring employees if needed. While some websites may charge for obtaining an EIN for your LLC, you can acquire one without cost.

You can obtain an EIN for free from the Internal Revenue Service (IRS), and the online application can be completed in just a few minutes.

>> Start Your LLC With Tailor Brands >>

South Dakota LLC Taxes

The yearly LLC costs for different taxes that South Dakota LLC owners must pay can vary greatly, depending on the type of tax. Some of these taxes include:

Federal Income Taxes

The IRS offers various treatment options for your LLC when dealing with federal income taxes. Based on the ownership setup, your LLC can be classified as either a Single-Member LLC or a Multi-Member LLC.

Single-Member LLC Taxes (Default Status)

For tax purposes, the IRS considers Single-Member LLCs as Disregarded Entities. This means the IRS doesn’t require these LLCs to register a separate federal income tax return. Instead, the owner of the Single-Member LLC reports the LLC’s income on their personal tax return and pays the related federal income taxes.

Multi-Member LLC Taxes (Default Status)

For Multi-Member LLCs, which have two or more owners, the IRS treats them as Partnerships for tax purposes. These LLCs must file a Partnership Return (Form 1065) and provide a Schedule K-1 to each owner. The income reported on these K-1 forms is allocated to each owner, who then pays their share of the income taxes on their individual tax return.

Husband and Wife LLC Taxes

In some states, a husband and wife who own an LLC together can choose to be treated as a Single-Member LLC (Qualified Joint Venture) or a Multi-Member LLC. However, this choice is only possible in community property states. South Dakota doesn’t offer this option because it’s not a community property state.

Electing Corporate Taxation for Your LLC

Besides the default options, an LLC can choose to be taxed as a Corporation, which may offer tax benefits. This decision should be made with advice from an accountant. The two types of corporate tax statuses available are S-Corporation and C-Corporation.

- An LLC can elect to be taxed as an S-Corporation by filing Form 2553 with the IRS, which may reduce self-employment taxes for businesses with steady profits.

- By submitting Form 8832 to the IRS, an LLC can choose C-Corporation taxation, potentially saving on healthcare benefits for larger employers, though this choice is less common.

South Dakota State Income Tax

South Dakota doesn’t charge state-level income taxes, which sets it apart. However, some industries and types of businesses may still need to pay other South Dakota business taxes. It’s advisable to consult an accountant for tax preparation.

Local Income Tax for South Dakota LLCs

Local municipalities might require you or your LLC to file and pay income taxes. It’s advisable to hire an accountant to manage these local income taxes, and you should contact your municipality for specific requirements.

South Dakota Sales Tax

If your business sells products to consumers in South Dakota, you may have to collect sales tax and get a Seller’s Permit. This permit allows you to collect sales tax on retail sales and is issued by the South Dakota Department of Revenue.

South Dakota LLC Payroll Taxes

For LLCs in South Dakota that have employees, it’s necessary to submit payroll taxes. This includes various taxes and filings such as federal and state income tax withholding, Social Security tax, Medicare tax, and unemployment taxes.

Setting up payroll, managing these deductions, and submitting the required taxes can involve complex calculations, leading many to seek help from payroll companies or accountants.

>> Get Started With Tailor Brands >>

South Dakota LLC Cost – FAQs

Conclusion

Starting an LLC in South Dakota requires more than just the initial fee. The process includes handling different financial factors such as getting documents, using registered agent services, setting up operational agreements, and securing an EIN. Managing finances well in these areas is crucial, and LLC service providers like Tailor Brands are skilled in this field.

By understanding the details of these various costs and using the knowledge of Tailor Brands, future entrepreneurs can confidently begin their LLC journey in South Dakota.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic