Setting up an LLC in Oklahoma involves more than just basic paperwork. It’s a common myth that the process will drain your wallet. This guide will break down the actual costs of starting an LLC in Oklahoma and highlight savvy strategies to keep expenses low. Using services like Tailor Brands can smartly cut down on costs while you manage the complex steps of the formation process.

What Is the Cost of Forming an LLC in Oklahoma?

The main expense when forming an LLC in Oklahoma is the $100 fee. This amount is for submitting your LLC’s Articles of Organization online to the Oklahoma Secretary of State.

Oklahoma Foreign LLC Formation Costs

If you’ve got an LLC set up in another state and you’re planning to expand your biz into Oklahoma, you’ll need to register your LLC as a foreign entity there.

Oklahoma slaps a $300 fee on this business registration. To get your foreign LLC recognized in Oklahoma, you’ll have to file an Application for Registration, also known as Form 0081.

Annual Cost for LLCs in Oklahoma

When managing the finances of your LLC in Oklahoma, it’s crucial to keep track of the ongoing costs needed to maintain it. Understanding these expenses is key to budgeting effectively and securing your LLC’s financial health over time.

Your main recurring expenses include the Annual Certificate, which needs filing every year with a $25 fee, and the Registered Agent Fee. Having a registered agent is mandatory, and if you go with a third-party service, it might set you back $100 to $300 each year.

Factoring in these steady financial obligations into your Oklahoma LLC’s budget helps you make savvy decisions and maintain your company’s fiscal strength.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Oklahoma With the Best LLC Service?

Tailor Brands LLC Formation Cost

Setting up an LLC in Oklahoma starts with a basic fee of $100. This initial LLC cost is just the beginning, as other charges may apply depending on how fast you need the process to go. Normally, it takes about 2 to 3 weeks to process everything. If you’re in a rush, you can opt for the expedited service, which shortens the wait to 3 to 5 days for an extra $50, or even quicker, 1 to 2 days for an additional $100.

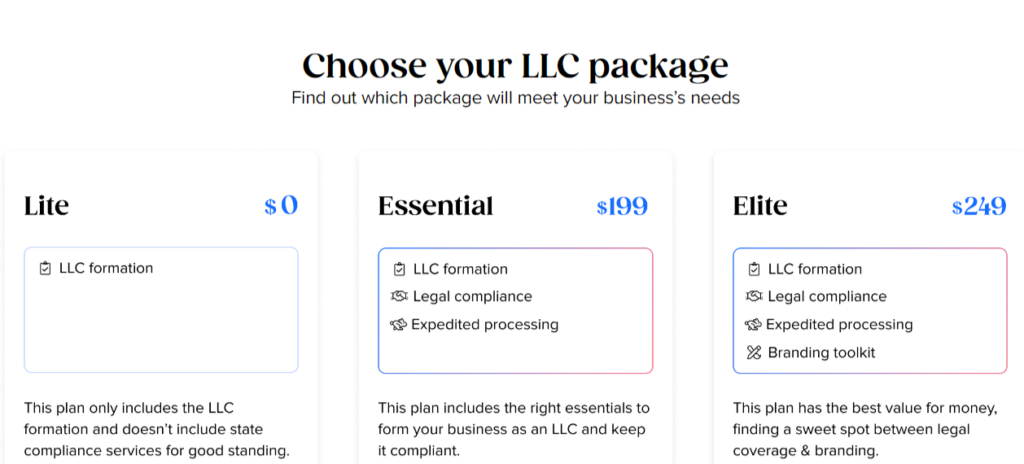

Tailor Brands offers several plans for LLC formation. Their Lite LLC plan, the most budget-friendly option, covers the basic LLC setup and the standard processing time for just the state filing cost. The Essential LLC plan, priced at $199 plus state fees, includes faster processing, annual compliance services, and an operating agreement. This plan has an ongoing annual cost of $199 for continued services.

For those looking for more comprehensive support, the Elite LLC plan from Tailor Brands is the top-tier option. It costs $249, plus the state filing fees, and includes all the features of the Essential plan, along with extras like a free business domain for the first year, tools for building a DIY website and online store, eight free logos, a digital business card, and a social media post maker. The annual renewal fee for the Elite plan is also $249.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Oklahoma

Oklahoma LLC Name Costs

Choosing a name for your Limited Liability Company (LLC) is free. When you submit your Articles of Organization, the approval of your selected Oklahoma LLC name is included without any additional fees.

You might come across online claims about the need for LLC Name Reservations. However, this is often not the case. Most states, including Oklahoma, don’t require you to reserve a name as a condition for forming your LLC. So, you won’t have to worry about any Name Reservation fees when setting up your LLC in Oklahoma.

Oklahoma Registered Agent Costs

In Oklahoma, the Registered Agent Fee varies from $0 to $125 annually, stemming from the state requirement to appoint a Registered Agent when forming your LLC.

A Registered Agent in Oklahoma can be either an individual or a company tasked with receiving legal papers and official communications for your LLC. This agent needs a physical address in the state and should be available during standard business hours.

If you choose to act as your own Registered Agent or appoint someone you trust for this role, you won’t face any additional fees.

Alternatively, you can choose to employ a Registered Agent service, which usually ranges in cost from $100 to $300 annually. These services often come with additional perks, such as extra business services and improved privacy protection.

Considering a Registered Agent service might be a smart move if:

- You don’t have a physical address in Oklahoma (since state law requires an in-state address for Registered Agents).

- You prefer to keep your address private (many services allow you to use their address instead of your personal one for added privacy).

Oklahoma Operating Agreement Costs

In Oklahoma, the LLC Operating Agreement is a crucial document that spells out the key details like ownership, management, and how profits are shared among the members. It’s necessary for both Single-Member and Multi-Member LLCs and should be drafted, kept within the company’s records, and provided to each member.

Although various online platforms often charge between $50 and $200 for drafting an Oklahoma LLC Operating Agreement, it’s worth mentioning that this document doesn’t inherently come with any costs.

Oklahoma EIN Cost

Getting an EIN Number, also called an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN), is vital for your LLC. You’ll need it for income tax purposes, to open a business bank account, and if you plan to hire employees. Although some websites might charge a fee to help you obtain an EIN, it’s important to know that you can get this number directly from the IRS at no cost.

The IRS offers a straightforward online application process that only takes a few minutes and is completely free.

>> Start Your LLC With Tailor Brands >>

Oklahoma LLC Taxes

The annual costs for Oklahoma LLC owners can vary widely because of the different taxes they must pay. Some examples of these taxes include:

Federal Income Taxes

When managing your Limited Liability Company (LLC) in terms of federal income taxes, the Internal Revenue Service (IRS) presents several options.

For Single-member LLCs, the IRS views them as Disregarded Entities. This means they aren’t required to file federal income taxes separately. Instead, the LLC owner handles the tax filings and payments. How the owner is taxed depends on their status: individual owners are taxed like Sole Proprietors, while corporate owners face taxes similar to a corporate branch.

By default, Multi-Member LLCs are taxed as Partnerships. These LLCs must file a 1065 Partnership Return and distribute a Schedule K-1 to each member, detailing their portion of the profits. Members are then required to declare this income on their personal tax returns using Form 1040.

In some states, a Husband and Wife LLC can file as either a Single-Member LLC (as a Qualified Joint Venture) or as a Multi-Member LLC, though this flexibility isn’t available everywhere.

LLCs also have the option to be taxed as a Corporation. This involves two corporate structures: S-Corporation and C-Corporation.

Choosing S-Corporation status, by filing Form 2553, might help reduce self-employment taxes for profitable businesses. However, it’s wise to make this decision after consulting with an accountant to ensure it suits the business’s financial situation.

Opting for C-Corporation status, which requires filing Form 8832, offers certain benefits like savings on healthcare fringe benefits for larger employers, but it’s a less common choice among LLC owners due to its implications and benefits.

Oklahoma State Income Tax

In Oklahoma, how state income taxes apply varies depending on the LLC type.

Single-Member LLCs generally don’t file a state tax return. Instead, the owner reports the LLC’s profits or losses on their personal state tax return.

Multi-Member LLCs may be required to file a state Partnership return. Additionally, each owner reports the LLC’s financial results on their personal state tax returns.

Given that certain industries and types of businesses may face other Oklahoma business taxes, it’s wise to consult with an accountant for tax preparation and filing.

Local Income Tax

LLC owners in Oklahoma may also have to deal with local income taxes at the city or county level. This involves filing and paying taxes to local municipalities. It’s recommended to hire an accountant for precise tax preparation and filing. It’s wise to verify specific requirements with the appropriate local authorities.

Oklahoma Sales Tax

If you’re selling products to consumers in Oklahoma, you’ll need to collect sales tax and obtain a Seller’s Permit. You can get this permit through the Oklahoma Tax Commission (OTC) via their OKTap service, which allows you to collect sales tax on retail sales in the state. This permit may also be referred to as a wholesale license, resale license, or sales tax permit/license.

For more information on Oklahoma’s sales tax requirements, you can consult resources provided by the OTC. If you have any questions about the need for a Seller’s Permit, reaching out to the Oklahoma Tax Commission is advisable.

Oklahoma LLC Payroll Taxes

For Oklahoma LLCs that have employees, there are obligations to manage payroll taxes. This involves various tasks such as withholding federal and state income taxes, Social Security and Medicare taxes, and paying different unemployment taxes. Setting up payroll, withholding the right amounts, and making sure filings are submitted to the correct agencies are all part of this responsibility.

Due to the complexities involved, numerous LLC owners opt to engage payroll services or seek advice from accountants. This approach helps guarantee precise calculations, adherence to regulations, and avoidance of penalties and fines.

>> Get Started With Tailor Brands >>

Oklahoma LLC Cost FAQs

Conclusion

In conclusion, setting up an LLC in Oklahoma involves more than just the initial filing fees. This process requires managing document requirements, working with registered agents, and handling essential tasks like drafting operating agreements and securing an EIN. Expert financial management in these areas is crucial, a task that services like Tailor Brands handle exceptionally well.

With a deep understanding of these complex financial details and support from Tailor Brands, aspiring entrepreneurs can confidently start their Oklahoma LLC journey.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic