Starting an LLC in North Dakota involves more than just submitting the first set of papers. Despite what some might think, it doesn’t cost a lot. This article explains all the costs of creating an LLC in North Dakota. It also looks at budget-friendly options like Tailor Brands, which help keep costs down without cutting corners on quality.

>> Start Your Business Today With Tailor Brands >>

What Is the Cost of Forming an LLC in North Dakota?

Starting an LLC in North Dakota mainly requires paying a $135 fee. This fee is for submitting your LLC’s Articles of Organization online to the North Dakota Secretary of State.

North Dakota Foreign LLC Formation Costs

If you have an LLC registered in another state and want to expand your business to North Dakota, you must register your LLC as a foreign LLC.

Registering a foreign LLC in ND costs $135. To register, you need to submit an application for a Certificate of Authority in North Dakota.

Annual Cost for LLCs in North Dakota

When you run a Limited Liability Company (LLC) in North Dakota, it’s important to consider the ongoing costs involved. Understanding these costs is key for planning your budget and keeping your LLC financially healthy.

The main ongoing costs for an LLC in North Dakota include a fee for a registered agent who handles legal documents. This fee is sometimes ongoing, except if you use a registered agent service.

Also, LLCs in North Dakota must pay an annual report fee of $50. Although North Dakota doesn’t charge additional state compliance fees for LLCs, you should watch out for other possible fees that can vary based on what your LLC does, the industry it’s in, and where it’s located in the state.

>> Get Started With Tailor Brands >>

How Much Does it Cost to Start an LLC in North Dakota with the Best LLC Service?

Starting an LLC in North Dakota comes with a base fee of $135, and you might face extra charges depending on your specific needs. Normally, processing your registration takes 2 to 3 weeks. If you’re in a hurry, you can pay an extra $50 to get it done in 6 to 8 days or $100 to speed it up to 3 to 4 days.

- The Lite LLC plan from Tailor Brands offers LLC setup with the standard processing time, which is their most affordable option, costing only the state filing fee.

- The Essential LLC plan is $199 plus state fees and speeds up your LLC setup, including yearly compliance help and an operating agreement. Tailor Brands asks for a yearly $199 to keep these services.

- The Elite LLC plan is their top offer at $249 plus state fees, giving you everything in the Essential plan plus more business tools and services. This includes a free domain for a year, a tool to build your website, an online store, eight free logos, a digital business card, a tool for making business cards, and a tool for creating social media posts. To maintain these services, there’s an annual $249 fee to Tailor Brands.

Additional Costs When Starting an LLC in North Dakota

North Dakota LLC Name Costs

Choosing a name for your LLC won’t cost you anything. When you file your Articles of Organization in North Dakota, and it gets approved, they include your LLC name approval for free.

You might have read online that you need to reserve your LLC name, but this is often optional in many states. You don’t usually have to reserve a name to form an LLC.

But, if you want to keep your preferred name for up to a year before you officially create your LLC, you can fill out a Reserved Name Application and pay a $10 fee.

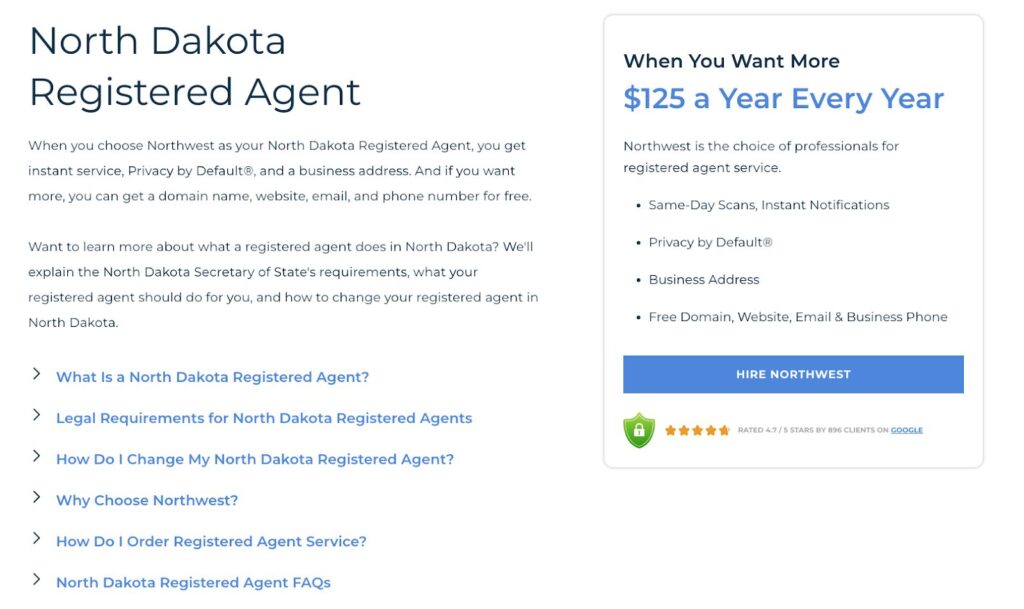

North Dakota Registered Agent Costs

In North Dakota, the fee for a Registered Agent can be $0 if you decide to take on the role yourself or up to $125 yearly if you choose to use a Registered Agent service. You must have a Registered Agent when you set up your LLC, but there’s no additional fee for listing them in your Articles of Organization.

A Registered Agent in North Dakota can be a person or a service that receives legal documents and state communications for your LLC. They need to have a physical address in the state and be available during normal business hours.

If you or someone you know agrees to be your LLC’s Registered Agent, it won’t cost you extra. On the other hand, hiring a Registered Agent service could cost between $100 and $300 each year. These services can provide several advantages, like privacy protection and business support, which make the cost worth it.

- If you need an address in the state, North Dakota requires Registered Agents to have a local address.

- If you want to keep your address private, some services let you use their address to protect your information.

>> North Dakota Registered Agent Service – Northwest >>

North Dakota Operating Agreement Costs

An LLC Operating Agreement is a document that members of an LLC create together. It details important information like who owns what part of the company, how the company is managed, and how profits are divided.

It’s a good idea for every LLC, whether it has one member or many, to make an Operating Agreement, keep it with the company’s records, and give a copy to every member.

Although some online services might charge between $50 to $200 to help you make an LLC Operating Agreement, you don’t have to pay this fee for your North Dakota LLC.

North Dakota EIN Cost

Getting an EIN Number for your LLC in North Dakota is free. An EIN, which stands for Employer Identification Number or Federal Employer Identification Number (FEIN), is important for filing income taxes, opening a bank account for your LLC, and hiring employees if necessary.

Some online services charge a fee to get an EIN for your LLC, but it’s essential to know that you can get this number for free.

The Internal Revenue Service (IRS) allows you to get an EIN for your LLC online, a quick process that takes just a few minutes and doesn’t cost anything.

>> Get an EIN Number With Tailor Brands >>

North Dakota LLC Taxes

The yearly costs associated with different taxes for North Dakota LLCs can vary widely. Owners need to pay several types of taxes, such as:

Federal Income Taxes for LLCs

The Internal Revenue Service (IRS) has different ways of handling taxes for Limited Liability Companies (LLCs).

In the case of Single-Member LLCs, they’re automatically classified as Disregarded Entities for tax purposes. This implies that the LLC does not have to file a separate federal income tax return; instead, the owner reports and settles any federal income taxes owed through their personal tax return.

For Multi-Member LLCs, the standard tax classification sees them as Partnerships. Here, the LLC must file a 1065 Partnership Return, and each owner then reports and pays taxes on their portion of the profits through Schedule K-1.

Husband and Wife LLC Taxation

In some states, such as Texas, married couples who own LLCs have the option to be taxed as a Single-Member LLC under something called a Qualified Joint Venture. But, this option isn’t offered in states that don’t recognize community property, including North Dakota. The way a couple chooses to be taxed for their LLC can affect how they file their taxes and must be aligned with the rules of the state.

Electing Corporate Taxation for LLCs

Besides the standard tax categories, an LLC can choose to be taxed as a Corporation. This decision requires advice from an accountant. There are two corporate tax options: S-Corporation and C-Corporation.

Choosing S-Corporation status might reduce self-employment taxes, which is often advantageous for mature businesses. Alternatively, C-Corporation status may offer benefits for larger companies, especially those providing healthcare fringe benefits to employees.

>> Get Started With Tailor Brands >>

North Dakota State Income Tax for LLCs

In North Dakota, tax treatment for LLCs depends on their structure.

- Single-member LLC owners usually report the company’s earnings or losses on their own state tax return.

- Owners of multi-member LLCs often file a partnership return for the state, and each owner reports a portion of their earnings or losses on their personal state tax returns.

Certain business sectors and types may have to pay additional business taxes in North Dakota. This highlights the need for professional help preparing and filing state income taxes.

Local Income & Sales Tax for North Dakota LLCs

North Dakota LLCs may need to pay local income or sales taxes based on their location within different cities or towns. It’s a good idea to hire an accountant to help meet local tax rules. For detailed instructions, it’s best to get in touch with the local city or town office or look up necessary information.

North Dakota Sales Tax and Seller’s Permit

Businesses that sell products to consumers in North Dakota often need to collect sales tax and get a Seller’s Permit from the North Dakota State Tax Commissioner. This permit allows them to add sales tax to the price of their retail items, and it might be called by different names.

North Dakota LLC Payroll Taxes

In North Dakota, LLCs that have employees need to take care of payroll taxes. This includes handling several kinds of taxes and paperwork, such as withholding federal and state income taxes, Social Security and Medicare taxes, unemployment taxes, and deductions.

Getting payroll set up correctly, making sure taxes are withheld properly, and filing everything on time are crucial tasks that may need the help of a payroll service or an accountant.

If payroll taxes aren’t managed correctly, the LLC could face penalties and fines, highlighting the need for professional help.

>> North Dakota LLC Formation – Tailor Brands >>

North Dakota LLC Cost FAQs

Conclusion

Setting up an LLC in North Dakota goes beyond the initial filing fee. This process includes handling important documents, getting help from registered agents, and dealing with critical parts like operating agreements and getting an EIN.

Managing money wisely in these areas is very important, showing why specialized LLC services like Tailor Brands are valuable. With a good understanding of these financial parts and help from Tailor Brands, future business owners can start their North Dakota LLC with confidence.

>> Start Your Business Today With Tailor Brands >>

Sections of this topic

Sections of this topic