Setting up an LLC in Mississippi involves more than filling out forms, it requires a grasp of the financial aspects to make smart choices. Though expenses might seem daunting, creating an LLC doesn’t need to break the bank. With tools like those from Tailor Brands, you can manage LLC costs effectively without skimping on quality.

This article will explore the different costs involved in filing an LLC in Mississippi, giving you the knowledge to start your business venture both prepared and financially aware.

What Is the Cost of Forming an LLC in Mississippi?

To set up an LLC in Mississippi, you mainly need to pay a $50 fee to file your LLC’s Certificate of Formation via the Mississippi Secretary of State’s online portal.

Mississippi Foreign LLC Formation Costs

If you already have an LLC established in another state and want to expand into Mississippi, you must register your LLC as a foreign entity there.

The cost to register a foreign LLC in Mississippi is $250. You can complete this registration by submitting an Application for Registration of Foreign Limited Liability Company.

Annual Cost for LLCs in Mississippi

When setting up an LLC in Mississippi, it’s essential to consider the recurrent costs associated with maintaining your business. Here are the primary expenses and filings to remember:

First, you must submit an annual report to the Secretary of State. This report is mandatory, although there is no fee for filing it.

Second, if you use a fictitious business name, it needs to be renewed by December 31 of the name’s fifth year, with a renewal fee of $25.

Third, having a registered agent is required. This agent is the official contact for receiving legal documents and formal communications for your LLC. The annual cost for this service ranges from $100 to $300, depending on whether you act as your own agent or hire a third party.

Understanding these costs is vital for estimating the total expenses of operating an LLC in Mississippi and making informed decisions about your business budget.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Mississippi With the Best LLC Service?

Tailor Brands LLC Formation Cost

Starting an LLC in Mississippi initially costs $50, with potential additional fees. The typical business registration processing time ranges from 2 to 3 weeks. For quicker service, you can opt for expedited processing, which takes 4 to 6 days for an extra $50, or a rush service that completes within 1 to 2 days for $100.

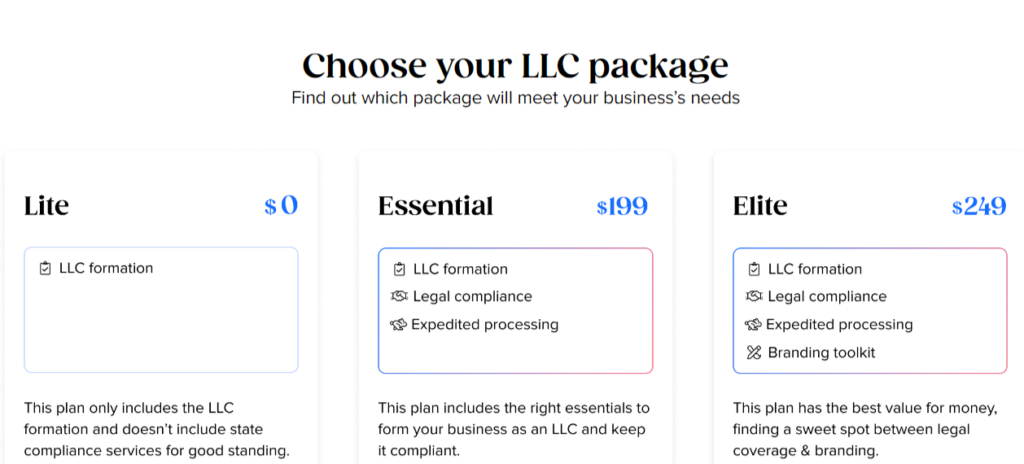

Tailor Brands offers a trio of LLC formation packages tailored to varying business needs. The Lite LLC plan stands out as the most budget-friendly option, only requiring payment equal to the state filing fee. It includes basic LLC formation and standard processing times.

Stepping up, the Essential LLC plan ramps up the offerings for $199 plus state fees. This package accelerates the LLC formation process and tacks on an operating agreement, along with annual compliance services. To maintain these perks, there’s an ongoing annual charge of $199.

At the top of the lineup, the Elite LLC plan ups the ante with a $249 price tag on top of state fees. It bundles everything from the Essential plan with an array of extra business tools and services. These goodies encompass a free business domain for the first year, a DIY website builder, an online store setup, eight unique logos, a digital business card, tools for crafting physical business cards, and a social media post creator. To keep these advanced features, customers cover an annual fee of $249.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Mississippi

Mississippi LLC Name Costs

Choosing a name for your Limited Liability Company doesn’t incur any additional costs. After the state approves your Certificate of Formation, your selected Mississippi LLC name is also approved with no extra fees.

To secure your preferred name for your LLC for a period of up to 180 days prior to formally establishing it, you have the option to submit an online LLC name reservation, accompanied by a $25 filing fee.

Mississippi Registered Agent Costs

The fee for a Mississippi Registered Agent can be $0 if you choose to take on this role yourself or $125 annually if you opt for a professional service. In Mississippi, you’re legally required to have a registered agentfor your LLC.

A Registered Agent in Mississippi can be either an individual or a service company. They’re tasked with accepting legal documents and state notifications for your LLC. To qualify, the Registered Agent must have a physical address in Mississippi and be available during regular business hours.

If you or someone you know acts as the Registered Agent, there will be no cost involved.

Alternatively, you have the option to enlist a Registered Agent service, commonly priced between $100 and $300 annually. These services not only serve as your Registered Agent but may also provide supplementary business services and enhance privacy protection.

Hiring a Registered Agent service is especially useful if:

- You lack a physical address in Mississippi, as the law requires a state address

- You prefer to keep your personal address off public records. With some services, you might use their address to protect your privacy

Mississippi Operating Agreement Costs

The LLC Operating Agreement in Mississippi is free.

This document acts as a formal agreement between LLC members, outlining detailed provisions for ownership, management, and profit distribution within the LLC.

It’s recommended that both single-member and multi-member LLCs have an operating agreement. This document should be kept with the business records, and a copy should be given to each member. While many online platforms may charge between $50 and $200 to create LLC Operating Agreements, there is no cost associated with this in Mississippi.

Mississippi EIN Cost

Securing an EIN Number for your LLC is completely free.

An EIN, or Employer Identification Number (also known as a Federal Employer Identification Number or FEIN), is a unique number that’s essential for several business activities. These include filing income taxes, opening a bank account for your LLC, and hiring employees, if needed.

While some websites might charge a fee to help you get an EIN, it’s crucial to know that getting one directly from the IRS incurs no cost. There are no state fees in Mississippi related to obtaining an EIN for your LLC.

You can apply for an EIN through the IRS’s online filing system quickly and at no expense.

>> Start Your LLC With Tailor Brands >>

Mississippi LLC Taxes

Owners of Mississippi LLCs face various tax obligations that can significantly vary their annual expenses.

Some of the taxes applicable to LLC owners include:

Federal Income Taxes

The Internal Revenue Service (IRS) provides several federal income tax treatment options for LLCs.

Single-Member LLC Taxes (Default Status)

For tax purposes, the IRS classifies Single-Member LLCs as Disregarded Entities, meaning they do not file separate federal income tax returns. Instead, the LLC owner files the return and pays the taxes directly.

The method of federal income taxation for the LLC depends on the nature of its owner:

- If the owner is an individual, the LLC is taxed like a Sole Proprietorship.

- If the owner is a company, the LLC is treated as a branch or division of the parent company.

Multi-Member LLC Taxes (Default Status)

If an LLC is owned by multiple individuals, it’s taxed as a Partnership. This arrangement necessitates filing a 1065 Partnership Return and distributing a Schedule K-1 to each owner. These documents specify each owner’s share of the profits. Owners then include this income on their personal tax returns (Form 1040) and pay taxes accordingly.

Husband and Wife LLC Taxes

In certain states, including Texas, couples who own an LLC together have the option to be classified as a Single-Member LLC (Qualified Joint Venture) instead of a Multi-Member LLC. This choice isn’t on the table in places like Mississippi, where community property laws don’t exist.

Electing Corporate Taxation for LLC

An LLC has the option to elect taxation as a Corporation rather than using its default status. Opting for this requires thoughtful deliberation and typically the guidance of an accountant. There are two choices:

- S-Corporation: This status can be beneficial for established businesses looking to reduce self-employment taxes.

- C-Corporation: While less frequently chosen, this option can offer advantages, particularly in healthcare benefits for large employers.

Mississippi State Income Tax

For Single-Member LLCs, the entity itself rarely files a state tax return. Instead, the owner reports the LLC’s profits or losses on their personal state tax return. Multi-member LLCs may need to file a state Partnership return, with each owner including their share of the LLC’s profits or losses on their individual state returns. Certain industry-specific and business taxes may also apply.

Local Income Tax for Mississippi LLCs

LLCs and their owners may need to file and pay income taxes locally. It’s advisable to consult with an accountant and contact the local municipality to understand their specific tax requirements.

Mississippi Sales Tax

If you’re selling products in Mississippi, you’ll likely need to collect sales tax and secure a Seller’s Permit from the Mississippi Department of Revenue (DOR). This permit authorizes the collection of tax on retail sales. Terms such as resale license, wholesale license, and sales tax permit are commonly used to refer to this permit.

Mississippi LLC Payroll Taxes

If your Mississippi LLC employs staff, you are responsible for managing payroll taxes. This includes withholding federal and state income taxes, as well as Social Security and Medicare taxes, plus federal and state unemployment taxes and any local deductions. Managing payroll taxes on your own is feasible, but given the complexity and risk of errors, many opt to hire a payroll service or consult an accountant.

>> Get Started With Tailor Brands >>

Mississippi LLC Cost – FAQs

Conclusion

In conclusion, setting up an LLC in Mississippi demands a thorough understanding of the associated financial obligations. Mississippi’s business-friendly policies provide a fertile ground for enterprises, yet aspiring business owners must account for costs like filing fees, registered agent fees, and potential expenses for professional advice. Using the best LLC services, such as Tailor Brands, can simplify this process.

Entrepreneurs should carefully assess these expenses, considering Mississippi’s favorable business climate, legal structure, and overall reputation. This ensures their chosen path is in sync with their goals and financial capabilities.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic