Entering the business scene in Kansas by starting an LLC comes with its costs. These costs consist of application charges and continuous fees needed to maintain your Limited Liability Company. This guide aims to cover every expense you might face while setting up an LLC in Kansas.

For those looking for help with documentation, LLC services such as Tailor Brands are available to make sure all paperwork is handled properly. Armed with the correct details and support, you can confidently handle the expenses and processes involved in establishing your Kansas LLC.

>> Start Your Business Today With Tailor Brands >>

What Is the Cost of Forming an LLC in Kansas?

The main cost to start an LLC in Kansas is paying a $160 fee to file your LLC’s Articles of Organization online with the Kansas Secretary of State.

Kansas Foreign LLC Formation Costs

To expand your business to Kansas with an LLC already set up in another state, you need to register it as a foreign entity in Kansas.

You’ll pay $165 to register a foreign LLC in Kansas. This involves filling out and submitting a Form FA, known as the Application for Registration of Foreign Covered Entity.

Annual Cost for LLCs in Kansas

When setting up an LLC in Kansas, understanding the regular costs of maintaining the LLC is essential.

These costs help you figure out the total money needed to run a Kansas LLC. Important ongoing costs include the Resident Agent Fee. Every LLC needs a registered agent to handle legal papers, and using a professional service for this can cost between $100 and $300 a year.

Also, you must file an Annual Report with the Secretary of State, which costs $50 for online filing and $55 if you send it by mail.

>> Get Started With Tailor Brands >>

How Much Does it Cost to Start an LLC in Kansas with the Best LLC Services?

The first key cost to file an LLC in Kansas is $160, and this amount can increase depending on the options you choose. Normally, it takes 2 to 3 weeks to process. If you need it done faster, you can pay an extra $50 to get it processed in 4 to 6 days. For the quickest option, a $100 rush service gets it done in 1 to 2 days.

- The Lite LLC plan from Tailor Brands offers LLC formation with standard processing times and is the most affordable option, only charging the state filing fee.

- The Essential LLC plan adds expedited processing, annual compliance services, and an operating agreement for an additional $199 plus the state fees. This plan also comes with a yearly $199 fee for ongoing services.

- The Elite LLC plan, costing $249 plus state fees, includes everything from the Essential plan plus extra business tools like a free business domain for a year, a DIY website builder, an online store, eight free logos, a digital business card, tools for making business cards, and a tool for creating social media posts. To keep these services, Tailor Brands requires an annual payment of $249.

Additional Costs When Starting an LLC in Kansas

Kansas LLC Name Costs

Registering a business name in Kansas costs nothing. Once the state approves your Articles of Organization, your chosen LLC name in Kansas is approved at no extra cost.

But, if you want to reserve your chosen name before officially forming your LLC, you can fill out an LLC Name Reservation Form (Form NR) and pay $30 online or $35 by mail to hold the name for up to 120 days.

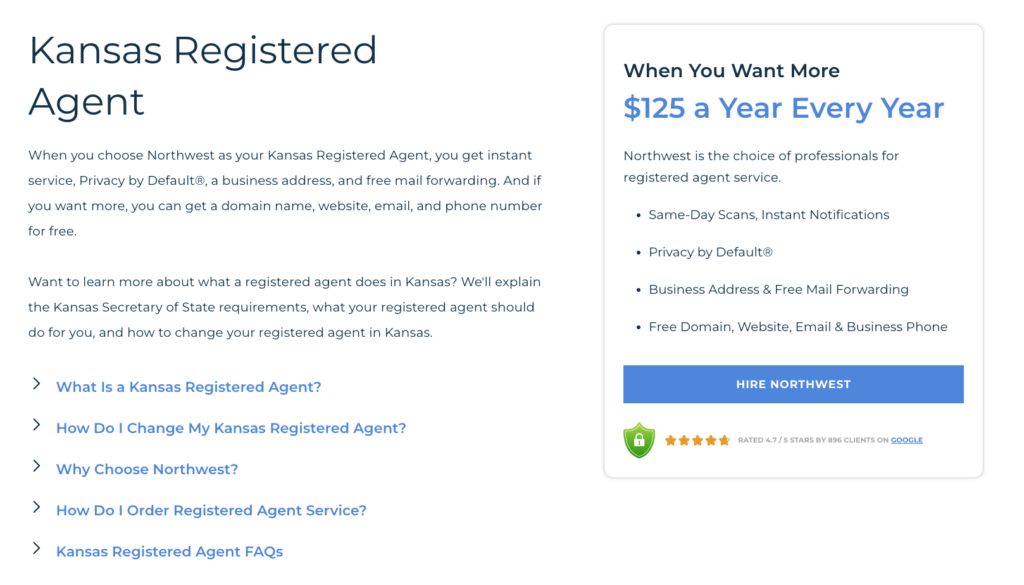

Kansas Registered Agent Costs

The Kansas Registered Agent Fee ranges from $0 to $125 per year. When you form your LLC in Kansas, you must choose a Registered Agent (also known as a Resident Agent) who will receive legal papers and official notices from the state for your LLC.

This agent needs to have an actual address in Kansas and be available during normal business hours. If you or someone you know acts as the Registered Agent, it won’t cost anything extra.

However, you can also hire a Registered Agent service, which usually charges between $100 and $300 a year. These services might offer additional helpful business features and help keep your privacy.

Hiring a Registered Agent service is a good idea if you don’t have a Kansas address since Kansas laws require the agent to have a physical address in the state. Also, if you want to keep your address private, some services let you use their address instead.

>> Kansas Registered Agent Service – Northwest >>

Kansas Operating Agreement Costs

Creating an LLC Operating Agreement in Kansas is free of charge. This agreement is a written document that members of the LLC use to detail the ownership structure, management processes, and how they split profits in the LLC.

Single-Member and Multi-Member LLCs are recommended to have an Operating Agreement, keep it with their business documents, and give copies to all members. This document is especially important for LLCs that have more than one member.

Even though many websites typically charge between $50 and $200 for LLC Operating Agreements, there’s no cost for this in Kansas.

Kansas EIN Cost

Acquiring an EIN Number, alternatively referred to as an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN), is free of charge. This distinctive identifier holds significant importance for tasks such as tax filing for your LLC, establishing a bank account for your LLC, and employing staff as necessary.

Despite numerous online platforms imposing fees for obtaining an EIN for your LLC, securing it comes at zero expense. You can acquire an EIN from the Internal Revenue Service (IRS) by completing an online application, typically requiring only a few minutes of your time.

>> Get an EIN Number With Tailor Brands >>

Kansas LLC Taxes

The yearly amount Kansas LLC owners must pay in different taxes can change a lot. Some taxes they might have to pay include:

Federal Income Taxes

For your LLC’s federal income taxes, the IRS has different ways of handling them based on the LLC’s setup. Single-Member LLCs are seen as Disregarded Entities by the IRS, so they don’t file a separate federal income tax return. Instead, the owner files the tax return and pays any taxes due.

How the taxes are handled depends on who owns the LLC: if it’s owned by an individual, it’s taxed like a Sole Proprietorship, and if owned by another business, it’s considered a branch of that company.

Multi-Member LLC Taxes

LLCs that have more than one owner get taxed as Partnerships. They need to submit a 1065 Partnership Return and give each owner a Schedule K-1, which shows their portion of the profits. Then, the owners must include this K-1 income on their personal tax return (Form 1040) and pay any taxes due on that income.

Taxes for LLCs owned by Spouses

In certain states like Texas, spouses who jointly own an LLC have the option to elect Single-Member LLC (Qualified Joint Venture) tax status instead of Multi-Member LLC status. However, this election is only available in states that acknowledge community property, such as Kansas.

Electing Corporate Taxation

Besides the standard options, an LLC can choose to be taxed as a corporation. This decision should be made with advice from an accountant. There are two types of corporate tax status: S-Corporation and C-Corporation.

- S-Corporation Tax Benefits: An LLC can switch to S-Corporation tax status by filing Form 2553 with the IRS. This move often lowers self-employment taxes for profitable, well-established businesses but adds extra costs. It’s usually a good fit for businesses where each LLC member earns more than $70,000.

- C-Corporation Tax Option: By submitting Form 8832, an LLC can choose C-Corporation taxation, which is mainly advantageous for big companies wanting to save on healthcare benefits. Yet, this option is rarely chosen by business owners.

>> Get Started With Tailor Brands >>

Kansas State Income Tax

In Kansas, owners of Single-Member LLCs do not submit a state return for their LLC; instead, they report the LLC’s profits or losses on their personal state tax return. Multi-Member LLCs and their owners may have to file a Partnership return at the state level.

Local Income Tax

Your LLC may need to pay local income taxes in some cities. It’s wise to get help from an accountant, and checking with the city can make the tax requirements clear.

Kansas Sales Tax

If you sell products in Kansas, you should collect sales tax. You can get a Seller’s Permit from the Kansas Department of Revenue (KDOR). This permit lets you collect tax on retail sales and is sometimes called a resale, wholesale, or sales tax permit or license.

Kansas LLC Payroll Taxes

Kansas LLCs that have employees need to take care of payroll taxes, which include different federal, state, and local taxes. Managing these taxes on your own is possible, but because they’re complex, mistakes could happen, leading to fines. Many people choose to use payroll companies or ask their accountants for help to avoid these issues.

>> Kansas LLC Formation – Tailor Brands >>

Kansas LLC Cost FAQs

Conclusion

To wrap it up, starting an LLC in Kansas means carefully looking at all the costs involved. Kansas offers a great place for businesses with its friendly rules and possible economic gains.

However, setting up an LLC includes paying filing fees, costs for a registered agent, and spending on legal or advice fees. Companies such as Tailor Brands offer easy ways to go through this process.

Business owners need to weigh these costs carefully against Kansas’s supportive legal system and business reputation to see if forming an LLC in Kansas fits their big business goals and budget.

>> Start Your Business Today With Tailor Brands >>

Sections of this topic

Sections of this topic