This guide details the “cost to form an LLC in California,” a state celebrated for its entrepreneurial opportunities. It covers the necessary and optional expenses required to set up an LLC.

Knowing the financial requirements to start an LLC in California is vital for both new and experienced business owners. The guide also shows how Tailor Brands can make this process easier and assist in managing the intricacies of starting a business.

What Is the Cost of Forming an LLC in California?

The main cost to form an LLC in California is $70 when you file online and $85 when you file by mail. This fee covers the submission of your LLC’s Articles of Organization to the California Secretary of State’s office.

California Foreign LLC Formation Costs

If you own an LLC registered in another state and plan to expand your business into California, you must set up your LLC as a foreign entity. This requires submitting an Application to Register a Foreign Limited Liability Company (Form LLC-5) with a fee of $70 for California foreign LLC registration.

Annual Cost for LLCs in California

For California LLCs, the annual costs include a mandatory Annual Franchise Tax of $800, due on April 15, regardless of income or activity. There’s also a $20 biennial Statement of Information fee, required for all California LLCs, payable every two years on the anniversary of formation.

The fees for a Registered Agent vary from $100 to $200 or more per year if one still needs to be designated. There may be a Business License fee, depending on the business type and location. This fee is usually required by the city or county where the business operates.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in California With the Best LLC Service?

Tailor Brands LLC Formation Cost

The basic filing fee to form an LLC is $70 in California, although this can change based on other factors. The usual processing time is between 2 to 3 weeks. However, paying an additional $50 for an expedited fee can reduce this time to 5 to 7 days. An extra $100 fee for even faster service can shorten the processing to just 2 to 3 days.

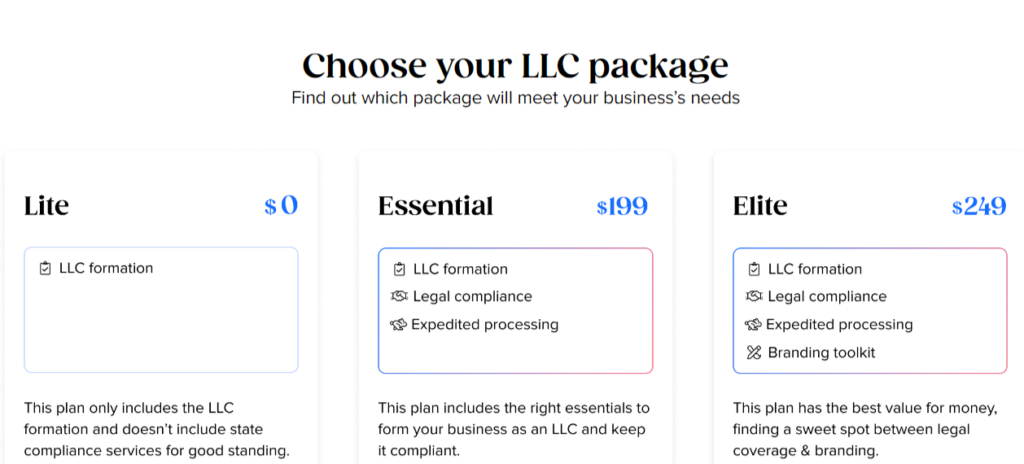

The Lite LLC plan from Tailor Brands LLC registration company offers LLC formation with standard processing times and is their most budget-friendly option, requiring only the state filing fee. The Essential LLC plan costs $199 plus state fees, including LLC formation with expedited processing, an operating agreement, and annual compliance services. Tailor Brands also charges an annual maintenance fee of $199 for these services.

The Elite LLC plan is their most comprehensive package, priced at $249 plus state fees. It encompasses all the features of the Essential plan along with additional business tools and services such as a free business domain for the first year, a do-it-yourself website builder, an online store, eight free logos, a digital business card, a business cards tool, and a social media post maker. An annual fee of $249 is required to maintain these services with Tailor Brands.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in California

California LLC Name Costs

In California, naming your Limited Liability Company (LLC) is free. When the state approves your LLC’s Articles of Organization, it also approves your chosen LLC name at no extra cost.

Despite some online information claiming that LLC Name Reservations are necessary, in most states, including California, there’s no fee associated with reserving a business name when forming an LLC.

California Registered Agent Costs

The California Registered Agent Fee varies between $0 and $125 annually. State law requires that you appoint a Registered Agent when you set up your LLC in California.

A Registered Agent in California is either an individual or a company tasked with receiving legal papers and state notices (known as “service of process”) for your LLC. They must have a physical address in the state and be available during normal business hours.

Choosing to act as your own Registered Agent or appointing someone you know for this role incurs no extra fees. These options don’t add to the LLC registration cost in California.

However, you can also hire a Registered Agent service, which costs between $100 and $300 per year. These services often provide additional valuable business-related support and can help maintain your privacy.

Using a Registered Agent service is especially beneficial if you don’t have an address in the state or if you prefer to keep your personal address off public records.

California Operating Agreement Costs

Creating a California LLC Operating Agreement, which is a written contract between LLC Members detailing ownership, management, and profit distribution, doesn’t cost anything. Both Single-Member and Multi-Member LLCs should prepare and keep this agreement in their business records and provide copies to each member.

Although many websites charge between $50 and $200 for these documents, no fees are required to create a basic LLC Operating Agreement.

California EIN Cost

Getting an EIN Number, crucial for income tax filing, setting up an LLC bank account, and hiring employees, is also known as an Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN). Although some websites charge for this service, you can obtain an EIN for your LLC for free. The Internal Revenue Service (IRS) offers a quick online filing process that can be completed in just a few minutes.

>> Start Your LLC With Tailor Brands >>

California LLC Taxes

Here are some of the most common LLC taxes in California:

Federal Income Taxes

When it comes to federal income taxes, the IRS’s treatment of your LLC depends on its structure. For Single-Member LLCs, the IRS considers them Disregarded Entities, meaning the LLC isn’t required to file a federal income tax return. Instead, the owner of the LLC files the return and manages the tax payments.

The taxation approach varies depending on the ownership of the LLC: if owned by an individual, the IRS categorizes it as a Sole Proprietorship; if owned by another company, it’s taxed as a division of the parent company.

Multi-Member LLC Taxes

LLCs with multiple owners are typically taxed as Partnerships. They’re required to file a Form 1065 Partnership Return and issue a Schedule K-1 to each owner. These K-1 forms detail each owner’s share of the profits, which the owners must then report on their personal tax returns using Form 1040.

Husband and Wife LLC Taxes

In states that recognize community property laws, like California, married couples who jointly own an LLC have the option to be taxed as a Single-Member LLC (Qualified Joint Venture) instead of as a Multi-Member LLC. They can elect this status during the EIN Application process or by submitting a letter to the IRS. If they don’t choose this option, the default tax classification for their LLC will be as a Partnership.

Electing Corporate Taxation

Besides their default tax statuses, an LLC can choose to be taxed as a corporation. This option includes two types of elections: S-Corporation and C-Corporation.

To initiate these elections, an LLC must file Form 2553 for S-Corporation status or Form 8832 for C-Corporation status with the IRS. Choosing S-corporation status can be advantageous for profitable, established businesses, while C-corporation status may be preferred by larger employers to save on healthcare fringe benefits.

California State Income Tax

Single-member LLCs in California do not file a state-level return; instead, the owner reports LLC profits and losses on their personal state return. Multi-member LLCs may file a state-level Partnership return, and the owners also report their share of profits and losses on their personal state returns.

Some industries and types of businesses in California may be subject to specific business taxes, which could require the help of an accountant.

California Annual Franchise Tax

All California LLCs are required to pay the California Annual Franchise Tax every year. This tax, which costs $800, is a compulsory fee for the privilege of doing business in the state, regardless of the LLC’s income or level of activity.

Local Income Tax for California LLCs

LLC owners and the LLC may need to file local income taxes with their local municipalities. It’s advisable to seek help from a professional, such as an accountant, because different cities have different requirements.

California Sales Tax

If your LLC sells products to California consumers, you might need to collect sales tax and obtain a Seller’s Permit. This permit enables you to collect sales tax on retail transactions within the state. Verifying the specific requirements with the California Department of Tax & Fee Administration is important.

California LLC Payroll Taxes

For California LLCs that have employees, managing payroll taxes is required. Payroll taxes include various taxes and filings, such as federal and state income tax withholding, Social Security tax, Medicare tax, and federal and state unemployment taxes.

Although it’s possible to manage payroll taxes independently, their complexity usually means hiring payroll companies or getting help from accountants to prevent mistakes and penalties.

>> Get Started With Tailor Brands >>

California LLC Cost – FAQs

Conclusion

Forming an LLC in California comes with various costs that future business owners need to know about. These costs can change depending on filing fees, publication needs, and extra options like faster processing.

Although the initial costs to set up an LLC can appear overwhelming, they provide essential benefits like legal protection, limited liability, and possible tax advantages for your business.

Tailor Brands can help simplify this process by advising on the necessary steps and paperwork. It’s crucial to thoroughly research and budget for these expenses to ensure establishing your California LLC goes smoothly and stays within your financial means.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic