Are you searching for a secure investment option? You’re in the right place if you’re considering Patriot Gold Group to protect your retirement plan. We can offer you essential insights. We recognize the importance of selecting a dependable company for your investments, so we’ve conducted thorough research on the key players in the industry.

Our detailed analysis assessed various factors to pinpoint companies that stand out in customer service. We aim to help you compare and evaluate the top choices, empowering you to make a decision that fits your investment objectives and needs.

This review will reveal the distinct features that establish Patriot Gold Group as a reliable choice for investors aiming to protect and enhance their wealth. Embark on this informative journey with us, where gold, wisdom, and prosperity converge within the world of Patriot Gold Group.

>> Investment Journey With Patriot Gold Group >>

What Is Patriot Gold Group?

Patriot Gold Group assists investors in purchasing, selling, and storing precious metals for investment and helps individuals set up precious metals IRAs, often referred to as gold IRAs.

Precious Metals IRA

Many people aim to save for retirement to have a dependable nest egg when they cease working. Investing is a powerful way to grow your savings over time, so many invest their retirement funds for increased growth.

A gold IRA is a specific type of account designed to aid in retirement savings. With a traditional IRA, you can deduct your contributions from your taxable income, reducing your tax burden in the years you contribute. You then pay taxes on withdrawals during retirement, potentially at a lower tax rate.

Patriot Gold Group facilitates the opening of a gold IRA, enabling investors to invest in precious metals while benefiting from the tax advantages of an IRA. You can collaborate with Patriot Gold Group to add cash to your account and purchase metals, and they can also manage storage and transportation.

Silver and Gold Products

Even if you don’t intend to open a gold IRA, you can still engage with Patriot Gold Group to buy and sell precious metals. The company primarily deals in gold and silver coins, without options for other precious metals like platinum and palladium.

The available coins for purchase originate from various countries, including:

- Austria

- Canada

- South Africa

- United States

One limitation of Patriot Gold Group is the absence of listed prices for its coins on its website. To generate a quote, you can specify your investment amount for each coin type, but you will need to contact a company representative to determine the exact pricing for each coin.

>> Get Started With Patriot Gold Group >>

How Much Does Patriot Gold Group Cost?

When dealing with any financial entity, from banks to investment firms, it’s crucial to consider fees. This is especially true for companies that facilitate investments in precious metals, as these services are more complex than other financial services.

Unlike stocks and bonds, metal is a tangible asset requiring physical movement, storage, and security. This means investors in precious metals must cover the costs of storing their coins and bars.

Pros and Cons of Patriot Gold Group

Pros

- Staff at Patriot Gold Group are known for their friendliness and efficiency

- Rapid service and turnover

- Over thirty years of experience and a solid reputation in the industry

- Quick and straightforward IRA account setup

- Offers clients the freedom to choose their own custodian and storage company, providing full control over their IRA accounts

Cons

- No precious metals are offered other than silver and gold bullion

- Clients cannot store their bullion at home

- The initial start-up fee of $225 is higher compared to other precious metal IRA companies

- There are limited options for purchasing gold bars

Where Does Patriot Gold Group Store My Precious Metals?

Storing your precious metals is one of the more challenging aspects of investing in them. These physical assets require secure storage to protect them from damage or theft.

Patriot Gold Group offers several vault storage options through multiple repositories nationwide. The company manages the transportation and storage of your gold and silver at these depositories for a fee.

For taxable accounts, Patriot Gold Group allows investors to store their metals at home. However, IRS rules prohibit IRA investors from keeping precious metals in their self-directed IRAs at home. Patriot Gold Group offers a complex strategy that enables investors to store IRA metals at home without breaching IRS regulations.

Yet, it’s advisable to keep your metals in a depository rather than using the company’s unproven method, which also necessitates handling storage and security.

>> Start Your Investment Journey With Patriot >>

Can I See How My Precious Metals IRA Is Performing?

Monitoring your portfolio and its performance is crucial for any investment. It enables you to adjust your strategy accordingly. The custodian you partner with through Patriot Gold Group will provide an online account where you can view your portfolio.

The company’s website features up-to-date pricing information for gold and silver, aiding your investment strategy.

How to Open an Account?

To open a precious metals IRA with Patriot Gold Group, fill out an application on their website or call (877) 583-2399. This form will request your contact and personal information, such as your Social Security number.

You’ll also need to provide bank account details so the company can withdraw purchase funds.

Once you submit this information, an account representative will contact you to complete the account setup. If you wish to transfer an existing retirement account into your new precious metals IRA, Patriot Gold Group’s 401(k) and IRA Rollover department will assist.

To make purchases, call your account representative, who will help place the order and arrange to transport the coins and bars to your storage location.

How Can I Withdraw From My Account?

Opening an IRA means following IRS guidelines on when you can start taking money out. You must wait until you’re 59½ to access your funds. Withdrawing earlier will lead to a 10% penalty and any applicable taxes.

When it’s time to access your self-directed IRA funds, you have two choices.

Patriot Gold Group can move the precious metal from storage to your home. Once the silver or gold coins and bars are in your hands, they’re yours to use.

Alternatively, your account rep can help sell your metals and transfer the cash to your bank account. This path is ideal if you need immediate funds.

Contact Support

When investing in precious metals, it’s crucial to choose a company with strong customer support. You’re bound to have questions, so it’s key to select a company ready to meet your needs.

Patriot Gold Group provides several contact methods, tailored to your preferences. For a quick chat with a representative, try their live chat feature. Remember, this isn’t instant messaging. Instead, a box will pop up where you enter your details and message.

Immediate responses during business hours aren’t guaranteed, yet this feature is still handy. If you prefer direct conversation, call them at 877-711-6641. Alternatively, email them at [email protected]. If you’re nearby, feel free to visit their office at 3010 Old Ranch Parkway Suite 350, Seal Beach, California 90740.

>> Visit Patriot Gold Group >>

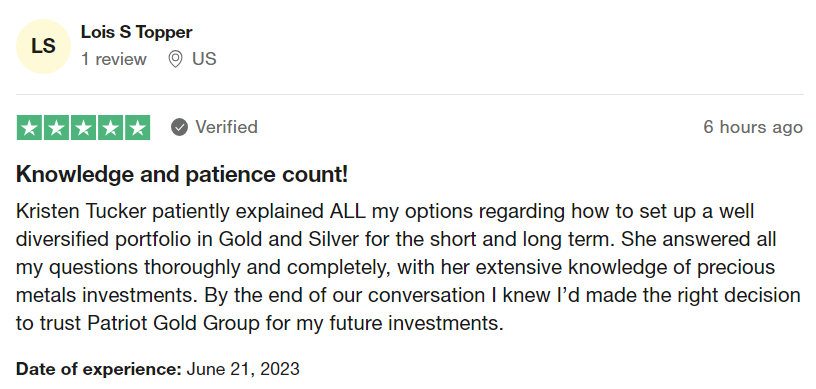

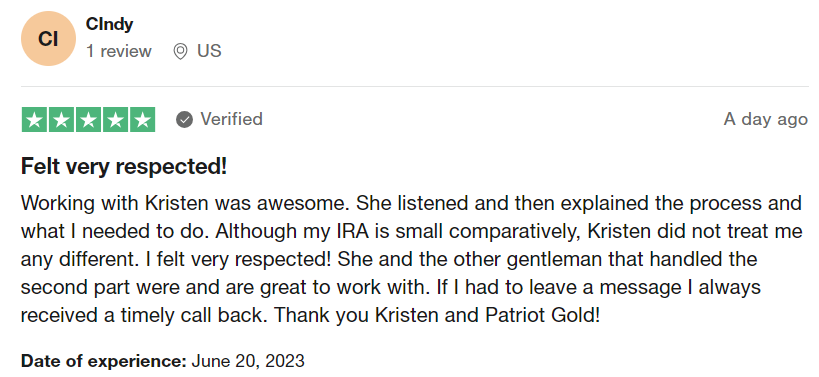

Patriot Gold Group Reviews From Real Users – How Legit Is It?

Let’s face it: not everyone is satisfied with every business interaction. As a smart shopper, you understand the importance of looking for red flags before making significant decisions, such as investing in precious metals. So, what do the reviews of Patriot Gold Group reveal?

Many customers have mentioned that PGG offers excellent education on precious metals. Most investors feel very comfortable with their experience and believe they’ve gained new knowledge to secure their retirement.

Alternatives to Patriot Gold Group

Augusta Precious Metals, a leading gold IRA company, boasts over 45 years of experience in providing investment products such as silver and gold bullion. They emphasize transparency with detailed expense breakdowns and one-on-one web panels for clients.

While there are no transaction fees, price spreads exist for physical metals. Augusta’s strong reputation, refund policy, and secure storage facilities make it a reliable choice, despite a high minimum investment and limited metal selection. Their customer service is also highly praised.

American Hartford Gold is the best precious metals IRA company for smaller investments. This reputable gold IRA company has a strong track record and high customer satisfaction ratings. It offers precious metal IRAs, gold and silver IRA rollovers, and direct purchases of gold and silver bars/coins. It provides versatile investment options with a $5,000 minimum for direct purchases and $10,000 for gold IRA rollovers.

They partner with Equity Trust as a custodian and offer secure storage through well-known companies like Brinks and Delaware Depository. American Hartford Gold also supports investors with dedicated account representatives and a free guide for making informed decisions.

Oxford Gold Group excels in providing educational resources for retirement planning through precious metals IRAs. They offer expert advice and a range of services, including purchasing physical gold, setting up Gold IRAs, and diversifying with silver, gold, platinum, and palladium.

They prioritize client education and offer secure storage options at reputable facilities like Brinks Depository and Delaware Depository. Despite their mysterious ownership, Oxford Gold Group aims to guide individuals toward a prosperous and diversified retirement future.

Patriot Gold Group Review – Frequently Asked Questions

>> Visit Patriot Gold Group >>

Final Thoughts on Patriot Gold Group

Patriot Gold Group delivers valuable support to newcomers and existing holders of Precious Metals IRAs. Self-directed IRAs with assets like precious metals enable consumers to diversify their retirement savings and enjoy the tax advantages of a self-directed IRA.

Patriot Gold Group manages the purchase and sale of precious metals for the client, coordinates with the IRA custodian, and ensures the assets are moved to secure storage.

Patriot Gold Group’s contribution to consumers is significant in terms of time savings and reducing complications. With nearly three decades in the precious metals industry, they manage all paperwork and electronic coordination between the custodian and the vault. This saves investors time and ensures the precious metals purchased comply with IRA requirements.

>> Invest With Patriot Gold Group >>

Sections of this topic

Sections of this topic