Are you seeking a secure, dependable investment to safeguard and grow your financial future? Augusta Precious Metals is your answer. Augusta Precious Metals is your reliable partner if you’re contemplating investing in precious metals to ensure your retirement. Known for their insightful guidance and outstanding customer service, they’re a leader in the industry.

After thorough research and analysis, we’ve assessed numerous factors to pinpoint the top market players. We aim to help you make an educated choice by highlighting the most credible options. Join us as we explore the distinct features and advantages that position Augusta Precious Metals as an excellent choice for investors eager to protect and enhance their wealth.

Begin this enlightening journey with Augusta Precious Metals, where precious metals, expert advice, and financial success meet. Learn about the benefits of partnering with a company committed to helping you reach your investment goals and secure your retirement dreams.

>> Invest in Precious Metals With Augusta >>

What Is Augusta Precious Metals?

At the heart of the precious metals market, it emerges as a leading gold IRA company that enables investors to explore investments in gold and silver.

Established in 2012 by visionary CEO Isaac Nuriani, Augusta Precious Metals has earned a reputation for its dedication to integrity and trust. The company primarily serves precious metals IRA customers and individuals looking to buy gold and silver, positioning itself as a model of excellence in the sector.

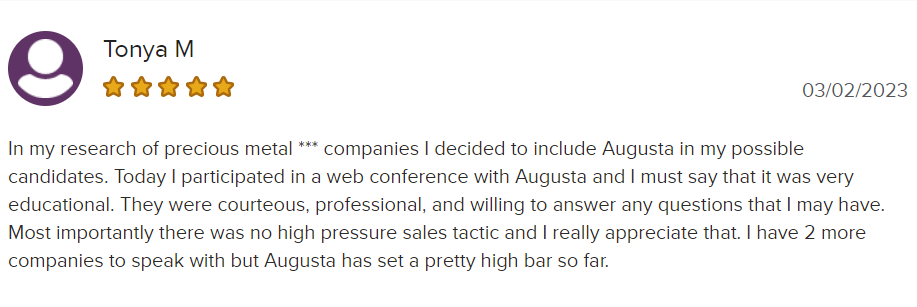

Augusta distinguishes itself with its commitment to transparency and education. The public is invited to participate in a one-on-one web conference led by a Harvard-trained economist on staff, providing deep insights into precious metals investment.

Augusta is an industry safeguard that helps clients avoid common mistakes. The company offers educational videos like “Ten Big Gold Dealer Lies” and “15 Bad Reasons To Buy Gold” to assist customers in making knowledgeable decisions.

What Makes Augusta Stand Out?

Here are some key features that highlight Augusta’s prominence in the precious metals industry:

- Commitment to customer support: Augusta Precious Metals demonstrates an unmatched commitment to its clients by providing lifelong support and guidance. When you partner with Augusta, you access a team of experts dedicated to aiding you in making informed investment choices.

- Focus on education: Augusta Precious Metals goes the extra mile to educate its customers, ensuring they possess the necessary knowledge to navigate the intricate world of precious metals. Augusta equips investors to make confident choices by offering valuable resources and educational materials.

- Outstanding reputation and accreditations: With an impressive 4.95-star rating from over 930 reviews and an A+ rating from the Better Business Bureau (BBB), Augusta Precious Metals has gained the trust and esteem of its clients. The company’s expertise, high-quality products, and exceptional customer service have cemented its status as a trusted leader in the industry.

>> Check Out Augusta Precious Metals >>

Augusta Precious Metals Gold IRA Offerings

In addition to their IRA investment offerings, Augusta also allows you to purchase gold or silver bars directly.

Gold & Silver IRA

When you establish a gold IRA account with Augusta Precious Metals, the company assures you’ll receive support from a representative from the initial decision to open the account and for any future inquiries.

Once you select your precious metals, Augusta covers all shipping fees and liability insurance until the metals reach the designated storage facility. The IRS has sanctioned specific coins and bullion for IRA investments. Gold bars and coins must generally be 99.5% pure, while silver coins and bars should be 99.9% pure.

Gold coins that Augusta features for your IRA include:

- American Eagles

- American Eagle Proofs

- Canadian Maple Leaf

- Gold Canadian Eagle

- American Buffalo

- Australian Striped Marlin

Silver coins that Augusta features for your IRA include:

- Canadian Silver Soaring Eagle

- Canadian Silver Eagle with Nest

- American Silver Eagle

- Canadian Silver Maple Leaf

- Gold & Silver Cash Purchases

If you’re not investing in an IRA or don’t meet the $50,000 minimum requirement, you can still buy gold and silver directly from Augusta Precious Metals.

Augusta offers a wide array of coins and bullion outside of an IRA and will ship your purchase to any location for free.

Common Bullion Products

Augusta Precious Metals provides a range of common gold and silver bullion products. Their full list is available on their website. However, prices aren’t listed online and must be confirmed by Augusta at the time of purchase. According to their transaction agreement, the margin on common bullion products can be up to 5.2%. Once you confirm your order, the price is locked in.

Premium Products

Augusta also has several premium gold and silver coins and bullion. As outlined in their transaction agreement, the margin on premium products can reach as high as 66%. Many of these premium items are in limited supply or already sold out on their website.

>> Visit Augusta Precious Metals for Pricing >>

Augusta Precious Metals Gold IRA Pricing

Augusta Precious Metals doesn’t display product prices on its website due to the ever-changing nature of gold and silver markets. You need to contact an agent to find out the price of a specific bar or coin. The company doesn’t impose management fees for its gold and silver IRAs.

Opening an IRA involves a one-time setup fee of $250, which covers custodian and storage expenses, plus a $200 annual fee for ongoing custodian and storage costs.

Augusta Precious Metals determines its own buyback prices internally based on the intrinsic value of the metal in the product. These buyback prices fluctuate regularly and vary between common bullion and premium products.

Gold and other precious metals are often seen as stable investments because they can offset market volatility and inflation, two major retirement risks. However, there are risks involved. Gold prices may not always rise, and since they don’t yield dividends, financial advisors often suggest limiting precious metal investments to a small portion of your portfolio, like 5% or less.

It doesn’t display product prices on its website due to the fluctuating nature of the gold and silver markets. To find out the price of a specific bar or coin, you must contact an agent directly. The company doesn’t impose management fees on its gold and silver IRAs.

Setting up an IRA incurs a one-time fee of $250, which covers custodian and storage costs, alongside a $200 annual fee for ongoing custodian and storage expenses.

They internally determines its own buyback prices based on the intrinsic value of the metal in each product. These buyback prices are regularly updated and vary depending on whether the product is a common bullion or a premium item.

Gold and other precious metals are regarded as stable investments because they can help hedge against market volatility, one of the most significant risks in retirement, and inflation. However, there are risks involved. Gold prices aren’t guaranteed to rise over time, and since they don’t provide dividends, financial advisors often suggest limiting investments in precious metals to a small portion of your portfolio, such as 5% or less.

Pros and Cons of Augusta Precious Metals

Pros

- Augusta prioritizes customer education on investing in precious metals for retirement

- Customers receive a one-on-one web conference with a Harvard-trained economist on staff

- Lifetime customer support is provided via phone and email by qualified gold IRA specialists

- Augusta’s specialists guide you through every step of the IRA to gold IRA transfer/rollover process

Cons

- Augusta Precious Metals requires a minimum investment of $50,000

- Investment options are limited to gold and silver, excluding platinum and palladium

>> Start Investing With Augusta Precious Metals >>

Benefits of Gold and Silver Investments

For centuries, gold and silver have been popular investments among investors for their unique properties and advantages, making them valuable additions to a diversified investment portfolio. Here are some key benefits of investing in gold and silver:

- Hedge Against Inflation: Gold and silver are historically considered hedges against inflation, as their value often rises when the purchasing power of fiat currencies declines. As central banks print more money, the value of paper currency decreases, leading to a higher cost of living. In contrast, precious metals retain their value over time, effectively protecting your wealth from inflation.

- Diversification: Investing in gold and silver can diversify your investment portfolio and reduce overall risk. Precious metals often have a low correlation with traditional assets like stocks and bonds, meaning they may perform differently under various economic conditions. Including gold and silver in your portfolio can potentially lessen volatility and create a more balanced investment mix.

- Safe Haven Asset: In times of economic uncertainty or geopolitical turmoil, investors often turn to gold and silver as safe-haven assets. These precious metals are considered stores of value that can preserve wealth when other assets, like stocks, are underperforming, helping to stabilize your portfolio during turbulent times.

- Limited Supply: Gold and silver have a finite supply, unlike fiat currencies, which can be printed in unlimited quantities. This limited availability increases their value and makes them less susceptible to manipulation by governments or financial institutions. As the global population and demand for precious metals grow, the scarcity of gold and silver could lead to higher prices over time.

- Tangible Asset: Gold and silver are tangible assets, meaning you can physically hold and store them, unlike stocks or bonds, which only exist on paper or digitally. The tangible nature of precious metals makes them less vulnerable to cyber threats, such as hacking or identity theft, providing investors with a sense of security.

- Liquidity: Gold and silver are globally recognized and accepted forms of wealth, making them highly liquid assets. They can be easily bought and sold on global markets, allowing you to convert your precious metals holdings into cash when needed.

- Potential for Long-Term Appreciation: While the prices of gold and silver can be volatile in the short term, they have historically appreciated in value over the long term. This potential for growth makes precious metals an attractive investment option for those aiming to build wealth and protect their retirement savings.

>> Invest in Precious Metals With Augusta >>

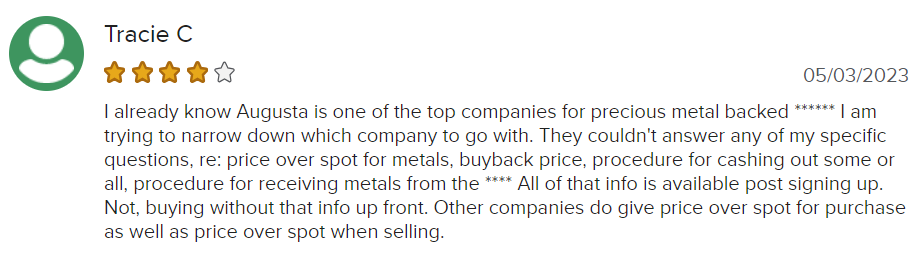

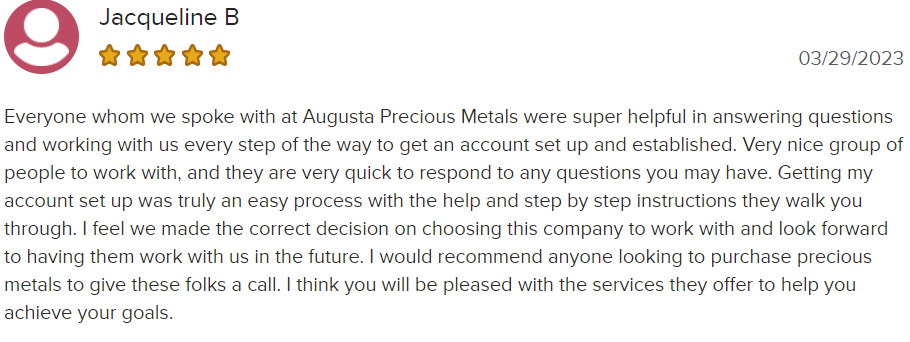

Augusta Precious Metals Reviews From Real Users – How Legit Is It?

Conscientious consumers should diligently research businesses before making major decisions like investing in precious metals. This involves looking for potential red flags and reviewing customer feedback. So, what do the reviews say about Augusta Precious Metals?

Augusta Precious Metals has earned a BBB customer review rating of 4.97 out of 5 stars, receiving praise for its professionalism and commitment to education.

Alternatives to Augusta Precious Metals

Goldco, a distinguished and privately held firm, excels in gold IRAs and asset protection. They’re celebrated as a leading gold IRA provider with more than a decade of expertise. Goldco supports individuals in initiating or transitioning their gold IRAs and offers services for various tax-advantaged retirement plans.

They facilitate direct sales of gold and silver, helping customers broaden their investment portfolios. Although fees apply for the gold IRA custodian, Goldco itself doesn’t impose any fees. They receive high customer satisfaction ratings due to their outstanding customer service and an extensive education center.

Goldco’s dedication to providing accurate information, fostering trust, and prioritizing client support distinguishes them in the sector.

Disclaimer: The authors of this post may be paid to recommend Goldco. The content on this website, including any positive reviews of Goldco, may not be neutral or independent.

American Hartford Gold, a reputable gold IRA company, boasts a strong track record and high customer satisfaction ratings. It provides services such as precious metal IRAs, gold and silver IRA rollovers, and direct purchases of gold and silver bars/coins. With a $5,000 minimum for direct purchases and $10,000 for gold IRA rollovers, it offers flexible investment options.

Collaborating with Equity Trust as a custodian, they ensure secure storage through renowned companies like Brinks and Delaware Depository. American Hartford Gold also offers ongoing support via dedicated account representatives and a free guide to assist investors in making informed decisions.

Oxford Gold Group is a prominent entity specializing in retirement planning with precious metals IRAs. It provides expert guidance and an array of services, including the purchase of physical gold, establishment of Gold IRAs, and diversification with silver, gold, platinum, and palladium.

They emphasize client education and secure storage through trusted facilities like Brinks Depository and Delaware Depository. Despite their ownership’s mystery, Oxford Gold Group strives to be a beacon for individuals aiming for a prosperous and diversified retirement future.

Augusta Precious Metals Review – Frequently Asked Questions

>> Open Your Gold IRA With Augusta >>

Final Thoughts on Augusta Precious Metals

Investing in gold IRAs provides exposure to precious metals, but diversifying your investment portfolio is crucial. Augusta Precious Metals is recognized for its comprehensive educational content and customer support, which led Money to name it one of the best gold IRAs.

The company is an excellent choice for those eager to learn about the precious metals industry and make informed investment decisions.

>> Consider Augusta Precious Metals >>

Disclaimer: The authors of this post may be paid to recommend Goldco. The content on this website, including any positive reviews of Goldco, may not be neutral or independent.

Sections of this topic

Sections of this topic