Do you have a tax debt of $10,000 or more? Anthem Tax Services might be your solution, helping you arrange a payment plan to reduce your tax liability or possibly both. What sets them apart? If Anthem Tax Services doesn’t secure a favorable outcome for you, they’ll refund your payment.

This assurance stands out as their straightforward money-back guarantee, without many restrictions and fine print. Such certainty can be a huge relief during stressful tax debt negotiations. Let’s inspect everything Anthem Tax Services offers.

>> Visit Anthem Tax Services >>

Since its founding in 2010, Anthem Tax Services has been committed to “fighting the battles taxpayers shouldn’t have to.” The company offers a broad array of services tailored to help individuals deal with tax debts, whether owed to the IRS or a state’s Department of Revenue.

However, everyone might have better choices than Anthem Tax Services. If your tax debt is relatively small, you’re still catching up on payments, or you feel confident using self-help options (such as setting up a payment plan by yourself), you might find it more economical and quicker to handle it on your own.

Pros & Cons of Anthem Tax Services

Pros

- Nationwide availability across all 50 states

- Offers free consultation with no obligations

- Possibility to receive a refund if Anthem cannot renegotiate your debt successfully

Cons

- Results aren’t guaranteed

- Resolution of your case might take several months or even years

- The money-back guarantee excludes the initial deposit and tax preparation services

Anthem Tax Services earns praise for its wide availability across multiple states and its robust money-back guarantee. Although initial deposits and tax prep fees aren’t refundable, their refund policy is still more generous than many competitors.

A crucial point to remember is that the availability of refunds underscores that resolutions aren’t guaranteed. It’s worth noting that Anthem Tax Services has faced criticism for sometimes promising more than it delivers, with processes taking longer than expected. Being aware of these aspects beforehand is essential.

>> Get Started With Anthem Tax Services >>

How Do Anthem Tax Services Work?

Anthem Tax Services kicks off its client relationship with a phone call. During this initial conversation, you’ll share the specifics of your tax situation, sign a service agreement and power of attorney, and handle any necessary deposits. Once these steps are completed, your case manager and lawyer will tackle your tax debt.

Anthem Tax Services will clarify the pricing for your particular tax relief scenario throughout this process. The total cost and the time to resolution will vary based on the complexity of your case, so it’s important to provide detailed information during your intake call to ensure a smooth process.

What Services Does Anthem Tax Services Offer?

Anthem Tax Services specializes in various tax relief options. Let’s dive into the key solutions they provide:

- Offer in Compromise (OIC): Previously part of the IRS Fresh Start Program, an OIC allows you to settle your tax debt for less than the full amount you owe. It’s a valuable option if you’re unable to pay your full tax liability.

- Installment Agreements (IAs): This plan enables you to pay your tax debt over time rather than in a single lump sum. Keep in mind, though, that interest and penalties will still accumulate.

- Currently Non Collectible (CNC) Status: CNC status offers a temporary reprieve from most IRS collection efforts. While it suspends payments and prevents asset seizure, penalties, interest, and liens can still apply.

- Penalty Abatement: This option can reduce or even eliminate penalties accrued on your tax debt. If successful, you’ll still owe the original tax amount, but the total due could be significantly less.

- Levy and Garnishment Release: In some cases, you can ask for levies on your assets or garnishments of your wages to be lifted. This process can be complex and has strict requirements, but Anthem Tax Services can guide you through it.

While Anthem offers services comparable to other tax relief firms, it’s worth comparing how they stack up against the competition. It’s important to note that many of these solutions can be requested directly through the IRS or your state’s revenue department without professional help.

Managing your tax debt independently might be the best route if your situation is straightforward—like owing a small amount or dealing with a single late filing. In these cases, the cost of professional services might outweigh the benefits.

If you’re in deep with a tax debt of several thousand dollars or facing harsher consequences like wage garnishment or even criminal charges, getting outside help is probably a smart move. When the stakes are high, having professional guidance can help you navigate the complexities of the tax system and potentially mitigate severe penalties.

>> Visit Anthem Tax Services >>

How Much Does Anthem Tax Services Cost?

What you’ll end up paying Anthem Tax Services hinges on your total tax liability, the complexities of your situation, and any filing fees required by the IRS. Typically, your costs will include:

- An initial deposit

- Service fees

- Filing fees

Since these expenses can vary widely, Anthem Tax Services doesn’t list specific fee amounts on its website. They need to assess your case first to provide accurate pricing.

Anthem Tax Services has partnerships with lenders who can offer financial help to cover your expenses upfront if cost is a concern. They provide a money-back guarantee.

However, it’s important to note that this guarantee doesn’t apply to deposits or cover general dissatisfaction. It only comes into play if Anthem Tax Services fails to reduce your tax liability, not if you feel the savings need to be more substantial.

>> Get Started With Anthem Tax Services >>

Anthem Tax Services Are Best For?

Anthem Tax Services offers high flexibility, and its team is equipped to handle a broad spectrum of tax-related queries and dilemmas. With licensing across all 50 states, they’re a viable option for anyone in the US, tackling both federal and state tax issues.

Anthem operates remotely through email and phone communications, so you don’t need to step into a physical office to sort out your tax matters. This approach is convenient and particularly prudent during the COVID-19 pandemic, as it minimizes health risks with cases on the rise throughout the fall.

How Much Can Anthem Tax Services Save Me?

Due to the unique nature of each individual’s tax situation, it’s highly challenging for tax relief companies to estimate potential savings accurately. It would be both difficult and unethical for these companies to provide any guarantees.

Ultimately, the final decision rests with federal and state tax authorities. Unfortunately, these agencies rarely act as quickly as taxpayers prefer. You will only discover the extent of your potential savings once your case is in progress.

By proactively addressing your tax debt, you can prevent wage garnishments, avoid levies, or have accumulated penalties waived entirely.

How Do You Start Working With Anthem Tax Services?

Engaging with Anthem Tax Services begins with a phone consultation. Here’s a breakdown of what to prepare for and what follows:

- Gather relevant documents like proof of income and tax returns beforehand.

- Verify tax debt and due dates with an Anthem representative during your phone consultation.

- Sign the service agreement and power of attorney to authorize Anthem’s communication regarding your tax debt.

- Pay a minimum deposit before Anthem actively works on your case (timing may vary).

- Meet your dedicated case manager and lawyer who will handle your case moving forward.

- Be patient and ask questions as needed, as resolving your tax debt can take significant time.

>> Visit Anthem Tax Services >>

Does Anthem Tax Services Have a Customer Service Team?

Anthem Tax Services genuinely possesses a dedicated team of customer support professionals. They aim to assist you in getting started and address any queries that may arise throughout the tax relief process.

Aside from the typical methods of communication like phone and email, you can connect with Anthem Tax Services through the chat box on their website. However, the chat feature doesn’t connect you with a live agent. As an alternative, you may prefer the following:

- Email: You can contact Anthem Tax Services by emailing [email protected]. Alternatively, you can fill out a contact form, and they will contact you.

- Phone: If you prefer direct conversation rather than email exchanges, call Anthem Tax Services at 855-749-2859. Their phone lines are open from 6:30 a.m. to 6 p.m. Pacific Time.

- Mail: If you need to send any physical documents or correspondence to Anthem Tax Services, their address is 6300 Canoga Avenue #600, Woodland Hills, CA 91367, located within the Trillium Towers building.

Is Anthem Tax Services LLC a Legitimate Company?

Anthem Tax Services LLC, established in 2010, is a reputable company with a long-standing presence of 14 years in the industry. Their strong recommendation by the SuperMoney community further solidifies their credibility.

>> Consider Anthem Tax Services for Tax Relief >>

How Legit Is Anthem Tax Services – Real User Review

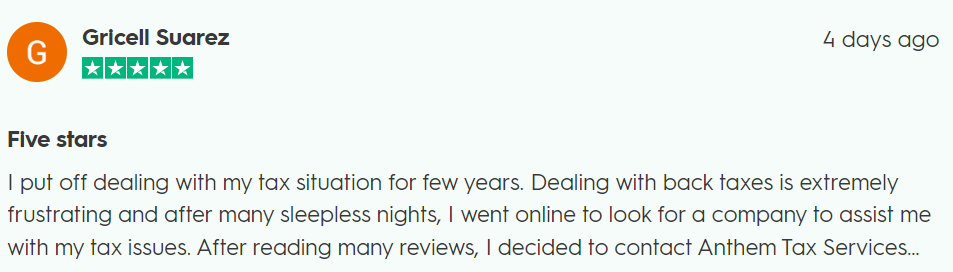

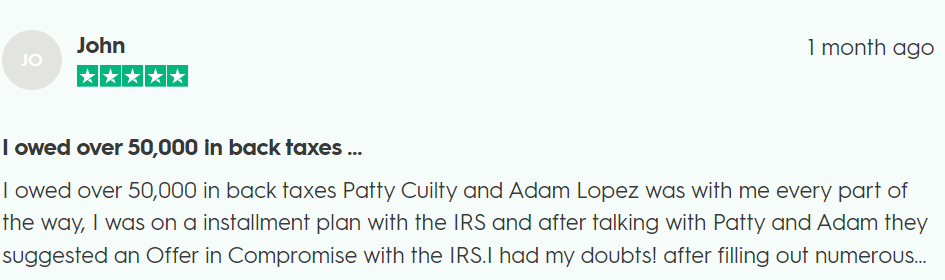

Discover the feedback from satisfied customers of Anthem Tax Services on Trustpilot.

Anthem Tax Relief Alternatives

Larson Tax Relief offers a diverse selection of business tax services, encompassing matters such as payroll and federal tax problems, disputes with revenue officers, and concerns related to worker classification.

This comprehensive range of expertise makes them an exceptional option for businesses seeking help with their tax debt.

Larson Tax Relief is committed to providing effective solutions for various tax issues, including personal IRS debt relief and corporate tax support, and aid in avoiding or postponing bank levies. Their team is well-equipped to handle various tax relief services, catering to individual and corporate clients.

Community Tax provides complimentary consultations and cost-effective investigation fees, which fall between $295 to $500.

Community Tax relief alleviates IRS tax debt and offers limited aid for state taxes. Like other companies in the industry, Community Tax assists with a wide range of applications, including installment agreements and offers in compromise, but doesn’t cover innocent spouse relief.

The company caters to customers with tax debt starting from as low as $10,000, and their money-back guarantee varies from state to state. If your issues are unresolved, you’re eligible for a full refund within three to ten days, depending on your location.

Anthem Tax Services tax relief – FAQs

Bottom Line – Anthem Tax Services Review

While you may perceive it as an additional expense, working with a legal help company is crucial when facing difficulties. The IRS offers various avenues for handling back taxes, but they require extensive education and knowledge of many tax codes, which the average person needs to gain.

You could spend countless hours on the phone with the IRS and make no progress, leaving you hopeless and desperate. Fortunately, Anthem Tax is here to help you comprehend your back taxes.

They’re committed to working tirelessly on your behalf to find a resolution that suits your needs. Anthem Tax is fully licensed (CAF #: 0312-45396R) and holds multiple accreditations. They ensure compliance and thoroughly explore all available programs and options.

While they cannot guarantee a reduction, Anthem Tax is a highly regarded and professional legal services provider with a proud track record of success. They’re worth considering as a trusted option.

Sections of this topic

Sections of this topic