Setting up your Limited Liability Company (LLC) in Maryland opens a road filled not just with forms but monetary decisions too. Yet, launching an LLC can feel more financially manageable initially.

Armed with the proper insights and aid from trusted LLC service providers like Tailor Brands, you can tackle the complex aspects of this process and boost your cost-efficiency.

This piece explores the various costs linked to setting up an LLC in Maryland and highlights ways to make this venture more budget-friendly.

What Is the Cost of Forming an LLC in Maryland?

Starting an LLC in Maryland comes with an initial LLC cost of $100. This fee is for filing your LLC’s Articles of Organization via the Maryland Department of Assessments and Taxation’s online system.

Maryland Foreign LLC Formation Costs

If you plan to expand your existing LLC into Maryland from another state, you’ll need to register it as a foreign entity in this state. Getting your LLC recognized in Maryland is straightforward, and there’s a $100 fee to handle it.

You can submit your Foreign Limited Liability Company Registration form online, by mail, or in person. This step is essential to ensure your business can operate smoothly across state lines.

Annual Cost for LLCs in Maryland

Understanding the ongoing costs is crucial when starting an LLC in Maryland. Knowing these expenses helps you determine the total investment needed to keep your LLC running in the state.

The main costs to remember include the Resident Agent Fee, which ranges from about $100 to $300 per year for registered agent services, and the Annual Report Fee, which is a fixed $300 every year, required by the Department of Assessments and Taxation.

Factoring in these expenses is key to smart budgeting and decision-making, which can help maintain the long-term financial health of your LLC in Maryland.

>> Start Your LLC With Tailor Brands >>

How Much Does It Cost to Start an LLC in Maryland With the Best LLC Service?

Tailor Brands LLC Formation Cost

Filing an LLC in Maryland starts at $100, with the possibility of extra costs. Typically, it takes 2 – 3 weeks to process. However, you can shorten this period to 9 – 11 days for an additional $50 or even further to 6 – 7 days for $100.

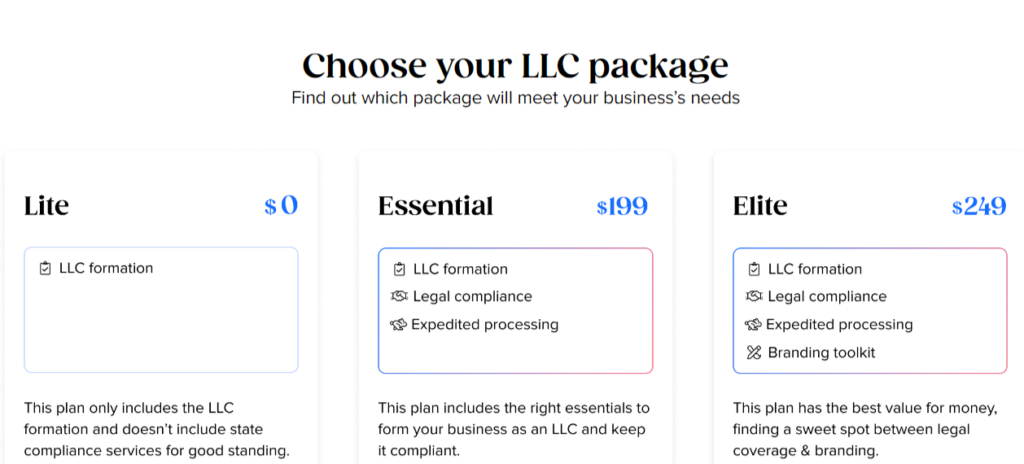

Tailor Brands offers a range of LLC plans, starting with the Lite plan, which covers LLC formation and standard processing for just the state filing fee. The Essential plan, costing $199 plus state fees, includes expedited processing, annual compliance, and an operating agreement. There’s a yearly fee of $199 to maintain these services.

The Elite plan, at $249 plus filing fees, includes all the benefits of the Essential plan along with extra business tools like a free domain for a year, a DIY website builder, an online store, eight free logos, a digital business card, a business cards tool, and a social media post maker. An annual fee of $249 is required to continue enjoying these services.

>> Check Out the Best Pricing for Tailor Brands >>

Additional Costs When Starting an LLC in Maryland

Maryland LLC Name Costs

In Maryland, there’s no charge for naming your LLC. You can choose your business name for free, and it becomes official once your Articles of Organization are approved by the state. Contrary to some online sources, reserving an LLC name isn’t required in many states, including Maryland, and generally isn’t necessary for forming an LLC.

However, if you want to secure your business name ahead of time, you can reserve it for 30 days by submitting a Corporate Name Reservation Application along with a $25 filing fee.

Maryland Registered Agent Costs

In Maryland, the Registered Agent Fee can range from $0 to $125 annually. State law requires every LLC to appoint a Registered Agent, also referred to as a Resident Agent, when forming the business. Importantly, there are no additional fees for Maryland LLC filings if you appoint a Registered Agent during the LLC formation process.

A Maryland Registered Agent, who can be either an individual or a company, is tasked with receiving legal documents and state notifications for your LLC. This agent must have a physical address in Maryland and be available during standard business hours.

Choosing to act as your own Registered Agent or assigning the role to someone you know won’t incur extra costs.

Alternatively, you can opt for a professional Registered Agent service, which generally costs between $100 and $300 per year. These services not only handle your legal notices but may also offer other business services and help maintain your privacy.

Consider hiring a Registered Agent service if:

- You don’t have a Maryland address (since the law requires a physical address in the state).

- You prefer not to have your address listed publicly (some services allow you to use their address for added privacy).

Maryland Operating Agreement Costs

There’s no fee for an LLC Operating Agreement in Maryland—it’s $0.

An Operating Agreement is vital for a Maryland LLC as it lays out clear guidelines among its members about ownership, management, and profit distribution. It serves as an official record of how the business operates.

It’s wise to have an Operating Agreement for both single-member and multi-member LLCs. This document should be kept with your business records and provided to all members.

However, it’s worth noting that many online platforms charge between $50 to $200 to draft an LLC Operating Agreement.

Maryland EIN Cost

An EIN, or Employer Identification Number, also known as a Federal Employer Identification Number (FEIN), is crucial for tasks like filing income taxes, setting up an LLC bank account, and hiring employees if needed.

Although some websites may charge a fee to obtain an EIN for your LLC, you can actually get one for free directly from the Internal Revenue Service (IRS). The online application is straightforward and can be completed in just a few minutes.

>> Start Your LLC With Tailor Brands >>

Maryland LLC Taxes

The annual tax costs for a Maryland LLC can vary widely depending on the different taxes that owners need to pay. Here are some of the taxes that LLC owners might encounter:

Federal Income Taxes

When dealing with federal income taxes for your LLC, the IRS offers different treatment options depending on the structure of your LLC.

For single-member LLCs, the IRS views them as disregarded entities, meaning they don’t have to file a separate federal income tax return. Instead, the LLC owner handles the tax filings and obligations. The tax approach varies with the ownership setup: if an individual owns the LLC, it’s taxed like a Sole Proprietorship; if another company owns it, it’s treated as a branch of the parent company.

The tax situation for multi-member LLCs is similar to that of a Partnership. The LLC must file a Partnership Return using Form 1065. Each owner then receives a Schedule K-1, which outlines their portion of the income, and they make their tax payments based on this information.

Husband and Wife LLC Taxes

In community property states like Texas, spouses owning an LLC can file taxes as a Single-Member LLC or a Qualified Joint Venture instead of as a Multi-Member LLC. However, this filing option isn’t available in non-community property states such as Maryland.

Electing Corporate Taxation

Apart from their default tax classifications, LLCs can choose to be taxed as corporations, with options including S-Corporation and C-Corporation status.

By submitting Form 2553, an LLC can elect to be taxed as an S-Corporation. This option is often beneficial for businesses with significant profits, as it can reduce self-employment taxes. On the other hand, using Form 8832 to elect C-Corporation status might be advantageous for larger businesses that can benefit from healthcare fringe benefits. However, consulting with an accountant before making such a decision is recommended.

Maryland State Income Tax for LLCs

In Maryland, Single-Member LLCs typically don’t file a state-level return themselves; instead, the owner reports the LLC’s profits or losses on their personal state tax return. Multi-Member LLCs, however, may need to file a state-level Partnership return, with each owner including their share of the LLC’s earnings on their personal returns.

Certain industries in Maryland are subject to specialized business taxes, making it crucial to seek assistance from an accountant to ensure accurate state income tax filings.

Local Income Tax for Maryland LLCs

Local municipalities might mandate income tax filings from both the LLC and its members. In particular, the Business Personal Property Tax, which is applicable to an LLC’s personal property, must be filed with the Maryland State Department of Assessments and Taxation (SDAT).

It’s recommended that professional assistance be sought for local income tax preparations and that local authorities be contacted to determine specific requirements.

Maryland Sales Tax

If you’re dealing products to consumers in Maryland, you might have to gather sales tax and secure a Seller’s Permit from the Maryland Comptroller. This permit allows you to legally collect sales tax within the state, and it may also be known as a resale, wholesale, or sales tax permit. It’s advisable to register for business taxes online with the Comptroller of Maryland, where you can also find detailed guidance and resources.

Maryland LLC Payroll Taxes

Hiring employees for a Maryland LLC means managing payroll taxes that include federal and state income tax withholding, Social Security tax, Medicare tax, Federal Unemployment Taxes (FUTA), State Unemployment Taxes (SUTA), and any local or county deductions.

Proper management of these taxes and filings is essential to prevent penalties. While you can manage payroll taxes on your own, their complexity often leads businesses to engage payroll professionals or accountants to ensure they comply accurately.

>> Get Started With Tailor Brands >>

Maryland LLC Cost – FAQs

Conclusion

Setting up an LLC in Maryland requires thoroughly evaluating the related costs. Maryland offers a supportive business environment with potential perks, but the expenses involved in forming an LLC include filing fees, registered agent fees, and possible legal or advisory costs. Streamlined LLC services like Tailor Brands offer various plans to simplify the entire process.

Entrepreneurs must carefully weigh these costs against Maryland’s favorable legal framework and solid business reputation. This will help them determine if starting an LLC in Maryland aligns with their broader business goals and financial means.

>> Start Your LLC With Tailor Brands >>

Sections of this topic

Sections of this topic